Answered step by step

Verified Expert Solution

Question

1 Approved Answer

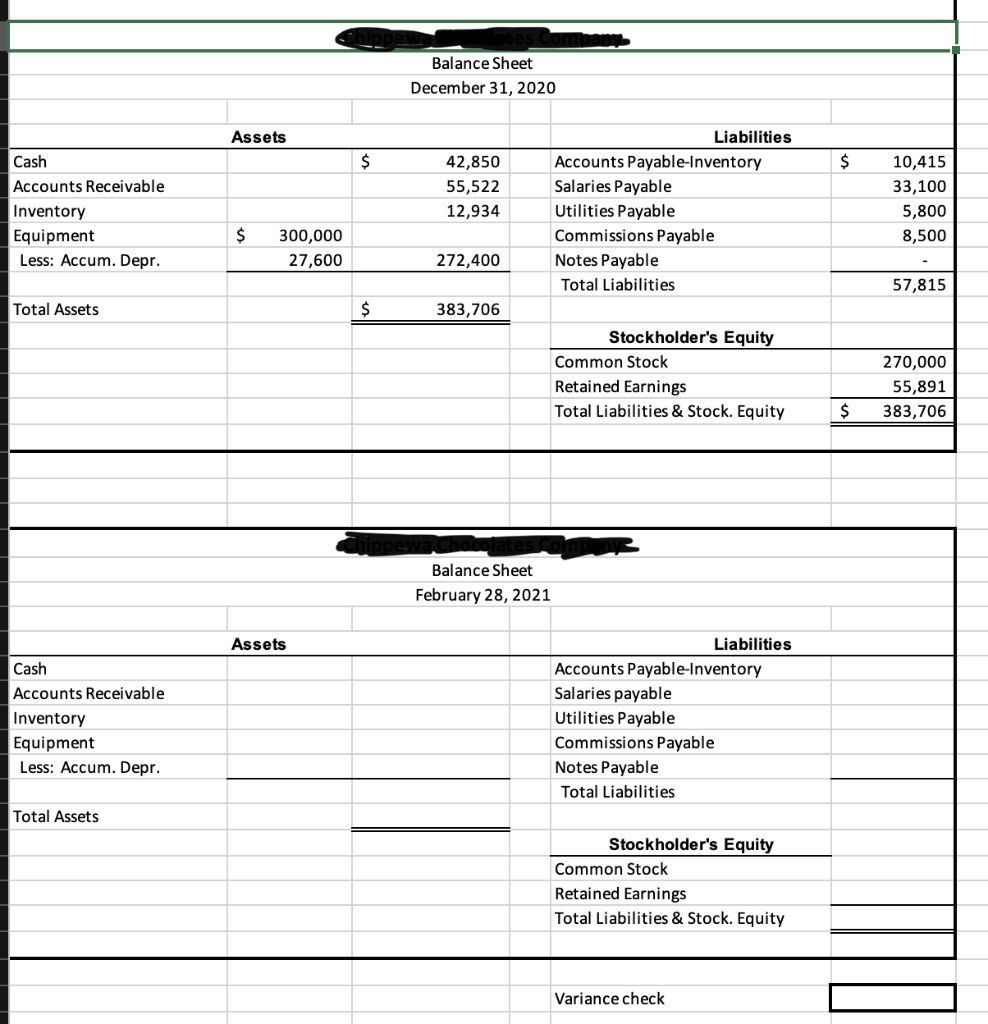

Please provide Excel Formulas, Thanks! Balance Sheet December 31, 2020 Assets $ $ Cash Accounts Receivable Inventory Equipment Less: Accum. Depr. 42,850 55,522 12,934 Liabilities

Please provide Excel Formulas, Thanks!

