Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide Competitive Analysis for the below case: In early December 2003, Dwayne Leslie was searching for a challenge when, coincidentally, his good friend, Ryan

Please provide Competitive Analysis for the below case:

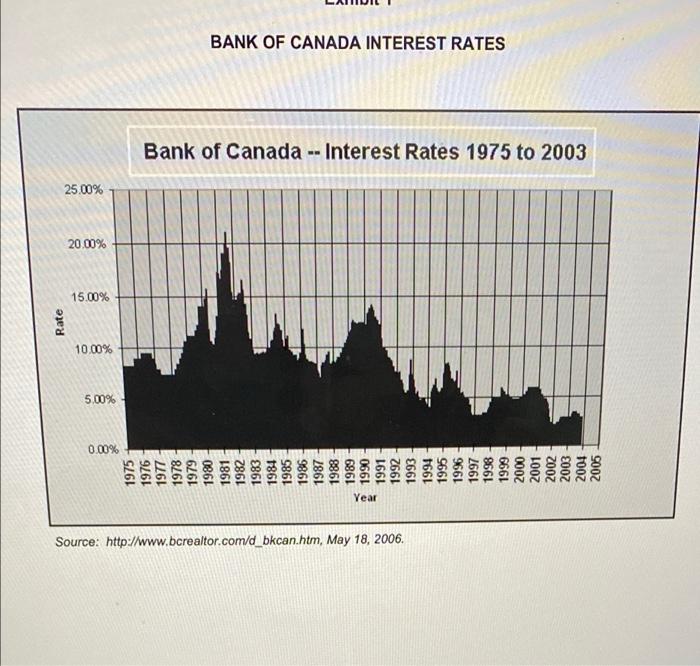

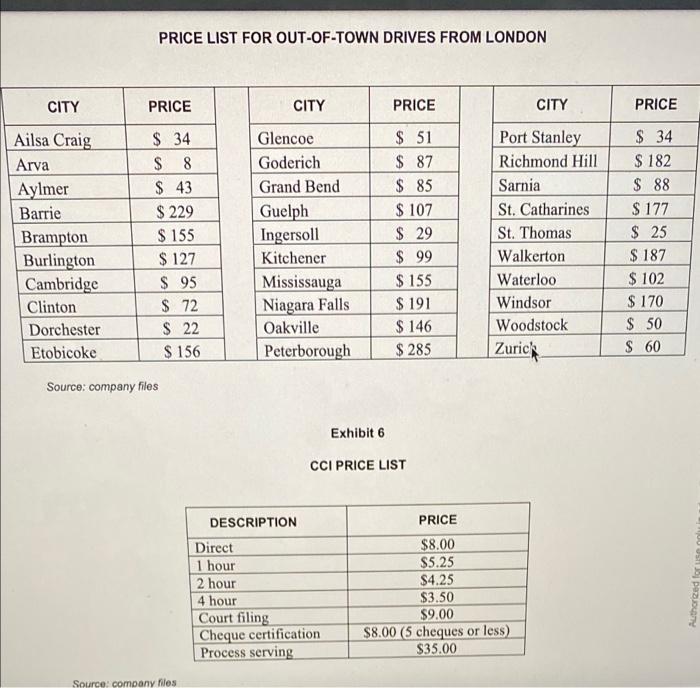

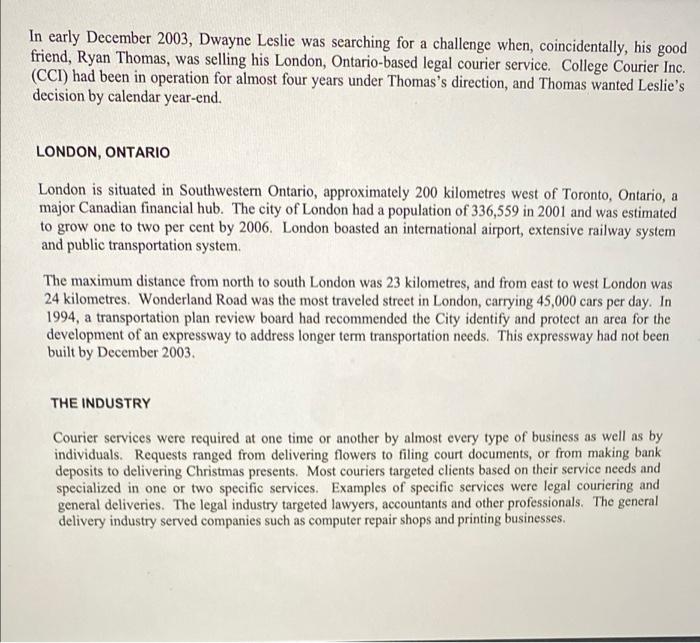

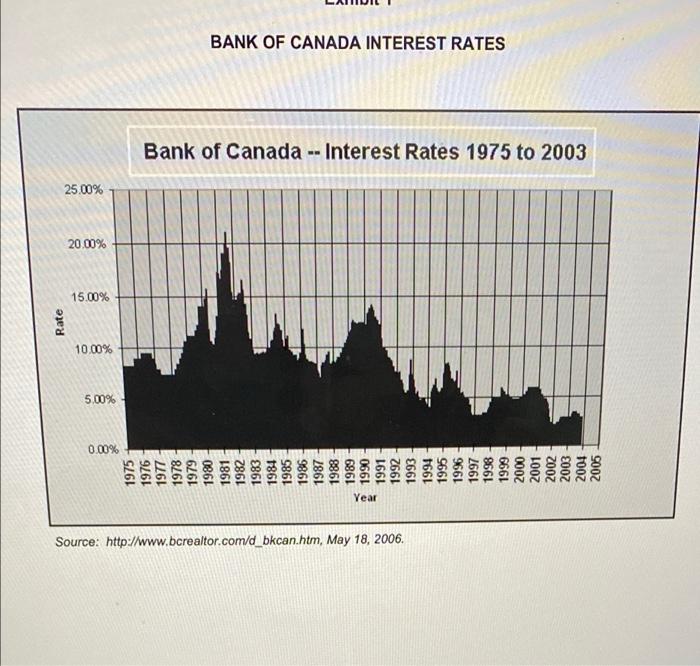

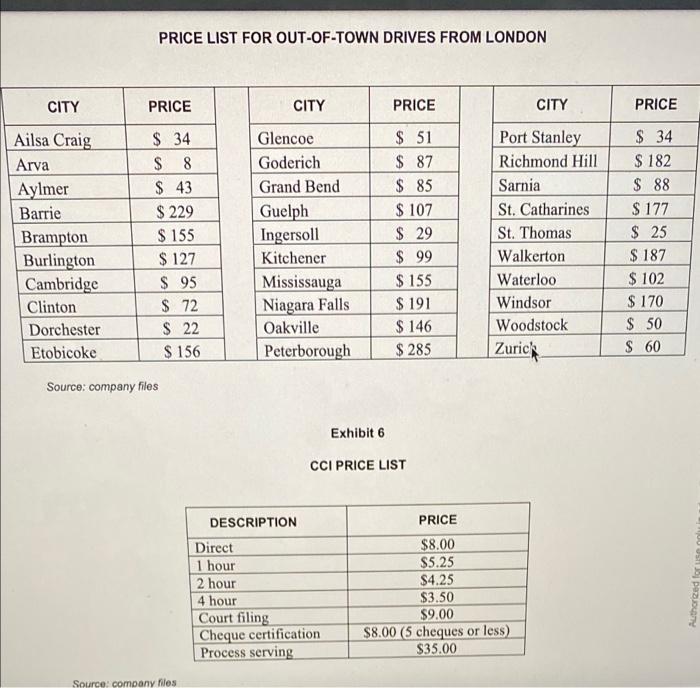

In early December 2003, Dwayne Leslie was searching for a challenge when, coincidentally, his good friend, Ryan Thomas, was selling his London, Ontario-based legal courier service. College Courier Inc. (CCI) had been in operation for almost four years under Thomas's direction, and Thomas wanted Leslie's decision by calendar year-end. LONDON, ONTARIO London is situated in Southwestern Ontario, approximately 200 kilometres west of Toronto, Ontario, a major Canadian financial hub. The city of London had a population of 336,559 in 2001 and was estimated to grow one to two per cent by 2006. London boasted an international airport, extensive railway system and public transportation system. The maximum distance from north to south London was 23 kilometres, and from east to west London was 24 kilometres. Wonderland Road was the most traveled street in London, carrying 45,000 cars per day. In 1994, a transportation plan review board had recommended the City identify and protect an area for the development of an expressway to address longer term transportation needs. This expressway had not been built by December 2003 THE INDUSTRY Courier services were required at one time or another by almost every type of business as well as by individuals. Requests ranged from delivering flowers to filing court documents, or from making bank deposits to delivering Christmas presents. Most couriers targeted clients based on their service needs and specialized in one or two specific services. Examples of specific services were legal couriering and general deliveries. The legal industry targeted lawyers, accountants and other professionals. The general delivery industry served companies such as computer repair shops and printing businesses. The Legal Market In London, the Yellow Pages on-line directory had 436 individuals and firms listed as lawyers, and 146 individuals and firms listed as accountants. The legal market required courier services for banking, deliveries, court filings and process servings Banking activity ranged from simple bank deposits to cheque certification. Most lawyers, accountants and other professionals utilized courier companies that could provide them with the full range of services. When deciding which courier company to retain the legal market also considered price, speed, flexibility and personal integrity. Price could be the most or least important buying criterion. This market demanded that services be completed in the agreed-upon time, but often expected couriers to accept rush and/or special orders in addition to normal requests; hence, flexibility was highly valued. Many documents entrusted to couriers were of a sensitive nature and therefore, required professional handling, so these professionals preferred to use a courier company or an individual whom they knew and trusted. Once the lawyer, accountant or professional became a client of the courier company, that courier service would be used almost exclusively. Only when the courier company was unable to accept a request would the client contact another courier company. Permanent switching of couriers