Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide explanation to the answers, give kudos! Question #1: During 2020, Crackers Corporation, a calendar year C corporation, has net short-term capital gains of

Please provide explanation to the answers, give kudos!

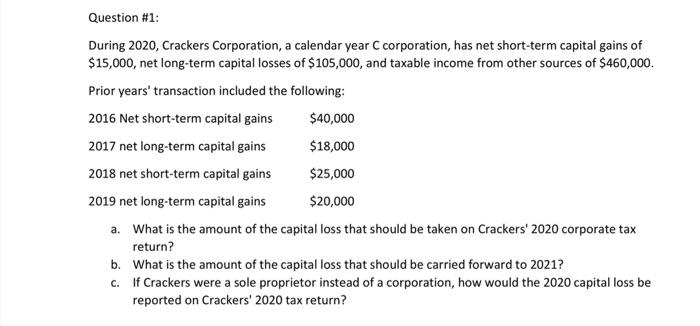

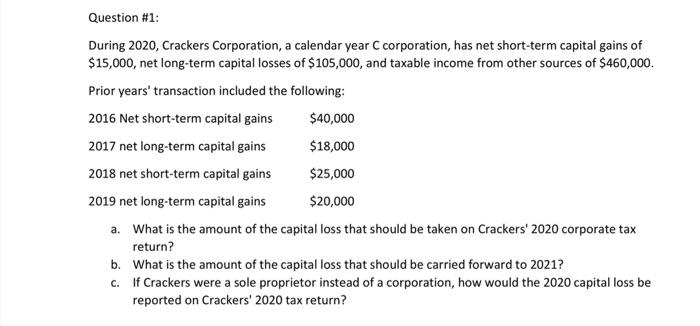

Question #1: During 2020, Crackers Corporation, a calendar year C corporation, has net short-term capital gains of $15,000, net long-term capital losses of $105,000, and taxable income from other sources of $460,000. Prior years' transaction included the following: 2016 Net short-term capital gains $40,000 2017 net long-term capital gains $18,000 2018 net short-term capital gains $25,000 2019 net long-term capital gains $20,000 a. What is the amount of the capital loss that should be taken on Crackers' 2020 corporate tax return? b. What is the amount of the capital loss that should be carried forward to 2021? C. If Crackers were a sole proprietor instead of a corporation, how would the 2020 capital loss be reported on Crackers' 2020 tax return

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started