please provide calculations

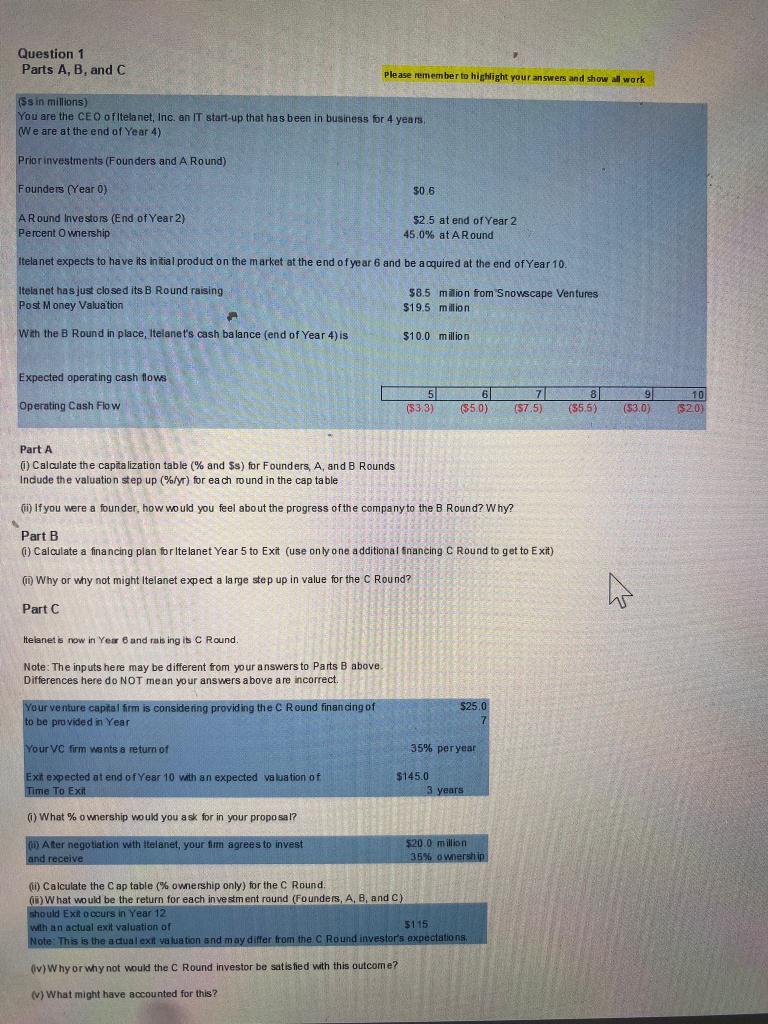

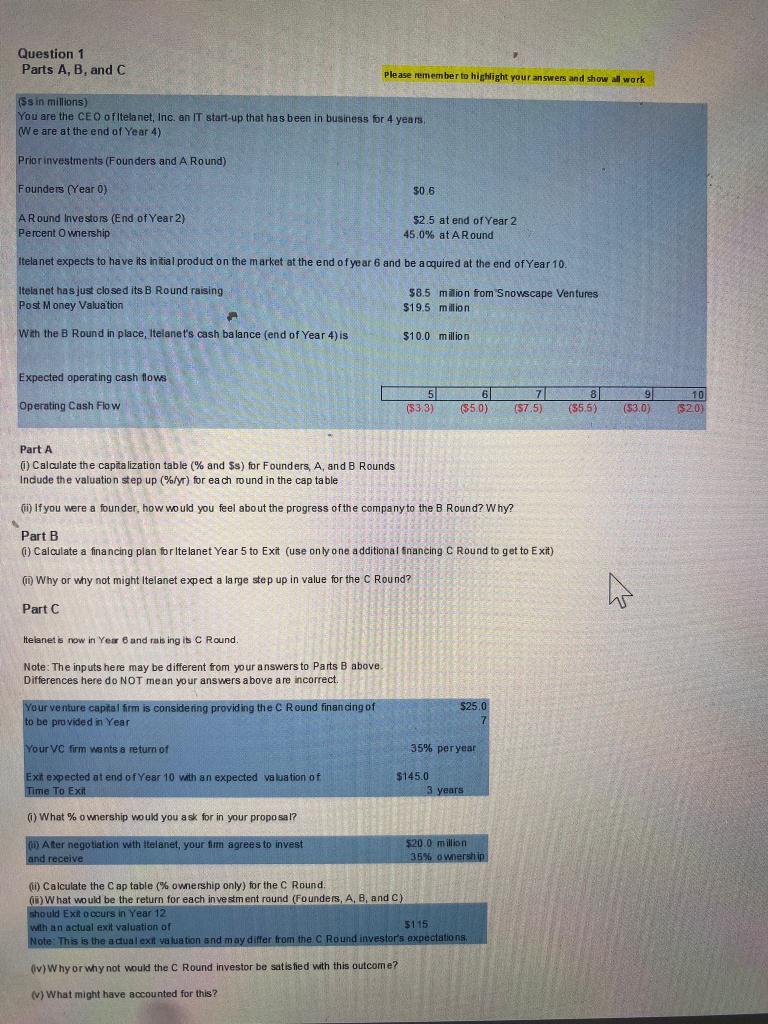

Question 1 Parts A, B, and C Please remember to highlight your answers and show all work (Ss in millions) You are the CEO ofitela net, Inc. an IT start-up that has been in business for 4 years (We are at the end of Year 4) Priorinvestments (Founders and A Round) Founders (Year 0) 30.6 A Round Investors (End of Year 2) Percent ownership $2.5 at end of Year 2 45.0% at A Round Itelanet expects to have its initial product on the market at the end of year 6 and be a cquired at the end of Year 10. Itelanet has just closed its B Round raising Post Money Valuation $8.5 million from Snowscape Ventures $19.5 million With the B Round in place, Itelanet's cash balance (end of Year 4) is $10.0 million Expected operating cash flows Operating Cash Flow 5 (83.3) 7 (S7.5) 81 ($5.5) 9 (53.0) ($5.0) 10 52.0) Part A Calculate the capitalization table (% and $s) for Founders, A and B Rounds Include the valuation step up (%/yr) for each round in the cap table 1) If you were a founder, how would you feel about the progress of the company to the B Round? Why? Part B Calculate a financing plan fortelanet Year 5 to Exit (use only one additional Enancing C Round to get to Exit) Why or why not might Itelanet expect a large step up in value for the Round? Part C Helanet is now in Year 6 and raising is C Round. C Note: The inputs here may be different from your answers to Parts B above. Differences here do NOT mean your answers above are incorrect. Your venture captal firm is considering providing the C Round financing of to be provided in Year 525.0 7 Your VC firm wants a return of 35% per year Exit expected at end of Year 10 with an expected valuation of Time To Exit $145.0 3 years 6) What % ownership would you ask for in your proposal? Ater negotiation with telanet, your firm agrees to invest and receive $20.0 million 35% ownership (i) Calculate the Cap table (% ownership only) for the C Round 68) What would be the return for each investment round (Founders, A, B, and c) should Ext occurs in Year 12 with an actual exit valuation of 5115 Note: This is the actual exit valuation and may differ from the Round investor's expectations (v) Why or why not would the C Round investor be satisfied