Question

Please provide an excel spreadsheet with the formulas!! More_Vino Expansion Proposal. Page 3: Page 4: costs, More Vino would have to increase its selling prices

Please provide an excel spreadsheet with the formulas!! More_Vino Expansion Proposal.

Page 3:

Page 4:

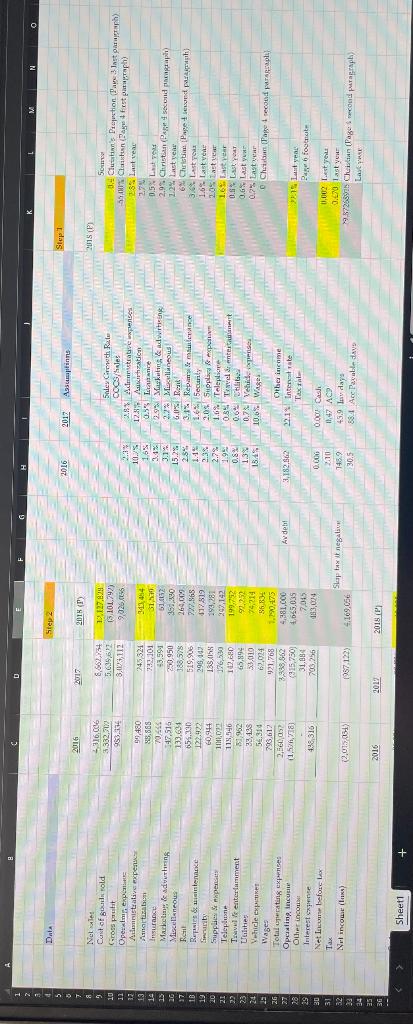

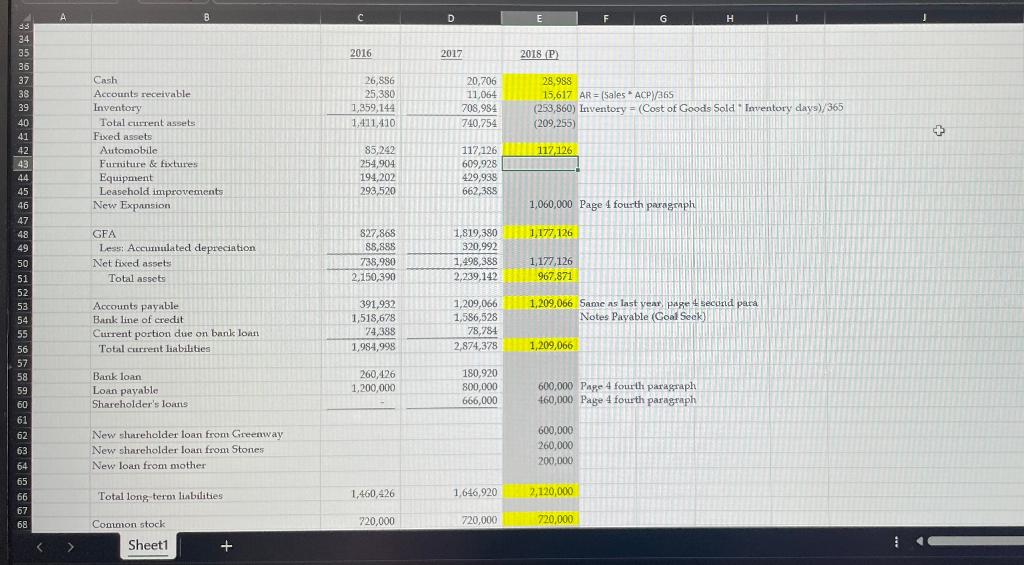

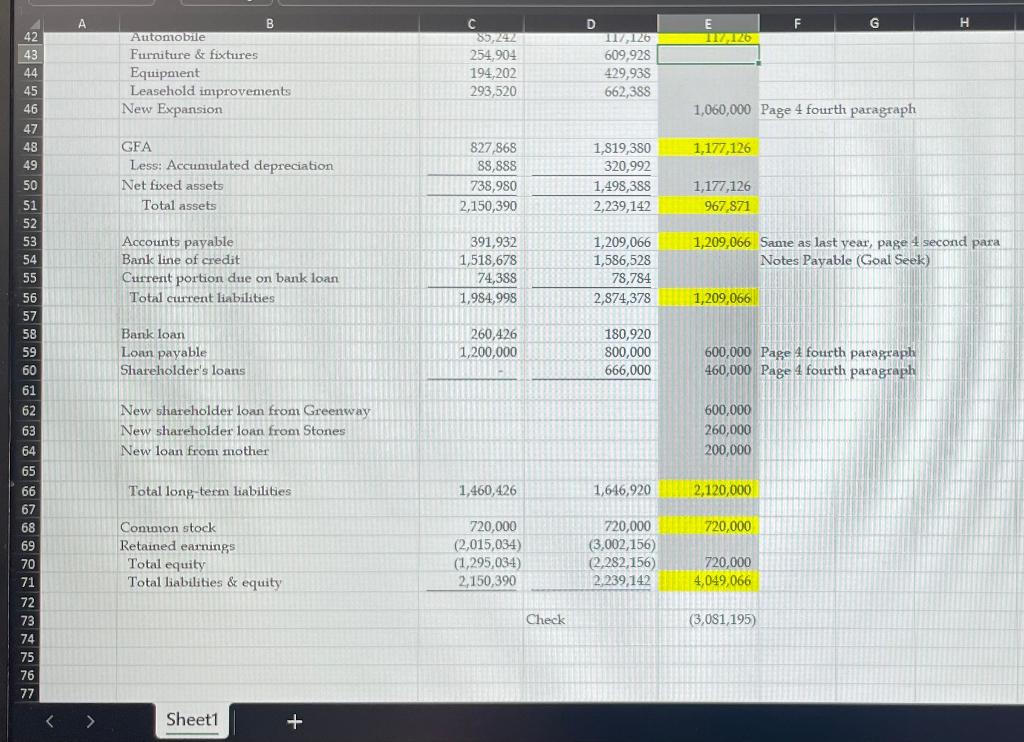

costs, More Vino would have to increase its selling prices at the retail level. Furthermore, with the expansion of More Vinos bar and restaurant business, Christian determined that a 30 per cent price increase on all products could be justified to align More Vinos prices with other competitors in the industry. As a result, Christian anticipated that this price hike would shrink the percentage of cost of goods sold to sales to approximately 55 per cent for 2018 and 2019. The expansion of More Vinos bar and restaurant would also increase other expenses. One of these would be an additional TT$300,000 in wages. As well, the stores rent expense would increase by 20 per cent for 2018. Christian also projected an increase in the marketing and advertising budget to 3.5 per cent of sales. The additional expenditure would promote the bars new patio area and would more effectively reach the intended target market. Finally, to reflect the changing mix of stock that would be carried in the store, it was expected that there would be a change in the days of inventory to 90 days. No change in accounts payable was anticipated since the business had recently been rewarded with extended payment terms from its suppliers going forward. Other items on the statement of earnings would remain roughly the same percentage of sales as was experienced in 2017. The brothers line of credit of TT$1,500,000 covered the working capital needs and seasonal peak purchases of inventory made in May and