Please prepare vertical and horizontal common-size income statements for each company for the last 3 years. (please show calculations as well)

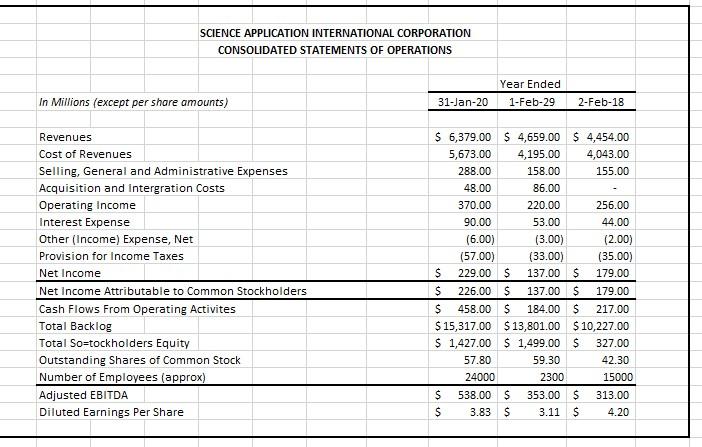

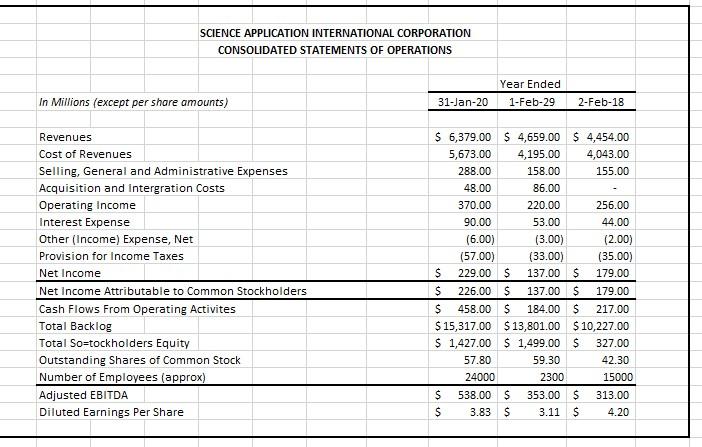

SAIC INCOME STATEMENT:

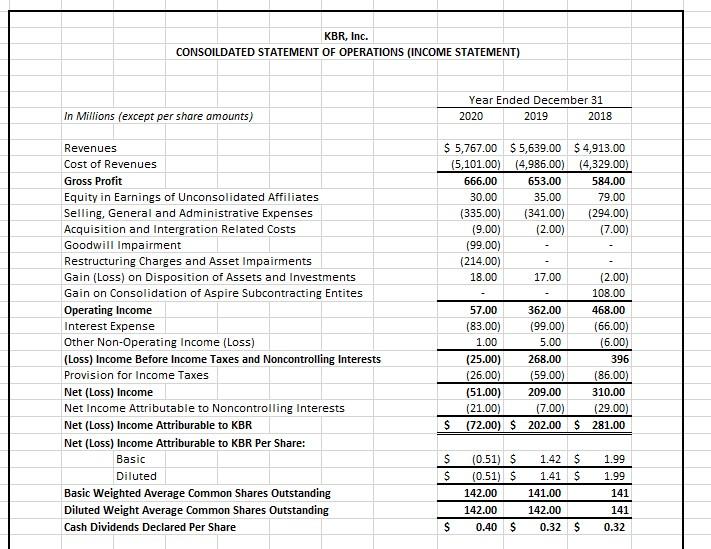

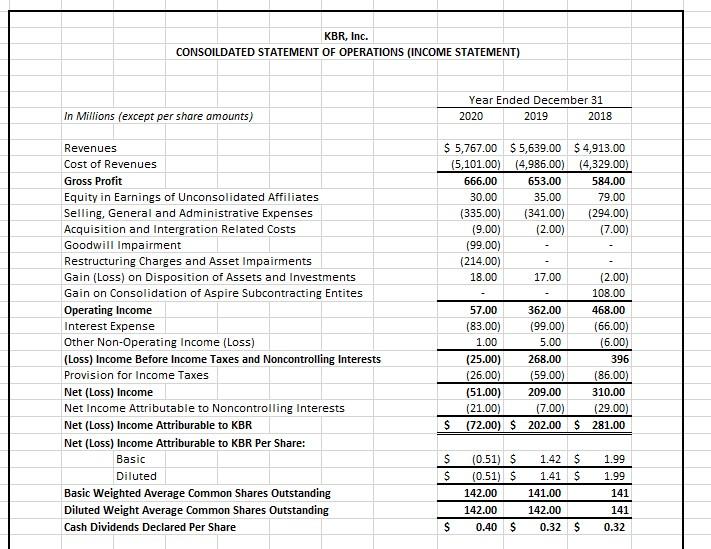

KBR INCOME STATEMENT:

