Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please Provide Answers for ALL PARTS As they are all part of ONE Problem, with Explanation and Read the Details please. thank you so much.

Please Provide Answers for ALL PARTS As they are all part of ONE Problem, with Explanation and Read the Details please.

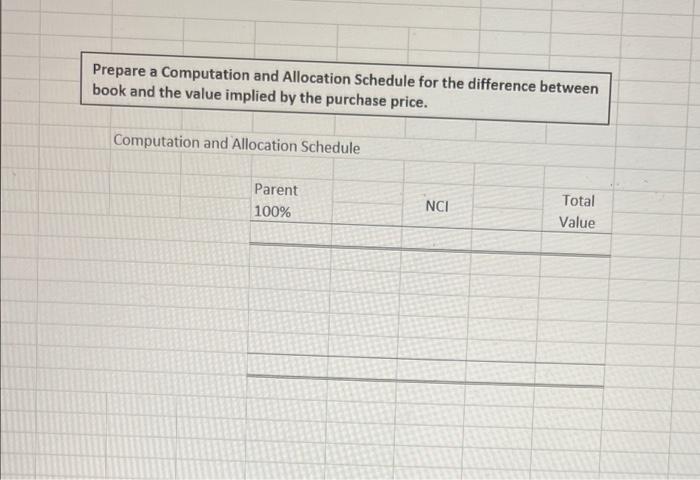

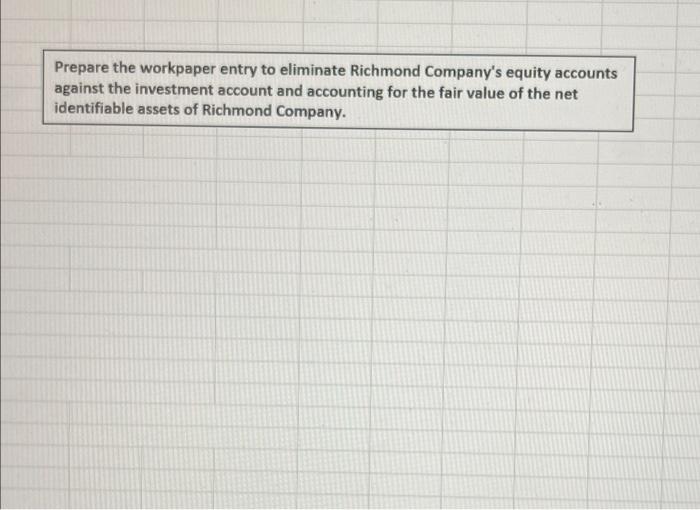

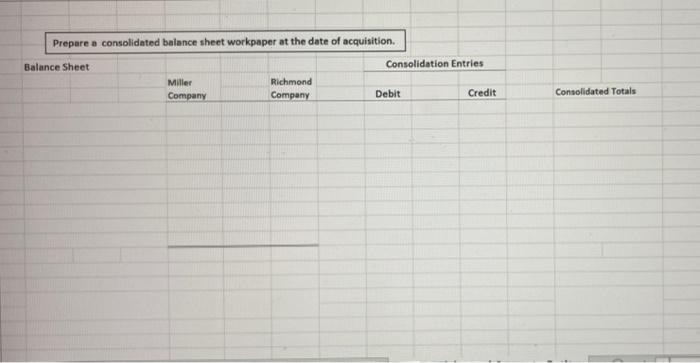

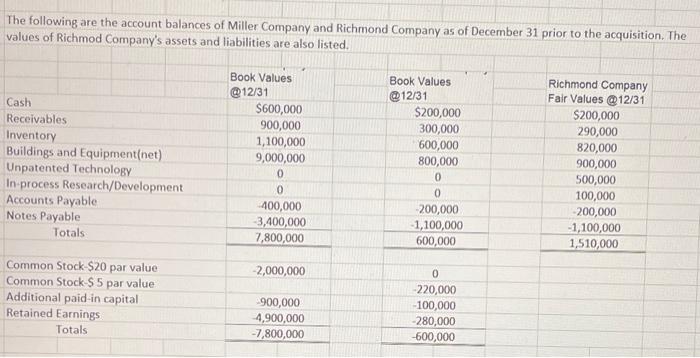

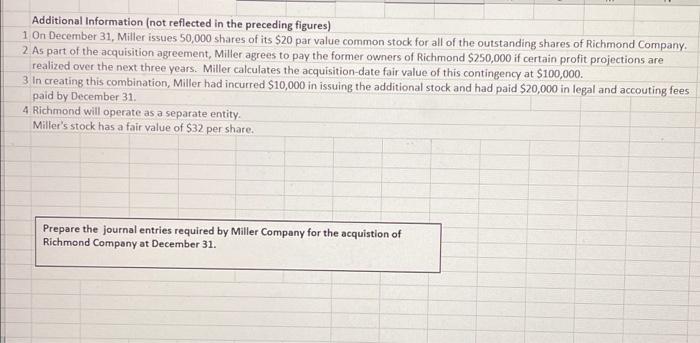

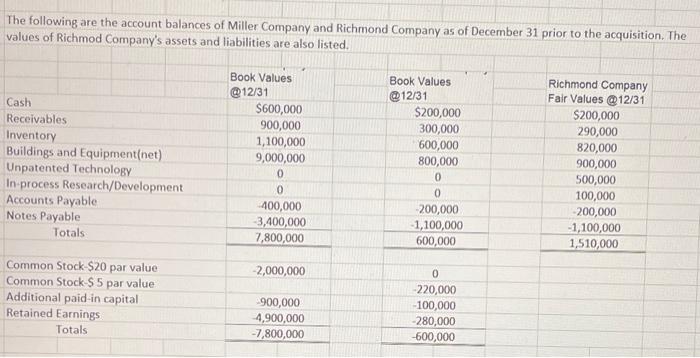

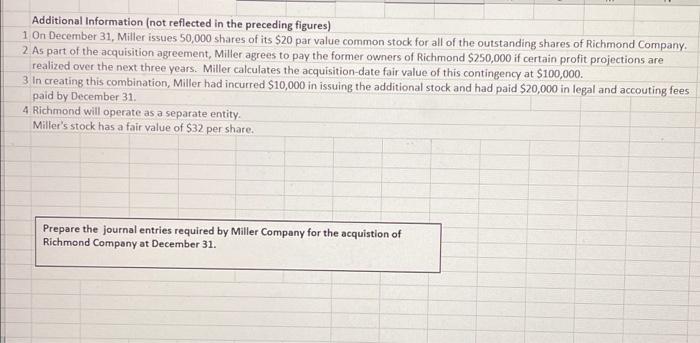

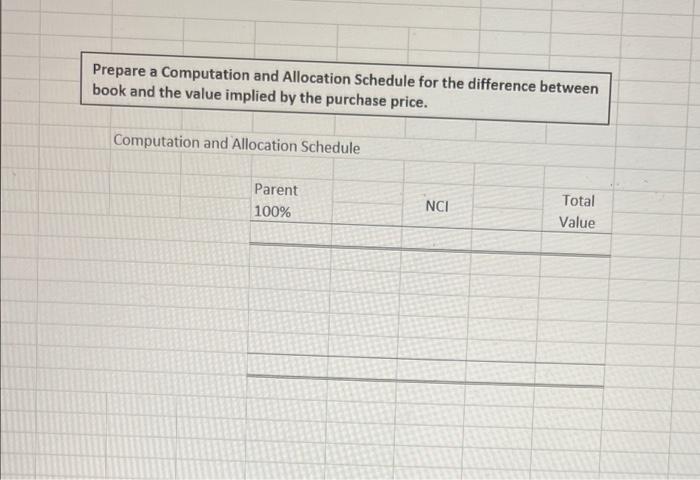

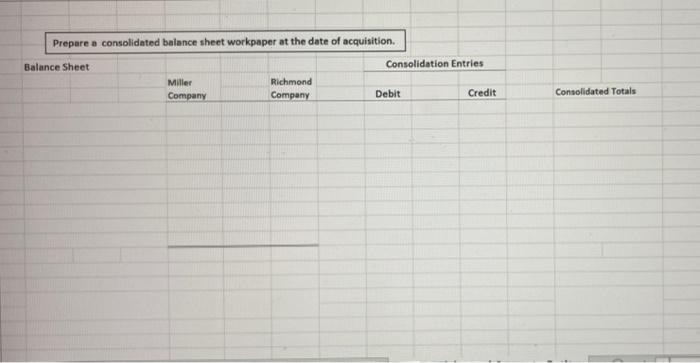

The following are the account balances of Miller Company and Richmond Company as of December 31 prior to the acquisition. The values of Richmod Company's assets and liabilities are also listed. Cash Receivables Inventory Buildings and Equipment(net) Unpatented Technology In process Research/Development Accounts Payable Notes Payable Totals Book Values @12/31 $600,000 900,000 1,100,000 9,000,000 0 0 -400,000 3,400,000 7,800,000 Book Values @12/31 $200,000 300,000 600,000 800,000 0 0 200,000 1,100,000 600,000 Richmond Company Fair Values @12/31 $200,000 290,000 820,000 900,000 500,000 100,000 200,000 1,100,000 1,510,000 -2,000,000 Common Stock-$20 par value Common Stock $ 5 par value Additional paid in capital Retained Earnings Totals 900,000 4,900,000 -7,800,000 0 220,000 -100,000 -280,000 -600,000 Additional Information (not reflected in the preceding figures) 1 On December 31, Miller issues 50,000 shares of its $20 par value common stock for all of the outstanding shares of Richmond Company 2 As part of the acquisition agreement, Miller agrees to pay the former owners of Richmond $250,000 if certain profit projections are realized over the next three years. Miller calculates the acquisition date fair value of this contingency at $100,000. 3 in creating this combination, Miller had incurred $10,000 in issuing the additional stock and had paid $20,000 in legal and accouting fees paid by December 31 4 Richmond will operate as a separate entity Miller's stock has a fair value of $32 per share. Prepare the journal entries required by Mill Richmond Company at December 31. Company for the acquistion of Prepare a Computation and Allocation Schedule for the difference between book and the value implied by the purchase price. Computation and Allocation Schedule Parent 100% NCI Total Value Prepare the workpaper entry to eliminate Richmond Company's equity accounts against the investment account and accounting for the fair value of the net identifiable assets of Richmond Company. Prepare a consolidated balance sheet workpaper at the date of acquisition. Balance Sheet Consolidation Entries Miller Company Richmond Company Debit Credit Consolidated Totals thank you so much.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started