Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide equation and steps explained so i can arrive to an answer if the numbers are changed a b economy: 2) State of the

please provide equation and steps explained so i can arrive to an answer if the numbers are changed  a

a  b

b

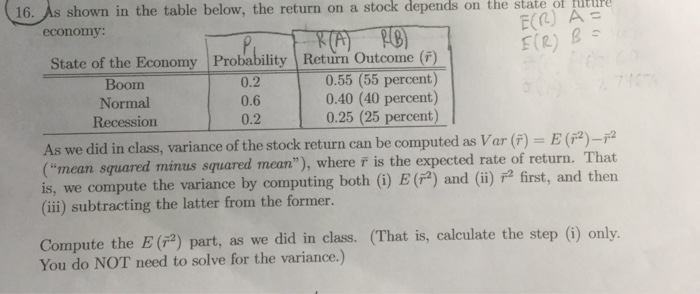

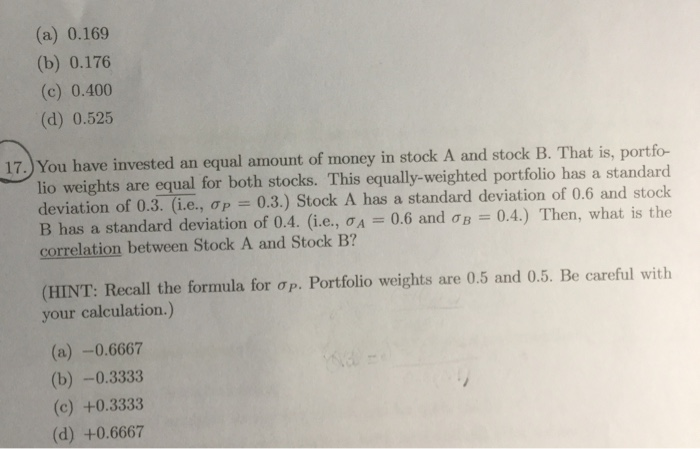

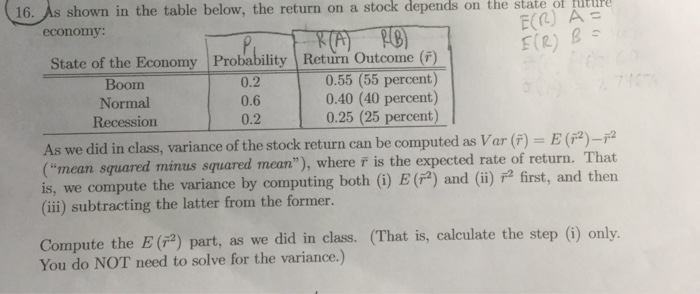

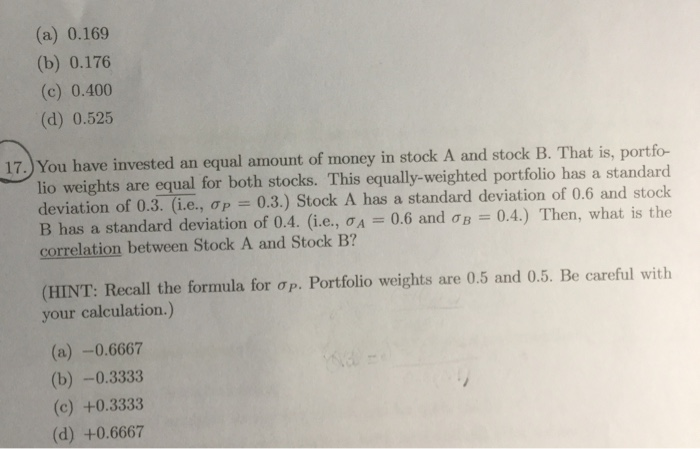

economy: 2) State of the Economy Probability Return Outcome (F) 0.2 0.6 0.2 0.55 (55 percent) 0.40 (40 percent) 0.25 (25 percent) Boom Normal Recession As we did in class, variance of the stock return can be computed as Var(F) E()-pa ("mean squared minus squared mean"), where is the expected rate of return. That is, we compute the variance by computing both (i) E (2) and ( (ii) subtracting the latter from the former. first, and then Compute the E (2) part, as we did in class. (That is, calculate the step () only. You do NOT need to solve for the variance.) (a) 0.169 (b) 0.176 (c) 0.400 (d) 0.525 17.) You have invested an equal amount of money in stock A and stock B. That is, portfo- lio weights are equal for both stocks. This equally-weighted portfolio has a standard deviation of 0.3 ie.' P-03 Stock A has a standard deviation of 0.6 and stock B has a standard deviation of 0.4. (i.e., 0A 0.6 and B-: 0.4.) Then, what is the correlation between Stock A and Stock B? (HINT: Recall the formula for . Portfolio weights are 0.5 and 0.5. Be careful with your calculation.) (a) -0.6667 (b) -0.3333 (c) +0.3333 (d) +0.6667  a

a b

bStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started