Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide answer o first 3 question thoroughly, as it is a case study, thankyou 25 Deutsche Post World Net: Leveraging Procurement Savings with Performance

please provide answer o first 3 question thoroughly, as it is a case study, thankyou

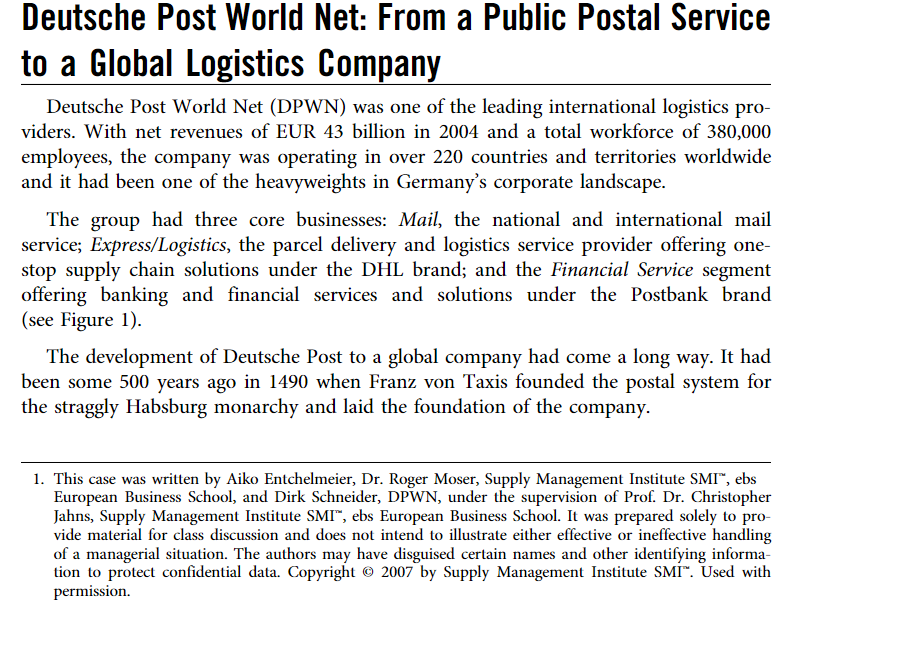

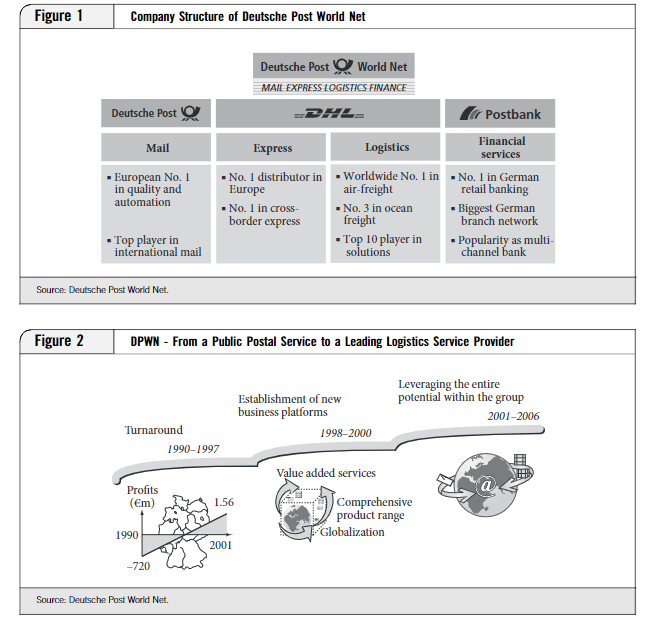

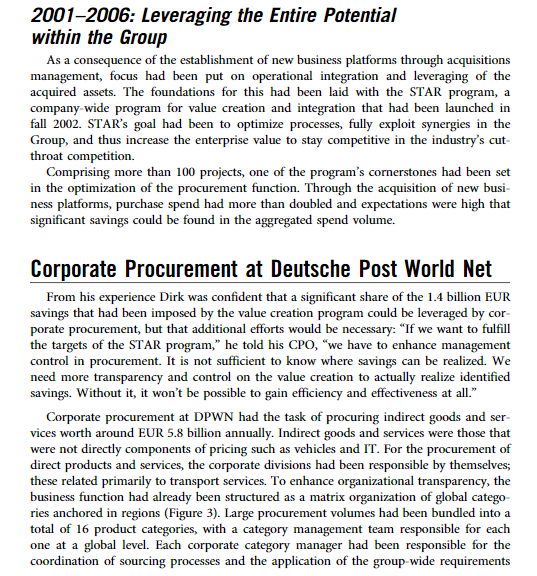

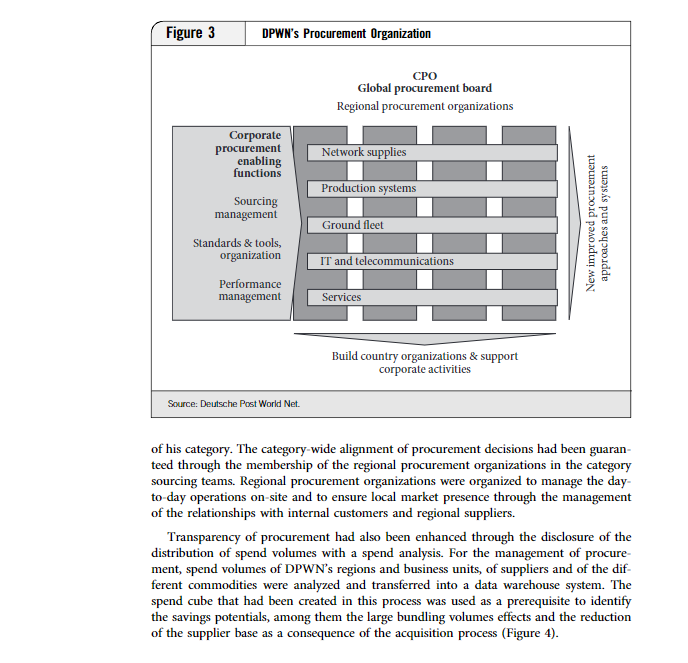

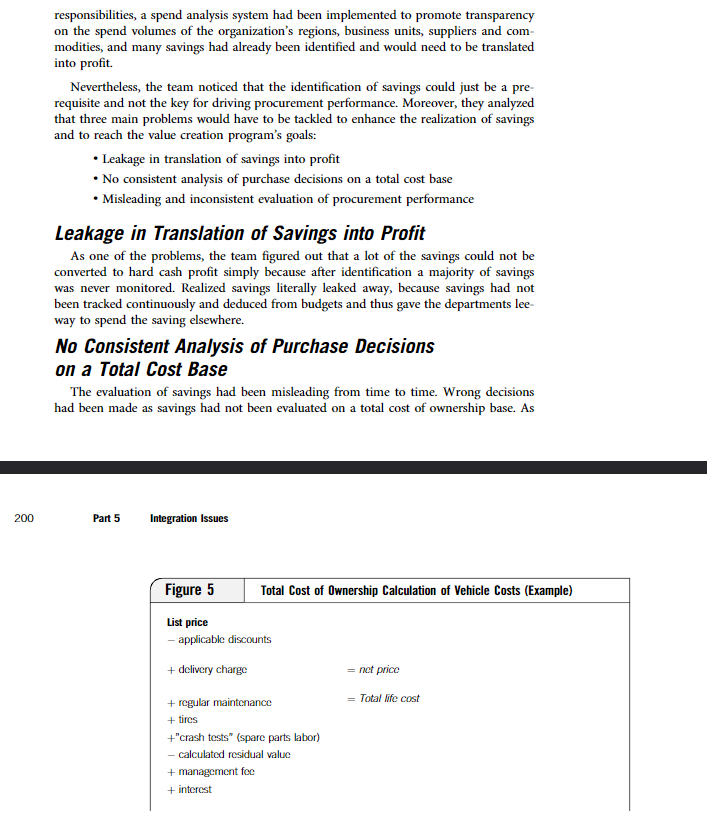

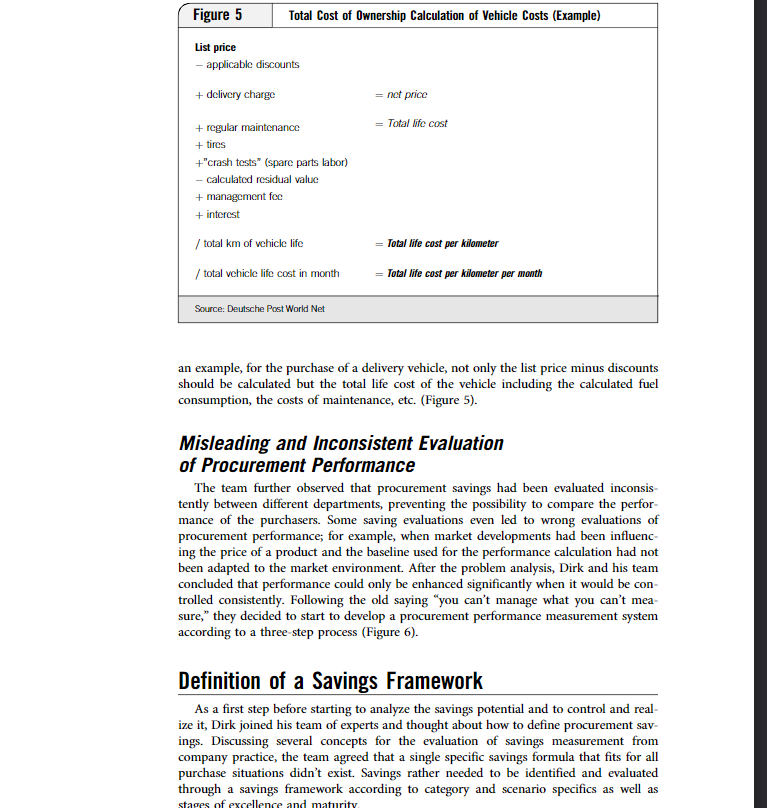

25 Deutsche Post World Net: Leveraging Procurement Savings with Performance Measures 1 It was an early evening August 6, 2002 when Dirk Schneider left a meeting with the CPO and the recently established Global Procurement Board of Deutsche Post World Net. As a senior vice president responsible for Procurement Performance Management of Deutsche Post World Net, Dirk had been assigned together with his colleagues from the procurement board to lever the enormous savings potentials that had been hidden in the company's procurement organization after the acquisition of several major companies. Dirk already knew that the identification of the savings itself was not sufficient to translate the huge synergy effects from recently acquired businesses into hard cash savings. Procurement savings would need to be controlled constantly to be translated into profit. Thinking about a solution, Dirk picked up the phone to start to discuss possible approaches with Michael Hohlbein, one of his team members. Deutsche Post World Net: From a Public Postal Service to a Global Logistics Company Deutsche Post World Net: From a Public Postal Service to a Global Logistics Company Deutsche Post World Net (DPWN) was one of the leading international logistics providers. With net revenues of EUR 43 billion in 2004 and a total workforce of 380,000 employees, the company was operating in over 220 countries and territories worldwide and it had been one of the heavyweights in Germany's corporate landscape. The group had three core businesses: Mail, the national and international mail service; Express/Logistics, the parcel delivery and logistics service provider offering onestop supply chain solutions under the DHL brand; and the Financial Service segment offering banking and financial services and solutions under the Postbank brand (see Figure 1). The development of Deutsche Post to a global company had come a long way. It had been some 500 years ago in 1490 when Franz von Taxis founded the postal system for the straggly Habsburg monarchy and laid the foundation of the company. 