Answered step by step

Verified Expert Solution

Question

1 Approved Answer

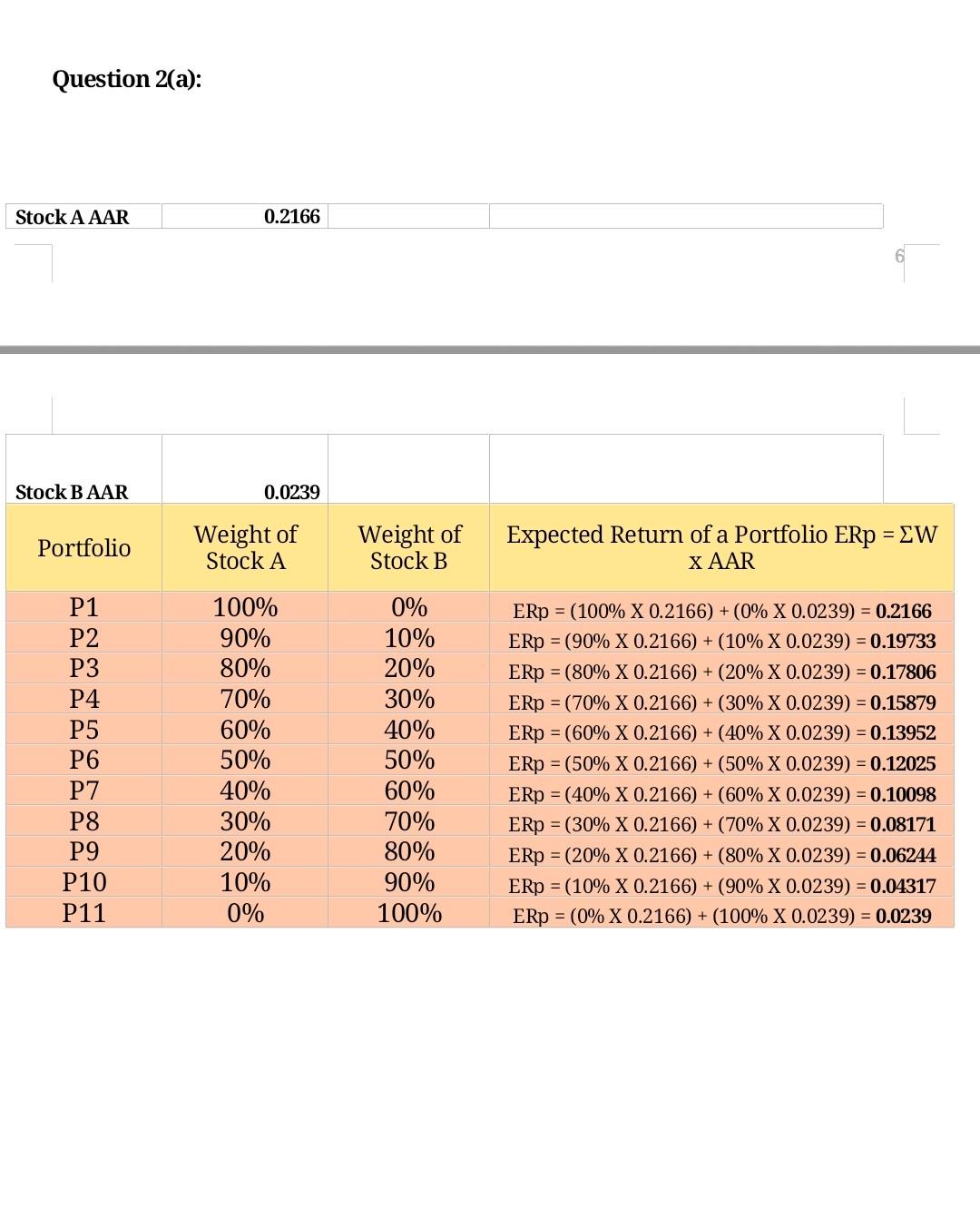

Please provide answer for Q2(b) Which portfolios is/are good to create. Provide reason Question 2(a): Stock A AAR 0.2166 Stock BAAR 0.0239 Portfolio Weight of

Please provide answer for Q2(b) Which portfolios is/are good to create. Provide reason