November, prior to the busy summer and winter periods. During the busy summer and winter months, working capital needs generally increased by another TT$120,000 to accommodate additional inventory purchases. The brothers were uncertain whether an increase on the line of credit would be needed to accommodate growth in the coming years. The patio expansion would cost TT$1,060,000, and Christian hoped to raise debt financing from three different sources. His mother, who had been a major source of funding over the past two years, had agreed to lend More Vino another TT$200,000. The brothers themselves were prepared to contribute an additional TT$130,000 each. Finally, Christian had approached Greenway and Moore for the remaining TT$600,000. All lenders agreed to lend these funds at an annual rate of nine per cent, and principal payments would not commence until 2020 when the business would be in a better position to reduce the balances. The current loan payable account would also not be reduced until 2020, leaving the bank loan as More Vinos only long-term debt obligation requiring payments in 2018 and 2019. THE DECISION More Vino had shown strong growth results in the past two years, but Greenway was concerned about providing more financing in addition to the original funds he and his partner had invested during the businesss startup. When he initially became involved with More Vino, Greenway had anticipated it to be a short-term arrangement, and he had not considered the prospect of participating in a second round of financing. Did he want to remain financially committed to the business? Would it be a better move to encourage the Stone brothers to look elsewhere for the TT$600,000 to fund the expansion? Finally, Greenway was also mindful of his personal relationship with Christian and David and the Stone family, should he elect to reject their financing proposal.

