please provide case analysis on this if possible.

thank you

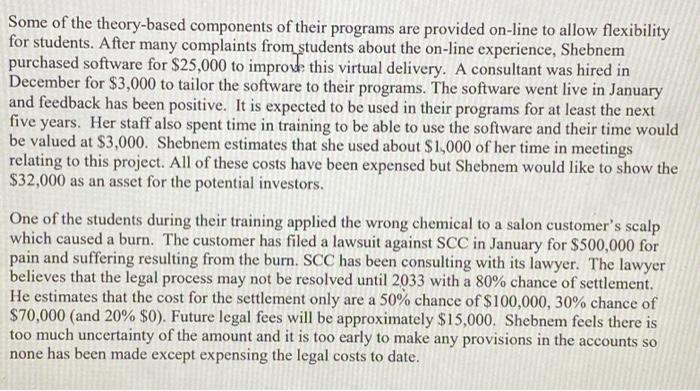

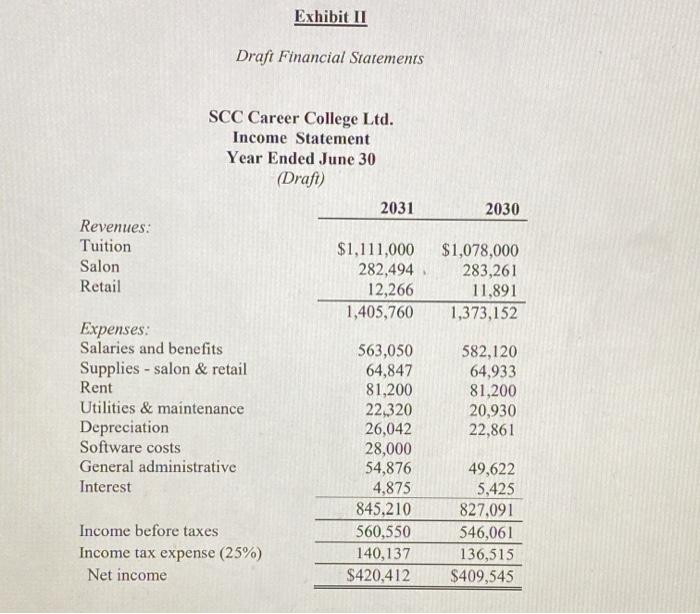

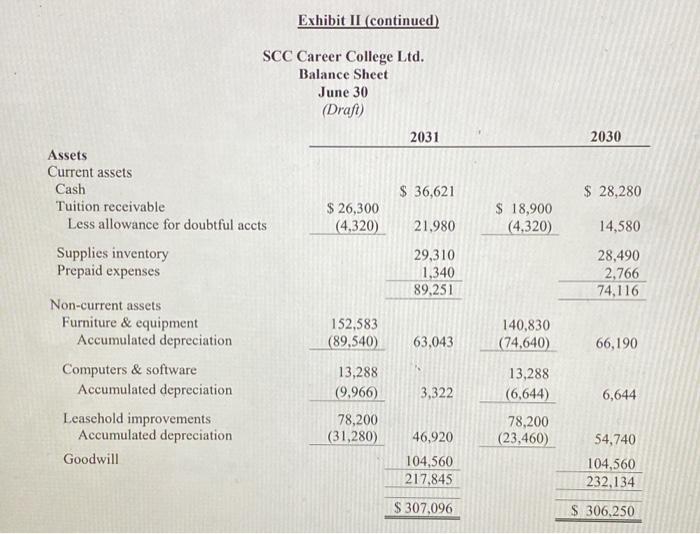

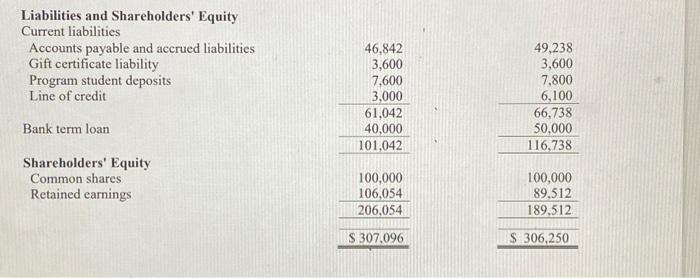

Case #2: Sceles Career College Sceles Career College (SCC) is a career college located in Halifax, Nova Scotia. SCC is a private company created in 2027 when Shebnem Jandu purchased the net assets of a career college from a retiring owner. Shebnem owns 70% of the company and her sister, Zeynap, owns 30%. SCC has about 100 students per year and provides three programs: Hair Styling, Esthetics, and Make-up. Programs last approximately 10 months (September to June) and tuition averages $11,000 (including all books, materials, and supplies). SCC rents space above a shopping mall in Halifax which contains classrooms and practical work space of a salon. During certain hours, students offer services to outside customers in the salon as part of their training with their instructors overseeing their work. They also sell a small amount of product to customers using the salon. Shebnem Jandu is the President of the company and her background is in the cosmetology industry. She has just hired you, CPA, as her new director of finance. SCC's previous director of finance left about ten months ago. SCC has a bookkeeper but Shebnem has been overseeing the accounting in the meantime so is very relieved to have you on board. SCC would like to prepare financial statements under IFRS as it is looking to attract international investors. It is now August 6, 2031 (your second day on the job!) You have just finished a meeting with Shebnem to be briefed on the accounting issues at SCC. Shebnem's immediate concern is SCC's annual financial statements for their June 30 year end. GAAP financial statements must be provided to their bank by August 31. SCC is required to have a debt ratio (total liabilities/total assets) not exceeding 0.6 (excluding goodwill) as a condition of their bank term loan and line of credit. The notes from your meeting with Shebnem are in Exhibit I and the draft financial statements prepared by the bookkeeper are included in Exhibit II Required Prepare a memo to Shebnem discussing the financial accounting issues and your recommendations for the June 30, 2031 financial statements. Some of the theory-based components of their programs are provided on-line to allow flexibility for students. After many complaints from students about the on-line experience, Shebnem purchased software for $25,000 to improve this virtual delivery. A consultant was hired in December for $3,000 to tailor the software to their programs. The software went live in January and feedback has been positive. It is expected to be used in their programs for at least the next five years. Her staff also spent time in training to be able to use the software and their time would be valued at $3,000. Shebnem estimates that she used about $1,000 of her time in meetings relating to this project. All of these costs have been expensed but Shebnem would like to show the $32,000 as an asset for the potential investors. One of the students during their training applied the wrong chemical to a salon customer's scalp which caused a burn. The customer has filed a lawsuit against SCC in January for $500,000 for pain and suffering resulting from the burn. SCC has been consulting with its lawyer. The lawyer believes that the legal process may not be resolved until 2033 with a 80% chance of settlement. He estimates that the cost for the settlement only are a 50% chance of $100,000, 