Answered step by step

Verified Expert Solution

Question

1 Approved Answer

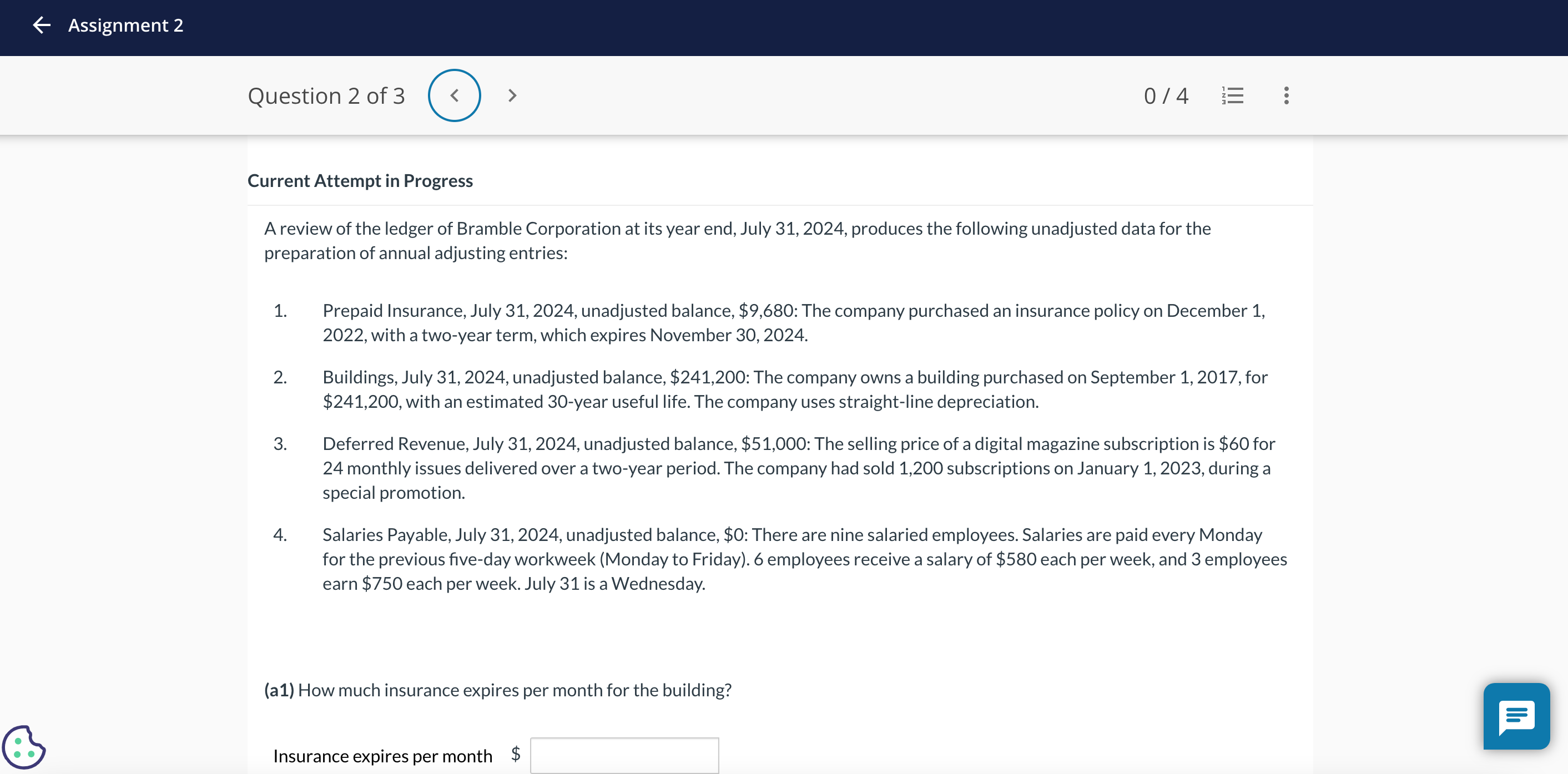

Please provide answers and journal entries for this question, thank you (a1) How much insurance expires per month for the building? Insurance expires per month