with this outcome? w) What might have accounted for this? Question 1 Parts A, B, and C Please remember to highlight your answers and show all work (Ss in millions) You are the CEO ofitela net, Inc. an IT start-up that has been in business for 4 years (We are at the end of Year 4) Priorinvestments (Founders and A Round) Founders (Year 0) 30.6 A Round Investors (End of Year 2) Percent ownership $2.5 at end of Year 2 45.0% at A Round Itelanet expects to have its initial product on the market at the end of year 6 and be a cquired at the end of Year 10. Itelanet has just closed its B Round raising Post Money Valuation $8.5 million from Snowscape Ventures $19.5 million With the B Round in place, Itelanet's cash balance (end of Year 4) is $10.0 million Expected operating cash flows Operating Cash Flow 5 (83.3) 7 (S7.5) 81 ($5.5) 9 (53.0) ($5.0) 10 52.0) Part A Calculate the capitalization table (% and $s) for Founders, A and B Rounds Include the valuation step up (%/yr) for each round in the cap table 1) If you were a founder, how would you feel about the progress of the company to the B Round? Why? Part B Calculate a financing plan fortelanet Year 5 to Exit (use only one additional Enancing C Round to get to Exit) Why or why not might Itelanet expect a large step up in value for the Round? Part C Helanet is now in Year 6 and raising is C Round. C Note: The inputs here may be different from your answers to Parts B above. Differences here do NOT mean your answers above are incorrect. Your venture captal firm is considering providing the C Round financing of to be provided in Year 525.0 7 Your VC firm wants a return of 35% per year Exit expected at end of Year 10 with an expected valuation of Time To Exit $145.0 3 years 6) What % ownership would you ask for in your proposal? Ater negotiation with telanet, your firm agrees to invest and receive $20.0 million 35% ownership (i) Calculate the Cap table (% ownership only) for the C Round 68) What would be the return for each investment round (Founders, A, B, and c) should Ext occurs in Year 12 with an actual exit valuation of 5115 Note: This is the actual exit valuation and may differ from the Round investor's expectations (v) Why or why not would the C Round investor be satisfied with this outcome? w) What might have accounted for this