Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide correct answer and detailed steps will upvote ABC Bank issues a $150 million 3-year note at a fixed annual coupon rate of 5%

please provide correct answer and detailed steps

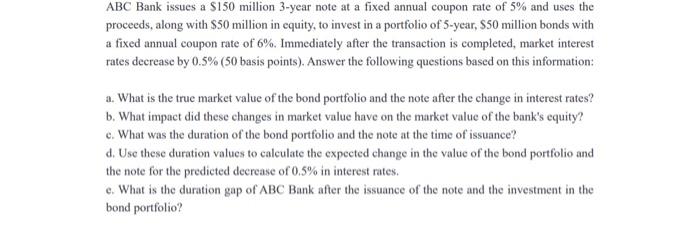

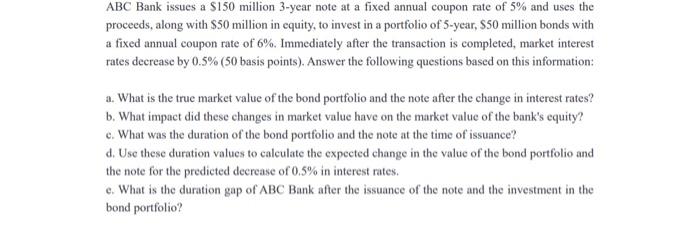

ABC Bank issues a $150 million 3-year note at a fixed annual coupon rate of 5% and uses the proceeds, along with $50 million in equity, to invest in a portfolio of 5-year, $50 million bonds with a fixed annual coupon rate of 6%. Immediately after the transaction is completed, market interest rates decrease by 0.5% ( 50 basis points). Answer the following questions based on this information: a. What is the true market value of the bond portfolio and the note after the change in interest rates? b. What impact did these changes in market value have on the market value of the bank's equity? e. What was the duration of the bond portfolio and the note at the time of issuance? d. Use these duration values to calculate the expected change in the value of the bond portfolio and the note for the predicted decrease of 0.5% in interest rates. e. What is the duration gap of ABC Bank after the issuance of the note and the investment in the bond portfolio will upvote

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started