Please provide detailed analysis and calculations, thanks

Please provide detailed analysis and calculations, thanks

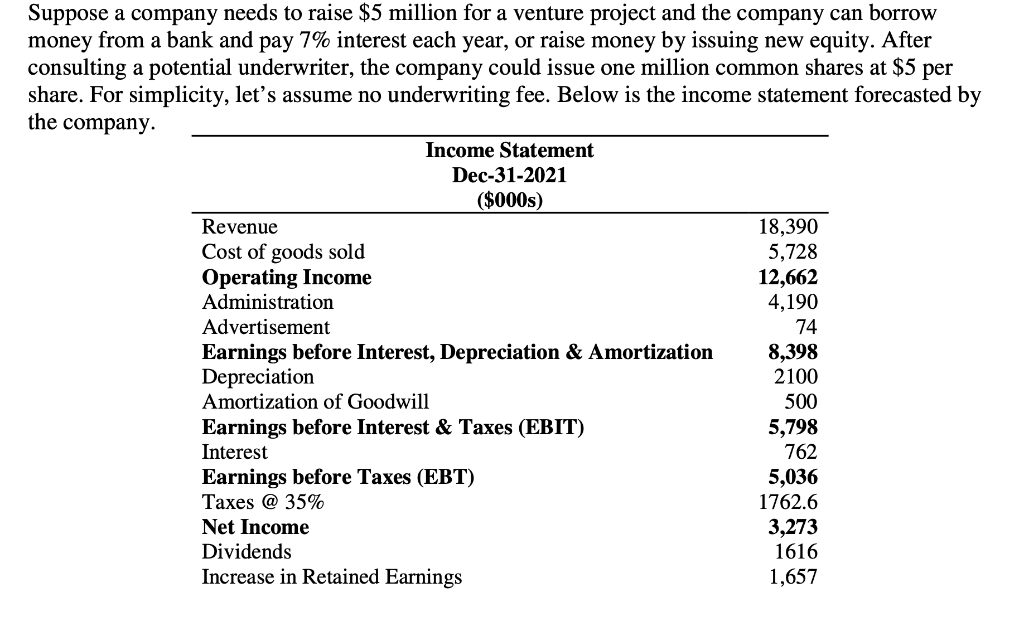

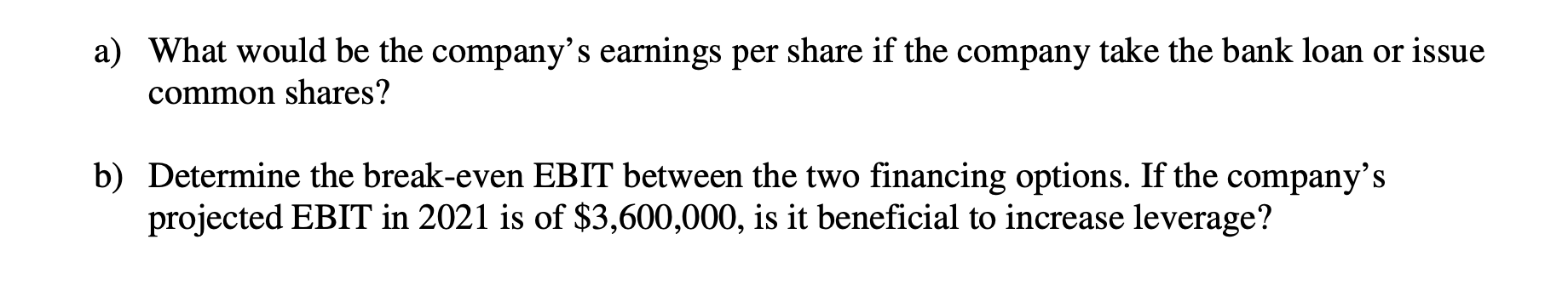

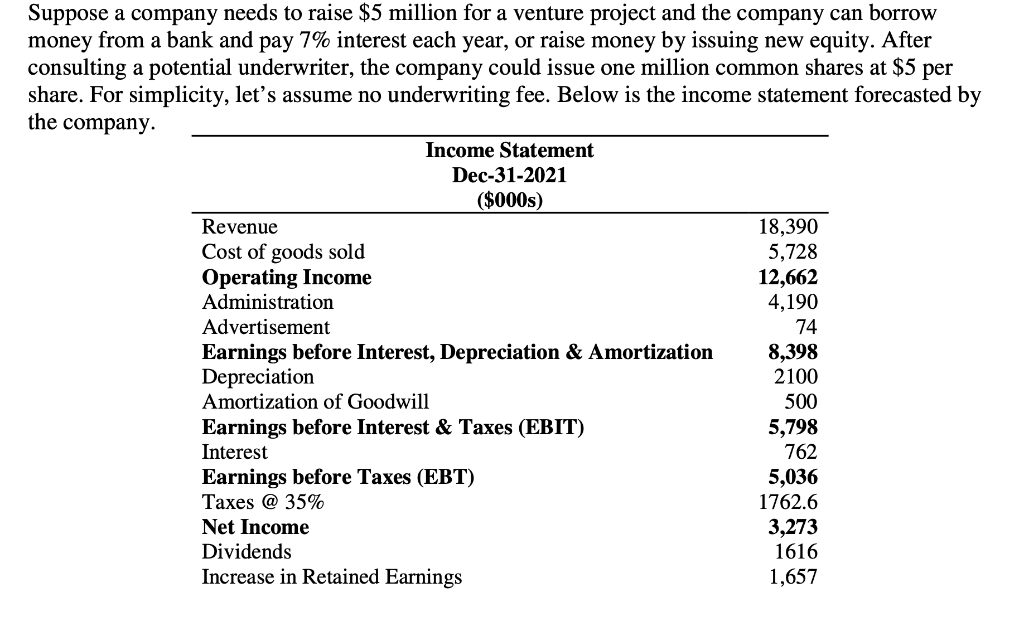

per Suppose a company needs to raise $5 million for a venture project and the company can borrow money from a bank and pay 7% interest each year, or raise money by issuing new equity. After consulting a potential underwriter, the company could issue one million common shares at $5 share. For simplicity, let's assume no underwriting fee. Below is the income statement forecasted by the company. Income Statement Dec-31-2021 ($000s) Revenue 18,390 Cost of goods sold 5,728 Operating Income 12,662 Administration 4,190 Advertisement 74 Earnings before Interest, Depreciation & Amortization 8,398 Depreciation 2100 Amortization of Goodwill 500 Earnings before Interest & Taxes (EBIT) 5,798 Interest 762 Earnings before Taxes (EBT) 5,036 Taxes @ 35% 1762.6 Net Income 3,273 Dividends 1616 Increase in Retained Earnings 1,657 a) What would be the company's earnings per share if the company take the bank loan or issue common shares? b) Determine the break-even EBIT between the two financing options. If the company's projected EBIT in 2021 is of $3,600,000, is it beneficial to increase leverage? per Suppose a company needs to raise $5 million for a venture project and the company can borrow money from a bank and pay 7% interest each year, or raise money by issuing new equity. After consulting a potential underwriter, the company could issue one million common shares at $5 share. For simplicity, let's assume no underwriting fee. Below is the income statement forecasted by the company. Income Statement Dec-31-2021 ($000s) Revenue 18,390 Cost of goods sold 5,728 Operating Income 12,662 Administration 4,190 Advertisement 74 Earnings before Interest, Depreciation & Amortization 8,398 Depreciation 2100 Amortization of Goodwill 500 Earnings before Interest & Taxes (EBIT) 5,798 Interest 762 Earnings before Taxes (EBT) 5,036 Taxes @ 35% 1762.6 Net Income 3,273 Dividends 1616 Increase in Retained Earnings 1,657 a) What would be the company's earnings per share if the company take the bank loan or issue common shares? b) Determine the break-even EBIT between the two financing options. If the company's projected EBIT in 2021 is of $3,600,000, is it beneficial to increase leverage

Please provide detailed analysis and calculations, thanks

Please provide detailed analysis and calculations, thanks