Please provide detailed solution process and analysis of each small question. Mainly help me answer questions six to eight.

Thanks!

Thanks!

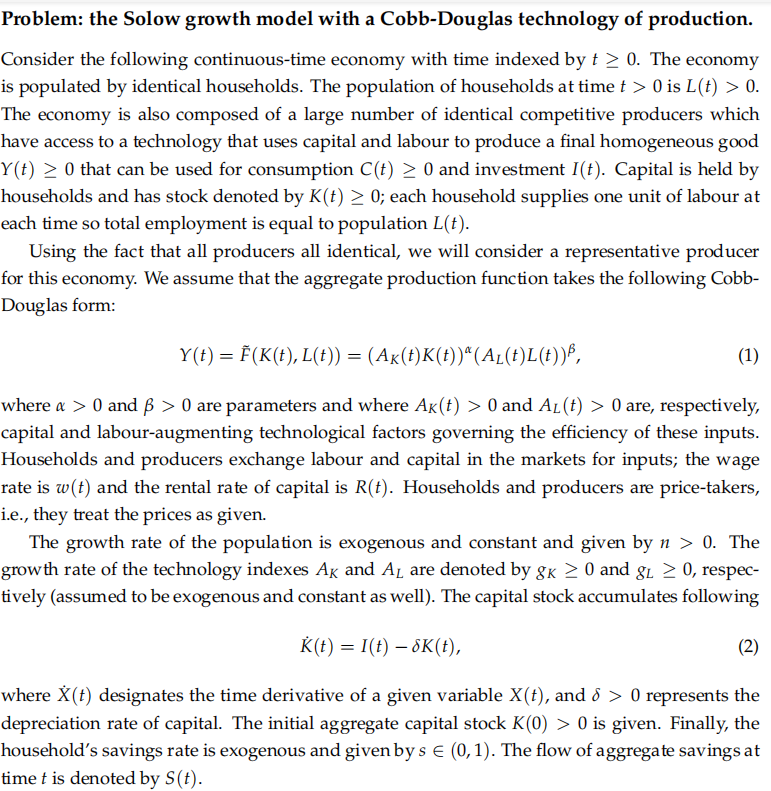

Problem: the Solow growth model with a Cobb-Douglas technology of production. Consider the following continuous-time economy with time indexed by t 0. The economy is populated by identical households. The population of households at time t > 0 is L(t) > 0. The economy is also composed of a large number of identical competitive producers which have access to a technology that uses capital and labour to produce a final homogeneous good Y(t) 0 that can be used for consumption C(t) 0 and investment I(t). Capital is held by households and has stock denoted by K(t) 0; each household supplies one unit of labour at each time so total employment is equal to population L(t).