occurred only when clients were dissatisfied with their service. Clients were displeased if the courier was slow, unfriendly or unwilling to accept rush or special requests. Although some clients were price conscious, couriers rarely lost clients due to price, since courier costs were commonly passed on to the lawyer's or accountant's respective clients. This meant that although the lawyer or accountant would pay the courier, the clients would eventually pay the lawyer or the accountant as part of their own bill. The legal courier industry was highly dependent on the demand for the services provided by lawyers and accountants. Lawyers were typically busier when the housing market performed well. More houses were sold when interest rates were low and during the summer months, the preferred time to move. See Exhibit 1 for interest rates in Canada from 1975 to 2003. Accountants, on the other hand, were typically busy in December when most businesses experienced fiscal year-end and in April, when personal Canadian income taxes were due. Pricing The courier price charged for a request depended on how urgent the request was, how far from the downtown core the destination was and whether the item needed to be returned to the client The more urgent the client request, the higher the price charged. The client had a choice of urgency ranging from a "direct" drive to a "four-hour" drive. The former requested the courier perform the delivery as soon as possible, while the latter gave the courier up to four hours to complete the delivery. Although the direct drives were the most lucrative, they could also cause scheduling problems. The number of direct drives a courier could accept was limited by the number of employees or drivers working that particular day Another consideration was the distance (i.e. pick-up to delivery) from the requesting client to the delivery destination - the shorter the distance, the lower the price charged for the drive. Most couriers charged more for deliveries beyond the downtown core. Each courier had its own process for determining the amount of additional charges for "out-of-core" deliveries, but most segmented the city into zones - the farther from downtown, the higher the price charged for the drive. Out-of-town drives were not offered by all courier firms, and often had to be completed after regular business hours. The charges for out-of-town drives depended on the distance in kilometres from the centre of London, Some requests required that a receipt or document be returned to the client after the service was performed. In this case, couriers would double-charge the client for a "return drive." For example, the price of a four- hour return drive was twice that of a four-hour drive. Competition Thomas had gathered some information regarding two legal competitors and three general delivery competitors: Walton Legal Service Walton Legal, owned by Kevin Walton, had approximately 40 clients and employed Walton's father part- time. Walton worked very long hours, and his company performed well as a result but he consistently complained of having a limited social life and no time for his family. Walton had recently tried to hire a full-time employee but several had quit since he paid only minimum wage. Authorized for use only in THE OPPORTUNITY Dwayne Leslie Leslie was considering purchasing CCI because he liked the flexibility it offered, and he wanted to "be his own boss. Leslie was 25 years old, single and had a high school education. He had recently been employed by Summit Foods, a food delivery company, where he