Answered step by step

Verified Expert Solution

Question

1 Approved Answer

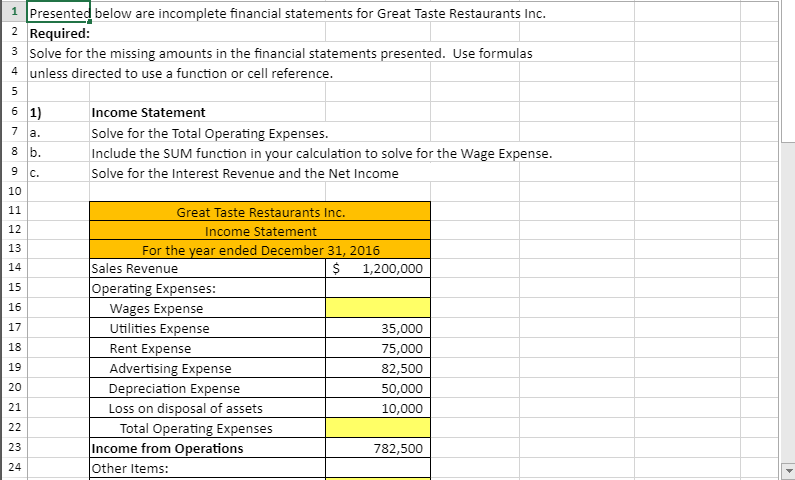

Please provide excel formulas 1 Presented below are incomplete financial statements for Great Taste Restaurants Inc. Required: Solve for the missing amounts in the financial