Please provide answers and journal entries for this question, thank you

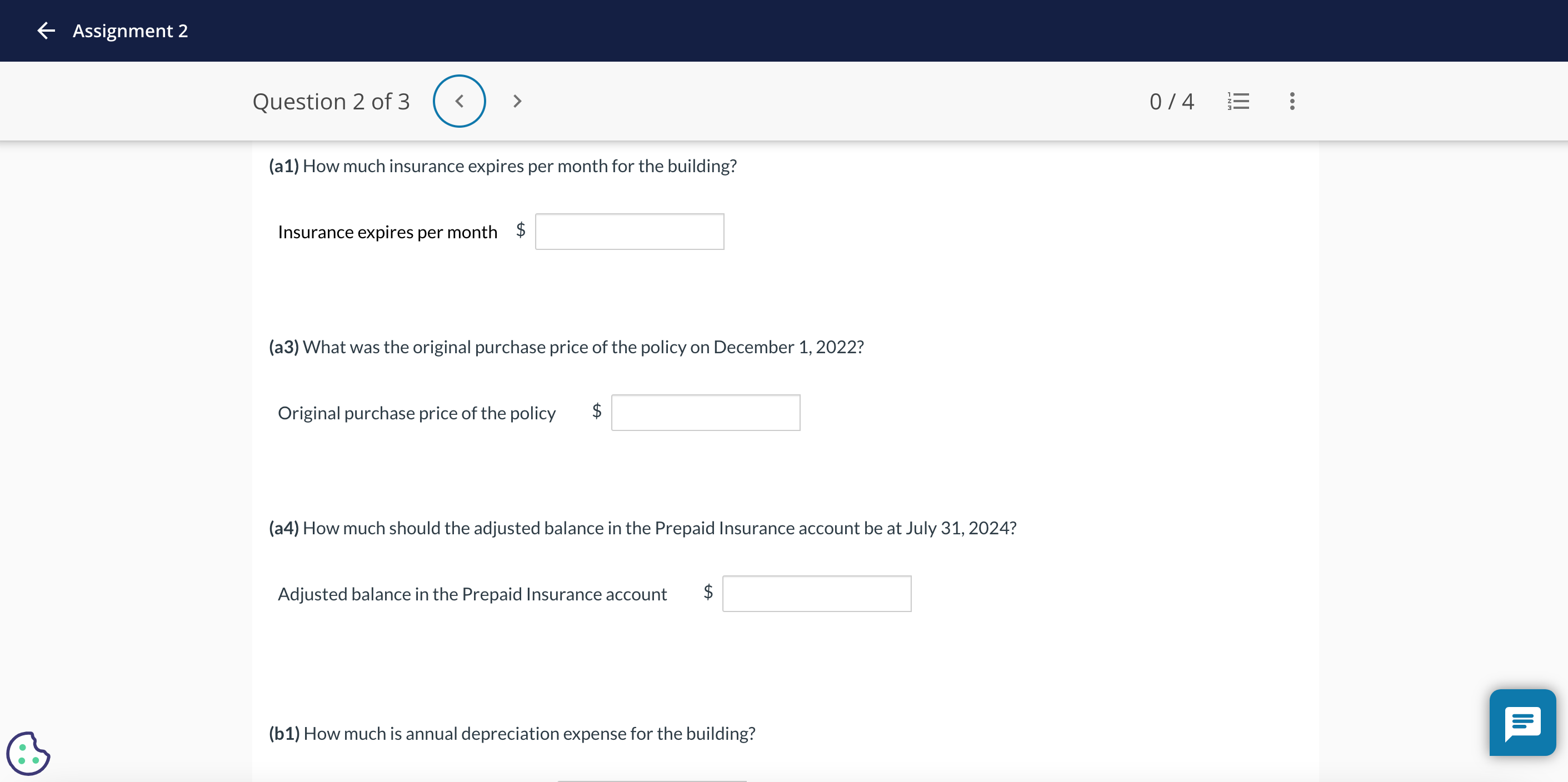

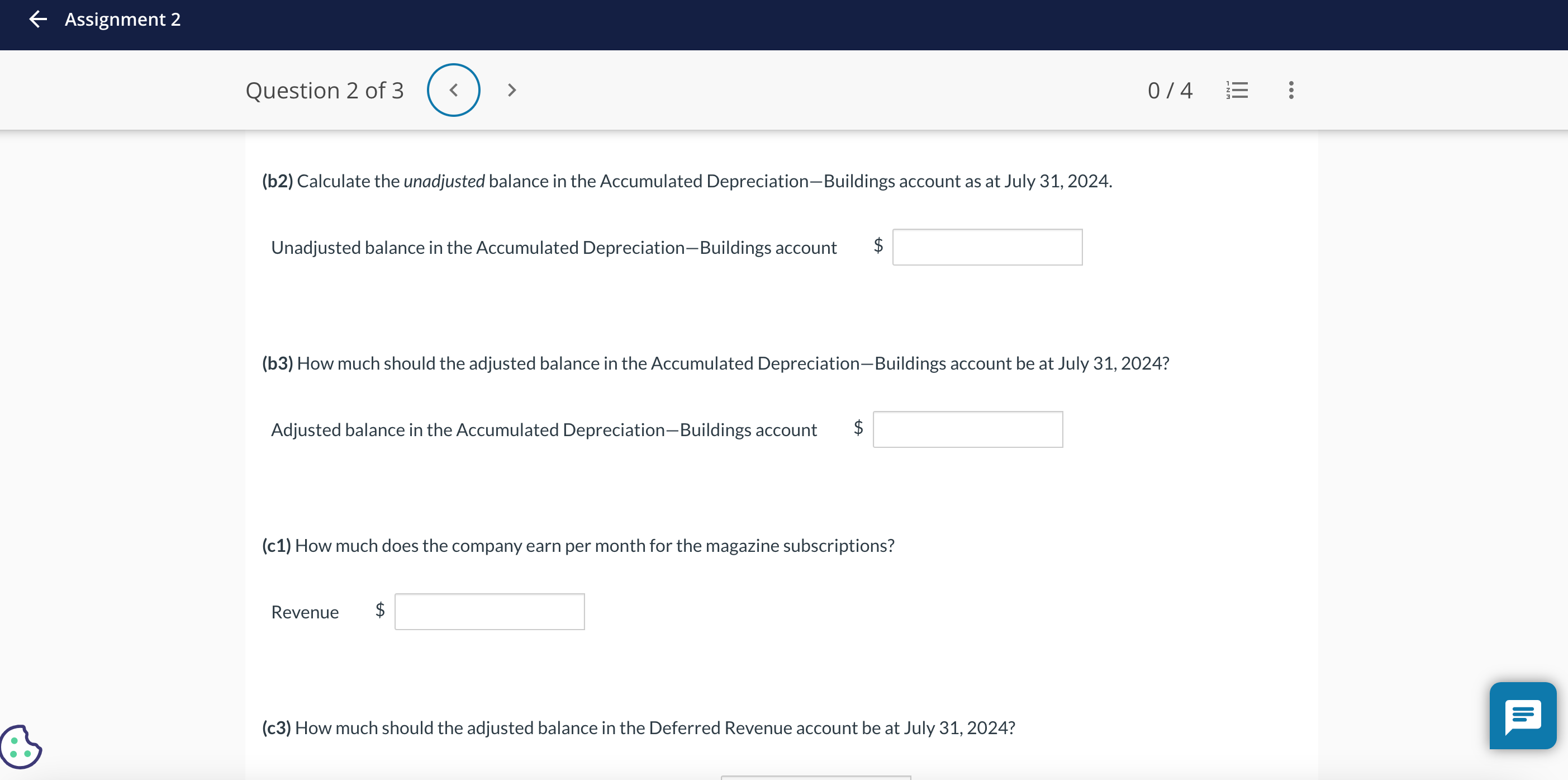

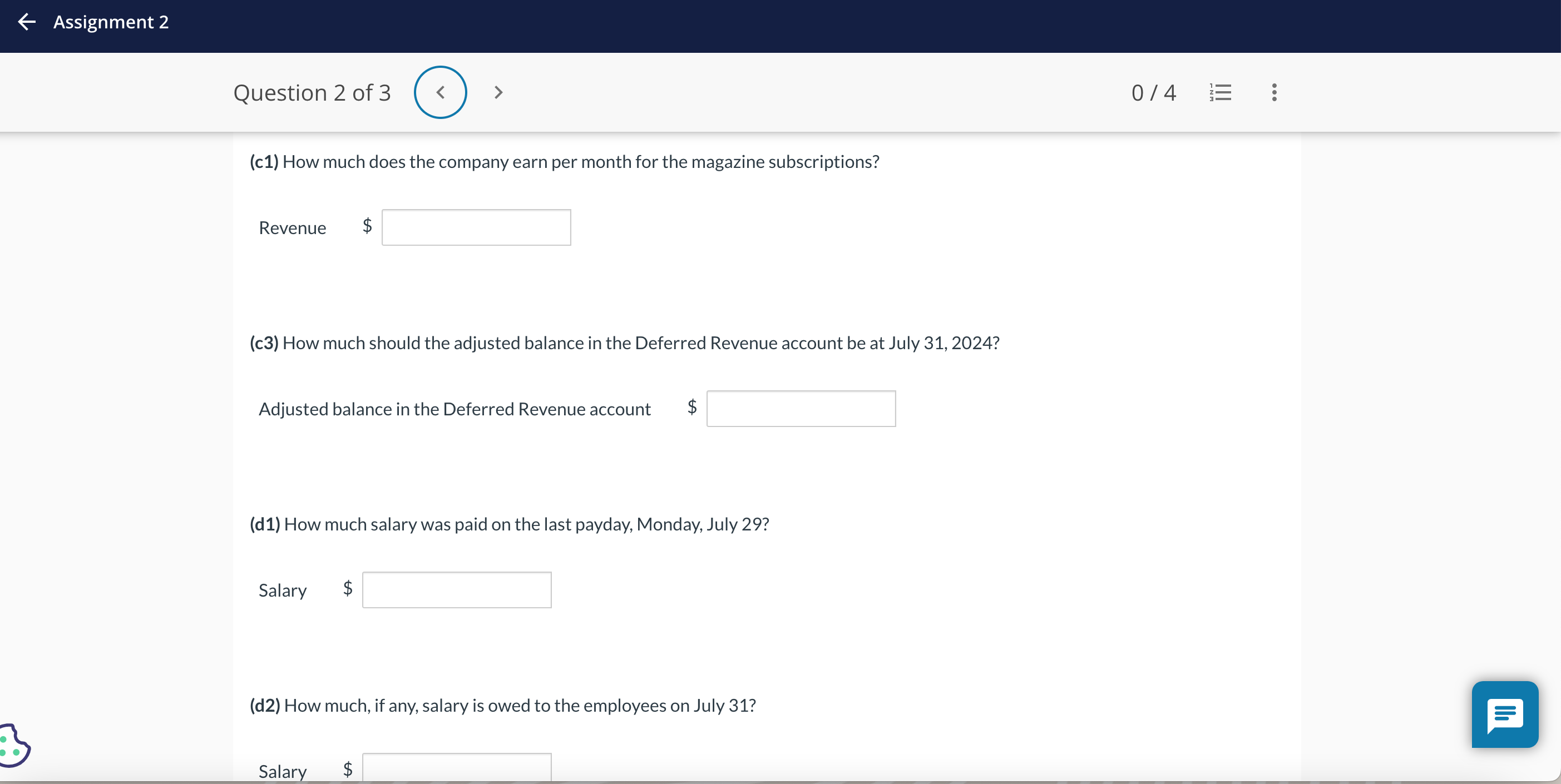

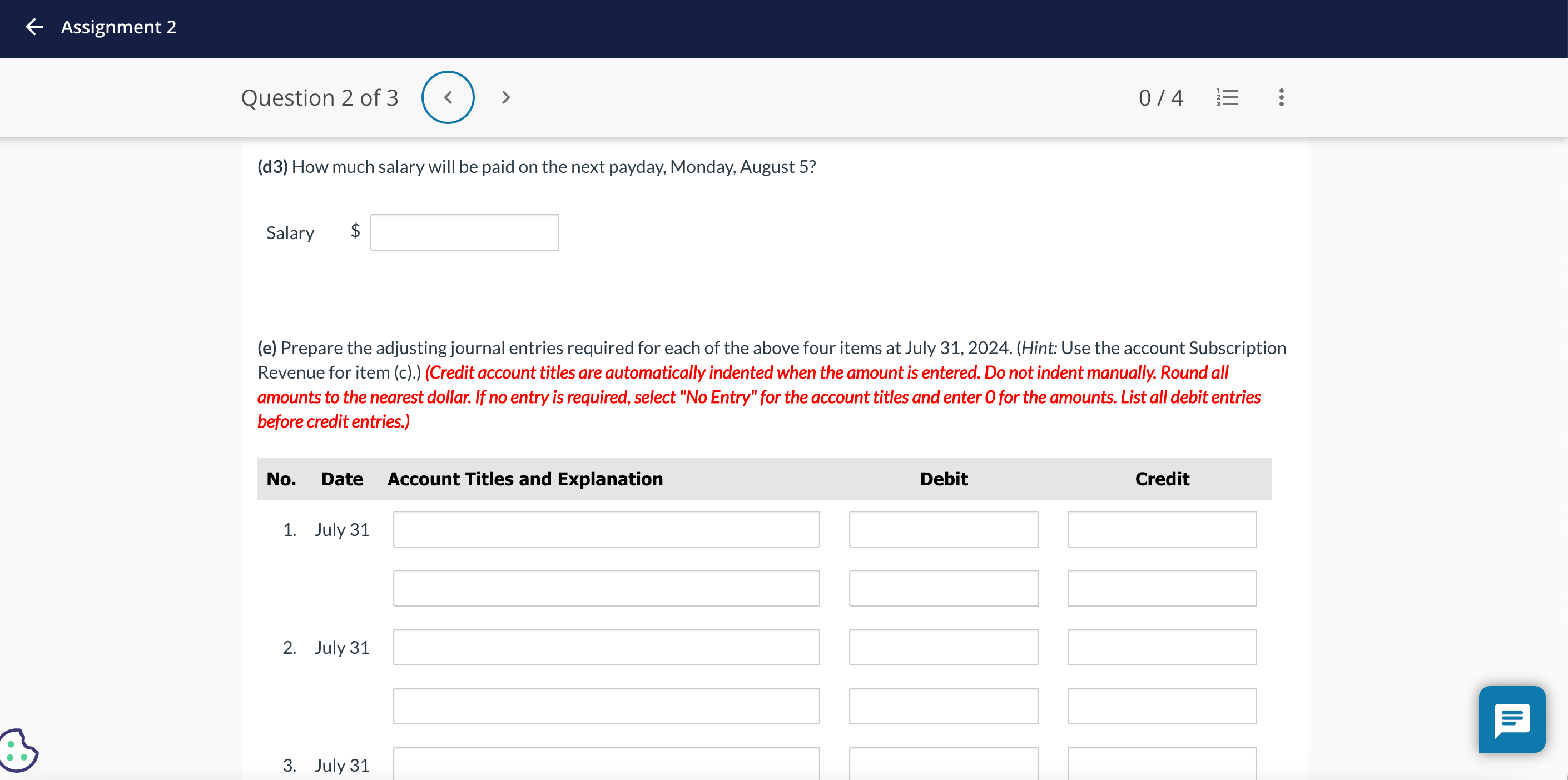

(a1) How much insurance expires per month for the building? Insurance expires per month \$ (a3) What was the original purchase price of the policy on December 1, 2022? Original purchase price of the policy (a4) How much should the adjusted balance in the Prepaid Insurance account be at July 31, 2024 ? Adjusted balance in the Prepaid Insurance account $ (b1) How much is annual depreciation expense for the building? (c1) How much does the company earn per month for the magazine subscriptions? Revenue \$ (c3) How much should the adjusted balance in the Deferred Revenue account be at July 31, 2024? Adjusted balance in the Deferred Revenue account (d1) How much salary was paid on the last payday, Monday, July 29? Salary \$ (d2) How much, if any, salary is owed to the employees on July 31 ? (b2) Calculate the unadjusted balance in the Accumulated Depreciation-Buildings account as at July 31, 2024. Unadjusted balance in the Accumulated Depreciation-Buildings