Question

Please provide all formulas Your new CEO has been very supportive of new projects and asked you to assess the merits of a particular 3-year

Please provide all formulas

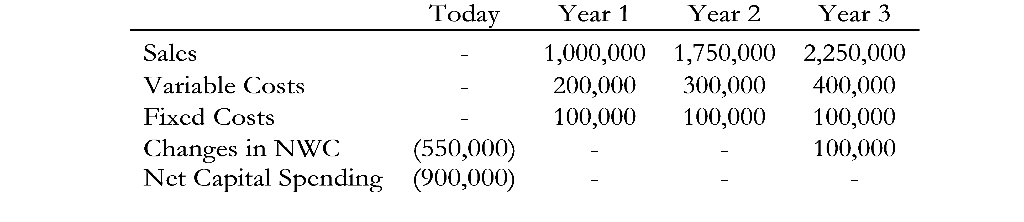

Your new CEO has been very supportive of new projects and asked you to assess the merits of a particular 3-year project. The information you were able to collect is the following

You were also informed that historically the projects of this particular division have been discounted with a required return of 20% to account for the risk of such projects.

Specifically, the CEO asked you for the following measures for this project. Assume a straight-line depreciation over the 3 years for the $900,000 assets you need to acquire for the project.

- The Payback Period and the Discounted Payback Period. Do those give rise to different decisions? If so, why?

- Internal Rate of Return

- NPV

- What is the meaning of the the values you got in (b) and (c)?

After you computed the measures above, you learned that the Marketing and Sales depart- ments put out a memo saying that there is a possibility of new entrants in the market competing directly with the product to be produced as part of this project. The memo also points out that, in the event that new companies are able to enter the market, the expected sales will be 15%, 20%, and 25% lower in years 1, 2, and 3, respectively.

e. Update the measures computed above in (a)(c).

f. Given your answers to (a) and (e), what would you recommend your CEO to do? What other information and analysis would you like to be able to collect and run before you need to make a definitive decision?

Today Year 1 Year 2 Year 3 Salcs Variable Costs Fixcd Costs Changes in NWC(550,000) Nct Capital Spending (900,000) 1,000,000 1,750,000 2,250,000 200,000 300,000 400,000 100,000100,000 100,000 100,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started