Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide excel screenshots ABC is debating the purchase of a new digital printer. The printer they acquired 6 years ago for $1,800,000 is worth

please provide excel screenshots

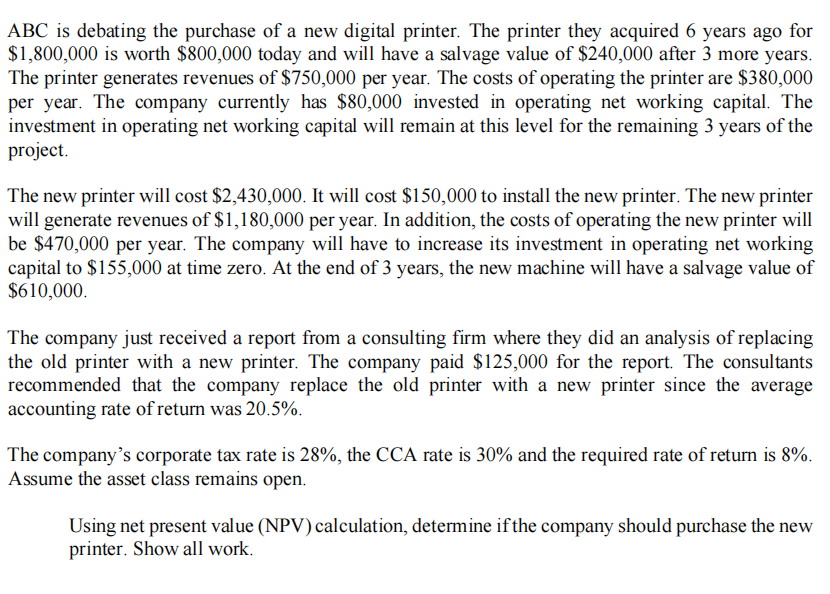

ABC is debating the purchase of a new digital printer. The printer they acquired 6 years ago for $1,800,000 is worth $800,000 today and will have a salvage value of $240,000 after 3 more years. The printer generates revenues of $750,000 per year. The costs of operating the printer are $380,000 per year. The company currently has $80,000 invested in operating net working capital. The investment in operating net working capital will remain at this level for the remaining 3 years of the project. The new printer will cost $2,430,000. It will cost $150,000 to install the new printer. The new printer will generate revenues of $1,180,000 per year. In addition, the costs of operating the new printer will be $470,000 per year. The company will have to increase its investment in operating net working capital to $155,000 at time zero. At the end of 3 years, the new machine will have a salvage value of $610,000 The company just received a report from a consulting firm where they did an analysis of replacing the old printer with a new printer. The company paid $125,000 for the report. The consultants recommended that the company replace the old printer with a new printer since the average accounting rate of return was 20.5%. The company's corporate tax rate is 28%, the CCA rate is 30% and the required rate of return is 8%. Assume the asset class remains open. Using net present value (NPV) calculation, determine if the company should purchase the new printer. Show all workStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started