Question

Please provide clear hand writing and detailed step-by-step instructions. Thank you. For the same two-stage investment decision tree in the lecture notes, let the initial

Please provide clear hand writing and detailed step-by-step instructions. Thank you.

For the same two-stage investment decision tree in the lecture notes, let the initial or prior probability of success for the new product, P(S), be 0.65, what is the maximum worth of the consultant if her track records have been one of the following:

8a. (10 points) Perfect information, i.e., P(F|S)=1 and P(F|N)=0

8b. (10 points) Wishy-washy, i.e., P(F|S)=0.5 and P(F|N)=0.5

8c. (10 points) Reasonable, e.g., P(F|S)=0.85 and P(F|N)=0.1

8d. (10 points) Perfect wrong information, i.e., P(F|S)=0 and P(F|N)=1

Ignore .977, .023, and .803 as they're suppose to be blank.

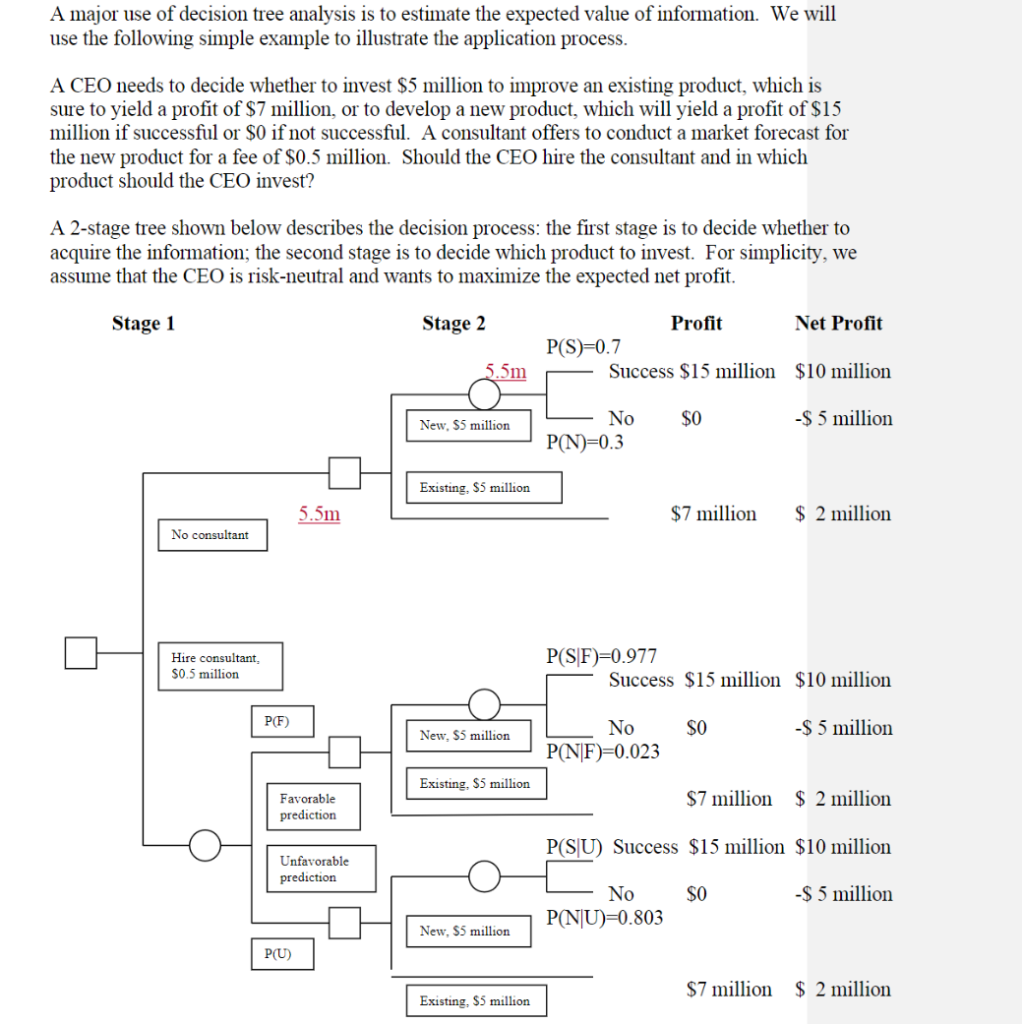

A major use of decision tree analysis is to estimate the expected value of information. We will use the following simple example to illustrate the application process. A CEO needs to decide whether to invest $5 million to improve an existing product, which is sure to yield a profit of $7 million, or to develop a new product, which will yield a profit of $15 million if successful or $0 if not successful. A consultant offers to conduct a market forecast for the new product for a fee of $0.5 million. Should the CEO hire the consultant and in which product should the CEO invest? A 2-stage tree shown below describes the decision process: the first stage is to decide whether to acquire the information; the second stage is to decide which product to invest. For simplicity, we assume that the CEO is risk-neutral and wants to maximize the expected net profit. Stage 1 Stage 2 Profit Net Profit P(S)=0.7 Success $15 million $10 million 5.5m New, $5 million $0 -$ 5 million No P(N)=0.3 Existing, $5 million 5.5m $7 million $ 2 million No consultant Hire consultant $0.5 million P(SF)=0.977 Success $15 million $10 million P(F) SO $ 5 million New, $5 million No P(NF)=0.023 Existing, $5 million Favorable prediction $7 million $ 2 million P(SU) Success $15 million $10 million Unfavorable prediction SO -$ 5 million No P(NU)=0.803 New, $5 million P(U) $7 million $ 2 million Existing, $5 millionStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started