travelled across Ontario, usually during the night. He did not enjoy the schedule or long hours, and had quit two months after being hired. Currently, he did odd jobs for his family and friends, but his income was insufficient to support him. He hoped to earn a salary of $250 per week in the first year and $400 per week in his second year, in addition to any vehicle and telephone expenses. He also hoped to take a 10-day holiday in August. If necessary, Leslie had $3,500 in personal savings that he was willing to invest in the business. If he purchased CCI, Leslie would need to purchase a vehicle, a cellphone, a computer and a printer for the first day of operations and planned to use Thomas's estimates for these costs. Operating Costs Several costs were associated with the successful operation of CCI. Each employee had to possess a personal cellular phone. While Thomas was the only one to receive calls from clients, each employee also needed a phone so that Thomas could dispatch them on jobs. Thomas's cellular phone originally cost him $150, and the monthly plan cost $350, which allowed him approximately 3,000 minutes. Thomas did not pay for or reimburse his employees for their cellular phones or their usage. Gas was a major expense of operating this business. A full-time employee used approximately three tanks of gas each week and, with gas at $0.70 per litre, each tank cost about $35. A tank of gas was consumed every 400 city kilometres. Thomas did not reimburse employees for their gas, but estimated he used a similar amount of gas as would a full-time employee. Gas prices were predicted to rise to almost $1 per litre by the summer of 2004. Thomas was leasing his car, which he used 90 per cent of the time for the business. His car payments were $700 per month, including insurance, and CCI paid for the total cost of the car, gas and maintenance, Repairs of approximately $500 per year were usually necessary, in September, after the busy summer months. In order to bill his clients, Thomas used a computer and color printer that he believed Leslie could purchase new for $1,000. Thomas's supplies, business cards, ink cartridges, paper and envelopes, cost $40 a month. Authorized for use only in Marketing Leslie had thought of several promotional options for the company, but was unsure which to pursue should he decide to purchase the company. He wanted to include his decisions within his projected cash budget. The first thought was to list in the Yellow Pages Directory, both on-line and in the phone book. The option would cost approximately $500 per year. Leslie also thought a name change might be appropriate. A name change would cost $210 to both file the appropriate forms and to register the new business name. Leslie also thought that in addition to signs placed in vehicle windows ($2 per sign), he might actually stencil the business name and phone number onto the side of his car. A local body shop quoted a price of $1,100 for this work. Other Considerations Leslie had previous experience working for Thomas, but had never managed the phone calls himself. Leslie wondered whether a change in ownership would affect the current number of CCI clients serviced. He thought a worst-case scenario would be a drop in total revenues of 40 per cent, but wanted to know how far revenues could fall before incurring a net loss. If revenues fell 40 per cent, Leslie thought he could perform all the couriering himself but he would still require a vehicle, a cellular phone, a computer and a printer. For the first year, Leslie planned to do all the billing