Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please privide calculation and explain why The current silver futures contract price is exist15.10/ounce (3-months to expiration, 5,000 ounces per contract). a. A silver-mining company

Please privide calculation and explain why

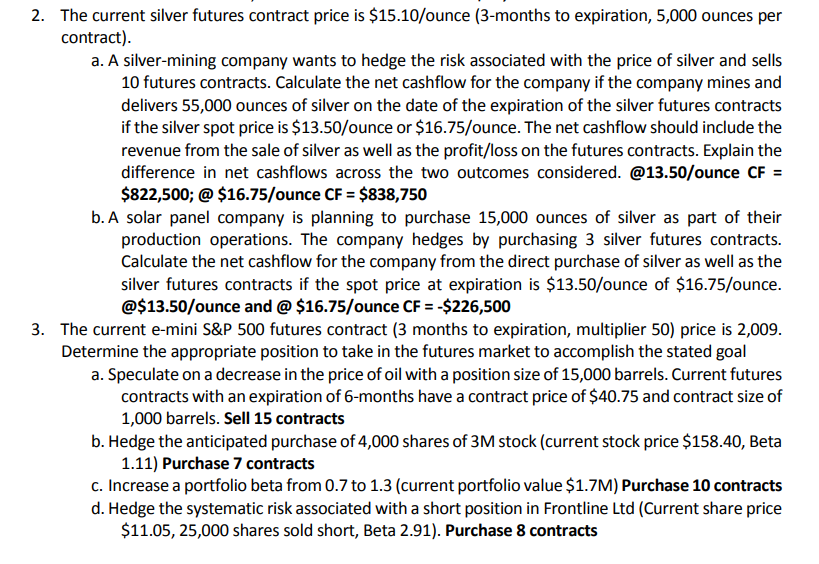

The current silver futures contract price is exist15.10/ounce (3-months to expiration, 5,000 ounces per contract). a. A silver-mining company wants to hedge the risk associated with the price of silver and sells 10 futures contracts. Calculate the net cashflow for the company if the company mines and delivers 55,000 ounces of silver on the date of the expiration of the silver futures contracts if the silver spot price is exist13.5O/ounce or exist16.75/ounce. The net cashflow should include the revenue from the sale of silver as well as the profit/loss on the futures contracts. Explain the difference in net cashflows across the two outcomes considered. @13.50/ounce CF = exist822, 500: @ exist16.75/ounce CF = exist838, 750 b. A solar panel company is planning to purchase 15,000 ounces of silver as part of their production operations. The company hedges by purchasing 3 silver futures contracts. Calculate the net cashflow for the company from the direct purchase of silver as well as the silver futures contracts if the spot price at expiration is exist13.5O/ounce of exist16.75/ounce. @exist13.5O/ounce and @ exist16.75/ounce CF = -exist226, 500 The current e-mini S&P 500 futures contract (3 months to expiration, multiplier 50) price is 2,009. Determine the appropriate position to take in the futures market to accomplish the stated goal a. Speculate on a decrease in the price of oil with a position size of 15,000 barrels. Current futures contracts with an expiration of 6-months have a contract price of exist40.75 and contract size of 1,000 barrels. Sell 15 contracts b. Hedge the anticipated purchase of 4,000 shares of 3M stock (current stock price exist158.40, Beta 1.11) Purchase 7 contracts c. Increase a portfolio beta from 0.7 to 1.3 (current portfolio value exist1.7M) Purchase 10 contracts d. Hedge the systematic risk associated with a short position in Frontline Ltd (Current share price exist11.05, 25,000 shares sold short, Beta 2.91). Purchase 8 contractsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started