SCIENCE APPLICATION INTERNATIONAL CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended 1-Feb-29 In Millions (except per share amounts) 31-Jan-20 2-Feb-18 Revenues Cost of Revenues Selling, General and Administrative Expenses Acquisition and intergration Costs Operating Income Interest Expense Other (Income) Expense, Net Provision for Income Taxes Net Income Net income Attributable to Common Stockholders Cash Flows From Operating Activites Total Backlog Total So=tockholders Equity Outstanding Shares of Common Stock Number of Employees (approx) Adjusted EBITDA Diluted Earnings Per Share $ 6,379.00 $ 4,659.00 $ 4,454.00 5,673.00 4,195.00 4,043.00 288.00 158.00 155.00 48.00 86.00 370.00 220.00 256.00 90.00 53.00 44.00 (6.00) (3.00) (2.00) (57.00) (33.00) (35.00) $ 229.00 S 137.00 $ 179.00 $ 226.00 $137.00 $ 179.00 $ 458.00 $ 184.00 $ 217.00 $ 15,317.00 $ 13,801.00 $ 10,227.00 $ 1,427.00 $ 1,499.00 $ 327.00 57.80 59.30 42.30 24000 2300 15000 $ 538.00 S 353.00 $ 313.00 $ 3.83 $ 3.11 $ 4.20 KBR, Inc. CONSOILDATED STATEMENT OF OPERATIONS (INCOME STATEMENT) in Millions (except per share amounts) Year Ended December 31 2020 2019 2018 Revenues Cost of Revenues Gross Profit Equity in Earnings of Unconsolidated Affiliates Selling, General and Administrative Expenses Acquisition and Intergration Related Costs Goodwill Impairment Restructuring Charges and Asset Impairments Gain (Loss) on Disposition of Assets and Investments Gain on Consolidation of Aspire Subcontracting Entites Operating Income Interest Expense Other Non-Operating Income (Loss) (Loss) Income Before Income Taxes and Noncontrolling Interests Provision for Income Taxes Net (Loss) Income Net Income Attributable to Noncontrolling Interests Net (Loss) Income Attriburable to KBR Net (Loss) Income Attriburable to KBR Per Share: Basic Diluted Basic Weighted Average Common Shares Outstanding Diluted Weight Average Common Shares Outstanding Cash Dividends Declared Per Share $ 5,767.00 $ 5,639.00 $4,913.00 (5,101.00) (4,986.00) (4,329.00) 666.00 653.00 584.00 30.00 35.00 79.00 (335.00) (341.00) (294.00) (9.00) (2.00) (7.00) (99.00) (214.00) 18.00 17.00 (2.00) 108.00 57.00 362.00 468.00 (83.00) (99.00) (66.00) 1.00 5.00 (6.00) (25.00) 268.00 396 (26.00) (59.00) (86.00) (51.00) 209.00 310.00 (21.00) (7.00) (29.00) S (72.00) $ 202.00 $281.00 S $ (0.51) $ (0.51) S 142.00 142.00 0.40 S 1.42 $ 1.41 $ 141.00 142.00 1.99 1.99 141 141 $ 0.32 $ 0.32 SCIENCE APPLICATION INTERNATIONAL CORPORATION CONSOLIDATED STATEMENTS OF OPERATIONS Year Ended 1-Feb-29 In Millions (except per share amounts) 31-Jan-20 2-Feb-18 Revenues Cost of Revenues Selling, General and Administrative Expenses Acquisition and intergration Costs Operating Income Interest Expense Other (Income) Expense, Net Provision for Income Taxes Net Income Net income Attributable to Common Stockholders Cash Flows From Operating Activites Total Backlog Total So=tockholders Equity Outstanding Shares of Common Stock Number of Employees (approx) Adjusted EBITDA Diluted Earnings Per Share $ 6,379.00 $ 4,659.00 $ 4,454.00 5,673.00 4,195.00 4,043.00 288.00 158.00 155.00 48.00 86.00 370.00 220.00 256.00 90.00 53.00 44.00 (6.00) (3.00) (2.00) (57.00) (33.00) (35.00) $ 229.00 S 137.00 $ 179.00 $ 226.00 $137.00 $ 179.00 $ 458.00 $ 184.00 $ 217.00 $ 15,317.00 $ 13,801.00 $ 10,227.00 $ 1,427.00 $ 1,499.00 $ 327.00 57.80 59.30 42.30 24000 2300 15000 $ 538.00 S 353.00 $ 313.00 $ 3.83 $ 3.11 $ 4.20 KBR, Inc. CONSOILDATED STATEMENT OF OPERATIONS (INCOME STATEMENT) in Millions (except per share amounts) Year Ended December 31 2020 2019 2018 Revenues Cost of Revenues Gross Profit Equity in Earnings of Unconsolidated Affiliates Selling, General and Administrative Expenses Acquisition and Intergration Related Costs Goodwill Impairment Restructuring Charges and Asset Impairments Gain (Loss) on Disposition of Assets and Investments Gain on Consolidation of Aspire Subcontracting Entites Operating Income Interest Expense Other Non-Operating Income (Loss) (Loss) Income Before Income Taxes and Noncontrolling Interests Provision for Income Taxes Net (Loss) Income Net Income Attributable to Noncontrolling Interests Net (Loss) Income Attriburable to KBR Net (Loss) Income Attriburable to KBR Per Share: Basic Diluted Basic Weighted Average Common Shares Outstanding Diluted Weight Average Common Shares Outstanding Cash Dividends Declared Per Share $ 5,767.00 $ 5,639.00 $4,913.00 (5,101.00) (4,986.00) (4,329.00) 666.00 653.00 584.00 30.00 35.00 79.00 (335.00) (341.00) (294.00) (9.00) (2.00) (7.00) (99.00) (214.00) 18.00 17.00 (2.00) 108.00 57.00 362.00 468.00 (83.00) (99.00) (66.00) 1.00 5.00 (6.00) (25.00) 268.00 396 (26.00) (59.00) (86.00) (51.00) 209.00 310.00 (21.00) (7.00) (29.00) S (72.00) $ 202.00 $281.00 S $ (0.51) $ (0.51) S 142.00 142.00 0.40 S 1.42 $ 1.41 $ 141.00 142.00 1.99 1.99 141 141 $ 0.32 $ 0.32