himself. If the volume of business was similar to fiscal 2003, Leslie would need additional employees. Zurawski said he would not continue to work for CCI if Thomas sold the business. Leslie wanted to calculate how many employees (full- and part-time) he should hire, how they would be compensated and when they should be paid. Thomas would sell the CCI logo to Leslie in the purchase price of the business. Thomas was asking $36,000 for the business to be paid monthly over a two-year period. These payments would begin in February 2004. Thomas and Leslie agreed that three per cent interest would be paid to Thomas once each year, on December 31, on the outstanding balance of the loan at fiscal year-end. Leslie thought a 2004 projected income statement and return on investment figure would aid him in his decision. CCI would be subject to a 16 per cent tax rate. BANK OF CANADA INTEREST RATES Bank of Canada -- Interest Rates 1975 to 2003 25.00% 20.00% 15.00% Rate 10.00% 5.00% 0.00% % 1975 1976 1977 1978 6L61 1980 1980 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1002 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2861 1861 SEL 1001 cer TOOZ 2005 Year Source: http://www.bcrealtor.com/d_bkcan.htm, May 18, 2006. PRICE LIST FOR OUT-OF-TOWN DRIVES FROM LONDON CITY PRICE CITY PRICE CITY PRICE Ailsa Craig Arva Aylmer Barrie Brampton Burlington Cambridge Clinton Dorchester Etobicoke $ 34 $ 8 $ 43 $ 229 $ 155 $ 127 $ 95 $ 72 $ 22 $ 156 Glencoe Goderich Grand Bend Guelph Ingersoll Kitchener Mississauga Niagara Falls Oakville Peterborough $ 51 $ 87 $ 85 $ 107 $ 29 $ 99 $ 155 $ 191 $ 146 $ 285 Port Stanley Richmond Hill Sarnia St. Catharines St. Thomas Walkerton Waterloo Windsor Woodstock Zurich $ 34 $ 182 $ 88 $ 177 $ 25 $ 187 $ 102 $ 170 $ 50 $ 60 Source: company files Exhibit 6 CCI PRICE LIST PRICE DESCRIPTION Direct 1 hour 2 hour 4 hour Court filing Cheque certification Process serving USD $8.00 $5.25 $4.25 $3.50 $9.00 $8.00 (5 cheques or less) $35.00 Source: company files In early December 2003, Dwayne Leslie was searching for a challenge when, coincidentally, his good friend, Ryan Thomas, was selling his London, Ontario-based legal courier service. College Courier Inc. (CCI) had been in operation for almost four years under Thomas's direction, and Thomas wanted Leslie's decision by calendar year-end. LONDON, ONTARIO London is situated in Southwestern Ontario, approximately 200 kilometres west of Toronto, Ontario, a major Canadian financial hub. The city of London had a population of 336,559 in 2001 and was estimated to grow one to two per cent by 2006. London boasted an international airport, extensive railway system and public transportation system. The maximum distance from north to south London was 23 kilometres, and from east to west London was 24 kilometres. Wonderland Road was the most traveled street in London, carrying 45,000 cars per day. In 1994, a transportation plan review board had recommended the City identify and protect an area for the development of an expressway to address longer term transportation needs. This expressway had not been built by December 2003 THE INDUSTRY Courier services were required at one time or another by almost every type of business as well as by individuals. Requests ranged from delivering flowers to filing court documents, or from making bank deposits to delivering Christmas presents. Most couriers targeted clients based on their service needs and specialized in one or two specific services. Examples of specific services were legal couriering and general deliveries. The legal industry