account $ (b3) How much should the adjusted balance in the Accumulated Depreciation-Buildings account be at July 31, 2024? Adjusted balance in the Accumulated Depreciation-Buildings account $ (c1) How much does the company earn per month for the magazine subscriptions? Revenue \$ (c3) How much should the adjusted balance in the Deferred Revenue account be at July 31, 2024? A review of the ledger of Bramble Corporation at its year end, July 31, 2024, produces the following unadjusted data for the preparation of annual adjusting entries: 1. Prepaid Insurance, July 31, 2024, unadjusted balance, $9,680 : The company purchased an insurance policy on December 1 , 2022, with a two-year term, which expires November 30, 2024. 2. Buildings, July 31,2024 , unadjusted balance, $241,200 : The company owns a building purchased on September 1,2017 , for $241,200, with an estimated 30-year useful life. The company uses straight-line depreciation. 3. Deferred Revenue, July 31,2024 , unadjusted balance, $51,000 : The selling price of a digital magazine subscription is $60 for 24 monthly issues delivered over a two-year period. The company had sold 1,200 subscriptions on January 1, 2023, during a special promotion. 4. Salaries Payable, July 31, 2024, unadjusted balance, $0 : There are nine salaried employees. Salaries are paid every Monday for the previous five-day workweek (Monday to Friday). 6 employees receive a salary of $580 each per week, and 3 employees earn $750 each per week. July 31 is a Wednesday. (d3) How much salary will be paid on the next payday, Monday, August 5 ? Salary $ (e) Prepare the adjusting journal entries required for each of the above four items at July 31, 2024. (Hint: Use the account Subscription Revenue for item (c).) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round all amounts to the nearest dollar. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.) (a1) How much insurance expires per month for the building? Insurance expires per month \$ (a3) What was the original purchase price of the policy on December 1, 2022? Original purchase price of the policy (a4) How much should the adjusted balance in the Prepaid Insurance account be at July 31, 2024 ? Adjusted balance in the Prepaid Insurance account $ (b1) How much is annual depreciation expense for the building? (c1) How much does the company earn per month for the magazine