Answered step by step

Verified Expert Solution

Question

1 Approved Answer

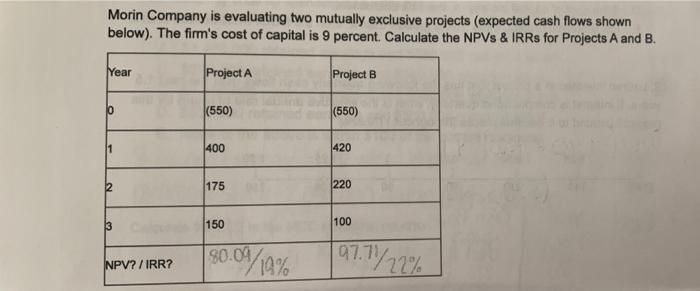

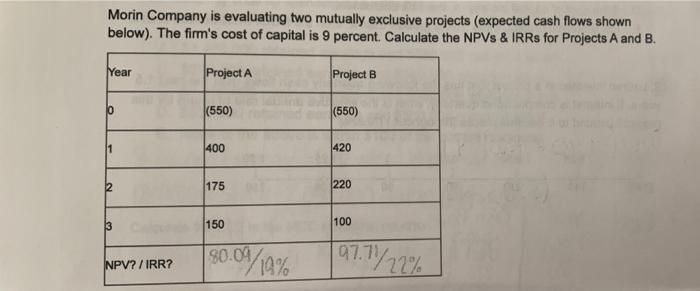

please provide calculations! thank you Morin Company is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 9

please provide calculations! thank you

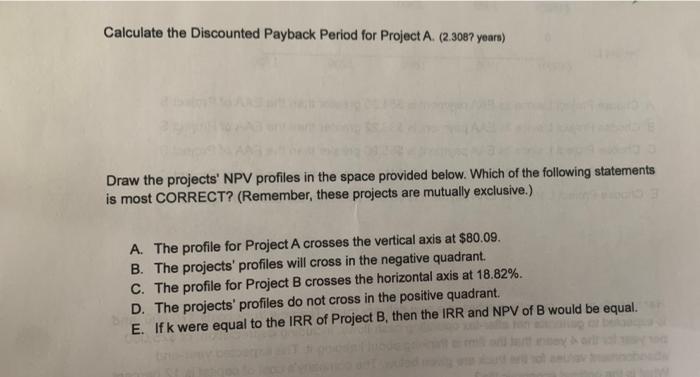

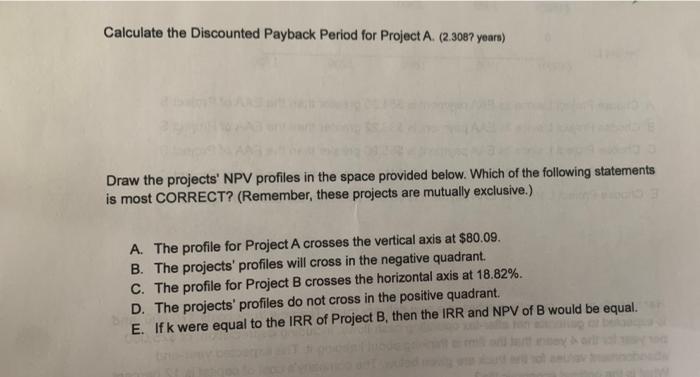

Morin Company is evaluating two mutually exclusive projects (expected cash flows shown below). The firm's cost of capital is 9 percent. Calculate the NPVS & IRRS for Projects A and B. Year 0 1 2 3 NPV?/IRR? Project A (550) 400 175 150 80.09/19% Project B (550) 420 220 100 97.71/22% Calculate the Discounted Payback Period for Project A. (2.3087 years) 8 ba Draw the projects' NPV profiles in the space provided below. Which of the following statements is most CORRECT? (Remember, these projects are mutually exclusive.) A. The profile for Project A crosses the vertical axis at $80.09. B. The projects' profiles will cross in the negative quadrant. C. The profile for Project B crosses the horizontal axis at 18.82%. D. The projects' profiles do not cross in the positive quadrant. E. Ifk were equal to the IRR of Project B, then the IRR and NPV of B would be equal

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started