targeted lawyers, accountants and other professionals. The general delivery industry served companies such as computer repair shops and printing businesses. The Legal Market In London, the Yellow Pages on-line directory had 436 individuals and firms listed as lawyers, and 146 individuals and firms listed as accountants. The legal market required courier services for banking, deliveries, court filings and process servings Banking activity ranged from simple bank deposits to cheque certification. Most lawyers, accountants and other professionals utilized courier companies that could provide them with the full range of services. When deciding which courier company to retain the legal market also considered price, speed, flexibility and personal integrity. Price could be the most or least important buying criterion. This market demanded that services be completed in the agreed-upon time, but often expected couriers to accept rush and/or special orders in addition to normal requests; hence, flexibility was highly valued. Many documents entrusted to couriers were of a sensitive nature and therefore, required professional handling, so these professionals preferred to use a courier company or an individual whom they knew and trusted. Once the lawyer, accountant or professional became a client of the courier company, that courier service would be used almost exclusively. Only when the courier company was unable to accept a request would the client contact another courier company. Permanent switching of couriers occurred only when clients were dissatisfied with their service. Clients were displeased if the courier was slow, unfriendly or unwilling to accept rush or special requests. Although some clients were price conscious, couriers rarely lost clients due to price, since courier costs were commonly passed on to the lawyer's or accountant's respective clients. This meant that although the lawyer or accountant would pay the courier, the clients would eventually pay the lawyer or the accountant as part of their own bill. The legal courier industry was highly dependent on the demand for the services provided by lawyers and accountants. Lawyers were typically busier when the housing market performed well. More houses were sold when interest rates were low and during the summer months, the preferred time to move. See Exhibit 1 for interest rates in Canada from 1975 to 2003. Accountants, on the other hand, were typically busy in December when most businesses experienced fiscal year-end and in April, when personal Canadian income taxes were due. Pricing The courier price charged for a request depended on how urgent the request was, how far from the downtown core the destination was and whether the item needed to be returned to the client The more urgent the client request, the higher the price charged. The client had a choice of urgency ranging from a "direct" drive to a "four-hour" drive. The former requested the courier perform the delivery as soon as possible, while the latter gave the courier up to four hours to complete the delivery. Although the direct drives were the most lucrative, they could also cause scheduling problems. The number of direct drives a courier could accept was limited by the number of employees or drivers working that particular day Another consideration was the distance (i.e. pick-up to delivery) from the requesting client to the delivery destination - the shorter the distance, the lower the price charged for the drive. Most couriers charged more for deliveries beyond the downtown core. Each courier had its own process