Answered step by step

Verified Expert Solution

Question

1 Approved Answer

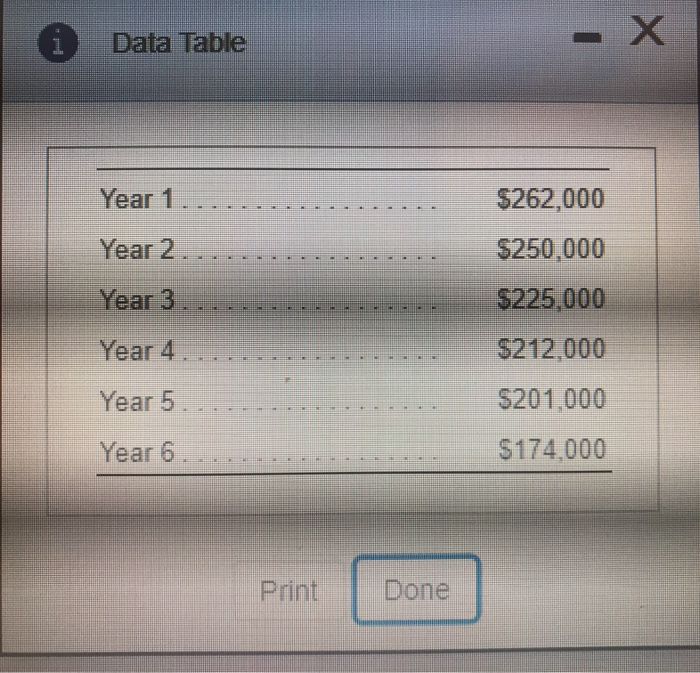

Please provide details along with formulas that can help me better understand the requirements of this question In the format requested i Data Table Year

Please provide details along with formulas that can help me better understand the requirements of this question In the format requested

