Please provide detailed answers and please send a copy of the solutions in Microsoft Word or PDF Format to q u a n t f i n 3 5 a t g m a i l d o t c o m

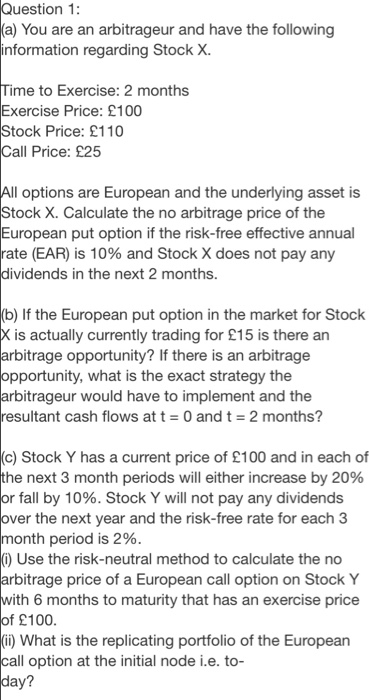

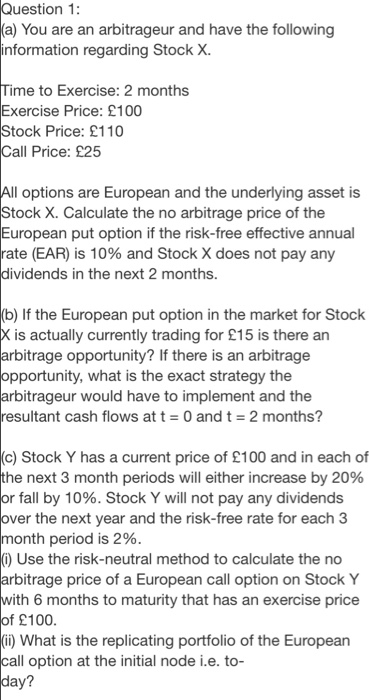

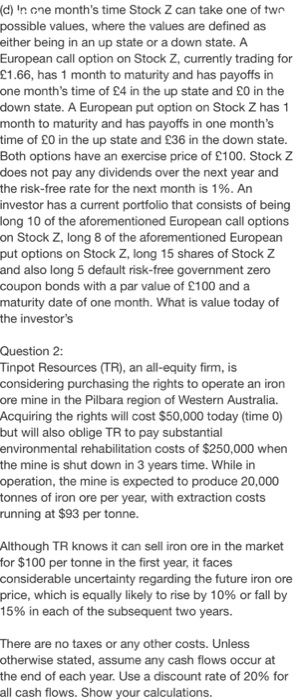

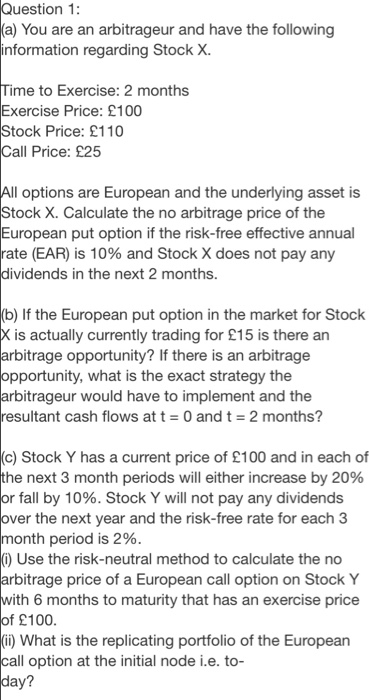

Question 1: (a) You are an arbitrageur and have the following information regarding Stock X. Time to Exercise: 2 months Exercise Price: 100 Stock Price: 110 Call Price: 25 All options are European and the underlying asset is Stock X. Calculate the no arbitrage price of the European put option if the risk-free effective annual rate (EAR) is 10% and Stock X does not pay any dividends in the next 2 months. b) If the European put option in the market for Stock X is actually currently trading for 15 is there an Jarbitrage opportunity? If there is an arbitrage opportunity, what is the exact strategy the arbitrageur would have to implement and the resultant cash flows at t = 0 and t = 2 months? (c) Stock Y has a current price of 100 and in each of the next 3 month periods will either increase by 20% or fall by 10%. Stock Y will not pay any dividends over the next year and the risk-free rate for each 3 month period is 2%. 10) Use the risk-neutral method to calculate the no arbitrage price of a European call option on Stock Y with 6 months to maturity that has an exercise price of 100. km) What is the replicating portfolio of the European call option at the initial node i.e. to- day? (d) in one month's time Stock Z can take one of two possible values, where the values are defined as either being in an up state or a down state. A European call option on Stock Z, currently trading for 1.66, has 1 month to maturity and has payoffs in one month's time of 4 in the up state and 0 in the down state. A European put option on Stock Z has 1 month to maturity and has payoffs in one month's time of 0 in the up state and 36 in the down state. Both options have an exercise price of 100. Stock Z does not pay any dividends over the next year and the risk-free rate for the next month is 1%. An investor has a current portfolio that consists of being long 10 of the aforementioned European call options on Stock Z, long 8 of the aforementioned European put options on Stock Z, long 15 shares of Stock Z and also long 5 default risk-free government zero coupon bonds with a par value of 100 and a maturity date of one month. What is value today of the investor's Question 2: Tinpot Resources (TR), an all-equity firm, is considering purchasing the rights to operate an iron pre mine in the Pilbara region of Western Australia. Acquiring the rights will cost $50,000 today (time 0) but will also oblige TR to pay substantial environmental rehabilitation costs of $250,000 when the mine is shut down in 3 years time. While in operation, the mine is expected to produce 20,000 tonnes of iron ore per year, with extraction costs running at $93 per tonne. Although TR knows it can sell iron ore in the market for $100 per tonne in the first year, it faces considerable uncertainty regarding the future iron ore price, which is equally likely to rise by 10% or fall by 15% in each of the subsequent two years. There are no taxes or any other costs. Unless otherwise stated, assume any cash flows occur at the end of each year. Use a discount rate of 20% for all cash flows. Show your calculations. (a) Draw a binomial tree depicting the possible market prices of iron ore during the mine's op- erating life. Remember, the price in year 1 is known with certainty. What is the expected market price of iron ore in years 2 and 3? (b) Calculate the NPV of the project. Should TR purchase the rights? (c) Explain why using the IRR rule is likely to result in an incorrect decision when evaluating this project (do not attempt to calculate the IRR). Now assume that TR has the ability to temporarily halt extraction operations if iron ore prices move adversely. However, by doing so, it cannot avoid paying the environmental rehabilitation costs at the end of the mine's