for determining the amount of additional charges for "out-of-core" deliveries, but most segmented the city into zones - the farther from downtown, the higher the price charged for the drive. Out-of-town drives were not offered by all courier firms, and often had to be completed after regular business hours. The charges for out-of-town drives depended on the distance in kilometres from the centre of London, Some requests required that a receipt or document be returned to the client after the service was performed. In this case, couriers would double-charge the client for a "return drive." For example, the price of a four- hour return drive was twice that of a four-hour drive. Competition Thomas had gathered some information regarding two legal competitors and three general delivery competitors: Walton Legal Service Walton Legal, owned by Kevin Walton, had approximately 40 clients and employed Walton's father part- time. Walton worked very long hours, and his company performed well as a result but he consistently complained of having a limited social life and no time for his family. Walton had recently tried to hire a full-time employee but several had quit since he paid only minimum wage. Authorized for use only in THE OPPORTUNITY Dwayne Leslie Leslie was considering purchasing CCI because he liked the flexibility it offered, and he wanted to "be his own boss. Leslie was 25 years old, single and had a high school education. He had recently been employed by Summit Foods, a food delivery company, where he travelled across Ontario, usually during the night. He did not enjoy the schedule or long hours, and had quit two months after being hired. Currently, he did odd jobs for his family and friends, but his income was insufficient to support him. He hoped to earn a salary of $250 per week in the first year and $400 per week in his second year, in addition to any vehicle and telephone expenses. He also hoped to take a 10-day holiday in August. If necessary, Leslie had $3,500 in personal savings that he was willing to invest in the business. If he purchased CCI, Leslie would need to purchase a vehicle, a cellphone, a computer and a printer for the first day of operations and planned to use Thomas's estimates for these costs. Operating Costs Several costs were associated with the successful operation of CCI. Each employee had to possess a personal cellular phone. While Thomas was the only one to receive calls from clients, each employee also needed a phone so that Thomas could dispatch them on jobs. Thomas's cellular phone originally cost him $150, and the monthly plan cost $350, which allowed him approximately 3,000 minutes. Thomas did not pay for or reimburse his employees for their cellular phones or their usage. Gas was a major expense of operating this business. A full-time employee used approximately three tanks of gas each week and, with gas at $0.70 per litre, each tank cost about $35. A tank of gas was consumed every 400 city kilometres. Thomas did not reimburse employees for their gas, but estimated he used a similar amount of gas as would a full-time employee. Gas prices were predicted to rise to almost $1 per litre by the summer of 2004. Thomas was leasing his car, which he used 90 per cent of the time for the business. His car payments were $700 per month, including insurance, and CCI paid for the total cost of the car, gas and maintenance, Repairs of approximately $500 per year were usually necessary, in September, after the busy summer months. In order to bill his clients, Thomas used a computer and color printer that he