Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide answers & explanation 1. Alrosa Mini Case (80 points) Alrosa is a Russian group of diamond mining companies that specialize in exploration, mining.

please provide answers & explanation

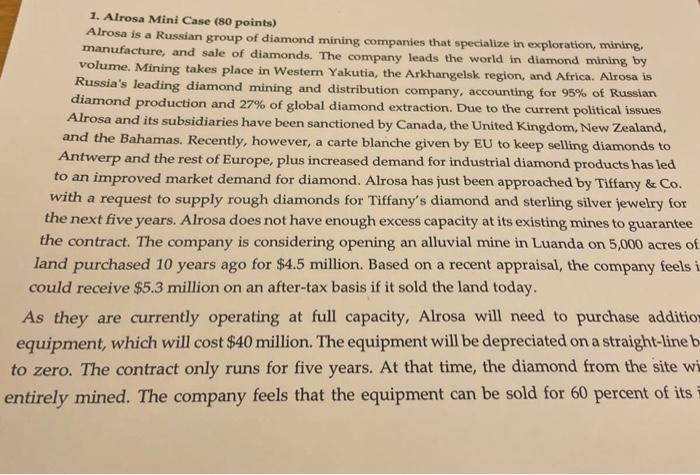

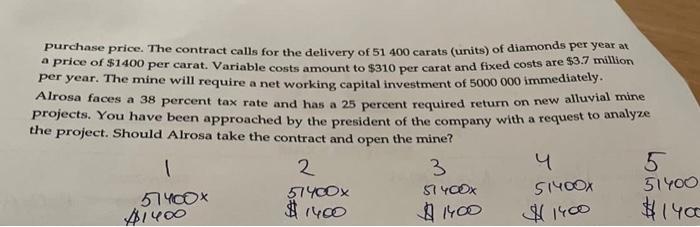

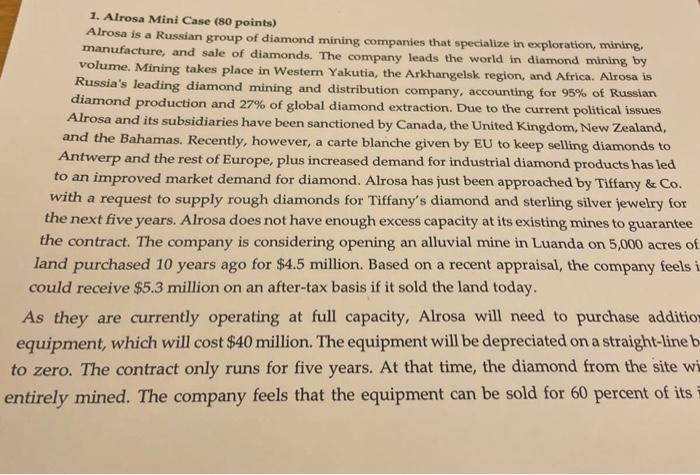

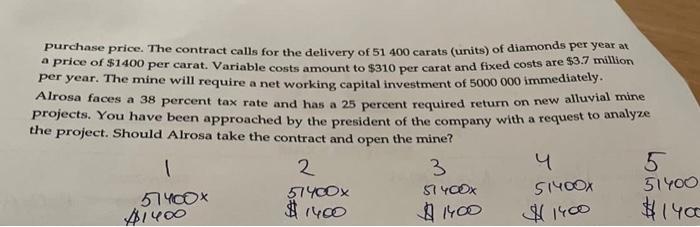

1. Alrosa Mini Case (80 points) Alrosa is a Russian group of diamond mining companies that specialize in exploration, mining. manufacture, and sale of diamonds. The company leads the world in diamond mining by Volume. Mining takes place in Western Yakutia, the Arkhangelsk region, and Africa. Alrosa is Russia's leading diamond mining and distribution company, accounting for 95% of Russian diamond production and 27% of global diamond extraction. Due to the current political issues Alrosa and its subsidiaries have been sanctioned by Canada, the United Kingdom, New Zealand, and the Bahamas. Recently, however, a carte blanche given by EU to keep selling diamonds to Antwerp and the rest of Europe, plus increased demand for industrial diamond products has led to an improved market demand for diamond. Alrosa has just been approached by Tiffany \& Co. With a request to supply rough diamonds for Tiffany's diamond and sterling silver jewelry for the next five years. Alrosa does not have enough excess capacity at its existing mines to guarantee the contract. The company is considering opening an alluvial mine in Luanda on 5,000 acres o land purchased 10 years ago for $4.5 million. Based on a recent appraisal, the company feels could receive $5.3 million on an after-tax basis if it sold the land today. As they are currently operating at full capacity, Alrosa will need to purchase additic quipment, which will cost $40 million. The equipment will be depreciated on a straight-line zero. The contract only runs for five years. At that time, the diamond from the site w tirely mined. The company feels that the equipment can be sold for 60 percent of its Purchase price. The contract calls for the delivery of 51400 carats (units) of diamonds per year at a price of $1400 per carat. Variable costs amount to $310 per carat and fixed costs are $3.7 million per year. The mine will require a net working capital investment of 5000000 immediately. Alrosa faces a 38 percent tax rate and has a 25 percent required return on new alluvial mine Projects. You have been approached by the president of the company with a request to analyze the project. Should Alrosa take the contract and open the mine? 1. Alrosa Mini Case (80 points) Alrosa is a Russian group of diamond mining companies that specialize in exploration, mining. manufacture, and sale of diamonds. The company leads the world in diamond mining by Volume. Mining takes place in Western Yakutia, the Arkhangelsk region, and Africa. Alrosa is Russia's leading diamond mining and distribution company, accounting for 95% of Russian diamond production and 27% of global diamond extraction. Due to the current political issues Alrosa and its subsidiaries have been sanctioned by Canada, the United Kingdom, New Zealand, and the Bahamas. Recently, however, a carte blanche given by EU to keep selling diamonds to Antwerp and the rest of Europe, plus increased demand for industrial diamond products has led to an improved market demand for diamond. Alrosa has just been approached by Tiffany \& Co. With a request to supply rough diamonds for Tiffany's diamond and sterling silver jewelry for the next five years. Alrosa does not have enough excess capacity at its existing mines to guarantee the contract. The company is considering opening an alluvial mine in Luanda on 5,000 acres o land purchased 10 years ago for $4.5 million. Based on a recent appraisal, the company feels could receive $5.3 million on an after-tax basis if it sold the land today. As they are currently operating at full capacity, Alrosa will need to purchase additic quipment, which will cost $40 million. The equipment will be depreciated on a straight-line zero. The contract only runs for five years. At that time, the diamond from the site w tirely mined. The company feels that the equipment can be sold for 60 percent of its Purchase price. The contract calls for the delivery of 51400 carats (units) of diamonds per year at a price of $1400 per carat. Variable costs amount to $310 per carat and fixed costs are $3.7 million per year. The mine will require a net working capital investment of 5000000 immediately. Alrosa faces a 38 percent tax rate and has a 25 percent required return on new alluvial mine Projects. You have been approached by the president of the company with a request to analyze the project. Should Alrosa take the contract and open the mine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started