Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PLEASE PRODIDE THE STEP BU STEP FORMULA YOU USE. All answers must be entered as a formula. Click OK to begin OK Prev 1 of

PLEASE PRODIDE THE STEP BU STEP FORMULA YOU USE.

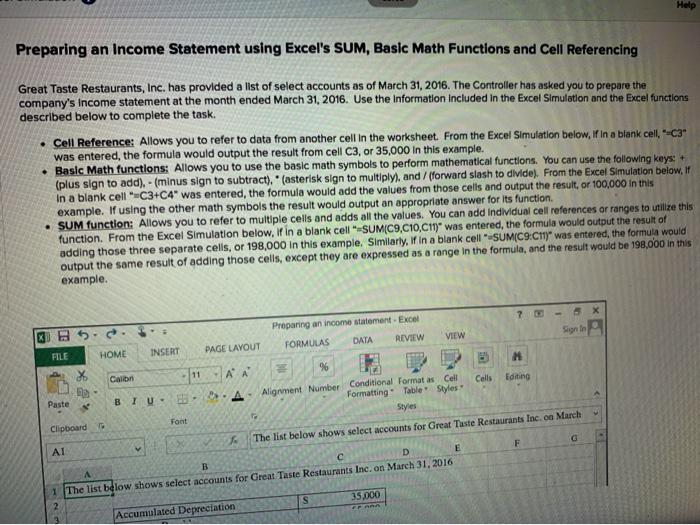

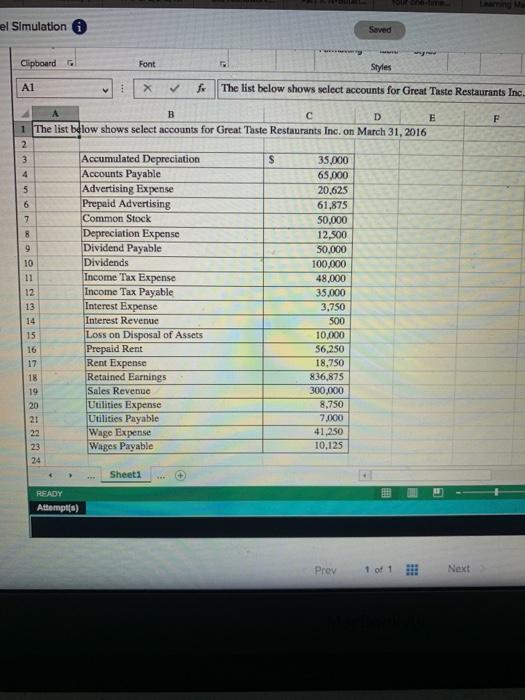

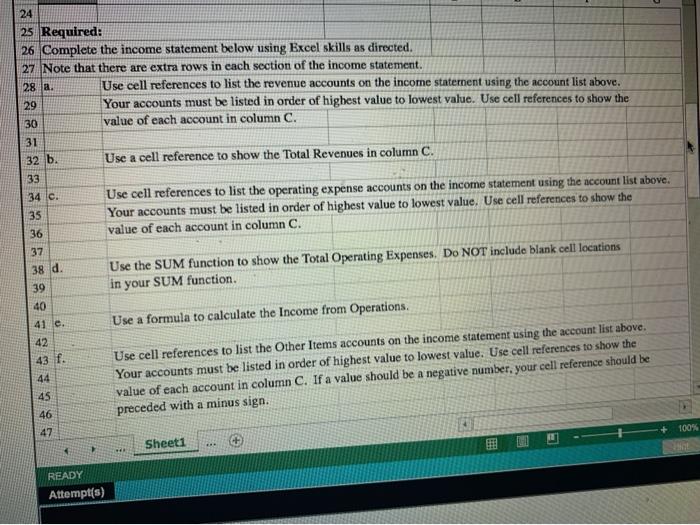

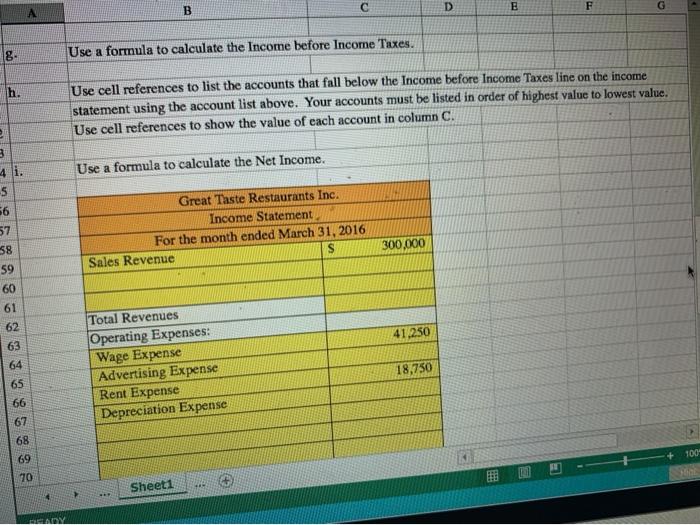

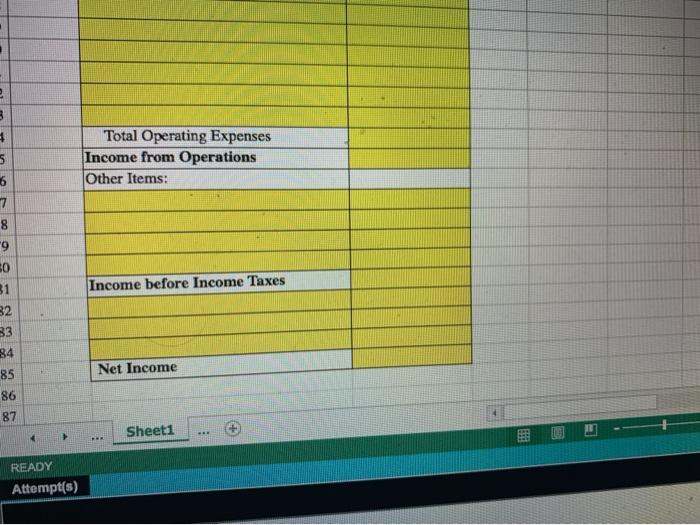

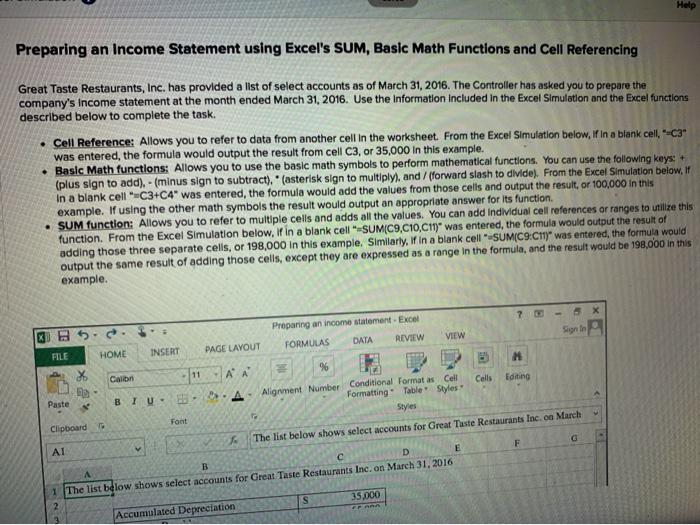

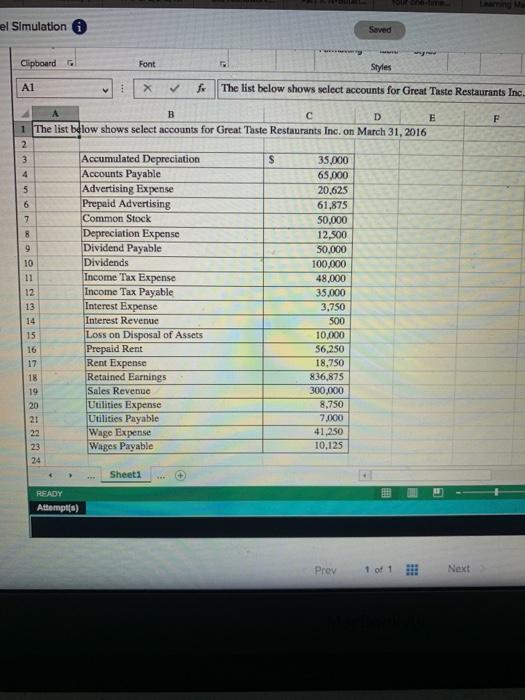

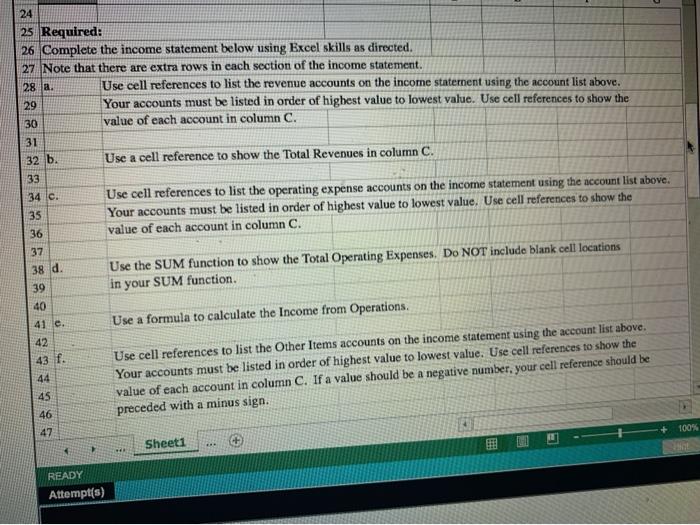

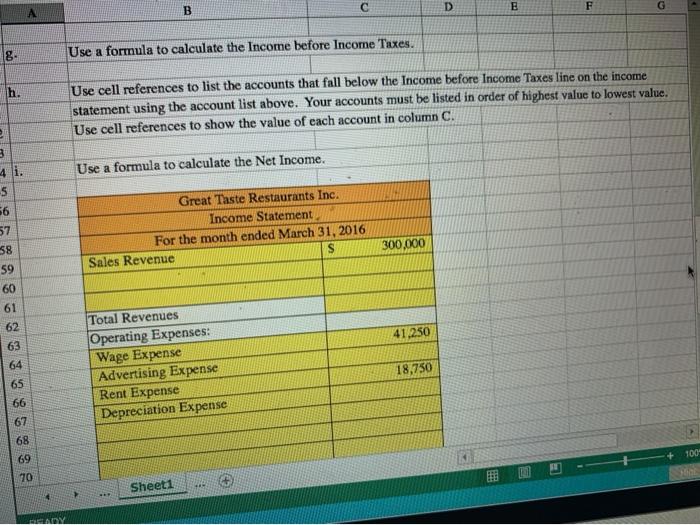

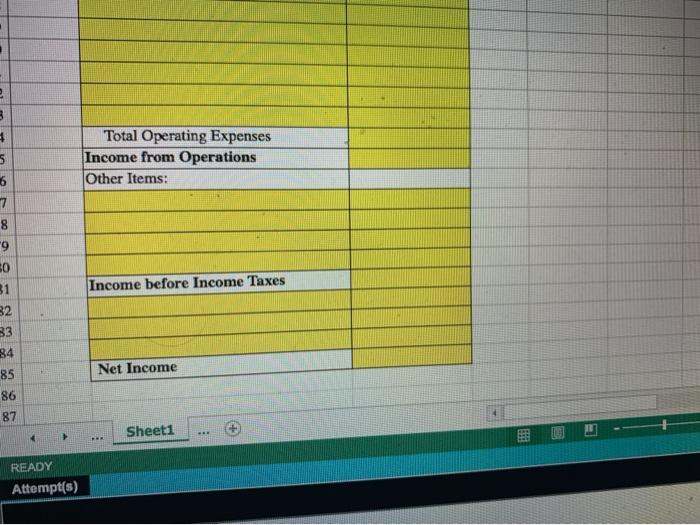

All answers must be entered as a formula. Click OK to begin OK Prev 1 of 1 Next Help Preparing an Income Statement using Excel's SUM, Basic Math Functions and Cell Referencing Great Taste Restaurants, Inc. has provided a list of select accounts as of March 31, 2016. The Controller has asked you to prepare the company's Income statement at the month ended March 31, 2016. Use the Information Included in the Excel Simulation and the Excel functions described below to complete the task. Cell Reference: Allows you to refer to data from another cell in the worksheet. From the Excel Simulation below, if in a blank cell, *-C3* was entered the formula would output the result from cell C3, or 35,000 in this example. Basic Math functions: Allows you to use the basic math symbols to perform mathematical functions. You can use the following keys: + (plus sign to add). - (minus sign to subtract)." (asterisk sign to multiply), and / forward slash to divide). From the Excel Simulation below. If in a blank cell-C3-C4" was entered, the formula would add the values from those cells and output the result, or 100,000 in this example. If using the other math symbols the result would output an appropriate answer for its function SUM function: Allows you to refer to multiple cells and adds all the values. You can add individual cell references or ranges to utilize this function. From the Excel Simulation below, if in a blank cell-SUMC9.C10,011) was entered the formula would output the result of adding those three separate cells, or 198,000 in this example. Similarly, in a blank cell-SUMC9-C17) was entered the formula would output the same result of adding those cells, except they are expressed as a range in the formula, and the result would be 198,000 in this example. 7 BB Preparing an income statement - Excel FORMULAS DATA REVIEW VIEW PAGE LAYOUT FILE INSERT HOME 36 Calibri Paste BIU- A A 9 M 9.4 Alignment Number Conditional Format as Cell Cells Editing Formatting Table Styles Styles The list below shows select accounts for Great Taste Restaurants Inc. on March Font Clipboard F AI B E 1 The list below shows select accounts for Great Taste Restaurants Inc. on March 31, 2016 S 35.000 2 Accumulated Depreciation el Simulation Saved Clipboard Font Styles A1 : The list below shows select accounts for Great Taste Restaurants