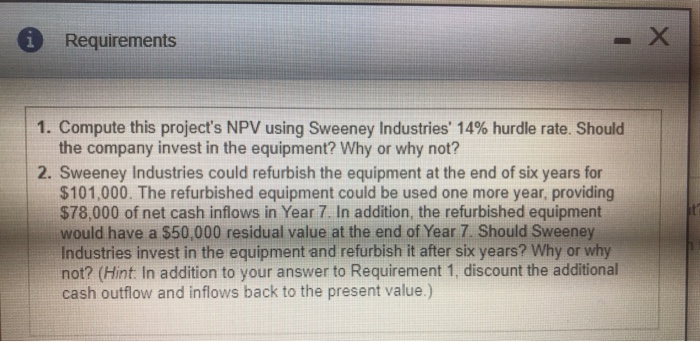

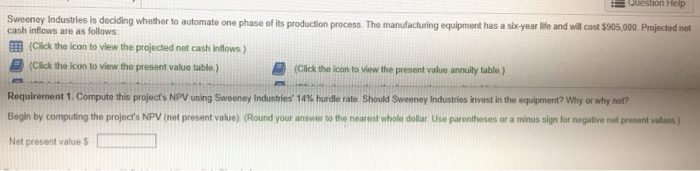

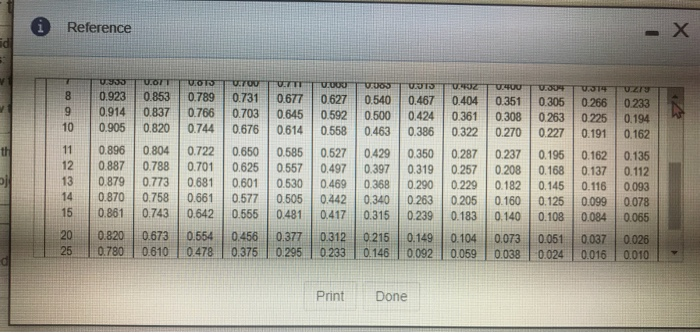

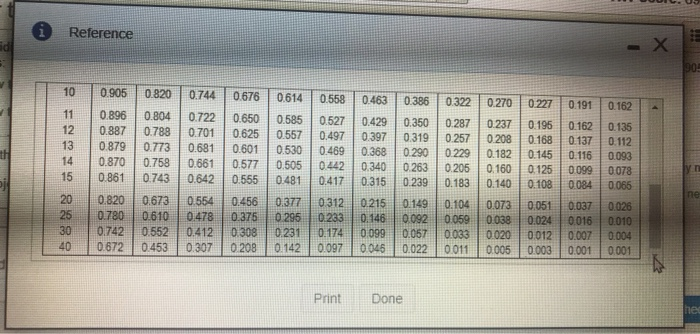

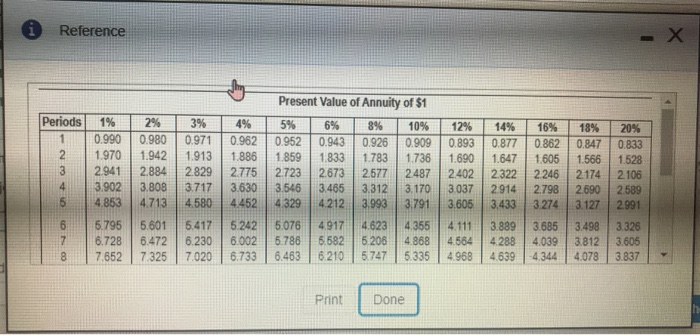

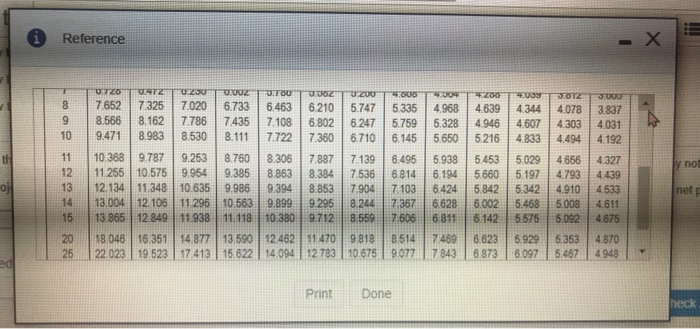

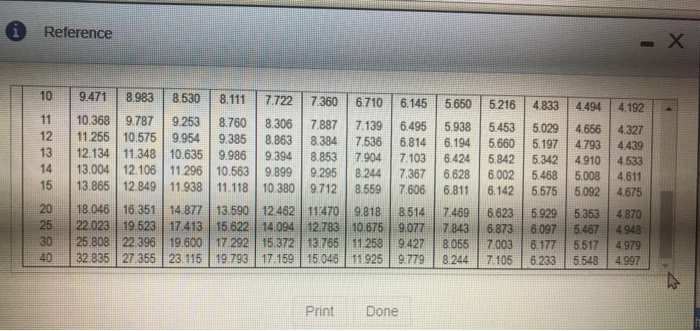

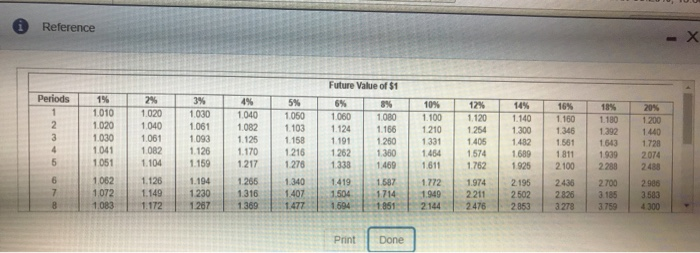

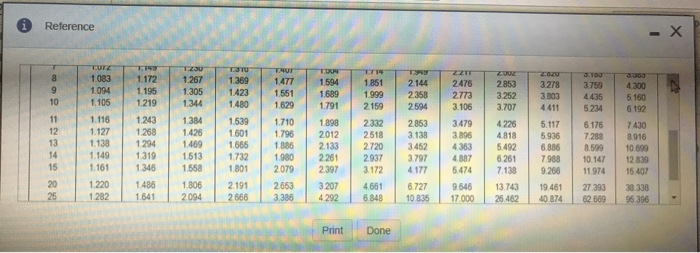

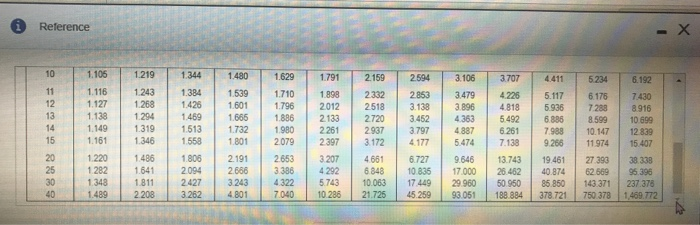

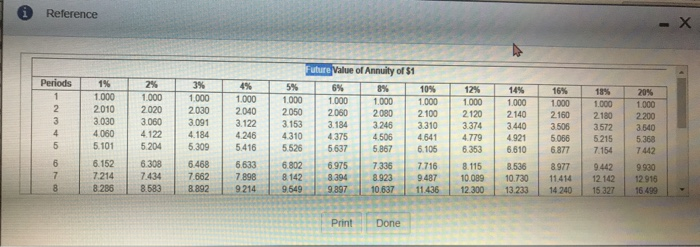

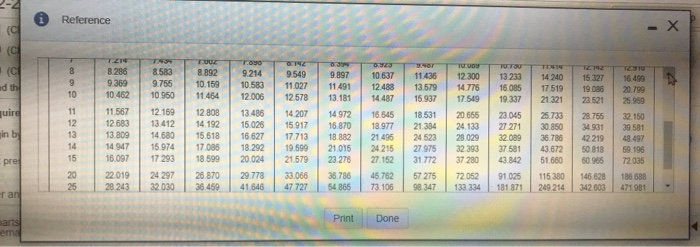

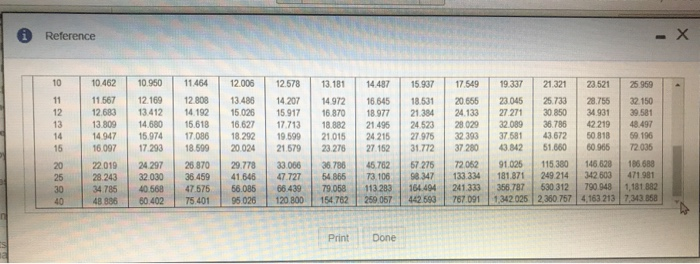

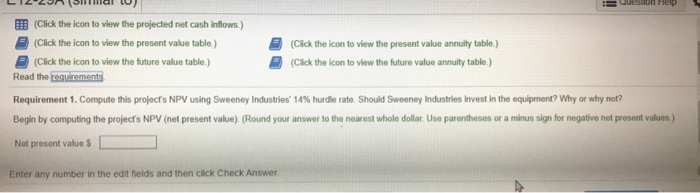

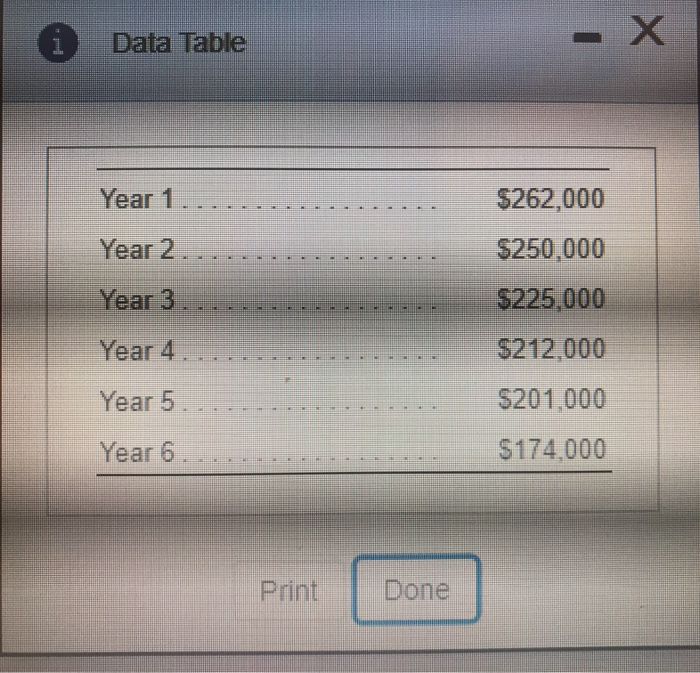

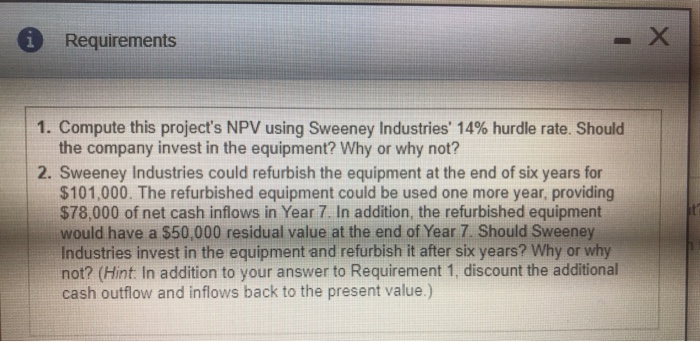

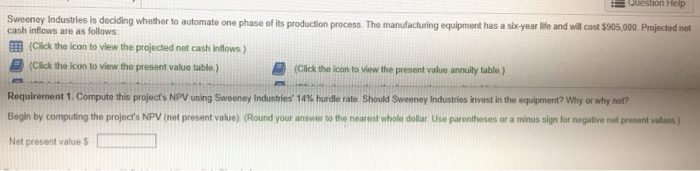

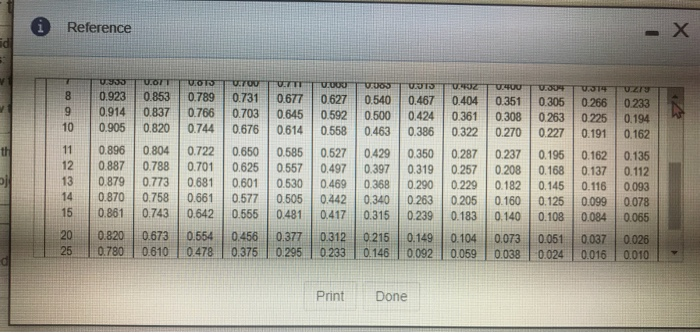

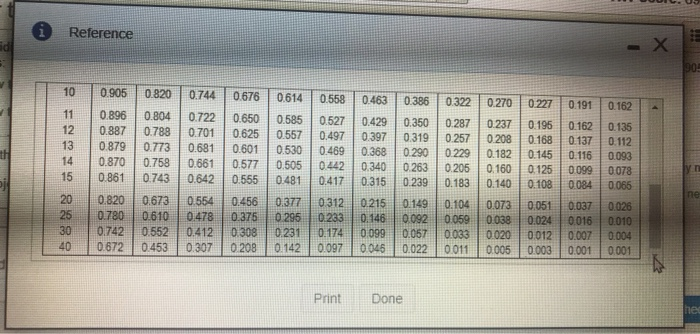

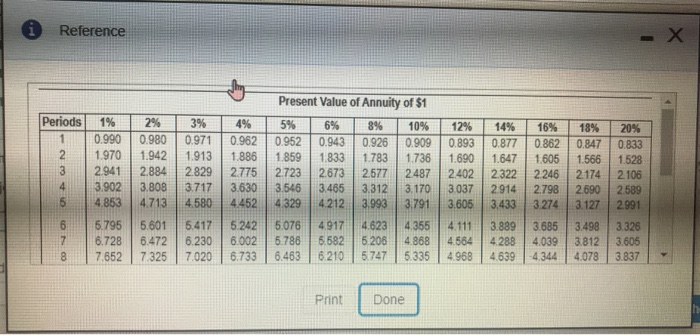

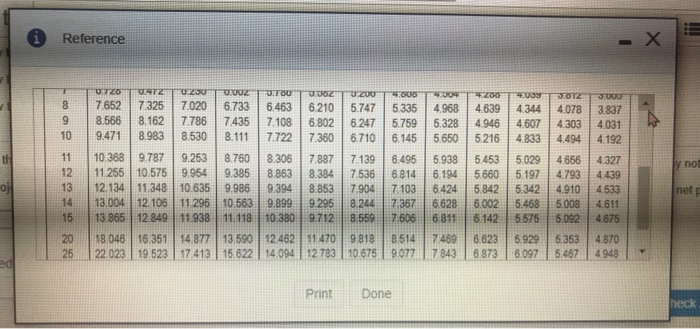

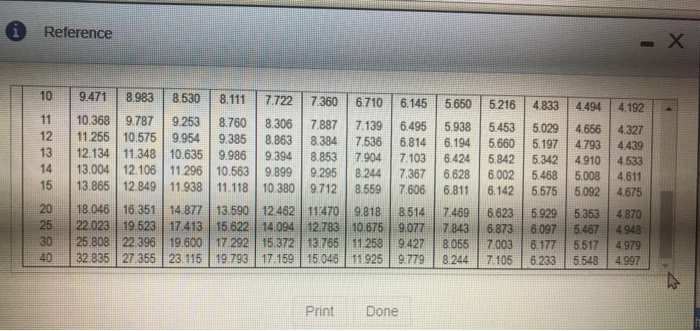

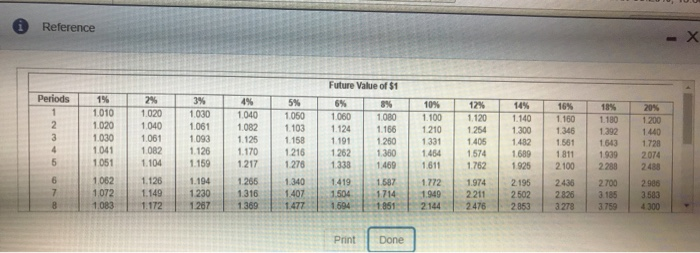

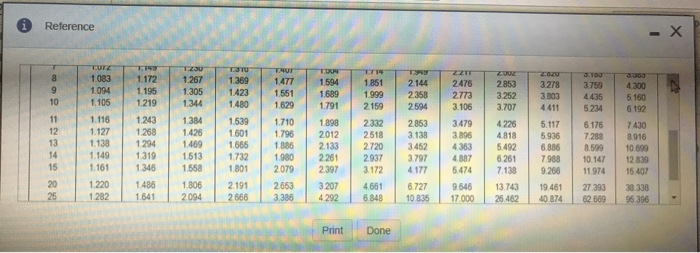

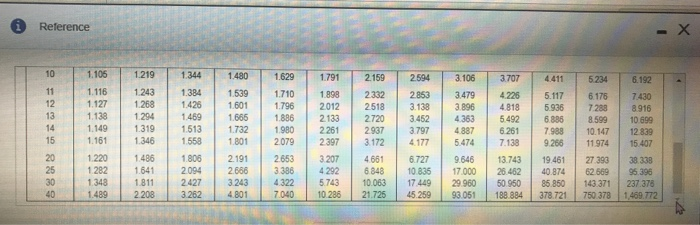

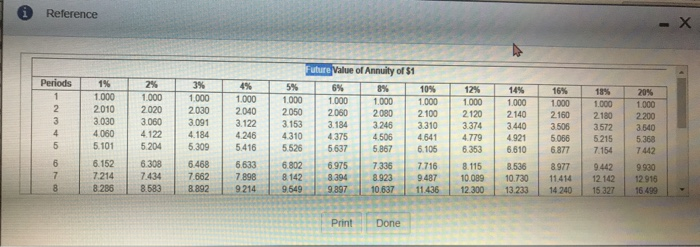

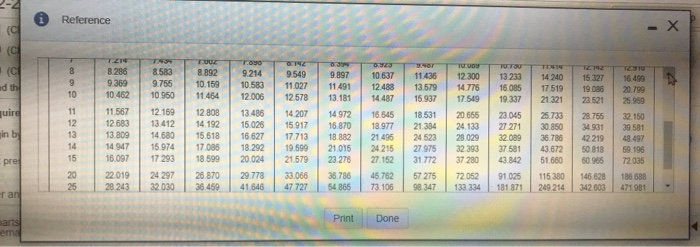

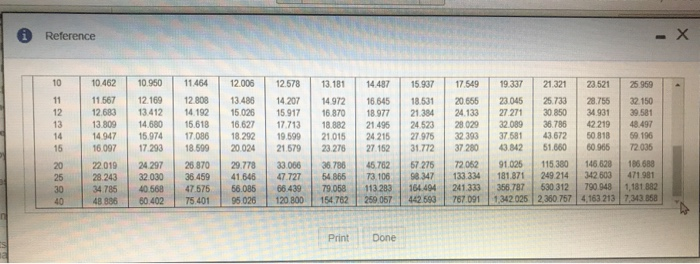

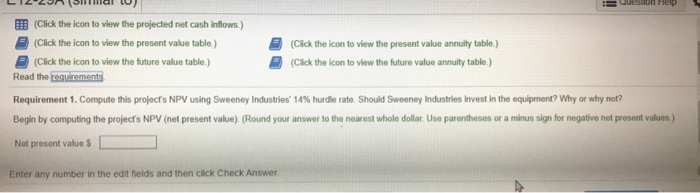

i Data Table Year 1. Year 2 Year 3 Year 4 Year 5 $262,000 $250,000 $225,000 $212,000 5201,000 Year 6 Print Done i Requirements 1. Compute this project's NPV using Sweeney Industries' 14% hurdle rate. Should the company invest in the equipment? Why or why not? 2. Sweeney Industries could refurbish the equipment at the end of six years for $101,000. The refurbished equipment could be used one more year, providing $78,000 of net cash inflows in Year 7. In addition, the refurbished equipment would have a $50,000 