please provide excel file if possible or provide working process

please provide excel file if possible or provide working process

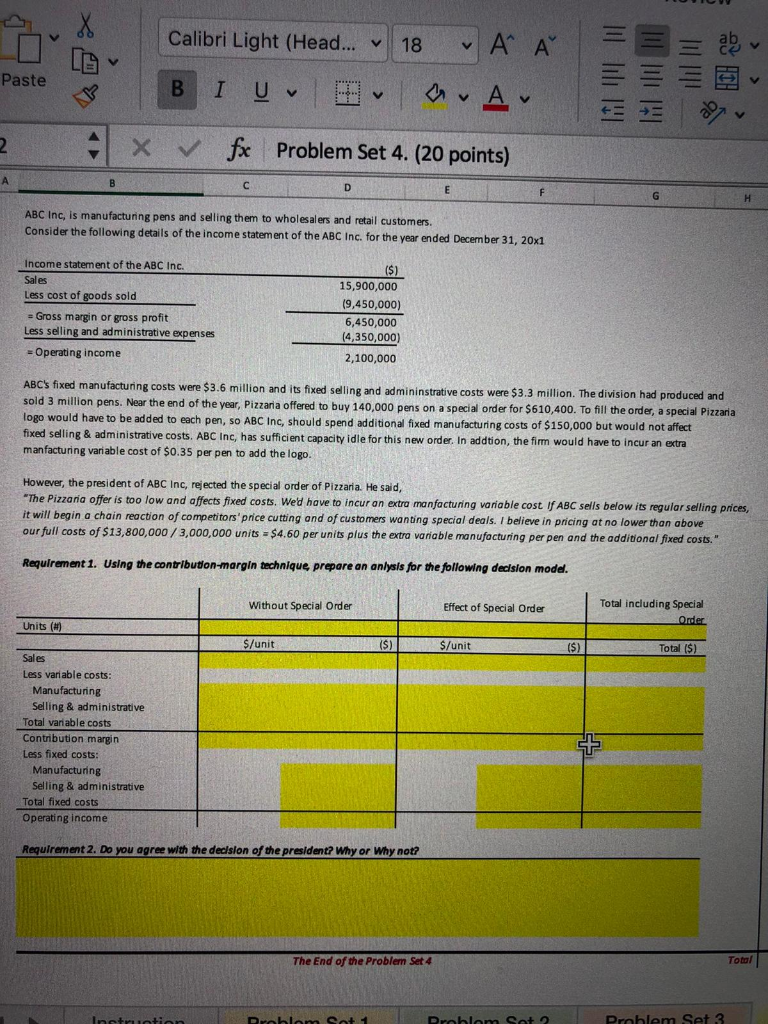

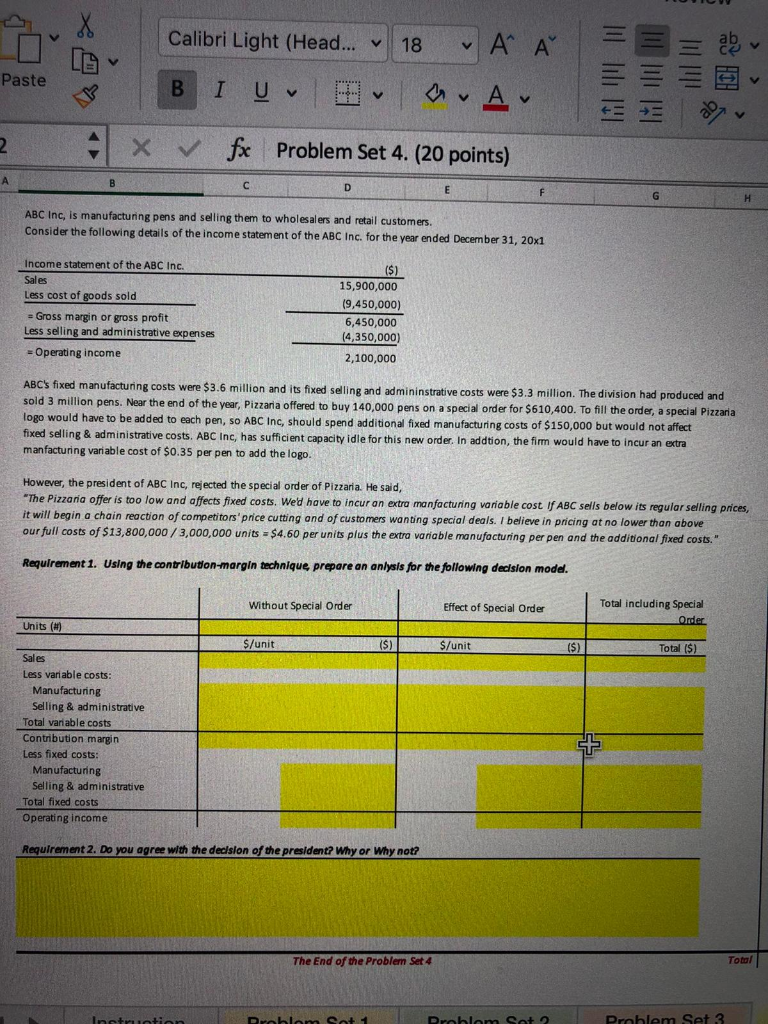

X Calibri Light (Head... 18 ' ' Paste In III B I U V A v 2 x fx Problem Set 4. (20 points) A B D E G H ABC Inc, is manufacturing pens and selling them to wholesalers and retail customers. Consider the following details of the income statement of the ABC Inc. for the year ended December 31, 20x1 Income statement of the ABC Inc. Sales Less cost of goods sold = Gross margin or gross profit Less selling and administrative expenses = Operating income ($) 15,900,000 (9,450,000) 6,450,000 (4,350,000) 2,100,000 ABC's fixed manufacturing costs were $3.6 million and its fixed selling and administrative costs were $3.3 million. The division had produced and sold 3 million pens. Near the end of the year, Pizzaria offered to buy 140,000 pens on a special order for $610,400. To fill the order, a special Pizzaria logo would have to be added to each pen, so ABC Inc, should spend additional fixed manufacturing costs of $150,000 but would not affect fixed selling & administrative costs. ABC Inc, has sufficient capacity idle for this new order. In addtion, the firm would have to incur an extra manfacturing variable cost of $0.35 per pen to add the logo. However, the president of ABC Inc, rejected the special order of Pizzaria. He said, "The Pizzaria offer is too low and affects fixed costs. Wed have to incur an extra manfacturing variable cost of ABC sells below its regular selling prices, it will begin a chain reaction of competitors' price cutting and of customers wanting special deals. I believe in pricing at no lower than above our full costs of $13,800,000 / 3,000,000 units = $4.60 per units plus the extra variable manufacturing per pen and the additional fixed costs." Requirement 1. Using the contribution-margin technique prepare an anlysis for the following decision model. Without Special Order Effect of Special Order Total including Special Order Units (1) $/unit (S) S/unit ($) Total ($) Sales Less variable costs: Manufacturing Selling & administrative Total variable costs CLOSES Contribution Less fixed costs: Manufacturing Selling & administrative Total fixed costs Operating income on margin Requirement 2. Do you agree with the decision of the president? Why or Why not? The End of the Problem Set 4 Total Instruction Debemot Problem Sot 2 Problem Set 3

please provide excel file if possible or provide working process

please provide excel file if possible or provide working process