Arthur Greenway Arthur Greenway, a family friend to the Stones, was the vice-president of a global consumer beverage firm and an accomplished businessman. Given his breadth of knowledge and experience, the brothers were grateful for Greenway's input on their venture and were overjoyed when their concept was met with great favor from Greenway and his investment partner, Ross Moore. With the help of Greenway's expertise in strategic planning and access to regional contacts in the beverage industry, the brothers prepared a business plan for the project. They sought and secured seed funding and bank financing of over TT\$1,500,000 in loans, but also approached Greenway and Moore for a portion of the start-up capital. After reviewing the brothers' proposal, Greenway provided funding to open the bar but remained a silent partner and split his two-thirds controlling ownership in the business with Moore. Christian and David invested their own money, taking ownership of the remaining one-third of the company. With financing in place and a workable business plan set for implementation, the brothers had to choose a location for More Vino. They rented a building that was a former residence adjacent to Ariapita Avenue, a strip well known as home to many of the island's finer restaurants. The building's interior was largc enough to display hundreds of wine vintages and accommodate a warehouse and office spacc. A large garden area that could be renovated for future expansions also surrounded the property. RESTAURANT AND BAR EXPANSION Christian expected to have an even sales split between wholesale and retail consumers when More Vino opened; however, the brothers soon discovered that the majority of More Vino's sales had come from onsite consumption (see Exhibits 2 to 6 for fiscal 2016 and fiscal 2017 information), with the remaining sales divided equally among wholesale and distribution, the retail store and delivery service. Althougb little headway had been made in the wholesale and distribution market, it became clear that More Vino' $ small bar operation was growing in popularity as an after-work destination for young professionals. In response to this unexpected outcome, the brothers produced a plan to expand More Vino's bar and restaurant area to encourage the momentum of this part of the business. Approval was granted to renovate the building's exterior garden space into an outdoor patio area and to expand total seating capacity to 250 . The brothers soon rearranged the wines displayed in More Vino's retail area to allow some additional seating, resulting in customers' beginning to rely more heavily on More Vino's detailed product catalogue to make their selections. In addition to wine, beer and spirits, the product catalogue was also expanded to include a menu of hors d'ocuvres and appetizers. The bar's operating hours would be maintained from 10 a.m. to 1 a.m., but Christian anticipated after-work hours between 4 p.m. and 7 p.m. to be the busiest, outside of the weekend crowd. Christian had aspirations to sell accessories (such as glasses, gift baskets, wine bottle holders and openers) and to offer winc-tasting events, special promotions and a More Vino wine club to attract and retain a regular elientele. Financial Projections Christian was excited about the potential sales growth that could result from the expansion. He anticipated total sales to increase by 40 per cent for 2018. As the business became more established as a leading competitor in the local bar and restaurant industry, Christian projected total sales to increase by another 20 per cent for 2019. However, Christian was concemed about increases in the cost of goods sold as a percentage of sales for the next two years. Island officials had announced a maximum 15 per cent increase on the excise duty tax eharged on locally manufactured alcoholic products, and up to a 30 per cent increase on international and imported alcoholic products. This would mean that most of More Vino's inventory purchases would be subject to a 10 per cent to 15 per cent increase in cost. To counteract these increased Arthur Greenway Arthur Greenway, a family friend to the Stones, was the vice-president of a global consumer beverage firm and an accomplished businessman. Given his breadth of knowledge and experience, the brothers were grateful for Greenway's input on their venture and were overjoyed when their concept was met with great favor from Greenway and his investment partner, Ross Moore. With the help of Greenway's expertise in strategic planning and access to regional contacts in the beverage industry, the brothers prepared a business plan for the project. They sought and secured seed funding and bank financing of over TT\$1,500,000 in loans, but also approached Greenway and Moore for a portion of the start-up capital. After reviewing the brothers' proposal, Greenway provided funding to open the bar but remained a silent partner and split his two-thirds controlling ownership in the business with Moore. Christian and David invested their own money, taking ownership of the remaining one-third of the company. With financing in place and a workable business plan set for implementation, the brothers had to choose a location for More Vino. They rented a building that was a former residence adjacent to Ariapita Avenue, a strip well known as home to many of the island's finer restaurants. The building's interior was largc enough to display hundreds of wine vintages and accommodate a warehouse and office spacc. A large garden area that could be renovated for future expansions also surrounded the property. RESTAURANT AND BAR EXPANSION Christian expected to have an even sales split between wholesale and retail consumers when More Vino opened; however, the brothers soon discovered that the majority of More Vino's sales had come from onsite consumption (see Exhibits 2 to 6 for fiscal 2016 and fiscal 2017 information), with the remaining sales divided equally among wholesale and distribution, the retail store and delivery service. Althougb little headway had been made in the wholesale and distribution market, it became clear that More Vino' $ small bar operation was growing in popularity as an after-work destination for young professionals. In response to this unexpected outcome, the brothers produced a plan to expand More Vino's bar and restaurant area to encourage the momentum of this part of the business. Approval was granted to renovate the building's exterior garden space into an outdoor patio area and to expand total seating capacity to 250 . The brothers soon rearranged the wines displayed in More Vino's retail area to allow some additional seating, resulting in customers' beginning to rely more heavily on More Vino's detailed product catalogue to make their selections. In addition to wine, beer and spirits, the product catalogue was also expanded to include a menu of hors d'ocuvres and appetizers. The bar's operating hours would be maintained from 10 a.m. to 1 a.m., but Christian anticipated after-work hours between 4 p.m. and 7 p.m. to be the busiest, outside of the weekend crowd. Christian had aspirations to sell accessories (such as glasses, gift baskets, wine bottle holders and openers) and to offer winc-tasting events, special promotions and a More Vino wine club to attract and retain a regular elientele. Financial Projections Christian was excited about the potential sales growth that could result from the expansion. He anticipated total sales to increase by 40 per cent for 2018. As the business became more established as a leading competitor in the local bar and restaurant industry, Christian projected total sales to increase by another 20 per cent for 2019. However, Christian was concemed about increases in the cost of goods sold as a percentage of sales for the next two years. Island officials had announced a maximum 15 per cent increase on the excise duty tax eharged on locally manufactured alcoholic products, and up to a 30 per cent increase on international and imported alcoholic products. This would mean that most of More Vino's inventory purchases would be subject to a 10 per cent to 15 per cent increase in cost. To counteract these increasedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started