residual value at the end of Year 7. Should Sweeney Industries invest in the equipment and refurbish it after six years? Why or why not? (Hint: In addition to your answer to Requirement 1, discount the additional cash outflow and inflows back to the present value.) Sweeney Industries is deciding whether to automate one phase of its production process. The manufacturing equipment has a six-year life and will cost $905,000. Projected net cash inflows are as follows: EFR (Click the icon to view the projected net cash inflows) (Click the icon to view the present value table.) (Click the icon to view the present value annuity table.) Requirement 1. Compute this project's NPV using Sweeney Industries' 14% hurdle rate Should Sweeney Industries invest in the equipment? Why or why not? Begin by computing the project's NPV (not present value) (Round your answer to the nearest whole dollar Use parentheses or a minus sign for negative net present values) Net present values Reference ecid Vs Periods 1% 0.990 0.980 0.971 0.961 0.951 0.942 0.933 0.923 2% 0.980 0.961 0.942 0.924 0.906 0.888 0.871 0.853 3% 0.971 0.943 0.915 0.888 0.863 0.837 0.813 0.789 Present Value of $1 4% 5% 6% 8% 10% 0.962 0.952 0.943 0.926 0.909 0.925 0.907 0.890 0.857 0.826 0.889 0.864 0.840 0.794 0.751 0.855 0.823 0.792 0.735 0.683 0.822 0.784 0.747 0.681 0.621 0.790 0.746 0.705 0.630 0.564 0.7600.711 0.665 0.583 0.513 0.731 0.677 0.627 0.540 0.467 12% 14% 16% 0.893 0.877 0.862 0.797 | 0.769 0.743 0.712 0.675 0.641 0.636 0.592 0.552 0.567 0.5190.476 0.507 0.456 0.410 0.4520.400 0.354 0.4040.351 0.305 18% 20% 0.847 0.833 0.7180.694 0.609 0.579 0.516 0.482 0.437 0.402 0.370 0.335 0.314 0.279 0.266 0.233 Print Done i Reference UZ 0.233 0.194 0.162 12 1.35 