life. (d) When will TR choose to exercise this option? Explain fully. (e) Determine the value of the abandonment option and comment on the source of the option value. Question 1: (a) You are an arbitrageur and have the following information regarding Stock X. Time to Exercise: 2 months Exercise Price: 100 Stock Price: 110 Call Price: 25 All options are European and the underlying asset is Stock X. Calculate the no arbitrage price of the European put option if the risk-free effective annual rate (EAR) is 10% and Stock X does not pay any dividends in the next 2 months. b) If the European put option in the market for Stock X is actually currently trading for 15 is there an Jarbitrage opportunity? If there is an arbitrage opportunity, what is the exact strategy the arbitrageur would have to implement and the resultant cash flows at t = 0 and t = 2 months? (c) Stock Y has a current price of 100 and in each of the next 3 month periods will either increase by 20% or fall by 10%. Stock Y will not pay any dividends over the next year and the risk-free rate for each 3 month period is 2%. 10) Use the risk-neutral method to calculate the no arbitrage price of a European call option on Stock Y with 6 months to maturity that has an exercise price of 100. km) What is the replicating portfolio of the European call option at the initial node i.e. to- day? (d) in one month's time Stock Z can take one of two possible values, where the values are defined as either being in an up state or a down state. A European call option on Stock Z, currently trading for 1.66, has 1 month to maturity and has payoffs in one month's time of 4 in the up state and 0 in the down state. A European put option on Stock Z has 1 month to maturity and has payoffs in one month's time of 0 in the up state and 36 in the down state. Both options have an exercise price of 100. Stock Z does not pay any dividends over the next year and the risk-free rate for the next month is 1%. An investor has a current portfolio that consists of being long 10 of the aforementioned European call options on Stock Z, long 8 of the aforementioned European put options on Stock Z, long 15 shares of Stock Z and also long 5 default risk-free government zero coupon bonds with a par value of 100 and a maturity date of one month. What is value today of the investor's Question 2: Tinpot Resources (TR), an all-equity firm, is considering purchasing the rights to operate an iron pre mine in the Pilbara region of Western Australia. Acquiring the rights will cost $50,000 today (time 0) but will also oblige TR to pay substantial environmental rehabilitation costs of $250,000 when the mine is shut down in 3 years time. While in operation, the mine is expected to produce 20,000 tonnes of iron ore per year, with extraction costs running at $93 per tonne. Although TR knows it can sell iron ore in the market for $100 per tonne in the first year, it faces considerable uncertainty regarding the future iron ore price, which is equally likely to rise by 10% or fall by 15% in each of the subsequent two years. There are no taxes or any other costs. Unless otherwise stated, assume any cash flows occur at the end of each year. Use a discount rate of 20% for all cash flows. Show your calculations. (a) Draw a binomial tree depicting the possible market prices of iron ore during the mine's op- erating life. Remember, the price in year 1 is known with certainty. What is the expected market price of iron ore in years 2 and 3? (b) Calculate the NPV of the project. Should TR purchase the rights? (c) Explain why using the IRR rule is likely to result in an incorrect decision when evaluating this project (do not attempt to calculate the IRR). Now assume that TR has the ability to temporarily halt extraction operations if iron ore prices move adversely. However, by doing so, it cannot avoid paying the environmental rehabilitation costs at the end of the mine's life. (d) When will TR choose to exercise this option? Explain fully. (e) Determine the value of the abandonment option and comment on the source of the option value