Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide answer compelete detail and solve all requirements thanks Q3. Relax, Inc., manufactures high-quality sleeping bags, which sell for Rs. 130 each. The variable

please provide answer compelete detail and solve all requirements thanks

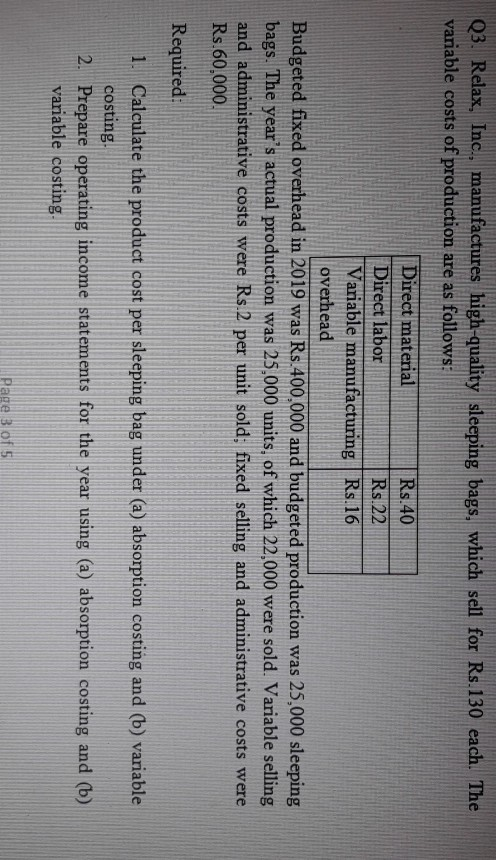

Q3. Relax, Inc., manufactures high-quality sleeping bags, which sell for Rs. 130 each. The variable costs of production are as follows: Direct material Rs.40 Direct labor Rs.22 Variable manufacturing Rs.16 overhead Budgeted fixed overhead in 2019 was Rs.400,000 and budgeted production was 25,000 sleeping bags. The year's actual production was 25,000 units, of which 22,000 were sold. Variable selling and administrative costs were Rs.2 per unit sold; fixed selling and administrative costs were Rs.60,000. Required: Calculate the product cost per sleeping bag under (a) absorption costing and (b) variable costing 2. Prepare operating income statements for the year using (a) absorption costing and (b) variable costing. Page 3 of 5 3. Reconcile reported operating income under the two methods using the shortcut methodStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started