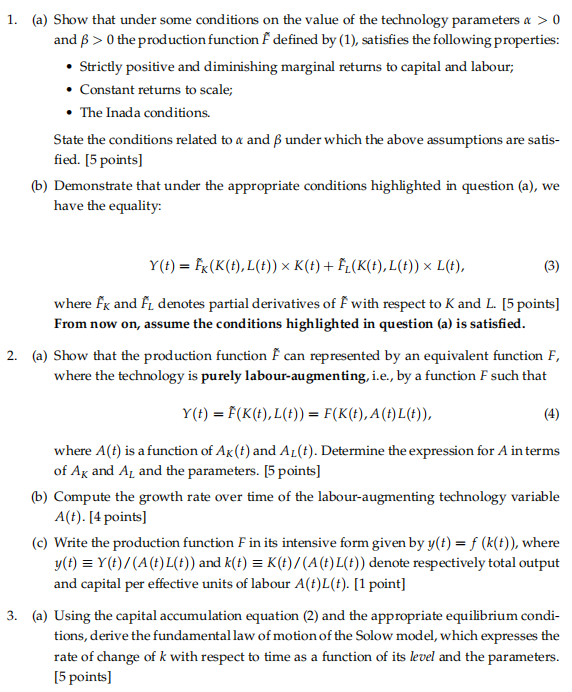

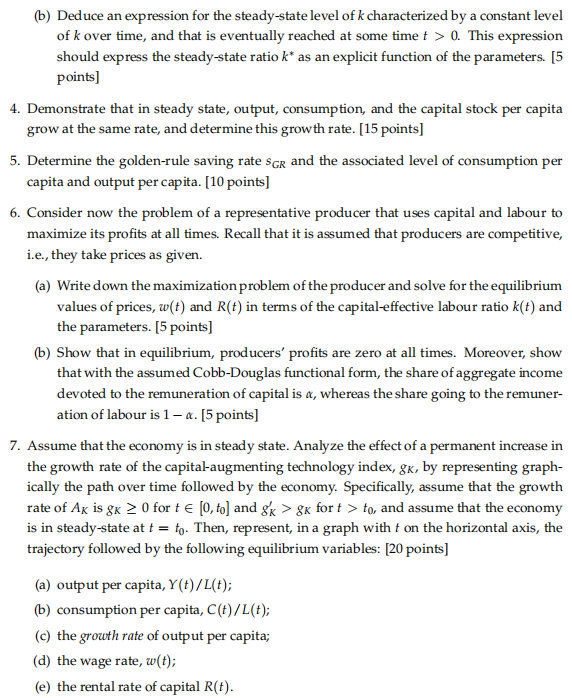

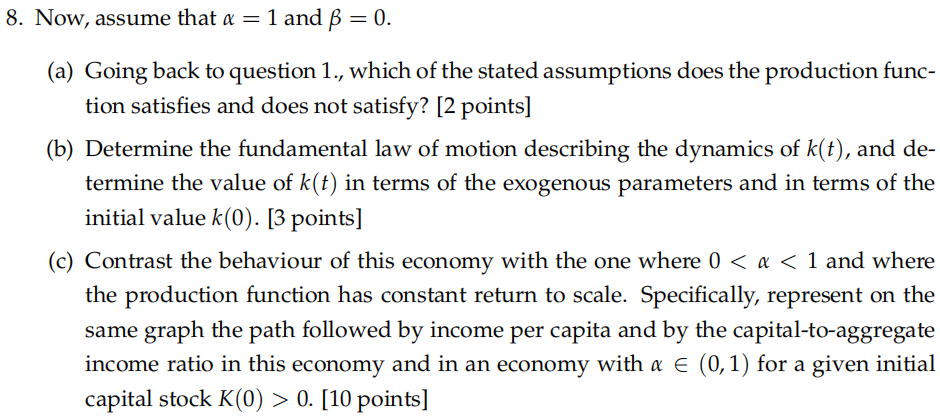

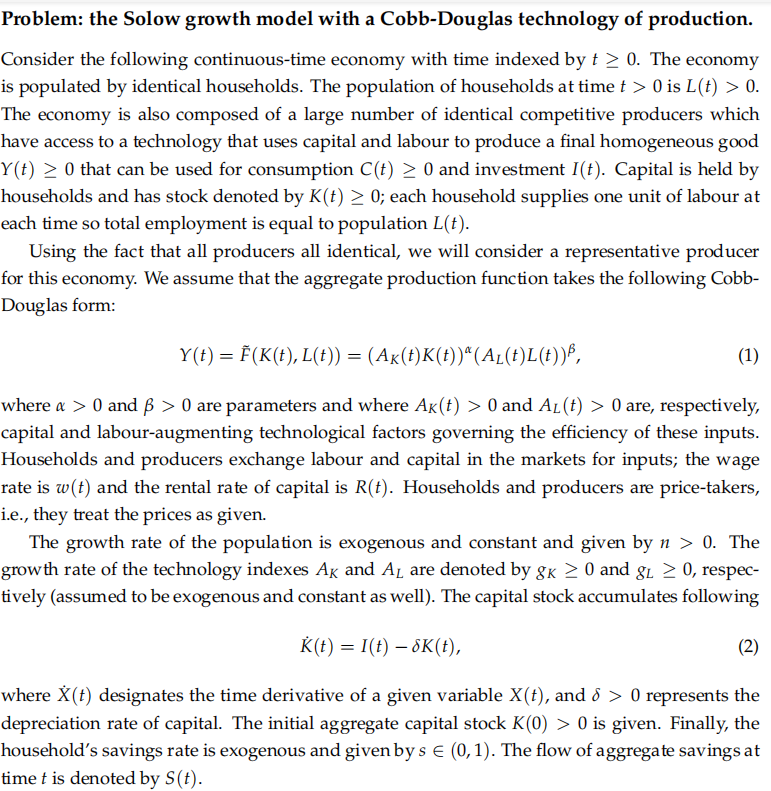

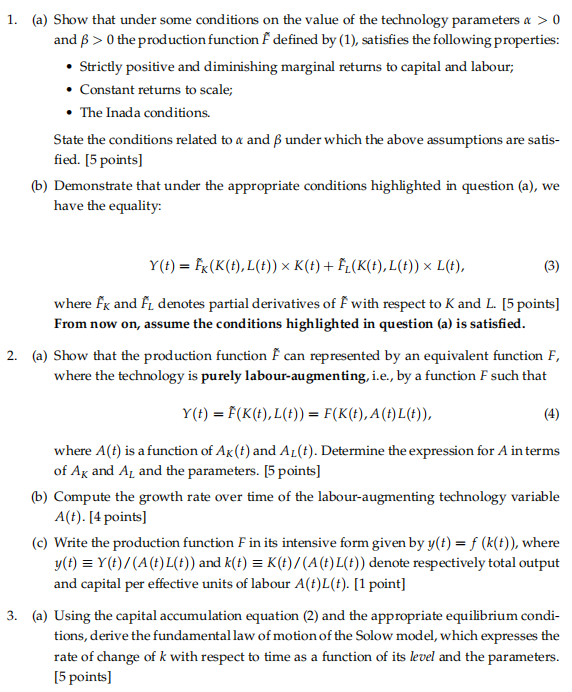

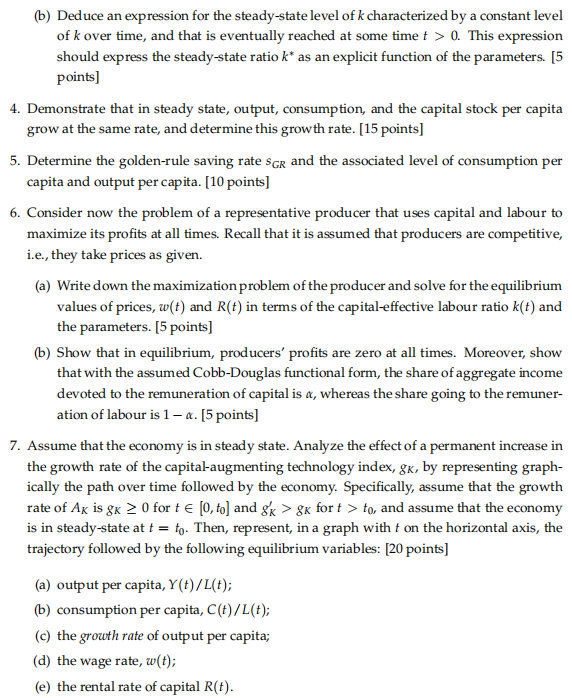

1. (a) Show that under some conditions on the value of the technology parameters > 0 and B > 0 the production function F defined by (1), satisfies the following properties: Strictly positive and diminishing marginal returns to capital and labour; Constant returns to scale; The Inada conditions. State the conditions related to a and under which the above assumptions are satis- fied. [5 points) (b) Demonstrate that under the appropriate conditions highlighted in question (a), we have the equality: Y(t) = fx (K(t), L(t)) K(t) + F(K(t), L(t)) ~ L(t), where fx and f, denotes partial derivatives of f with respect to K and L. [5 points] From now on, assume the conditions highlighted in question (a) is satisfied. 2. (a) Show that the production function f can represented by an equivalent function F, where the technology is purely labour augmenting, i.e., by a function F such that = Y(t) = f(K(t), L(t)) = F(K(t), A(t) L(t)), (4) where A(t) is a function of Ak(t) and Az(t). Determine the expression for A in terms of Ag and A_ and the parameters. [5 points] (6) Compute the growth rate over time of the labour-augmenting technology variable A(t). [4 points) (C) Write the production function Fin its intensive form given by y(t) = f (k(t)), where y(t) = Y(t)/(A(t)/(t)) and k(t) = K(t)/(A(t)/(t)) denote respectively total output and capital per effective units of labour Act)l(t). [1 point] 3. (a) Using the capital accumulation equation (2) and the appropriate equilibrium condi- tions, derive the fundamental law of motion of the Solow model, which expresses the rate of change of k with respect to time as a function of its level and the parameters. [5 points) (b) Deduce an expression for the steady-state level of k characterized by a constant level of k over time, and that is eventually reached at some time t > 0. This expression should express the steady-state ratio k* as an explicit function of the parameters. [5 points) 4. Demonstrate that in steady state, output, consumption, and the capital stock per capita grow at the same rate, and determine this growth rate. [15 points] 5. Determine the golden-rule saving rate SGR and the associated level of consumption per capita and output per capita. [10 points] 6. Consider now the problem of a representative producer that uses capital and labour to maximize its profits at all times. Recall that it is assumed that producers are competitive, i.e., they take prices as given. (a) Write down the maximization problem of the producer and solve for the equilibrium values of prices, w(t) and R(t) in terms of the capital-effective labour ratio k(t) and the parameters. [5 points] (b) Show that in equilibrium, producers' profits are zero at all times. Moreover, show that with the assumed Cobb-Douglas functional form, the share of aggregate income devoted to