Please provide answers to Q1, Q2 and Q3 below.

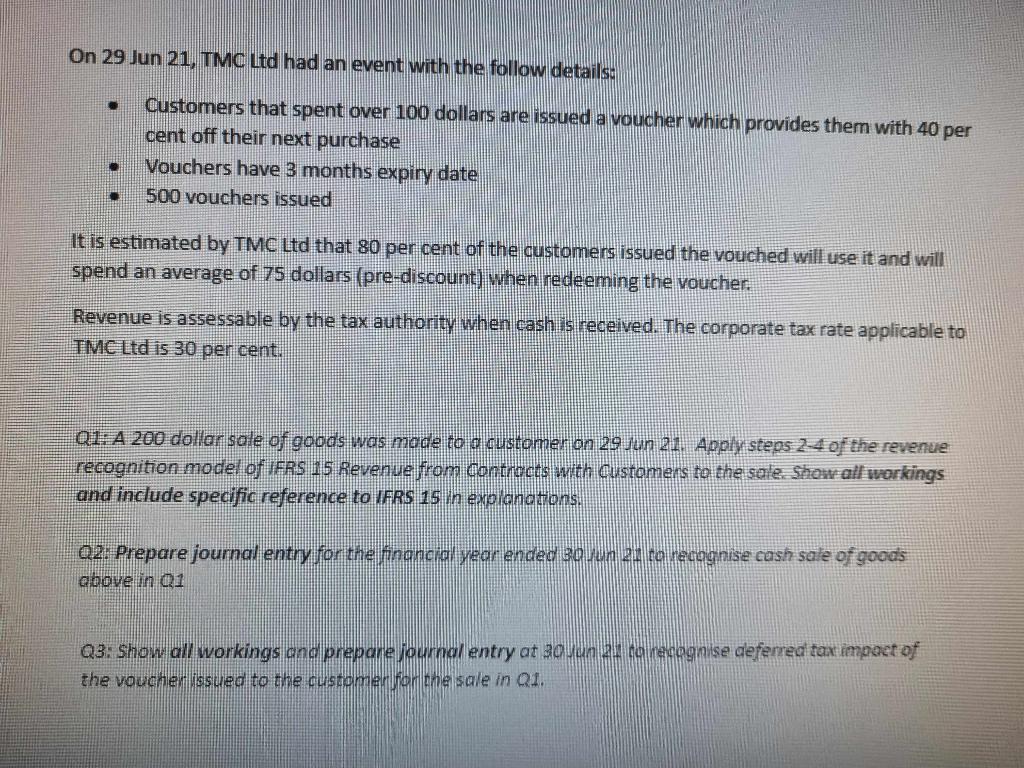

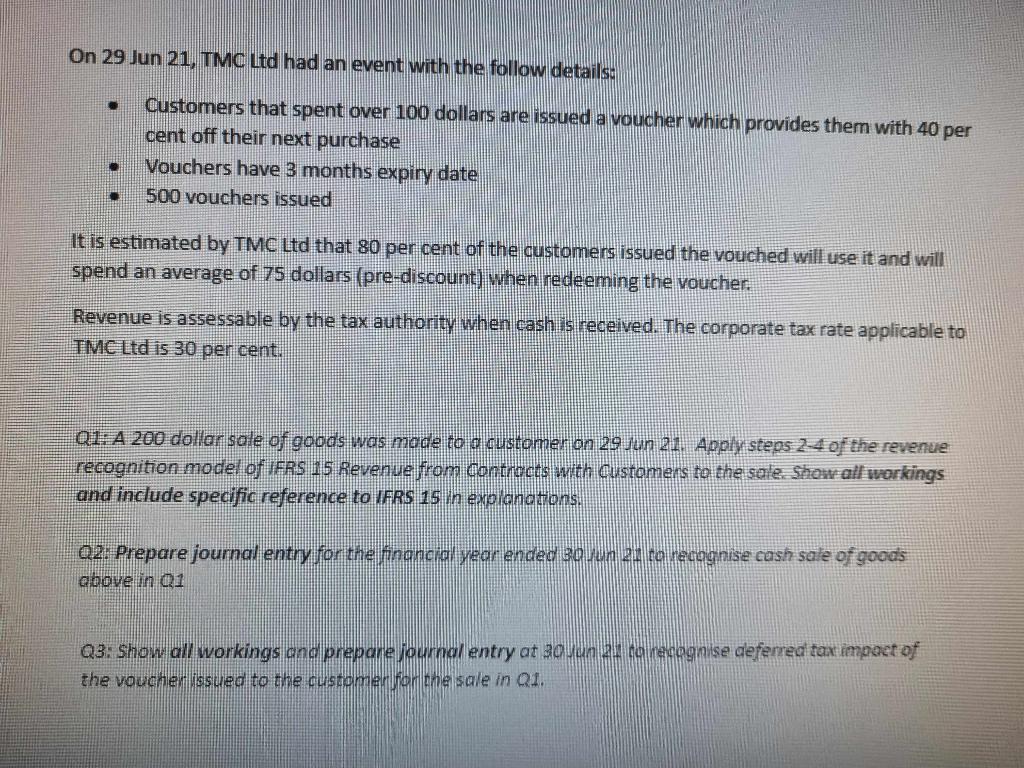

On 29 Jun 21, TMC Ltd had an event with the follow details: - Customers that spent over 100 dollars are issued a voucher which provides them with 40 per cent off their next purchase - Vouchers have 3 months expiry date - 500 vouchers issued It is estimated by TMC Ltd that 80 per cent of the customers issued the vouched will use it and will spend an average of 75 dollars (pre-discount) when redeeming the voucher. Revenue is assessable by the tax authority when cash is received. The corporate tax rate applicable to TMCltd is 30 per cent. Q1: A 200 dollar sale of goods was mode to o customer on 29 jun 21. Apoly steps 2-4 of the revenue recognition model of IFRS 15 Reven uefrom controcts with customers to the sale. Show all workings and include specific reference to IFRS 15 in expionations. Q2. Prepare journal entry for the fingncialyear ended 30 - Ln 2 th to recagnise cash sale of goods above in Q1 Q3: Show all workings and prepane journal entry at 39 un 21 tigireagpinise deferred tax impact of the voucher issued to the custamerf for the sale in Q1. On 29 Jun 21, TMC Ltd had an event with the follow details: - Customers that spent over 100 dollars are issued a voucher which provides them with 40 per cent off their next purchase - Vouchers have 3 months expiry date - 500 vouchers issued It is estimated by TMC Ltd that 80 per cent of the customers issued the vouched will use it and will spend an average of 75 dollars (pre-discount) when redeeming the voucher. Revenue is assessable by the tax authority when cash is received. The corporate tax rate applicable to TMCltd is 30 per cent. Q1: A 200 dollar sale of goods was mode to o customer on 29 jun 21. Apoly steps 2-4 of the revenue recognition model of IFRS 15 Reven uefrom controcts with customers to the sale. Show all workings and include specific reference to IFRS 15 in expionations. Q2. Prepare journal entry for the fingncialyear ended 30 - Ln 2 th to recagnise cash sale of goods above in Q1 Q3: Show all workings and prepane journal entry at 39 un 21 tigireagpinise deferred tax impact of the voucher issued to the custamerf for the sale in Q1