TUOTT VOTT UTOU TUTTU.000 VOTUS TURZ.400 T 0.30 UT 0.923 0.853 0.789 0.731 0.677 0.627 0.540 0.467 0.404 | 0.3510.305 0266 0.914 0.837 0.766 0.703 0.645 0.592 0.500 0.424 0.361 0.308 0.263 0225 0.905 0.820 0.744 0.676 0.614 0.558 10.463 0.386 0.322 0.270 0.227 0.191 0.896 0.8040.722 0.650 0.585 0.527 0.429 0.350 0.287 0.237 0.195 0.162 0.887 0.788 0.701 0.625 0.557 0.497 0.397 0.319 0.257 0.208 0.168 0.137 0.879 0.773 0.681 0.601 0.530 0.469 0.368 0.290 0.229 0.182 0.145 0.116 0.870 0.7580.661 0.577 0.505 0.442 0.340 0.263 0.205 0.160 0.125 0.099 0.861 0.743 0.642 0.555 0.481 0.417 0.315 0.2390.183 | 0.140 0.108 0.084 0.820 0.673 0.554 0.456 0.377 0.3120.215 0.149 0.104 0.073 0.051 0.037 0.780 0610 0.478 | 0.375 0.2950 233 0.146 00920 059 0.038 0.0240016 0.136 0.112 0.093 0.078 0.065 0.026 0.010 Print Done Reference 0.905 0.896 0.887 0.879 0.870 0.861 0.820 0.780 0.742 0.672 0.820 0.744 0.804 | 0.722 0.788 0.701 0.773 0.681 0.758 0.661 | 0.743 | 0.642 0.673 0.554 0.610 0.478 0.552 0.412 0.453 0.307 0.676 0.614 0.558 0.650 0.585 0.527 0.625 0.557 0.497 0.601 0.530 0.469 0.577 0.505 0.442 0.555 0.481 0.417 0.456 0.377 0.312 0.375 10 2960 233 0.308 0.231 0.174 0.208 0.142 0.097 0.463 0.386 0.429 0.350 0.397 0.319 0.368 0.290 0.3400 263 0.315 0.239 0.322 0.270 0 227 0.191 0.162 0.287 0.237 0.19 0.162 0.135 0.257 0.208 0.168 0.137 0.112 0.229 0.182 0.145 0.116 0.093 0.206 0.160 0.125 0099 0.078 0.183 0.140 0.108 0.084 0.066 0.104 0.073 0.051 0.037 0.026 0.059 0.038 | 0.0240016 0.010 0.033 0.0200012 0.007 0.004 0.0110.005 0.003 0.001 0.001 0.215 0.146 0 099 0045 0.149 0.092 0.067 0.022 Print Done 0 Reference Periods 1% 2% 3% 0.990 0.980 0.971 1.970 | 1.942 1.913 2941 2.884 2829 3.902 3808 3.717 4.853 4.713 4.580 