the remuneration of capital is &, whereas the share going to the remuner- ation of labour is 1 . [5 points] 7. Assume that the economy is in steady state. Analyze the effect of a permanent increase in the growth rate of the capitalaugmenting technology index, gk, by representing graph- ically the path over time followed by the economy. Specifically, assume that the growth rate of Ak is gk > 0 for t (0, to) and fx > gk fort > to, and assume that the economy is in steady-state at t = to. Then, represent, in a graph with t on the horizontal axis, the trajectory followed by the following equilibrium variables: [20 points] (a) output per capita, y(t)/L(t); (b) consumption per capita, C(t)/L(t); (c) the growth rate of output per capita; (d) the wage rate, w(t); (e) the rental rate of capital R(t). 8. Now, assume that a = 1 and B = 0. (a) Going back to question 1., which of the stated assumptions does the production func- tion satisfies and does not satisfy? [2 points] (b) Determine the fundamental law of motion describing the dynamics of k(t), and de- termine the value of k(t) in terms of the exogenous parameters and in terms of the initial value k(0). [3 points] (c) Contrast the behaviour of this economy with the one where 0 0. [10 points] Problem: the Solow growth model with a Cobb-Douglas technology of production. Consider the following continuous-time economy with time indexed by t > 0. The economy is populated by identical households. The population of households at time t > 0 is L(t) > 0. The economy is also composed of a large number of identical competitive producers which have access to a technology that uses capital and labour to produce a final homogeneous good Y(t) > 0 that can be used for consumption C(t) > 0 and investment I(t). Capital is held by households and has stock denoted by K(t) > 0; each household supplies one unit of labour at each time so total employment is equal to population L(t). Using the fact that all producers all identical, we will consider a representative producer for this economy. We assume that the aggregate production function takes the following Cobb- Douglas form: Y(t) = f(K(t), L(t)) = (Ak(t)K(t))"(Al(t)L(t)), (1) where a > 0 and > 0 are parameters and where Ak(t) > 0 and Al(t) > 0 are, respectively, capital and labour-augmenting technological factors governing the efficiency of these inputs. Households and producers exchange labour and capital in the markets for inputs; the wage rate is w(t) and the rental rate of capital is R(t). Households and producers are price-takers, i.e., they treat the prices as given. The growth rate of the population is exogenous and constant and given by n > 0. The growth rate of the technology indexes Ak and A are denoted by gk > 0 and gl > 0, respec- tively (assumed to be exogenous and constant as well). The capital stock accumulates following K(t) = I(t) - 8K(t), = (2) where $(t) designates the time derivative of a given variable X(t), and 8 > 0 represents the depreciation rate of capital. The initial aggregate capital stock K0) > 0 is given. Finally, the household's savings rate is exogenous and given by s (0,1). The flow of aggregate savings at time t is denoted by S(t). 