1. This case was written by Aiko Entchelmeier, Dr. Roger Moser, Supply Management Institute SMI", ebs European Business School, and Dirk Schneider, DPWN, under the supervision of Prof. Dr. Christopher Jahns, Supply Management Institute SMI", ebs European Business School. It was prepared solely to provide material for class discussion and does not intend to illustrate either effective or ineffective handling of a managerial situation. The authors may have disguised certain names and other identifying information to protect confidential data. Copyright 2007 by Supply Management Institute SMI*. Used with permission. \begin{tabular}{|l|l} Figure 1 & Company Structure of Deutsche Post World Net \\ \hline \end{tabular} Deutsche Post World Net MAll EXPRESS LOGISTICS FINANCE Source: Deutsche Post World Net. \begin{tabular}{|l|l|} \hline Figure 2 & DPWN - From a Public Postal Service to a Leading Logistics Service Provider \\ \hline \end{tabular} Leveraging the entire Establishment of new potential within the group business platforms Turnaround 2001-2006 1990-1997 Value added services Comprehensive product range Source: Deutsche Post World Net. Modern history of Deutsche Post World Net, however, started in 1989 when governmental reforms commenced to convert the German national postal service from a publicly-owned monopolist to a publicly listed stock corporation that would have to face competition. Since then, transformation of what was now Deutsche Post World Net had been undertaken in a three-step process (see Figure 2). 1990-1997: Turnaround After privatization, the former governmental postal service had to be made ready for competition. With 380,000 workers and DM 20.2 billion in revenues (1990) the organization had been largely inefficient and received even more subsidies than revenues. As an Case 25 Deutsche Post World Net: Leveraging Procurement Savings with Performance Measures additional barrier, the highly inefficient East German postal service had to be integrated after the country's reunification in 1989. As a consequence, large structural efforts like the redesign of the distribution strategy and the cut down of the number of the company's retail outlet centers had to be taken to convert DPWN to a profitable corporation that would be able to issue shares to the public. 1998-2000: Establishment of New Business Platforms After restructuring the company from a money-losing publicly-owned company to a profitable corporation with sustainable growth, management attention had been put on the establishment of new business platforms. Senior management was aware that with the increasing competition the market was going to be divided between DPWN and a few major competitors like the American companies UPS and FedEx and the Dutchbased TPG. Milestones in this process had been the acquisition of DHL, then global market leader for express mail service, and the acquisition of Postbank, the newly created financial service segment of DPWN. 2001-2006: Leveraging the Entire Potential within the Group As a consequence of the establishment of new business platforms through acquisitions management, focus had been put on operational integration and leveraging of the acquired assets. The foundations for this had been laid with the STAR program, a company-wide program for value creation and integration that had been launched in fall 2002. STAR's goal had been to optimize processes, fully exploit synergies in the Group, and thus increase the enterprise value to stay competitive in the industry's