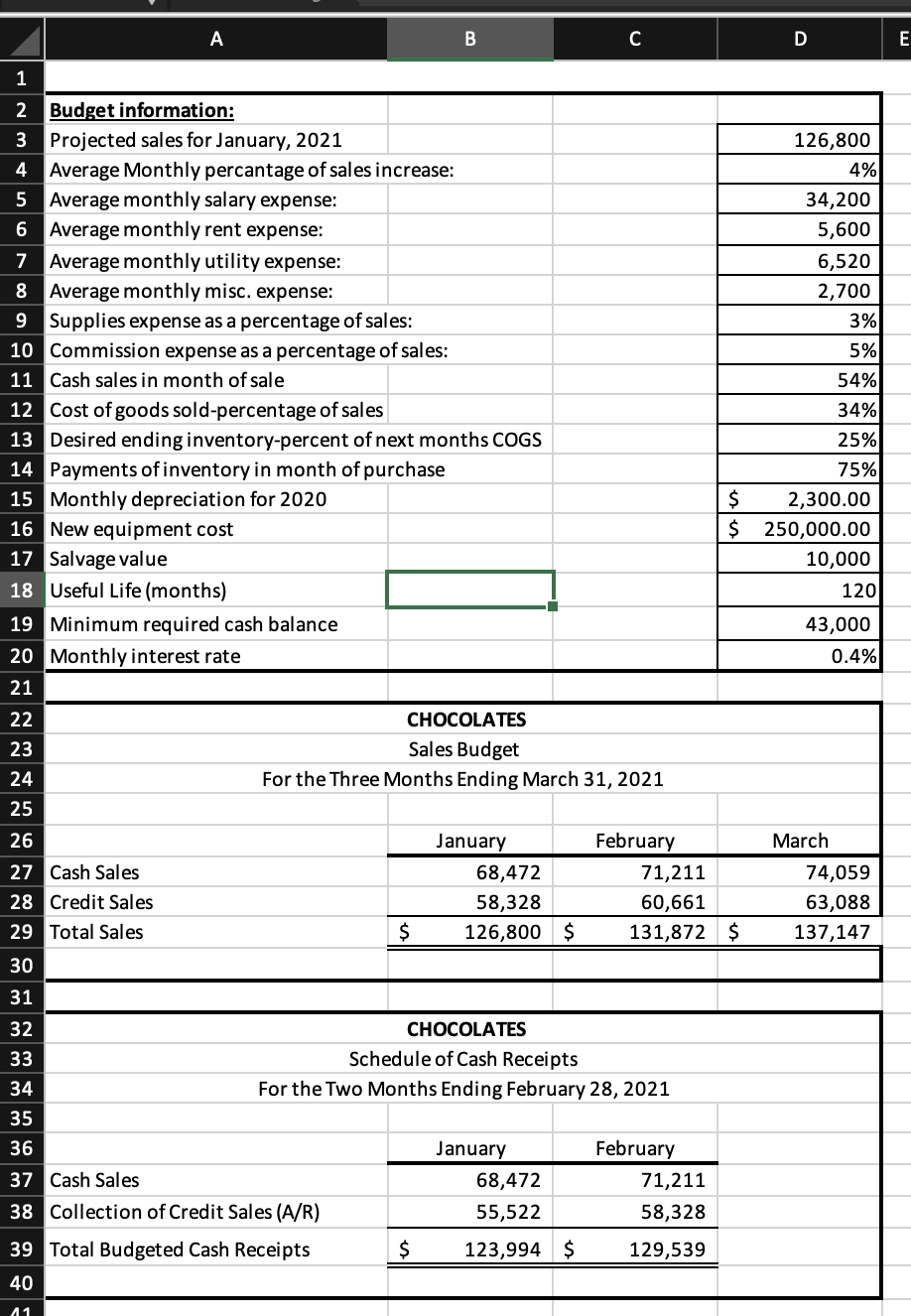

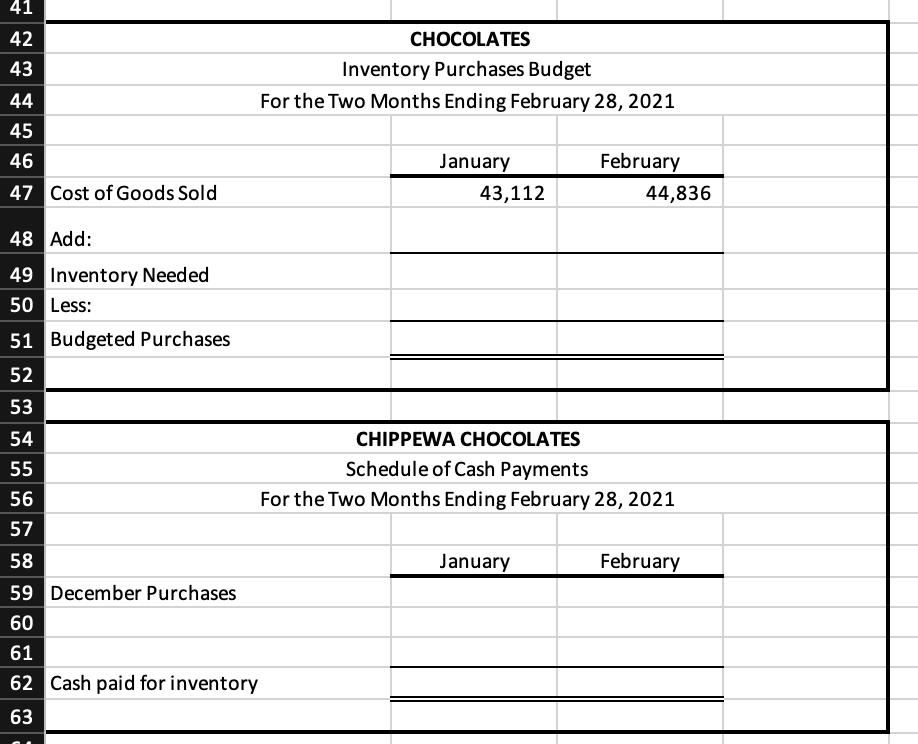

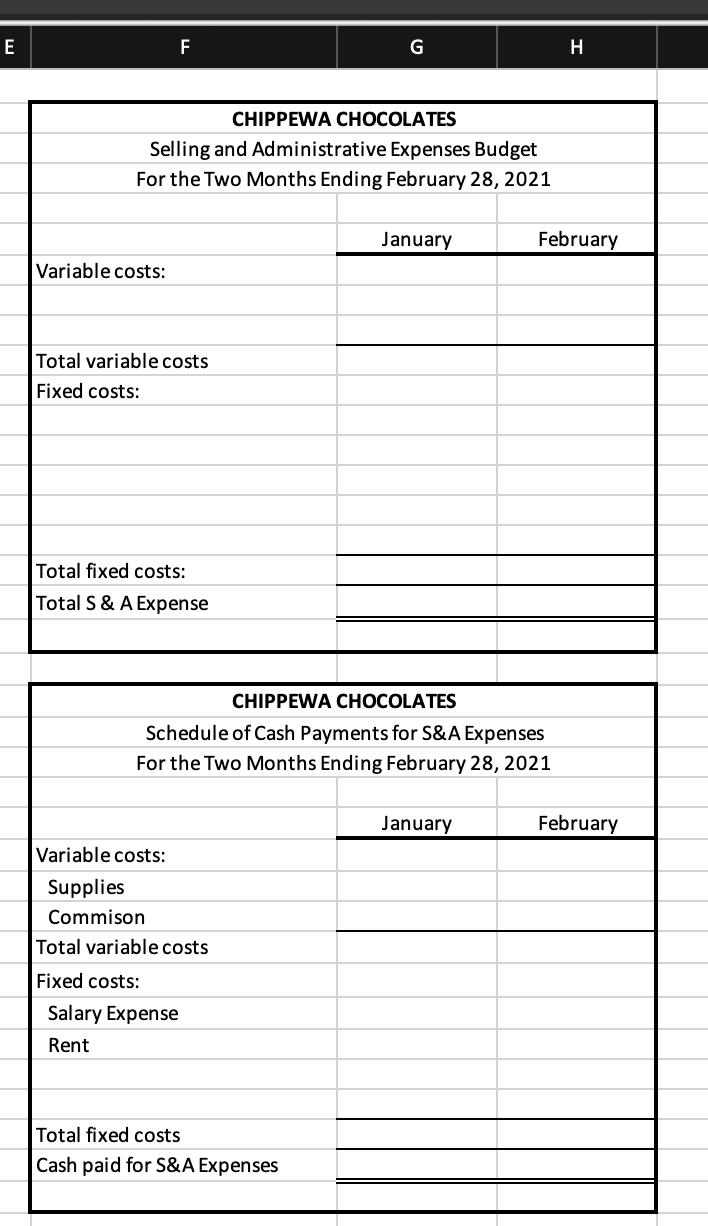

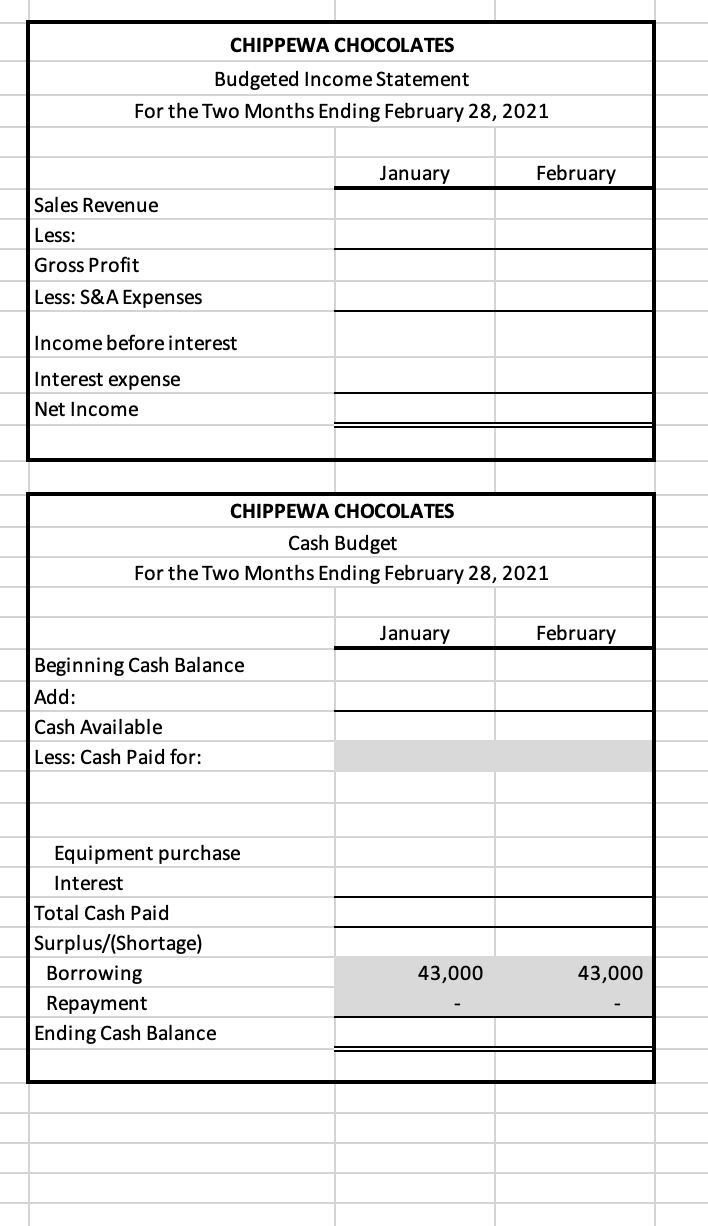

Balance Sheet December 31, 2020 Assets $ $ Cash Accounts Receivable Inventory Equipment Less: Accum. Depr. 42,850 55,522 12,934 Liabilities Accounts Payable-Inventory Salaries Payable Utilities Payable Commissions Payable Notes Payable Total Liabilities 10,415 33,100 5,800 8,500 $ 300,000 27,600 272,400 57,815 Total Assets $ 383,706 Stockholder's Equity Common Stock Retained Earnings Total Liabilities & Stock. Equity 270,000 55,891 383,706 $ Balance Sheet February 28, 2021 Assets Cash Accounts Receivable Inventory Equipment Less: Accum. Depr. Liabilities Accounts Payable Inventory Salaries payable Utilities Payable Commissions Payable Notes Payable Total Liabilities Total Assets Stockholder's Equity Common Stock Retained Earnings