Answered step by step

Verified Expert Solution

Question

1 Approved Answer

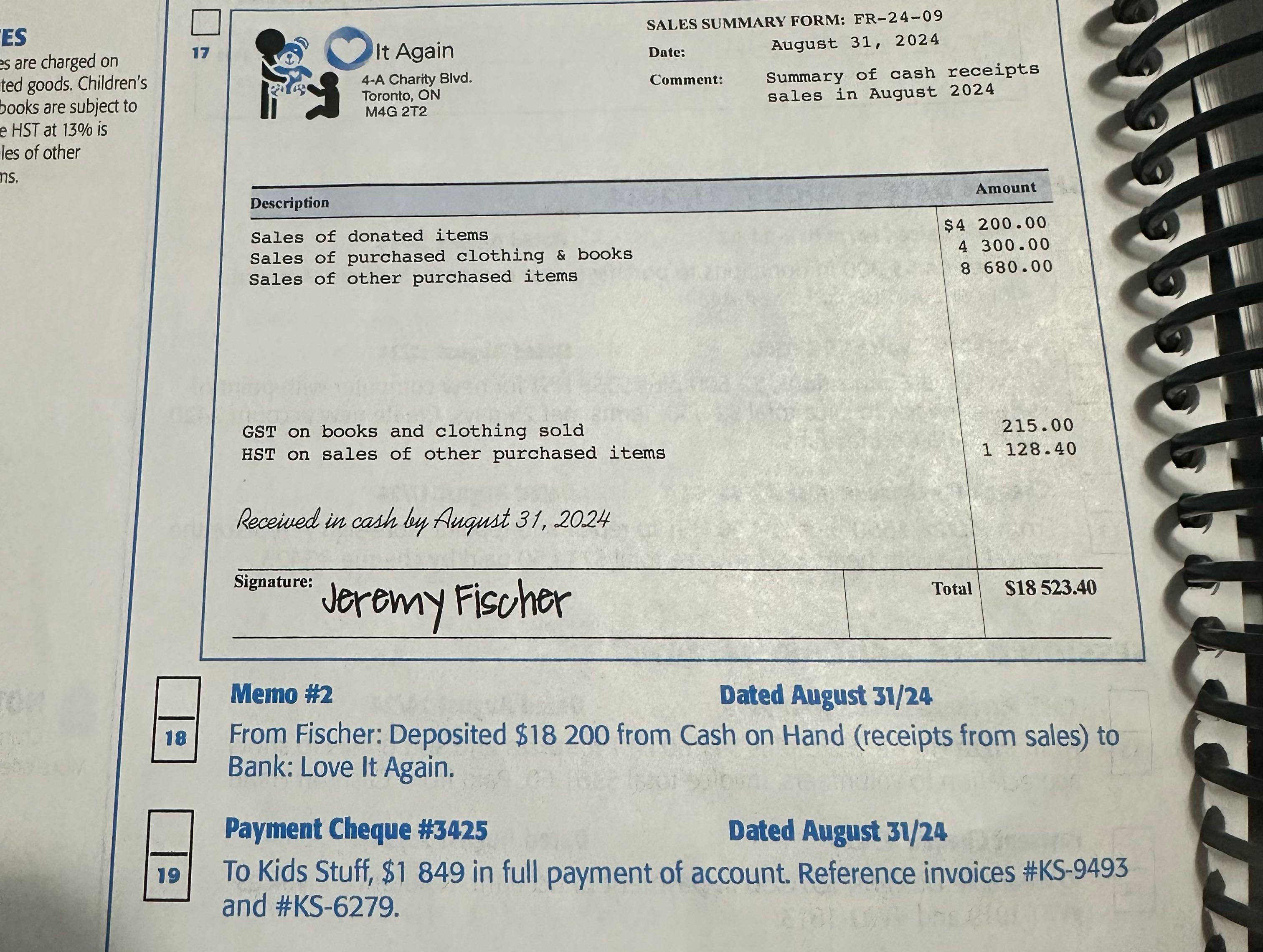

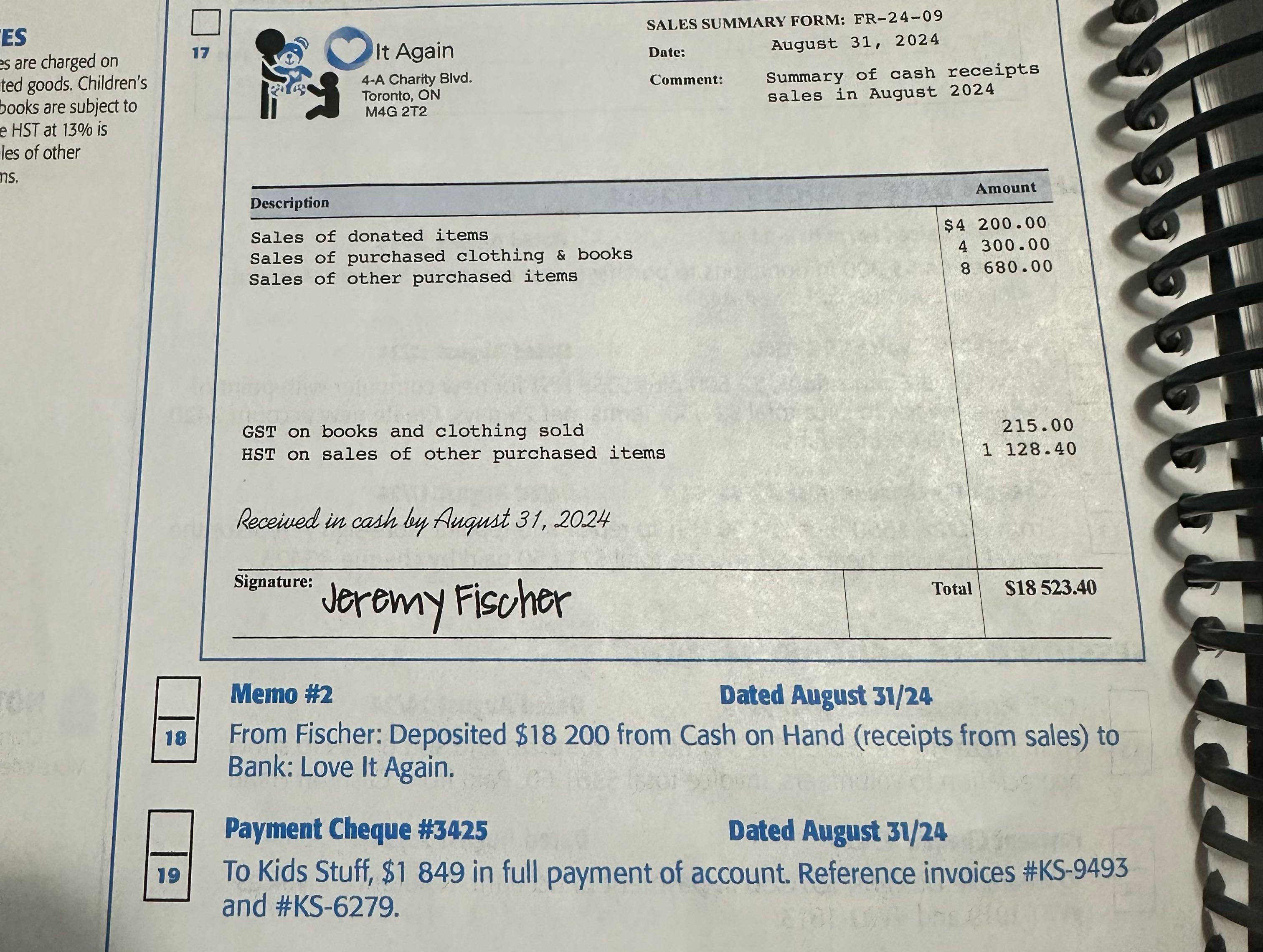

Please provide a journal entry for this transaction ES es are charged on ted goods. Children's books are subject to e HST at 13% is

Please provide a journal entry for this transaction

ES es are charged on ted goods. Children's books are subject to e HST at 13% is les of other ms. 18 19 17 It Again 4-A Charity Blvd. Toronto, ON M4G 2T2 Description Sales of donated items Sales of purchased clothing & books Sales of other purchased items SALES SUMMARY FORM: FR-24-09 Date: Comment: August 31, 2024 Summary of cash receipts sales in August 2024 Amount $4 200.00 4 300.00 8 680.00 GST on books and clothing sold HST on sales of other purchased items Received in cash by August 31, 2024 Signature: Jeremy Fischer 215.00 1 128.40 Total $18 523.40 Memo #2 Dated August 31/24 From Fischer: Deposited $18 200 from Cash on Hand (receipts from sales) to Bank: Love It Again. Payment Cheque #3425 15401 Dated August 31/24 To Kids Stuff, $1 849 in full payment of account. Reference invoices #KS-9493 and #KS-6279.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Sales of donated items 420000 2 Sales of purchased clothing books 430000 3 Sales of other purchased items 868000 GST on books and clothing sold 21500 HST on sales of other purchased items 112840 Tot...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started