Answered step by step

Verified Expert Solution

Question

1 Approved Answer

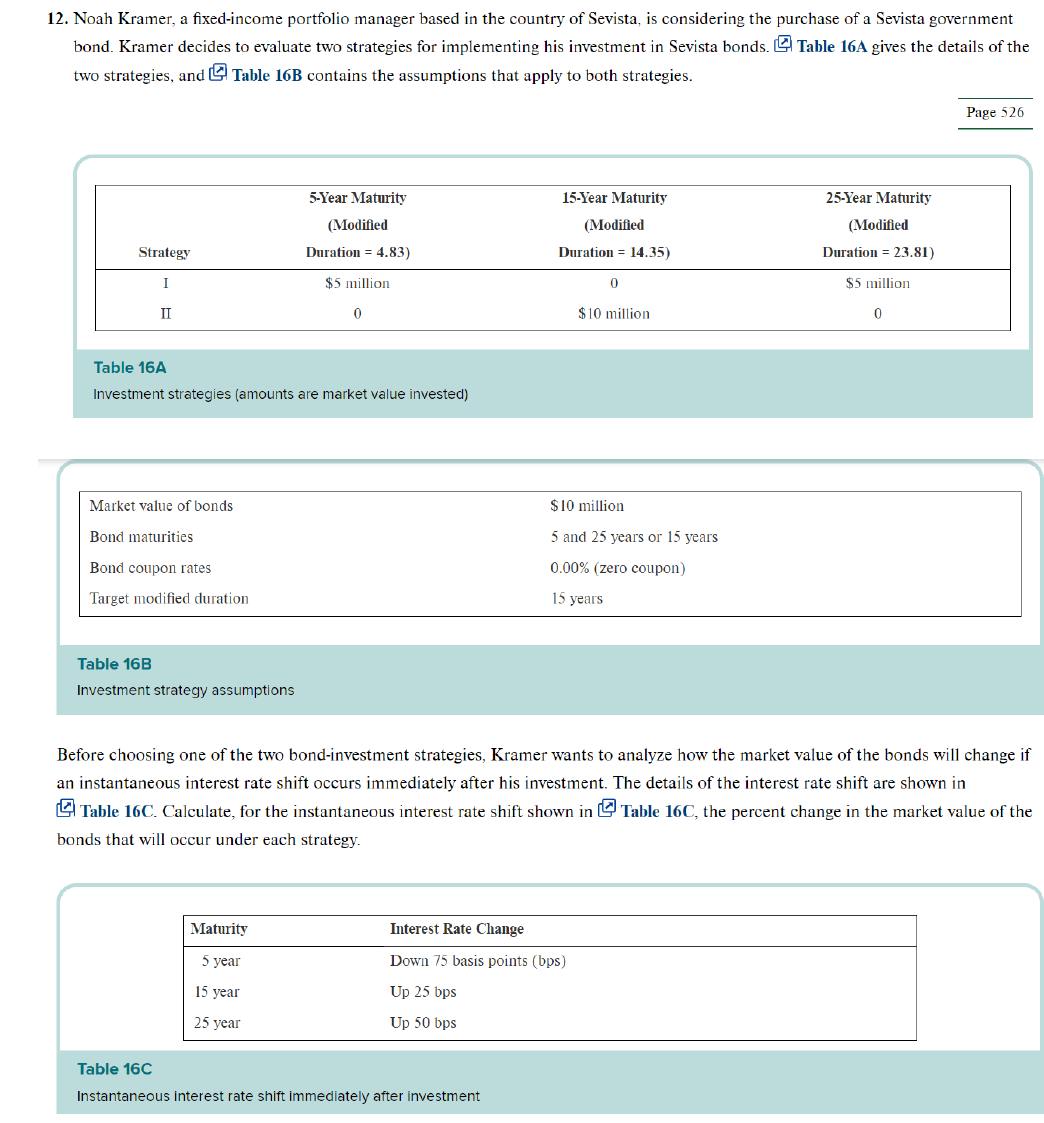

please provide all calculations and steps Noah Kramer, a fixed - income portfolio manager based in the country of Sevista, is considering the purchase of

please provide all calculations and steps Noah Kramer, a fixedincome portfolio manager based in the country of Sevista, is considering the purchase of a Sevista government

bond. Kramer decides to evaluate two strategies for implementing his investment in Sevista bonds. Table A gives the details of the

two strategies, and Table B contains the assumptions that apply to both strategies.

Table A

Investment strategies amounts are market value invested

Market value of bonds

Bond maturities

Bond coupon rates

Target modified duration

$ million

and years or years

zero coupon

years

Table B

Investment strategy assumptions

Before choosing one of the two bondinvestment strategies, Kramer wants to analyze how the market value of the bonds will change if

an instantaneous interest rate shift occurs immediately after his investment. The details of the interest rate shift are shown in

Table C Calculate, for the instantaneous interest rate shift shown in Table C the percent change in the market value of the

bonds that will occur under each strategy.

Table

Instantaneous interest rate shift immediately after investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started