6.795 5.601 6.728 6.4726.230 7.652 7.325 7020 Present Value of Annuity of $1 4% 5% 6% 10% 12% 14% 16% 0.9620.952 0.943 0.926 0.909 0.893 0.877 0.862 1.886 1.859 1.833 1.783 1736 1.690 1.647 1.605 2.775 2.723 2.673 2.577 2487 2402 2.322 2246 3.630 3.546 3.466 3.312 3.170 3.037 2914 2.798 4452 4329 4212 | 3.993 3.791 3.605 3.433 3 274 5.0764917 4.6234355 4 111 3.889 3.685 6.002 5.786 6.5825.206 4.86845644288 4.039 6.733 6.463 6.210 5747 5.33549684.6394344 18% 0.847 1.566 2174 2.690 3.127 20% 0.833 1.528 2106 2 589 2.991 3.326 3.605 3.837 D00 3.812 4.078 Print Done Reference UTZO TUTZ UZ TUZTUTUTODOZTUZOUT 9.000 UT200 T OT 3000 7652 7.325 7.020 6.733 6.463 6210 5.747 5335 4.9684.6394.344 4.078 3.837 8.566 8.162 7.786 7.435 7.108 6.8026.247 5.759 5,3284 946 4.507 4.303 4.031 9.471 8.983 8.530 8.111 7.7227.360 6.710 6.145 5.650 5.216 4.833 | 4.494 4.192 10 368 97879.2538.760 8.306 7.887 7.139 6.495 6.938 5.453 5.029 4656 4.327 11 255 10.575 9.954 9.385 8.863 8.384 7.536 6.814 6.194 5660 5.197 4.793 4.439 12.134 11.348 10.635 9.986 9.3948.853 7.904 7 103 6424 5.842 6.342 4.910 4533 13.004 12.106 11 296 10.5639.899 9.295 8.244 7367 6.628 6.002 5.468 5.008 4.611 13.865 12 849 11.938 11. 11810.380 9.712 8.559 7 606 6.142 6.675 6.092 4675 16.351 14.877 13.590 12.462114709818 851474696.623 6.929 4870 22.023 19.523 17.413 15.622 14094 12 783 | 10675 907778436.873 6.097 6.4674948 net 28 GB 18.046 Print Done i Reference 4.494 4.192 4.327 4439 6.814 9.471 10.368 11.255 12.134 13.004 13.865 18.046 8.9838.530 8.111 7.722 7.360 9.787 9.253 8.760 8.3067.887 10.575 9.954 9.3858.863 8.384 11.348 10.635 9.9869.394 8.853 12.106 11.296 10.563 9.899 9.295 12.849 11.938 11.11810.380 9.712 16.351 14.877 13.590 12.462 11:470 19.523 17.413 