subscriptions? Revenue \$ (c3) How much should the adjusted balance in the Deferred Revenue account be at July 31, 2024? Adjusted balance in the Deferred Revenue account (d1) How much salary was paid on the last payday, Monday, July 29? Salary \$ (d2) How much, if any, salary is owed to the employees on July 31 ? (b2) Calculate the unadjusted balance in the Accumulated Depreciation-Buildings account as at July 31, 2024. Unadjusted balance in the Accumulated Depreciation-Buildings account $ (b3) How much should the adjusted balance in the Accumulated Depreciation-Buildings account be at July 31, 2024? Adjusted balance in the Accumulated Depreciation-Buildings account $ (c1) How much does the company earn per month for the magazine subscriptions? Revenue \$ (c3) How much should the adjusted balance in the Deferred Revenue account be at July 31, 2024? A review of the ledger of Bramble Corporation at its year end, July 31, 2024, produces the following unadjusted data for the preparation of annual adjusting entries: 1. Prepaid Insurance, July 31, 2024, unadjusted balance, $9,680 : The company purchased an insurance policy on December 1 , 2022, with a two-year term, which expires November 30, 2024. 2. Buildings, July 31,2024 , unadjusted balance, $241,200 : The company owns a building purchased on September 1,2017 , for $241,200, with an estimated 30-year useful life. The company uses straight-line depreciation. 3. Deferred Revenue, July 31,2024 , unadjusted balance, $51,000 : The selling price of a digital magazine subscription is $60 for 24 monthly issues delivered over a two-year period. The company had sold 1,200 subscriptions on January 1, 2023, during a special promotion. 4. Salaries Payable, July 31, 2024, unadjusted balance, $0 : There are nine salaried employees. Salaries are paid every Monday for the previous five-day workweek (Monday to Friday). 6 employees receive a salary of $580 each per week, and 3 employees earn $750 each per week. July 31 is a Wednesday. (d3) How much salary will be paid on the next payday, Monday, August 5 ? Salary $ (e) Prepare the adjusting journal entries required for each of the above four items at July 31, 2024. (Hint: Use the account Subscription Revenue for item (c).) (Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round all amounts to the nearest dollar. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started