Answered step by step

Verified Expert Solution

Question

1 Approved Answer

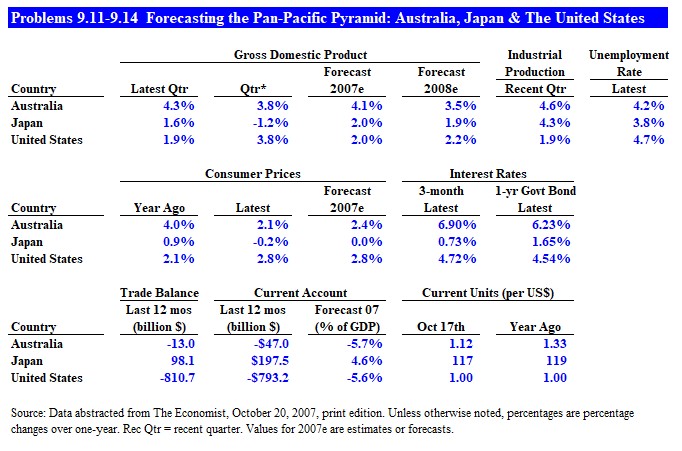

Please provide equation and final answer, and show work. Problems 9.11-9.14 Forecasting the Pan-Pacific Pyramid: Australia, Japan & The United States loymentatetest4.2%3.8%4.7% Source: Data abstracted

Please provide equation and final answer, and show work.

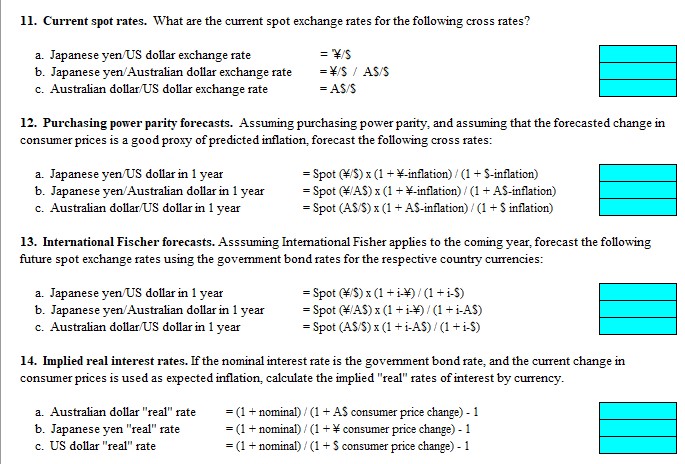

Problems 9.11-9.14 Forecasting the Pan-Pacific Pyramid: Australia, Japan \& The United States loymentatetest4.2%3.8%4.7% Source: Data abstracted from The Economist, October 20,2007, print edition. Unless otherwise noted, percentages are percentage changes over one-year. RecQtr= recent quarter. Values for 2007e are estimates or forecasts. 11. Current spot rates. What are the current spot exchange rates for the following cross rates? a. Japanese yen/US dollar exchange rate b. Japanese yen/Australian dollar exchange rate c. Australian dollar/US dollar exchange rate =7=/S==/S/AS/S=AS/S 12. Purchasing power parity forecasts. Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following cross rates: a. Japanese yen US dollar in 1 year b. Japanese yen/Australian dollar in 1 year c. Australian dollar/US dollar in 1 year =Spot(#/S)(1+=-inflation)/(1+S-inflation)=Spot(F/AS)(1+=-inflation)/(1+AS-inflation)=Spot(AS/S)(1+AS-inflation)/(1+Sinflation) 13. International Fischer forecasts. Asssuming International Fisher applies to the coming year, forecast the following future spot exchange rates using the government bond rates for the respective country currencies: a. Japanese yen/US dollar in 1 year b. Japanese yen/Australian dollar in 1 year c. Australian dollar/US dollar in 1 year =Spot(=/S)(1+i=)/(1+iS)=Spot(#/AS)(1+i=)/(1+iAS)=Spot(AS/S)(1+iAS)/(1+iS) 14. Implied real interest rates. If the nominal interest rate is the government bond rate, and the current change in consumer prices is used as expected inflation, calculate the implied "real" rates of interest by currency. a. Australian dollar "real" rate b. Japanese yen "real" rate c. US dollar "real" rate =(1+nominal)/(1+ASconsumerpricechange)1=(1+nominal)/(1+consumerpricechange)1=(1+nominal)/(1+Sconsumerpricechange)1

Problems 9.11-9.14 Forecasting the Pan-Pacific Pyramid: Australia, Japan \& The United States loymentatetest4.2%3.8%4.7% Source: Data abstracted from The Economist, October 20,2007, print edition. Unless otherwise noted, percentages are percentage changes over one-year. RecQtr= recent quarter. Values for 2007e are estimates or forecasts. 11. Current spot rates. What are the current spot exchange rates for the following cross rates? a. Japanese yen/US dollar exchange rate b. Japanese yen/Australian dollar exchange rate c. Australian dollar/US dollar exchange rate =7=/S==/S/AS/S=AS/S 12. Purchasing power parity forecasts. Assuming purchasing power parity, and assuming that the forecasted change in consumer prices is a good proxy of predicted inflation, forecast the following cross rates: a. Japanese yen US dollar in 1 year b. Japanese yen/Australian dollar in 1 year c. Australian dollar/US dollar in 1 year =Spot(#/S)(1+=-inflation)/(1+S-inflation)=Spot(F/AS)(1+=-inflation)/(1+AS-inflation)=Spot(AS/S)(1+AS-inflation)/(1+Sinflation) 13. International Fischer forecasts. Asssuming International Fisher applies to the coming year, forecast the following future spot exchange rates using the government bond rates for the respective country currencies: a. Japanese yen/US dollar in 1 year b. Japanese yen/Australian dollar in 1 year c. Australian dollar/US dollar in 1 year =Spot(=/S)(1+i=)/(1+iS)=Spot(#/AS)(1+i=)/(1+iAS)=Spot(AS/S)(1+iAS)/(1+iS) 14. Implied real interest rates. If the nominal interest rate is the government bond rate, and the current change in consumer prices is used as expected inflation, calculate the implied "real" rates of interest by currency. a. Australian dollar "real" rate b. Japanese yen "real" rate c. US dollar "real" rate =(1+nominal)/(1+ASconsumerpricechange)1=(1+nominal)/(1+consumerpricechange)1=(1+nominal)/(1+Sconsumerpricechange)1 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started