15.622 14.094 12.783 22.396 19.600 17.292 15.372 13.765 27.356 23.115 | 19.793 17.159 15.046 5.216 5.453 5.660 5.842 6.002 4.533 6.710 6.145 | 5650 7.139 6.495 5.938 7.536 6.194 7.904 7.103 6.424 7.367 6.628 8.559 7.606 6.811 9.818 8.514 7.469 10.675 9.077 7.843 11 2589.427 8.055 11.925 9.7798.244 8.244 6.142 4.833 5.029 5.197 5.342 6.468 5.575 6.929 6.097 6.177 6.233 4.656 4.793 4.910 5.008 5.092 5.353 5.467 5.517 5.548 6.623 6.873 4.611 4.675 4870 4.948 4.979 4.997 7003 32.835 7.105 Print Done Reference Future Value of $1 Periods 35 18% 1.010 1030 1080 12% 1 120 1 254 20% 1200 1440 1 180 1.392 1020 1.020 1040 1.061 1,082 1.104 1.061 1.093 1.126 1159 1.040 1082 1 125 1.170 1.217 1.030 1.041 1051 1.062 1072 5% 1.050 1.103 1.158 1.216 1.278 1.340 1.407 1.477 1.124 1 191 1 262 1338 1643 1.080 1.166 1.260 1.360 1.469 10% 1.100 1.140 1.160 1210 1.300 1346 1331 1405 1482 1551 1.454 1574 1 811 1.762 1925 2.100 1.772 1.974 2.195 2436 1.949 2211 2502 2826 2.144247628533278 1689 1811 1.728 2074 2488 2.986 3583 4300 1.126 1.149 1.172 1.194 1230 1 287 1.265 1.316 1.369 1.419 1.504 1594 2288 2700 3185 3.759 1.587 1714 1851 10R3 Print Done 0 Reference 2144 2353 2594 2475 2773 3106 2150 2332 3479 1083 1 172 1267 1369 1094 1195 1305 1423 1551 1.105 1219 1344 1 480 1629 11 1.116 1.243 1.384 1.539 1710 1.898 12 1.127 1 268 1.426 1601 1.796 2012 13 113812941.469 1665 1886 14 11491319 15131732 19802261 15116113461.558 180120792397 20122014861806 2.19126533207 25 128216412094 2666 4 292 2053 1139 3652 3797 4177 2518 2720 2937 3.172 2853 3778 4300 3252 300 4435 5 160 3.707 4411 5734 6192 4226 5.117 6.176 7430 4318 5936 7290 1916 5.492 10.699 5251 10.10 2009 7.138 11.974 15407 13.743 19.461 27393 33 338 25.462408746260096396 