believed Leslie could purchase new for $1,000. Thomas's supplies, business cards, ink cartridges, paper and envelopes, cost $40 a month. Authorized for use only in Marketing Leslie had thought of several promotional options for the company, but was unsure which to pursue should he decide to purchase the company. He wanted to include his decisions within his projected cash budget. The first thought was to list in the Yellow Pages Directory, both on-line and in the phone book. The option would cost approximately $500 per year. Leslie also thought a name change might be appropriate. A name change would cost $210 to both file the appropriate forms and to register the new business name. Leslie also thought that in addition to signs placed in vehicle windows ($2 per sign), he might actually stencil the business name and phone number onto the side of his car. A local body shop quoted a price of $1,100 for this work. Other Considerations Leslie had previous experience working for Thomas, but had never managed the phone calls himself. Leslie wondered whether a change in ownership would affect the current number of CCI clients serviced. He thought a worst-case scenario would be a drop in total revenues of 40 per cent, but wanted to know how far revenues could fall before incurring a net loss. If revenues fell 40 per cent, Leslie thought he could perform all the couriering himself but he would still require a vehicle, a cellular phone, a computer and a printer. For the first year, Leslie planned to do all the billing himself. If the volume of business was similar to fiscal 2003, Leslie would need additional employees. Zurawski said he would not continue to work for CCI if Thomas sold the business. Leslie wanted to calculate how many employees (full- and part-time) he should hire, how they would be compensated and when they should be paid. Thomas would sell the CCI logo to Leslie in the purchase price of the business. Thomas was asking $36,000 for the business to be paid monthly over a two-year period. These payments would begin in February 2004. Thomas and Leslie agreed that three per cent interest would be paid to Thomas once each year, on December 31, on the outstanding balance of the loan at fiscal year-end. Leslie thought a 2004 projected income statement and return on investment figure would aid him in his decision. CCI would be subject to a 16 per cent tax rate. BANK OF CANADA INTEREST RATES Bank of Canada -- Interest Rates 1975 to 2003 25.00% 20.00% 15.00% Rate 10.00% 5.00% 0.00% % 1975 1976 1977 1978 6L61 1980 1980 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1002 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2861 1861 SEL 1001 cer TOOZ 2005 Year Source: http://www.bcrealtor.com/d_bkcan.htm, May 18, 2006. PRICE LIST FOR OUT-OF-TOWN DRIVES FROM LONDON CITY PRICE CITY PRICE CITY PRICE Ailsa Craig Arva Aylmer Barrie Brampton Burlington Cambridge Clinton Dorchester Etobicoke $ 34 $ 8 $ 43 $ 229 $ 155 $ 127 $ 95 $ 72 $ 22 $ 156 Glencoe Goderich Grand Bend Guelph Ingersoll Kitchener Mississauga Niagara Falls Oakville Peterborough $ 51 $ 87 $ 85 $ 107 $ 29 $ 99 $ 155 $ 191 $ 146 $ 285 Port Stanley Richmond Hill Sarnia St. Catharines St. Thomas Walkerton Waterloo Windsor Woodstock Zurich $ 34 $ 182 $ 88 $ 177 $ 25 $ 187 $ 102 $ 170 $ 50 $ 60 Source: company files Exhibit 6 CCI PRICE LIST PRICE DESCRIPTION Direct 1 hour 2 hour 4 hour Court filing Cheque certification Process serving USD $8.00 $5.25 $4.25 $3.50 $9.00 $8.00 (5 cheques or less) $35.00 Source: company files

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started