30% chance of $70,000 (and 20% $0). Future legal fees will be approximately $15,000. Shebnem feels there is too much uncertainty of the amount and it is too early to make any provisions in the accounts so none has been made except expensing the legal costs to date. Exhibit II Drafi Financial Statements SCC Career College Ltd. Income Statement Year Ended June 30 (Draft 2031 2030 Revenues: Tuition Salon Retail $1,111,000 282,494 12,266 1,405,760 $1,078,000 283,261 11,891 1,373,152 Expenses: Salaries and benefits Supplies - salon & retail Rent Utilities & maintenance Depreciation Software costs General administrative Interest 582,120 64,933 81,200 20,930 22,861 563,050 64,847 81,200 22,320 26,042 28,000 54,876 4,875 845,210 560,550 140,137 $420,412 49,622 5,425 827,091 546,061 136,515 $409,545 Income before taxes Income tax expense (25%) Net income Exhibit II (continued) SCC Career College Ltd. Balance Sheet June 30 (Draft) 2031 2030 Assets Current assets Cash Tuition receivable Less allowance for doubtful accts $ 36,621 $ 28,280 $ 26,300 (4.320) $ 18,900 (4,320) 21.980 14,580 Supplies inventory Prepaid expenses 29,310 1,340 89,251 28,490 2,766 74,116 Non-current assets Furniture & equipment Accumulated depreciation Computers & software Accumulated depreciation 152,583 (89,540) 140,830 (74,640) 63,043 66,190 13,288 (9,966) 13,288 (6,644) 3,322 6,644 Leasehold improvements Accumulated depreciation 78,200 (31,280) 46,920 78,200 (23,460) 54,740 Goodwill 104,560 217,845 104,560 232,134 $ 307,096 $ 306,250 Liabilities and Shareholders' Equity Current liabilities Accounts payable and accrued liabilities Gift certificate liability Program student deposits Line of credit 46,842 3,600 7,600 3,000 61,042 40,000 101,042 49,238 3,600 7,800 6,100 66,738 50,000 116,738 Bank term loan Shareholders' Equity Common shares Retained earnings 100,000 106,054 206,054 100,000 89,512 189,512 S 307.096 S 306,250 Case #2: Sceles Career College Sceles Career College (SCC) is a career college located in Halifax, Nova Scotia. SCC is a private company created in 2027 when Shebnem Jandu purchased the net assets of a career college from a retiring owner. Shebnem owns 70% of the company and her sister, Zeynap, owns 30%. SCC has about 100 students per year and provides three programs: Hair Styling, Esthetics, and Make-up. Programs last approximately 10 months (September to June) and tuition averages $11,000 (including all books, materials, and supplies). SCC rents space above a shopping mall in Halifax which contains classrooms and practical work space of a salon. During certain hours, students offer services to outside customers in the salon as part of their training with their instructors overseeing their work. They also sell a small amount of product to customers using the salon. Shebnem Jandu is the President of the company and her background is in the cosmetology industry. She has just hired you, CPA, as her new director of finance. SCC's previous director of finance left about ten months ago. SCC has a bookkeeper but Shebnem has been overseeing the accounting in the meantime so is very relieved to have you on board. SCC would like to prepare financial statements under IFRS as it is looking to attract international investors. It is now August 6, 2031 (your second day on the job!) You have just finished a meeting with Shebnem to be briefed on the accounting issues at SCC. Shebnem's immediate concern is SCC's annual financial statements for their June 30 year end. GAAP financial statements must be provided to their bank by August 31. SCC is required to have a debt ratio (total