cutthroat competition. Comprising more than 100 projects, one of the program's cornerstones had been set in the optimization of the procurement function. Through the acquisition of new business platforms, purchase spend had more than doubled and expectations were high that 2001-2006: Leveraging the Entire Potential within the Group As a consequence of the establishment of new business platforms through acquisitions management, focus had been put on operational integration and leveraging of the acquired assets. The foundations for this had been laid with the STAR program, a company-wide program for value creation and integration that had been launched in fall 2002. STAR's goal had been to optimize processes, fully exploit synergies in the Group, and thus increase the enterprise value to stay competitive in the industry's cutthroat competition. Comprising more than 100 projects, one of the program's cornerstones had been set in the optimization of the procurement function. Through the acquisition of new business platforms, purchase spend had more than doubled and expectations were high that significant savings could be found in the aggregated spend volume. Corporate Procurement at Deutsche Post World Net From his experience Dirk was confident that a significant share of the 1.4 billion EUR savings that had been imposed by the value creation program could be leveraged by corporate procurement, but that additional efforts would be necessary: "If we want to fulfill the targets of the STAR program," he told his CPO, "we have to enhance management control in procurement. It is not sufficient to know where savings can be realized. We need more transparency and control on the value creation to actually realize identified savings. Without it, it won't be possible to gain efficiency and effectiveness at all." Corporate procurement at DPWN had the task of procuring indirect goods and services worth around EUR 5.8 billion annually. Indirect goods and services were those that were not directly components of pricing such as vehicles and IT. For the procurement of direct products and services, the corporate divisions had been responsible by themselves; these related primarily to transport services. To enhance organizational transparency, the business function had already been structured as a matrix organization of global categories anchored in regions (Figure 3). Large procurement volumes had been bundled into a total of 16 product categories, with a category management team responsible for each one at a global level. Each corporate category manager had been responsible for the coordination of sourcing processes and the application of the group-wide requirements of his category. The category-wide alignment of procurement decisions had been guaranteed through the membership of the regional procurement organizations in the category sourcing teams. Regional procurement organizations were organized to manage the dayto-day operations on-site and to ensure local market presence through the management of the relationships with internal customers and