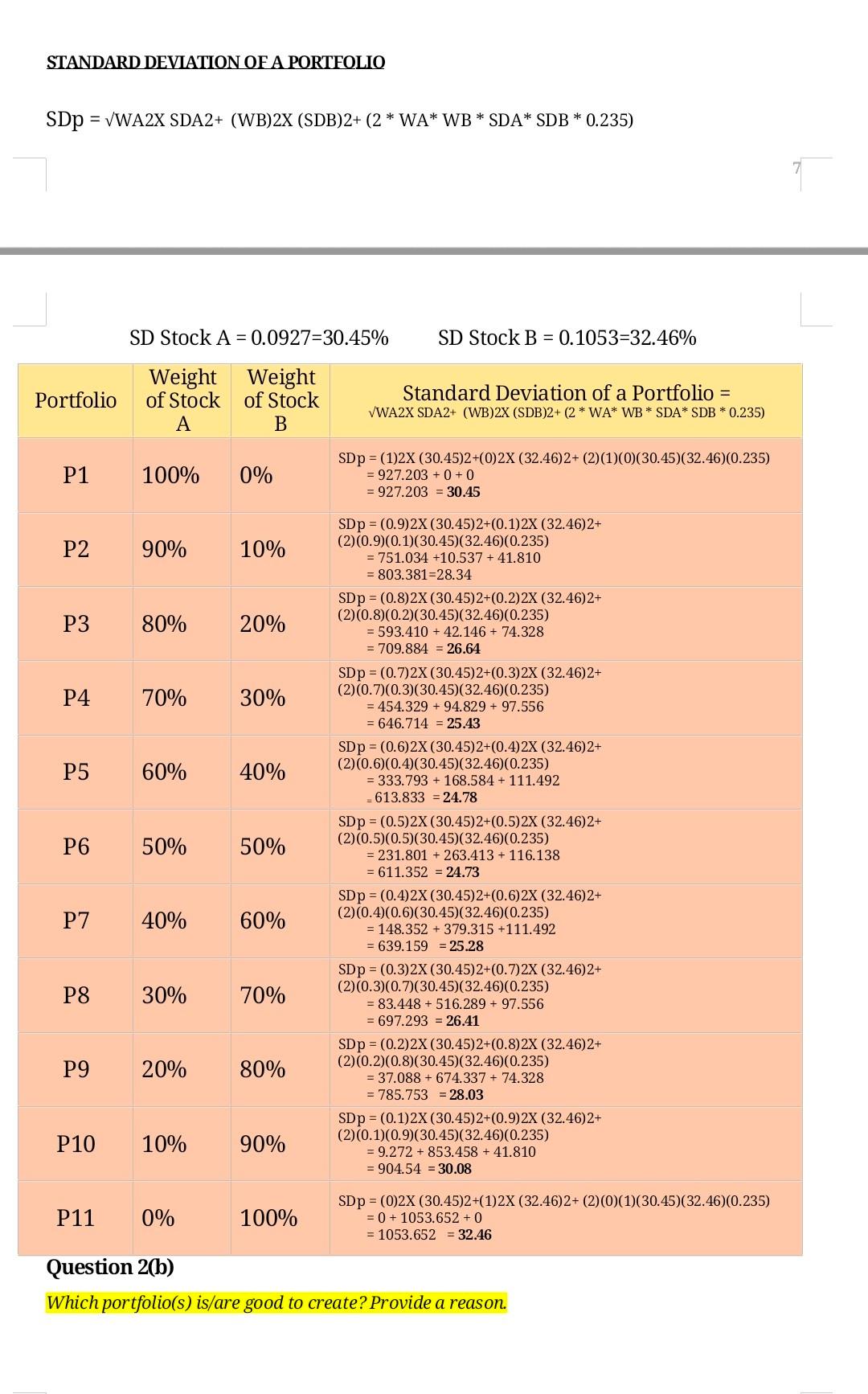

Question 2(a): Stock A AAR 0.2166 Stock BAAR 0.0239 Portfolio Weight of Stock A Weight of Stock B Expected Return of a Portfolio ERp = EW X AAR P1 P2 P3 P4 P5 P6 P7 P8 P9 P10 P11 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% 0% 10% 20% 30% 40% 50% 60% 70% 80% 90% 100% ERA = (100% X 0.2166) + (0% X 0.0239) = 0.2166 ERP = (90% X 0.2166) + (10% X 0.0239) = 0.19733 ERP = (80% X 0.2166) + (20% X 0.0239) = 0.17806 ERA = (70% X 0.2166) + (30% X 0.0239) = 0.15879 ERP = (60% X 0.2166) + (40% X 0.0239) = 0.13952 ERP = (50% X 0.2166) + (50% X 0.0239) = 0.12025 ERP = (40% X 0.2166) + (60% X 0.0239) = 0.10098 ERP = (30% X 0.2166) + (70% X 0.0239) = 0.08171 ERP = (20% X 0.2166) + (80% X 0.0239) = 0.06244 ERP = (10% X 0.2166) + (90% X 0.0239) = 0.04317 ERP = (0% X 0.2166) + (100% X 0.0239) = 0.0239 STANDARD DEVIATION OF A PORTFOLIO SDp = = VWA2X SDA2+ (WB)2X (SDB)2+ (2* WA* WB * SDA* SDB * 0.235) SD Stock A = 0.0927=30.45% SD Stock B = 0.1053=32.46% Portfolio Weight Weight of Stock of Stock A B Standard Deviation of a Portfolio = VWA2X SDA2+ (WB)2X (SDB)2+ (2* WA* WB * SDA* SDB * 0.235) P1 100% 0% SDp = (1)2X (30.45)2+(0)2X (32.46)2+ (2)(1)0(30.45)(32.46)(0.235) = 927.203 + 0 + 0 = 927.203 = 30.45 P2 90% 10% P3 80% 20% P4 70% 30% P5 60% 40% P6 50% 50% SDp = (0.9)2X (30.45)2+(0.1)2X (32.46)2+ (2)(0.9)(0.1)(30.45)(32.46) (0.235) = 751.034 +10.537 + 41.810 = 803.381=28.34 SDp = (0.8)2X (30.45)2+(0.2)2X (32.46)2+ (2)(0.8)(0.2)(30.45)(32.46)(0.235) = 593.410 + 42.146 + 74.328 = 709.884 = 26.64 SDp = (0.7)2X (30.45)2+(0.3)2X (32.46)2+ (2)(0.7)(0.3)(30.45)(32.46 (0.235) = 454.329 + 94.829 + 97.556 = 646.714 = 25.43 SDp = (0.6)2X (30.45)2+(0.4)2X (32.46)2+ (2)(0.6) (0.4)(30.45)(32.46) (0.235) = 333.793 +168.584 + 111.492 613.833 = 24.78 SDp = (0.5)2X (30.45)2+(0.5)2X (32.46)2+ (2)(0.5)(0.5)(30.45)(32.46) (0.235) = 231.801 + 263.413 +116.138 = 611.352 = 24.73 SDp = (0.4)2X (30.45)2+(0.6)2X (32.46)2+ (2)(0.4)(0.6)(30.45)(32.46) (0.235) = 148.352 + 379.315 +111.492 = 639.159 = 25.28 SDp = (0.3)2X (30.45)2+(0.7)2X (32.46)2+ (2)(0.3)(0.7)(30.45)(32.46) (0.235) = 83.448 + 516.289 + 97.556 = 697.293 = 26.41 SDp = (0.2)2X (30.45)2+(0.8)2X (32.46)2+ (2)(0.2)(0.8)(30.45)(32.46) (0.235) = 37.088 +674.337 + 74.328 = 785.753 = 28.03 SDp = (0.1)2X (30.45)2+(0.9)2X (32.46)2+ (2)(0.1)(0.9)(30.45)(32.46)(0.235) = 9.272 +853.458 + 41.810 = 904.54 = 30.08 P7 40% 60% P8 30% 70% P9 20% 80% P10 10% 90% P11 0% 100% SDp = (0)2X (30.45)2+(1)2X (32.46)2+ (2)0(1)(30.45)(32.46)(0.235) = 0 + 1053.652 +0 = 1053.652 = 32.46 Question 2(b) Which portfolio(s) is/are good to create? Provide a reasonStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started