Total Liabilities & Stock. Equity Variance check A B C D E 5% 1 2 Budget information: 3 Projected sales for January, 2021 126,800 4 Average Monthly percantage of sales increase: 4% 5 Average monthly salary expense: 34,200 6 Average monthly rent expense: 5,600 7 Average monthly utility expense: 6,520 8 Average monthly misc. expense: 2,700 9 Supplies expense as a percentage of sales: 3% 10 Commission expense as a percentage of sales: 11 Cash sales in month of sale 54% 12 Cost of goods sold-percentage of sales 34% 13 Desired ending inventory-percent of next months COGS 25% 14 Payments of inventory in month of purchase 75% 15 Monthly depreciation for 2020 $ 2,300.00 16 New equipment cost $ 250,000.00 17 Salvage value 10,000 18 Useful Life (months) 120 19 Minimum required cash balance 43,000 20 Monthly interest rate 0.4% 21 22 CHOCOLATES 23 Sales Budget 24 For the Three Months Ending March 31, 2021 25 26 January February March 27 Cash Sales 68,472 71,211 74,059 28 Credit Sales 58,328 60,661 63,088 29 Total Sales $ 126,800 $ 131,872 $ 137,147 30 31 32 CHOCOLATES 33 Schedule of Cash Receipts 34 For the Two Months Ending February 28, 2021 35 36 January February 37 Cash Sales 68,472 71,211 38 Collection of Credit Sales (A/R) 55,522 58,328 39 Total Budgeted Cash Receipts $ 123,994 $ 129,539 40 11 41 42 43 44 45 46 47 Cost of Goods Sold CHOCOLATES Inventory Purchases Budget For the Two Months Ending February 28, 2021 January 43,112 February 44,836 48 Add: 49 Inventory Needed 50 Less: 51 Budgeted Purchases 52 53 54 CHIPPEWA CHOCOLATES 55 Schedule of Cash Payments 56 For the Two Months Ending February 28, 2021 57 58 January February 59 December Purchases 60 61 62 Cash paid for inventory 63 E F G H CHIPPEWA CHOCOLATES Selling and Administrative Expenses Budget For the Two Months Ending February 28, 2021 January February Variable costs: Total variable costs Fixed costs: Total fixed costs: Total S & A Expense CHIPPEWA CHOCOLATES Schedule of Cash Payments for S&A Expenses For the Two Months Ending February 28, 2021 January February Variable costs: Supplies Commison Total variable costs Fixed costs: Salary Expense Rent Total fixed costs Cash paid for S&A Expenses CHIPPEWA CHOCOLATES Budgeted Income Statement For the Two Months Ending February 28, 2021 January February Sales Revenue Less: Gross Profit Less: S&A Expenses Income before interest Interest expense Net Income CHIPPEWA CHOCOLATES Cash Budget For the Two Months Ending February 28, 2021 January February Beginning Cash Balance Add: Cash Available Less: Cash Paid for: Equipment purchase Interest Total Cash Paid Surplus/(Shortage) Borrowing Repayment Ending Cash Balance 43,000 43,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started