regional suppliers. Transparency of procurement had also been enhanced through the disclosure of the distribution of spend volumes with a spend analysis. For the management of procurement, spend volumes of DPWN's regions and business units, of suppliers and of the different commodities were analyzed and transferred into a data warehouse system. The spend cube that had been created in this process was used as a prerequisite to identify the savings potentials, among them the large bundling volumes effects and the reduction of the supplier base as a consequence of the acquisition process (Figure 4). From Performance Improvement to Performance Measurement When Dirk and his team analyzed the steps that would have to be taken to achieve the goals that had been imposed on corporate procurement by the company's value creation program, they agreed that transparency on the realization of the identified savings would be decisive for the improvement in performance. Analyzing the status quo, they noticed that some requirements had already been implemented and would facilitate their work. The organization was organized as a matrix structure with clear Case 25 Deutsche Post World Net: Leveraging Procurement Savings with Performance Measures responsibilities, a spend analysis system had been implemented to promote transparency on the spend volumes of the organization's regions, business units, suppliers and commodities, and many savings had already been identified and would need to be translated into profit. responsibilities, a spend analysis system had been implemented to promote transparency on the spend volumes of the organization's regions, business units, suppliers and commodities, and many savings had already been identified and would need to be translated into profit. Nevertheless, the team noticed that the identification of savings could just be a prerequisite and not the key for driving procurement performance. Moreover, they analyzed that three main problems would have to be tackled to enhance the realization of savings and to reach the value creation program's goals: - Leakage in translation of savings into profit - No consistent analysis of purchase decisions on a total cost base - Misleading and inconsistent evaluation of procurement performance Leakage in Translation of Savings into Profit As one of the problems, the team figured out that a lot of the savings could not be converted to hard cash profit simply because after identification a majority of savings was never monitored. Realized savings literally leaked away, because savings had not been tracked continuously and deduced from budgets and thus gave the departments leeway to spend the saving elsewhere. No Consistent Analysis of Purchase Decisions on a Total Cost Base The evaluation of savings had been misleading from time to time. Wrong decisions had been made as savings had not been evaluated on a total cost of ownership base. As an example, for the purchase of a delivery vehicle, not only the list price minus discounts should be calculated but the total life cost of the