Question

PLEASE PROVIDE CALCULATION Dan plans to reduce his work schedule and work only half-time for WJJJ in 2019. He has been writing songs for several

PLEASE PROVIDE CALCULATION

Dan plans to reduce his work schedule and work only half-time for WJJJ in 2019. He has been writing songs for several years and wants to devote more time to developing a career as a songwriter. Because of the uncertainty in the music business, however, he would like you to make all computations assuming that he will have no income from songwriting in 2019. To make up for the loss of income, Freida plans to increase the amount of time she spends selling real estate. She estimates that she will be able to earn $90,000 in 2019.

- Assume that all other income and expense items will be approximately the same as they were in 2018 (including the prize winnings).

- Assume that Willie will be enrolled in college as a full-time student for the summer and fall semesters. No changes regarding Gina and Sam.

- The $3,100 commission received on January 10, 2019, is included in the $90,000 income to be earned by Freida in 2019.

- The 22% 2018 marginal tax rate remains the same in 2019.

- Assume a payroll tax rate for FICA and Medicare of 7.65% and the Kentucky state income rate of 4%.

- Assume Interest income, dividend income, prize income and the standard deduction will be the same for 2019.

Complete the following letter regarding whether the Butlers will have more or less disposable income (after Federal income tax) in 2019.

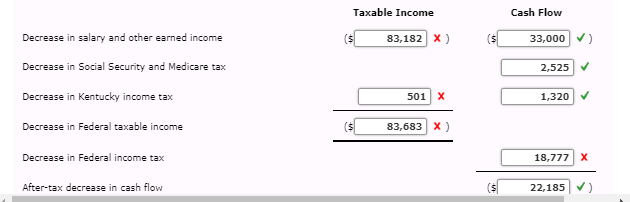

You asked me to estimate your after-tax income under the assumption that Dan will work only halftime next year. The $ 37,000 reduction in Dans pay will be partially offset by a $ 4,000 estimated increase in the amount Freida will earn. This net $ 33,000 reduction in salary and wages will also result in a decrease in your Kentucky income tax, Social Security tax, and Medicare tax. The net reduction in your after-tax cash flow will be approximately $22,185 . The calculations are presented below:

Taxable Income Cash Flow Decrease in salary and other earned income 83,182 X ) ($ 33,000) Decrease in Social Security and Medicare tax 2,525 Decrease in Kentucky income tax 501 1,320 Decrease in Federal taxable income 83,683 ) Decrease in Federal income tax 18,777 X After-tax decrease in cash flow 22,185 Taxable Income Cash Flow Decrease in salary and other earned income 83,182 X ) ($ 33,000) Decrease in Social Security and Medicare tax 2,525 Decrease in Kentucky income tax 501 1,320 Decrease in Federal taxable income 83,683 ) Decrease in Federal income tax 18,777 X After-tax decrease in cash flow 22,185Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started