liabilities/total assets) not exceeding 0.6 (excluding goodwill) as a condition of their bank term loan and line of credit. The notes from your meeting with Shebnem are in Exhibit I and the draft financial statements prepared by the bookkeeper are included in Exhibit II Required Prepare a memo to Shebnem discussing the financial accounting issues and your recommendations for the June 30, 2031 financial statements. Some of the theory-based components of their programs are provided on-line to allow flexibility for students. After many complaints from students about the on-line experience, Shebnem purchased software for $25,000 to improve this virtual delivery. A consultant was hired in December for $3,000 to tailor the software to their programs. The software went live in January and feedback has been positive. It is expected to be used in their programs for at least the next five years. Her staff also spent time in training to be able to use the software and their time would be valued at $3,000. Shebnem estimates that she used about $1,000 of her time in meetings relating to this project. All of these costs have been expensed but Shebnem would like to show the $32,000 as an asset for the potential investors. One of the students during their training applied the wrong chemical to a salon customer's scalp which caused a burn. The customer has filed a lawsuit against SCC in January for $500,000 for pain and suffering resulting from the burn. SCC has been consulting with its lawyer. The lawyer believes that the legal process may not be resolved until 2033 with a 80% chance of settlement. He estimates that the cost for the settlement only are a 50% chance of $100,000, 30% chance of $70,000 (and 20% $0). Future legal fees will be approximately $15,000. Shebnem feels there is too much uncertainty of the amount and it is too early to make any provisions in the accounts so none has been made except expensing the legal costs to date. Exhibit II Drafi Financial Statements SCC Career College Ltd. Income Statement Year Ended June 30 (Draft 2031 2030 Revenues: Tuition Salon Retail $1,111,000 282,494 12,266 1,405,760 $1,078,000 283,261 11,891 1,373,152 Expenses: Salaries and benefits Supplies - salon & retail Rent Utilities & maintenance Depreciation Software costs General administrative Interest 582,120 64,933 81,200 20,930 22,861 563,050 64,847 81,200 22,320 26,042 28,000 54,876 4,875 845,210 560,550 140,137 $420,412 49,622 5,425 827,091 546,061 136,515 $409,545 Income before taxes Income tax expense (25%) Net income Exhibit II (continued) SCC Career College Ltd. Balance Sheet June 30 (Draft) 2031 2030 Assets Current assets Cash Tuition receivable Less allowance for doubtful accts $ 36,621 $ 28,280 $ 26,300 (4.320) $ 18,900 (4,320) 21.980 14,580 Supplies inventory Prepaid expenses 29,310 1,340 89,251 28,490 2,766 74,116 Non-current assets Furniture & equipment Accumulated depreciation Computers & software Accumulated depreciation 152,583 (89,540) 140,830 (74,640) 63,043 66,190 13,288 (9,966) 13,288 (6,644) 3,322 6,644 Leasehold improvements Accumulated depreciation 78,200 (31,280) 46,920 78,200 (23,460) 54,740 Goodwill 104,560 217,845 104,560 232,134 $ 307,096 $ 306,250 Liabilities and Shareholders' Equity Current liabilities Accounts payable and accrued liabilities Gift certificate liability Program student deposits Line of credit 46,842 3,600 7,600 3,000 61,042 40,000 101,042 49,238 3,600 7,800 6,100 66,738 50,000 116,738 Bank term loan Shareholders' Equity Common shares Retained earnings 100,000 106,054 206,054 100,000 89,512 189,512 S 307.096 S 306,250