Question

Please prepare the report to Steve addressing the following: Illustrate the transfer of the assets to the corporation under Section 85 in Excel using the

Please prepare the report to Steve addressing the following:

Illustrate the transfer of the assets to the corporation under Section 85 in Excel using the attached T2057 election form template, be sure to show the non-share and share consideration he will receive on the transfer.

In a memo (on the second sheet of the attached excel spreadsheet), explain to Steve: - a brief summary of how the Section 85 transfer works - asset(s) that should be sold to VKI (outside of the Section 85 transfer) - asset(s) that should not be transferred to the corporation

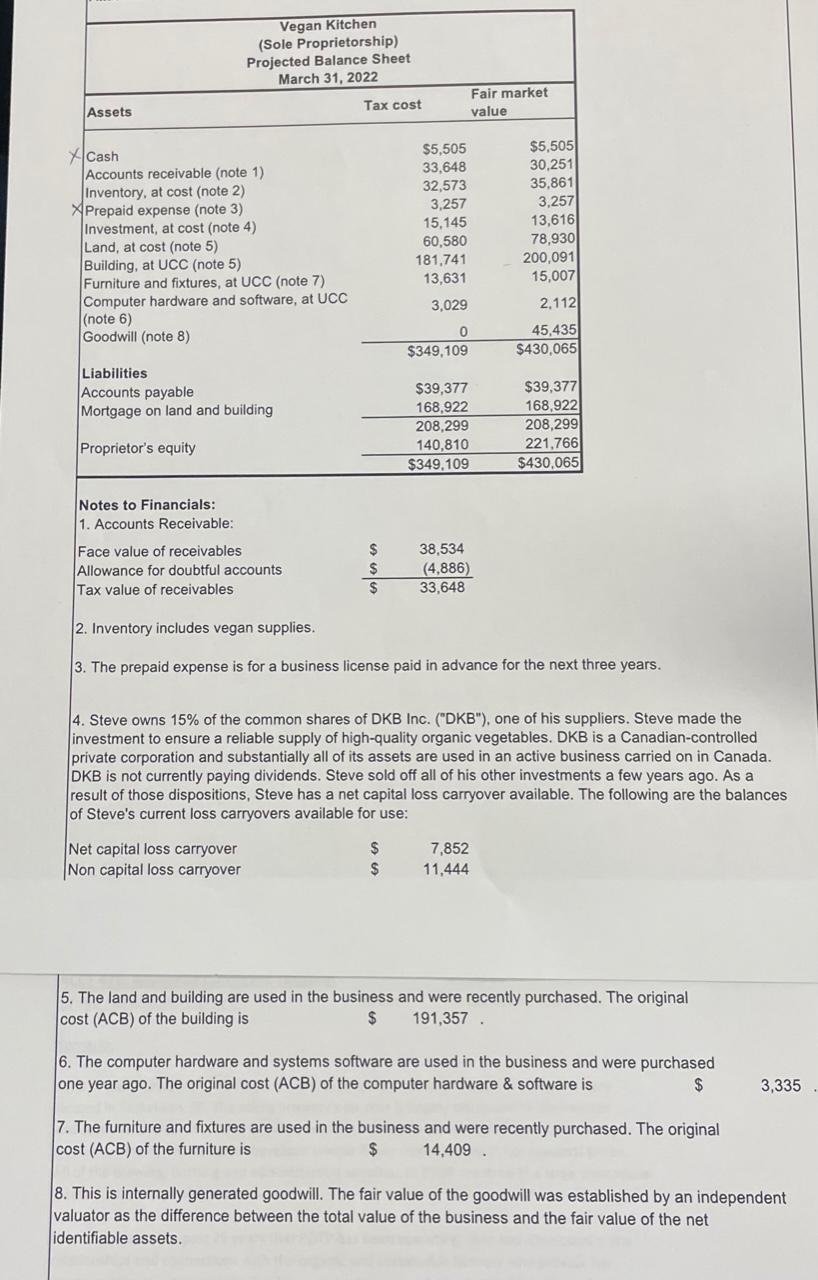

Assets Cash Accounts receivable (note 1) Inventory, at cost (note 2). XPrepaid expense (note 3) Investment, at cost (note 4) Land, at cost (note 5) Vegan Kitchen (Sole Proprietorship) Projected Balance Sheet March 31, 2022 Tax cost Building, at UCC (note 5) Furniture and fixtures, at UCC (note 7) Computer hardware and software, at UCC (note 6) Goodwill (note 8) Liabilities Accounts payable Mortgage on land and building Proprietor's equity Notes to Financials: 1. Accounts Receivable: Face value of receivables Allowance for doubtful accounts Tax value of receivables $ $ $ Net capital loss carryover Non capital loss carryover $5,505 33,648 32,573 3,257 15,145 60,580 181,741 13,631 3,029 0 $ $ $349,109 $39,377 168,922 208,299 140,810 $349,109 Fair market value 38,534 (4,886) 33,648 $5,505 30,251 35,861 3,257 13,616 78,930 200,091 15,007 2,112 45,435 $430,065 2. Inventory includes vegan supplies. 3. The prepaid expense is for a business license paid in advance for the next three years. $39,377 168,922 4. Steve owns 15% of the common shares of DKB Inc. ("DKB"), one of his suppliers. Steve made the investment to ensure a reliable supply of high-quality organic vegetables. DKB is a Canadian-controlled private corporation and substantially all of its assets are used in an active business carried on in Canada. DKB is not currently paying dividends. Steve sold off all of his other investments a few years ago. As a result of those dispositions, Steve has a net capital loss carryover available. The following are the balances of Steve's current loss carryovers available for use: 7,852 11,444 208,299 221,766 $430,065 5. The land and building are used in the business and were recently purchased. The original cost (ACB) of the building is 191,357. $ 6. The computer hardware and systems software are used in the business and were purchased one year ago. The original cost (ACB) of the computer hardware & software is $ 7. The furniture and fixtures are used in the business and were recently purchased. The original cost (ACB) of the furniture is $ 14,409. 3,335 8. This is internally generated goodwill. The fair value of the goodwill was established by an independent valuator as the difference between the total value of the business and the fair value of the net identifiable assets.

Step by Step Solution

3.29 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

To illustrate the transfer of assets to the corporation under Section 85 in Excel you can use the at...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started