1. (a) Show that under some conditions on the value of the technology parameters > 0 and B > 0 the production function F defined by (1), satisfies the following properties: Strictly positive and diminishing marginal returns to capital and labour; Constant returns to scale; The Inada conditions. State the conditions related to a and under which the above assumptions are satis- fied. [5 points) (b) Demonstrate that under the appropriate conditions highlighted in question (a), we have the equality: Y(t) = fx (K(t), L(t)) K(t) + F(K(t), L(t)) ~ L(t), where fx and f, denotes partial derivatives of f with respect to K and L. [5 points] From now on, assume the conditions highlighted in question (a) is satisfied. 2. (a) Show that the production function f can represented by an equivalent function F, where the technology is purely labour augmenting, i.e., by a function F such that = Y(t) = f(K(t), L(t)) = F(K(t), A(t) L(t)), (4) where A(t) is a function of Ak(t) and Az(t). Determine the expression for A in terms of Ag and A_ and the parameters. [5 points] (6) Compute the growth rate over time of the labour-augmenting technology variable A(t). [4 points) (C) Write the production function Fin its intensive form given by y(t) = f (k(t)), where y(t) = Y(t)/(A(t)/(t)) and k(t) = K(t)/(A(t)/(t)) denote respectively total output and capital per effective units of labour Act)l(t). [1 point] 3. (a) Using the capital accumulation equation (2) and the appropriate equilibrium condi- tions, derive the fundamental law of motion of the Solow model, which expresses the rate of change of k with respect to time as a function of its level and the parameters. [5 points) (b) Deduce an expression for the steady-state level of k characterized by a constant level of k over time, and that is eventually reached at some time t > 0. This expression should express the steady-state ratio k* as an explicit function of the parameters. [5 points) 4. Demonstrate that in steady state, output, consumption, and the capital stock per capita grow at the same rate, and determine this growth rate. [15 points] 5. Determine the golden-rule saving rate SGR and the associated level of consumption per capita and output per capita. [10 points] 6. Consider now the problem of a representative producer that uses capital and labour to maximize its profits at all times. Recall that it is assumed that producers are competitive, i.e., they take prices as given. (a) Write down the maximization problem of the producer and solve for the equilibrium values of prices, w(t) and R(t) in terms of the capital-effective labour ratio k(t) and the parameters. [5 points] (b) Show that in equilibrium, producers' profits are zero at all times. Moreover, show that with the assumed Cobb-Douglas functional form, the share of aggregate income devoted to the remuneration of capital is &, whereas the share going to the remuner- ation of labour is 1 . [5 points] 7. Assume that the economy