Please provide excel formulas

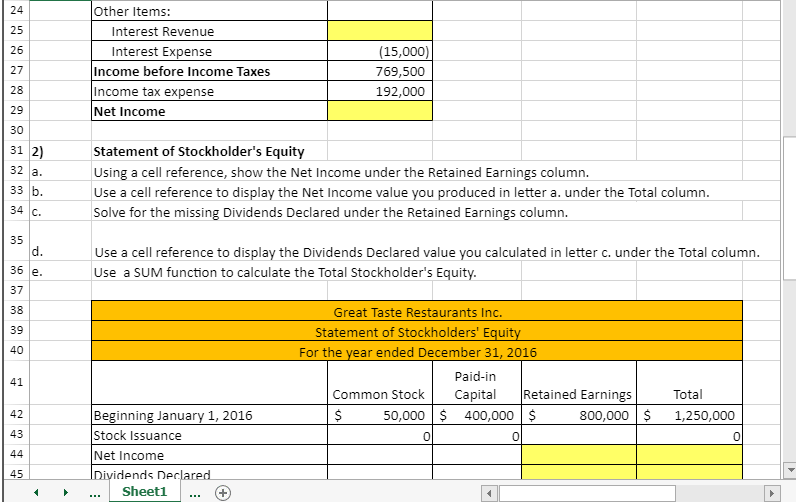

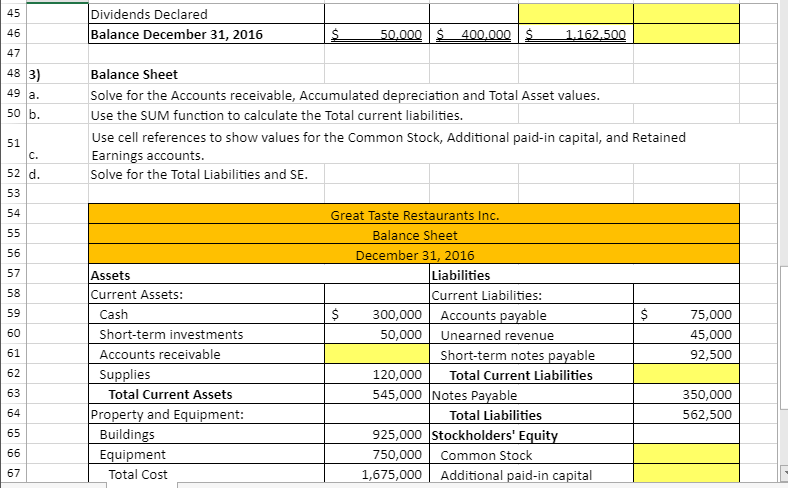

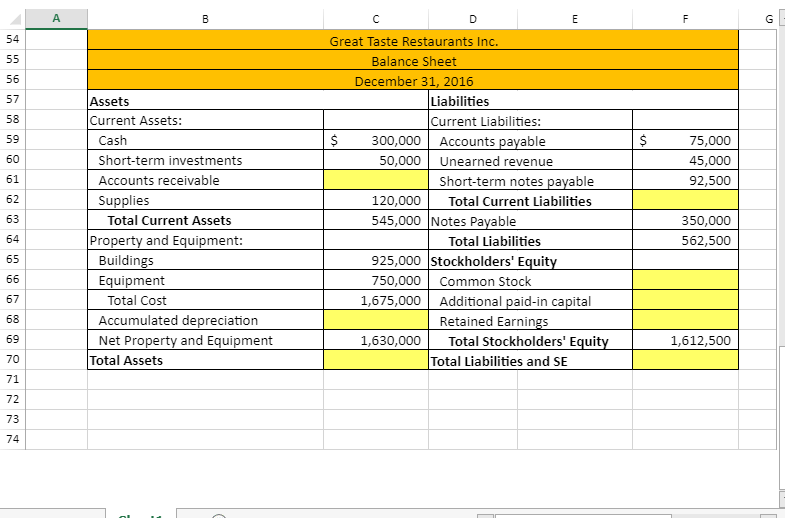

1 Presented below are incomplete financial statements for Great Taste Restaurants Inc. Required: Solve for the missing amounts in the financial statements presented. Use formulas 4 unless directed to use a function or cell reference. Income Statement Solve for the Total Operating Expenses. Include the SUM function in your calculation to solve for the Wage Expense. Solve for the Interest Revenue and the Net Income so Great Taste Restaurants Inc Income Statement For the year ended December 31, 2016 Sales Revenue $ 1,200,000 Operating Expenses: Wages Expense Utilities Expense 35,000 Rent Expense 75,000 Advertising Expense 82,500 Depreciation Expense 50,000 Loss on disposal of assets 10,000 Total Operating Expenses Income from Operations 782,500 Other Items: Other Items: Interest Revenue Interest Expense Income before Income Taxes Income tax expense Net Income (15,000) 769,500 192,000 Statement of Stockholder's Equity Using a cell reference, show the Net Income under the Retained Earnings column. Use a cell reference to display the Net Income value you produced in letter a. under the total column. Solve for the missing Dividends Declared under the Retained Earnings column. Use a cell reference to display the Dividends Declared value you calculated in letter c. under the total column. Use a SUM function to calculate the Total Stockholder's Equity. Great Taste Restaurants Inc. Statement of Stockholders' Equity For the year ended December 31, 2016 Paid-in Common Stock Capital Retained Earnings 50,000 $ 400,000 $ 800,000 $ Total 1,250,000 Beginning January 1, 2016 Stock Issuance Net Income Dividends Declared ... Sheet1 ... + Dividends Declared Balance December 31, 2016 50.000 $ 400.000 $ 1.162.500 Balance Sheet Solve for the Accounts receivable, Accumulated depreciation and Total Asset values. Use the SUM function to calculate the Total current liabilities. Use cell references to show values for the Common Stock, Additional paid-in capital, and Retained Earnings accounts. Solve for the Total Liabilities and SE. $ Great Taste Restaurants Inc. Balance Sheet December 31, 2016 Liabilities Current Liabilities: $ 300,000 Accounts payable 50,000 Unearned revenue Short-term notes payable 120,000 Total Current Liabilities 545,000 Notes Payable Total Liabilities 925,000 Stockholders' Equity 750,000 Common Stock 1,675,000 | Additional paid-in capital Assets Current Assets: Cash Short-term investments Accounts receivable Supplies Total Current Assets Property and Equipment: Buildings Equipment | Total Cost 75,000 45,000 92,500 350,000 562,500 $ 75,000 45,000 92,500 Assets Current Assets: Cash Short-term investments Accounts receivable Supplies Total Current Assets Property and Equipment: Buildings Equipment Total Cost Accumulated depreciation Net Property and Equipment Total Assets Great Taste Restaurants Inc. Balance Sheet December 31, 2016 Liabilities Current Liabilities: 300,000 Accounts payable 50,000 Unearned revenue Short-term notes payable 120,000 Total Current Liabilities 545,000 Notes Payable Total Liabilities 925,000 Stockholders' Equity 750,000 Common Stock 1,675,000 Additional paid-in capital Retained Earnings 1,630,000 Total Stockholders' Equity Total Liabilities and SE 350,000 562,500 1,612,500Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started