8590 5674 4661 6 848 6727 10 835 9.546 17000 Print Done || | | | Reference 10 | | 307 14 1219 1243 1263 1294 1319 146 | 2694 253 3138 3.106 3479 3296 5.117 552 213 | 1105 | 1116 | 1.127 1138 1.149 | 1.161 1220 1282 1343 1.29 32, 1344 | 1480 1.38. | 15.39 1425 1601 1666 1513 1732 1.553 1 B01 16 2191 2009 2 655 22 3243 3262 | 2011 1.629 | 1791 | 2159 2332 1.796 2017 2518 1.886 2720 1980 2937 2079 3172 2653 | 3207 4661 3386 4292 1. 322 57 | 10.063 7040 | 10 28 | 21.725 7 1524 B. 192 6 175 ( 430 7223 1.96 8.5 10 ass 12 839 1974 15.407 393 3 358 1 2 865 35 142371 23737 T5 33 1452 3797 a. 7 6727 12 15.259 1.426 1.54] 13] 1220 2646 1 , 0 29 960 33.051 9265 9 461 40.874 13.743 26. 462 | 12,391 i Reference Periods 1.000 1000 1000 000 2010 3.030 4060 5.101 Future Value of Annuity of $1 5% 10% 12% 14% 1595 1.000 1000 1000 1.000 1.000 2040 2050 2060 2080 2100 2120 2140 2160 3.18432463.310 3.374 3.440 3.506 4246 4.310 4375 4506 4541 47794921 5.066 5.526 563750575.105 63536610 6877 6.633 68026975733677168.115 8.536 8977 7.898 8 142839439239.487 10.080 10.730 11.414 92149 5499 897 10.63711 436 12.300 13.23314 240 1.000 2020 2030 3.060 3.091 4122 4.184 5204 5.309 6.308 6.468 7.434 7.662 8538992 3.122 2189 3572 5215 7.154 1000 2200 2840 5368 12 5416 12916 6.152 7214 8.286 12.142 15 327 Print Done 1 Reference ST 1063711436 1243 13579 14 R 15 937 dth TTTTTTTT 182868.5838.892921495499.897 9360 9.755 10.159 10.583 11.027 11 491 10.462 10.950 11.454 12.006 12578 13.181 11.567 12.169 1 2808 13.486 14 207 14.972 12 683 13.412 14 192 15 025 15 917 15,870 13 809 14.680 15,618 16.627 17.713 18 22 14 07 15 974170381329219 599 21015 15097 17 293185992002421579 23 278 22.019 24 297 26870 29.778 33.066 35.786 28 243 32 030 3 8 459 41 646 | 47 727 | 54866 12 300 14775 17.549 20 655 24.133 28.029 quire 16 645 18.977 21.495 13223 14 240 1505 17 519 19.337 21321 23 521 23.045 25.733 28756 27 271 30.850 M901 32089 36 788 219 37581 13 672 50319 51 550 91 025 115200 146 628 181871249214342 603 In 39 581 48 492 59194 18.531 21 384 24523 27975 31.772 57 275 98 347 20215 27 192 pre 45 752 73. 106 37 280 72052 133 334 471 981 Print Done Reference BE6%88% 0462080 | | 12006 567 10 | | 2 134 12 | 14 192 16 006 1. 10 6513 14 9476 974 | | 17 006 6 07 1711 0 2014 | 527 1977 2 243 | 03 13645941,646 6 7575 | tar | 257 14 3G | 3521 11 20 2045 | 55 | 10 89 ,384 24 13 7 271 - 8 17/10 16 | 46218 200 29 97 10,000 - 21015 24 210 1 976 | 30, 400 BO 16 2009 12 27 123172 37 20 M251.00 0966 | 2006 ACM |8 15 TU2 75 26 19 026 115 300 16 678 1060 688 ATTA ASA 106 | 4 201249 21 M2 EP01 43998 | 11328 | 3DMay | 2413 6 PF50 32790 918 1.181 10 800 15 67 | 889 | TEP 91 134225 260 67 2.163 25 733 Print Done L 12-20R ( S al 1) Wuusaon Help 3 (Click the icon to view the projected net cash inflows.) (Click the icon to view the present value table.) (Click the icon to view the future value table.) Read the requirements (Click the icon to view the present value annuity table) (Click the icon to view the future value annuity table.) Requirement 1. Compute this project's NPV using Sweeney Industries' 14% hurdle rate. Should Sweeney Industries invest in the equipment? Why or why not? Begin by computing the project's NPV (net present value). (Round your answer to the nearest whole dollar Use parentheses or a minus sign for negative net present values) Not prosent value $ Enter any number in the edit fields and then click Check

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started