is in steady state. Analyze the effect of a permanent increase in the growth rate of the capitalaugmenting technology index, gk, by representing graph- ically the path over time followed by the economy. Specifically, assume that the growth rate of Ak is gk > 0 for t (0, to) and fx > gk fort > to, and assume that the economy is in steady-state at t = to. Then, represent, in a graph with t on the horizontal axis, the trajectory followed by the following equilibrium variables: [20 points] (a) output per capita, y(t)/L(t); (b) consumption per capita, C(t)/L(t); (c) the growth rate of output per capita; (d) the wage rate, w(t); (e) the rental rate of capital R(t). 8. Now, assume that a = 1 and B = 0. (a) Going back to question 1., which of the stated assumptions does the production func- tion satisfies and does not satisfy? [2 points] (b) Determine the fundamental law of motion describing the dynamics of k(t), and de- termine the value of k(t) in terms of the exogenous parameters and in terms of the initial value k(0). [3 points] (c) Contrast the behaviour of this economy with the one where 0 0. [10 points] Problem: the Solow growth model with a Cobb-Douglas technology of production. Consider the following continuous-time economy with time indexed by t > 0. The economy is populated by identical households. The population of households at time t > 0 is L(t) > 0. The economy is also composed of a large number of identical competitive producers which have access to a technology that uses capital and labour to produce a final homogeneous good Y(t) > 0 that can be used for consumption C(t) > 0 and investment I(t). Capital is held by households and has stock denoted by K(t) > 0; each household supplies one unit of labour at each time so total employment is equal to population L(t). Using the fact that all producers all identical, we will consider a representative producer for this economy. We assume that the aggregate production function takes the following Cobb- Douglas form: Y(t) = f(K(t), L(t)) = (Ak(t)K(t))"(Al(t)L(t)), (1) where a > 0 and > 0 are parameters and where Ak(t) > 0 and Al(t) > 0 are, respectively, capital and labour-augmenting technological factors governing the efficiency of these inputs. Households and producers exchange labour and capital in the markets for inputs; the wage rate is w(t) and the rental rate of capital is R(t). Households and producers are price-takers, i.e., they treat the prices as given. The growth rate of the population is exogenous and constant and given by n > 0. The growth rate of the technology indexes Ak and A are denoted by gk > 0 and gl > 0, respec- tively (assumed to be exogenous and constant as well). The capital stock accumulates following K(t) = I(t) - 8K(t), = (2) where $(t) designates the time derivative of a given variable X(t), and 8 > 0 represents the depreciation rate of capital. The initial aggregate capital stock K0) > 0 is given. Finally, the household's savings rate is exogenous and given by s (0,1). The flow of aggregate savings at time t is denoted by S(t)

Thanks!

Thanks!