Inc. F A B D E 1 The list below shows select accounts for Great Taste Restaurants Inc. on March 31, 2016 2 3 Accumulated Depreciation S 35,000 4 Accounts Payable 65.000 5 Advertising Expense 20.625 6 Prepaid Advertising 61.875 7 Common Stock 50,000 8 Depreciation Expense 12,500 9 Dividend Payable 50,000 10 Dividends 100,000 11 Income Tax Expense 48,000 12 Income Tax Payable 35,000 13 Interest Expense 3.750 14 Interest Revenue SOO 15 Loss on Disposal of Assets 10,000 16 Prepaid Rent 56,250 17 Rent Expense 18,750 18 Retained Earnings 836,875 19 Sales Revenue 300,000 20 Utilities Expense 8,750 21 Utilities Payable 7.000 22 Wage Expense 41.250 23 Wages Payable 10,125 24 Sheet1 READY Attempt(s) Prev 1 of 1 !!! Next 24 25 Required: 26 Complete the income statement below using Excel skills as directed. 27 Note that there are extra rows in each section of the income statement 28 a. Use cell references to list the revenue accounts on the income statement using the account list above. 29 Your accounts must be listed in order of highest value to lowest value. Use cell references to show the 30 value of each account in column C. 31 32 b. Use a cell reference to show the Total Revenues in column C. 33 34 c. Use cell references to list the operating expense accounts on the income statement using the account list above. 35 Your accounts must be listed in order of highest value to lowest value. Use cell references to show the 36 value of each account in column C. 37 Use the SUM function to show the Total Operating Expenses. Do NOT include blank cell locations 39 in your SUM function. 40 41 e. Use a formula to calculate the Income from Operations. 42 43 f. Use cell references to list the Other Items accounts on the income statement using the account list above, 44 Your accounts must be listed in order of highest value to lowest value. Use cell references to show the 45 value of each account in column C. If a value should be a negative number, your cell reference should be 46 preceded with a minus sign. 47 Sheet1 100% 38 d. READY Attempt(s) D B E F A G . 18. Use a formula to calculate the Income before Income Taxes. h. Use cell references to list the accounts that fall below the Income before Income Taxes line on the income statement using the account list above. Your accounts must be listed in order of highest value to lowest value. Use cell references to show the value of each account in column C. e Use a formula to calculate the Net Income. 3 4 i. 5 56 57 38 59 Great Taste Restaurants Inc. Income Statement For the month ended March 31, 2016 Sales Revenue S 300.000 60 61 62 63 41.250 64 Total Revenues Operating Expenses: Wage Expense Advertising Expense Rent Expense Depreciation Expense 18,750 65 66 67 68 100 69 70 Sheet1 MOV 3 2 3 5 Total Operating Expenses Income from Operations Other Items: 6 7 8 9 80 Income before Income Taxes 31 32 33 34 85 86 87 Net Income Sheet1 READY Attempt(s)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started