vehicle including the calculated fuel consumption, the costs of maintenance, etc. (Figure 5). Misleading and Inconsistent Evaluation of Procurement Performance The team further observed that procurement savings had been evaluated inconsistently between different departments, preventing the possibility to compare the performance of the purchasers. Some saving evaluations even led to wrong evaluations of procurement performance; for example, when market developments had been influencing the price of a product and the baseline used for the performance calculation had not been adapted to the market environment. After the problem analysis, Dirk and his team concluded that performance could only be enhanced significantly when it would be controlled consistently. Following the old saying "you can't manage what you can't measure," they decided to start to develop a procurement performance measurement system according to a three-step process (Figure 6). Definition of a Savings Framework As a first step before starting to analyze the savings potential and to control and realize it, Dirk joined his team of experts and thought about how to define procurement savings. Discussing several concepts for the evaluation of savings measurement from company practice, the team agreed that a single specific savings formula that fits for all purchase situations didn't exist. Savings rather needed to be identified and evaluated through a savings framework according to category and scenario specifics as well as Based on this decision, a generic savings definition was derived that would serve as a guiding principle for all saving related discussions and as a guideline to develop a comprehensive, category-specific savings framework as a manual for the evaluation of all actions: Procurement savings are the financially calculable value contribution of procurement functions to the company result. Savings influence DPWN's cost structure across the entire supply chain from the suppliers through the company, including the incurred process costs, up to the customers or disposal. Within this definition it was agreed that savings should be considered as the difference between the expected EBITA when a procurement initiative launched and when the same procurement initiative would not have been launched. Having the guiding definition in mind, Dirk and his team took advantage to develop a comprehensive savings framework in three steps before translating the savings then into company performance and implementing future-looking indicators: - Identification of savings types on a total cost basis - Development of savings scenarios for the different savings types and assignment to categories - Definition of consistent calculation rules for every savings scenario Discussion Questions 1. What is the purpose and content of the STAR program? 2. What kind of savings types and appropriate saving scenarios might be applied by Dirk and his team? 3. What kind of calculation rules for saving scenarios might Dirk apply

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started