Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please prepare the following: FMV Allocation Schedule Pell's ACTUAL journal entries Worksheet Elimination Entries Swift's Journal Entry to Adopt Pushdown Accounting Worksheet Elimination Entry if

Please prepare the following:

FMV Allocation Schedule

Pell's ACTUAL journal entries

Worksheet Elimination Entries

Swift's Journal Entry to Adopt Pushdown Accounting

Worksheet Elimination Entry if Pushdown Accounting is used

Do the above assuming

a) Pell paid stock AND $10,000 cash (i.e. with goodwill)

b) Pell paid ONLY stock (no cash) (i.e. Gain on Bargain Purchase)

thanks!

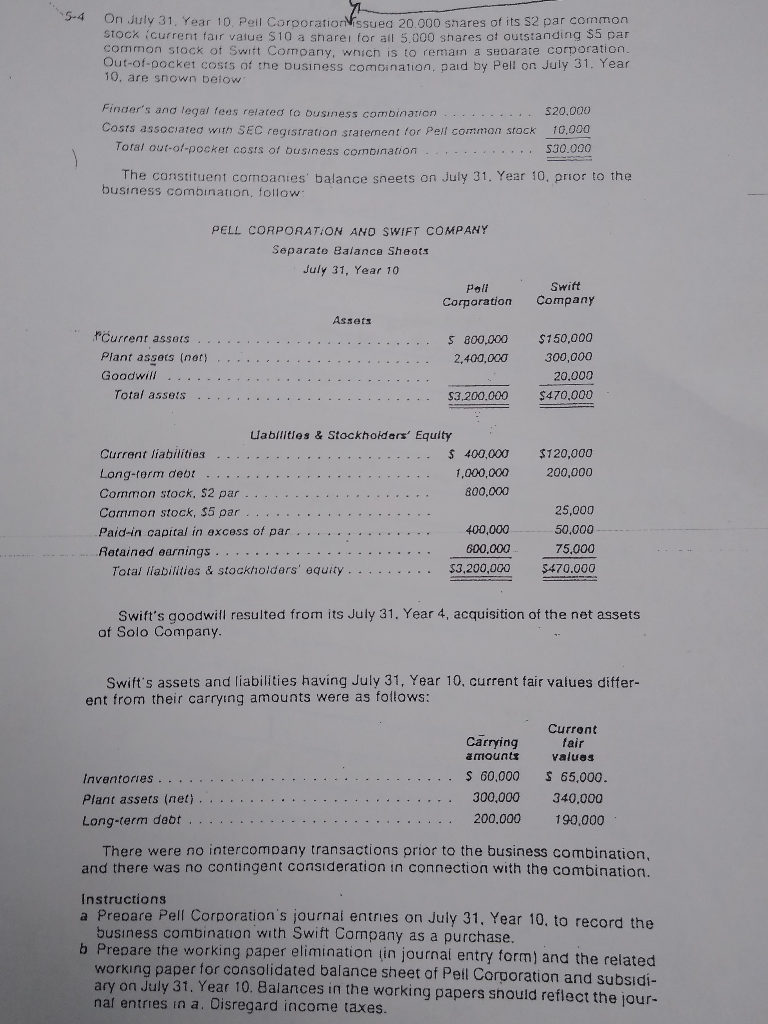

74 5-4 On July 31, Year 10. Peil Corporationissuea 20.000 shares of its S2 par common Stock (current fair value $10 a sharei for all 5.000 shares of outstanding $5 par common stock of Swift Company, wnich is to remain a suparate corporation. Out-of-pocket costs of the Dusiness compination, paid by Pell on July 31. Year 10, are snown below Finder's and legal fees related to $20,000 business combinaion . Costs assoCiated with SEC reqistration starement for Pell common stOck Total out-of-pocker costs of business combination 10,000 S30.000 The constituent comoanies' balance sheets on July 31, Year 10, prior to the business combination, follow: PELL CORPORATION ANO SWIFT COMPANY Separate Balance Sheots July 31, Year 10 Swift Poll Company Corporation Assets Current assets $150,000 800,000 Plant assets (net) 300,000 2.400,000 Goodwill 20,000 Total assets $470,000 $3.200.000 Uabilities & Stockholders' Equity Current liabilities $ 400,000 $120,000 Long-torm debt Common stock, $2 par 1.000,000 200,000 800,000 25,000 Common stock, $5 par 400,000 50,000 Paid-in caprtal in excess of par Retained earnings.. 75.000 600,000 $3,200,000 $470.000 Total labilities & stockholders' equity. Swift's goodwill resulted from its July 31, Year 4, acquisition of the net assets of Solo Company. Swift's assets and liabilities having July 31, Year 10, current fair values differ- ent from their carrying amounts were as follows: Current fair Carrying amounts values S 60.000 S 65,000. Inventories . 300,000 Plant assets (net) 340,000 200.000 Long-term debt 190,000 There were no intercompany transactions prior to the business combination. and there was no contingent consideration in connection with the combination. Instructions a Preoare Pell Corporation's journal entries on July 31, Year 10, to record the business combination with Swift Company as a purchase. b Prepare the working paper elimination tin journal entry form) and the related working paperfor consolidated balance sheet of Peil Corporation and subsidi- ary on July 31. Year 10. Balances in the warking papers should reflect the jour- nal entries in a. Oisregard income taxes. 74 5-4 On July 31, Year 10. Peil Corporationissuea 20.000 shares of its S2 par common Stock (current fair value $10 a sharei for all 5.000 shares of outstanding $5 par common stock of Swift Company, wnich is to remain a suparate corporation. Out-of-pocket costs of the Dusiness compination, paid by Pell on July 31. Year 10, are snown below Finder's and legal fees related to $20,000 business combinaion . Costs assoCiated with SEC reqistration starement for Pell common stOck Total out-of-pocker costs of business combination 10,000 S30.000 The constituent comoanies' balance sheets on July 31, Year 10, prior to the business combination, follow: PELL CORPORATION ANO SWIFT COMPANY Separate Balance Sheots July 31, Year 10 Swift Poll Company Corporation Assets Current assets $150,000 800,000 Plant assets (net) 300,000 2.400,000 Goodwill 20,000 Total assets $470,000 $3.200.000 Uabilities & Stockholders' Equity Current liabilities $ 400,000 $120,000 Long-torm debt Common stock, $2 par 1.000,000 200,000 800,000 25,000 Common stock, $5 par 400,000 50,000 Paid-in caprtal in excess of par Retained earnings.. 75.000 600,000 $3,200,000 $470.000 Total labilities & stockholders' equity. Swift's goodwill resulted from its July 31, Year 4, acquisition of the net assets of Solo Company. Swift's assets and liabilities having July 31, Year 10, current fair values differ- ent from their carrying amounts were as follows: Current fair Carrying amounts values S 60.000 S 65,000. Inventories . 300,000 Plant assets (net) 340,000 200.000 Long-term debt 190,000 There were no intercompany transactions prior to the business combination. and there was no contingent consideration in connection with the combination. Instructions a Preoare Pell Corporation's journal entries on July 31, Year 10, to record the business combination with Swift Company as a purchase. b Prepare the working paper elimination tin journal entry form) and the related working paperfor consolidated balance sheet of Peil Corporation and subsidi- ary on July 31. Year 10. Balances in the warking papers should reflect the jour- nal entries in a. Oisregard income taxesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started