Please provide explanations! Thank you!!!

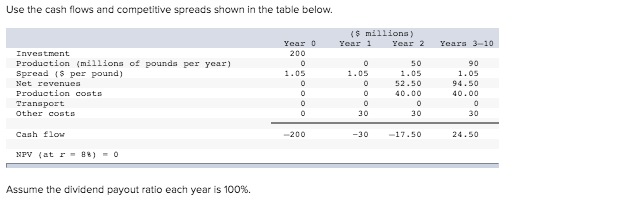

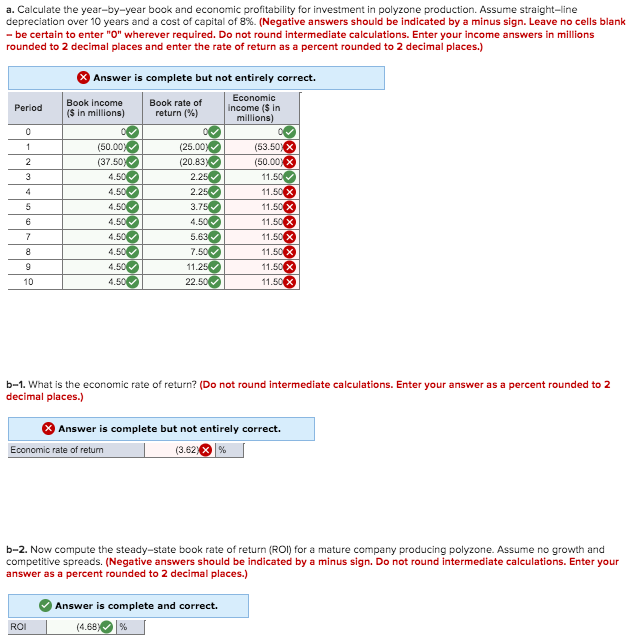

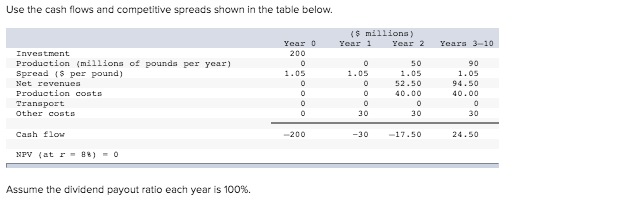

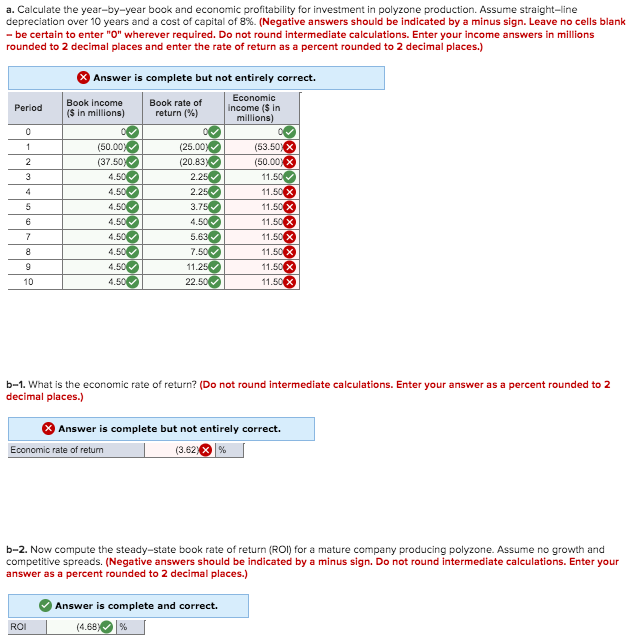

Use the cash flows and competitive spreads shown in the table below. {$ millions) Year 1 Year 2 Years 3-10 Year 0 200 50 1.05 1.05 1.05 Investment Production (millions of pounds per year) Spread ($ per pound) Net revenues Production costs Transport Other conta 1.05 52.50 40.00 40.00 30 30 cash flow -200 -30 -17.50 24.50 NTV (at 08) = 0 Assume the dividend payout ratio each year is 100%. a. Calculate the year-by-year book and economic profitability for investment in polyzone production. Assume straight-line depreciation over 10 years and a cost of capital of 8%. (Negative answers should be indicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your income answers in millions rounded to 2 decimal places and enter the rate of return as a percent rounded to 2 decimal places.) X Answer is complete but not entirely correct. Period Book income is in millions) Book rate of return (%) Economic Income ($ in millions) 0 (25.00) (20.83) 2.25 07 (50.00% (37.50) 4.50 4.50 4.50 4.50 .50 4.50 .50 4.50 (53.50) X (50.00% 11.50 11.50X 11.50 11.50% 11.50 11.50X 11.50% 11.50 X 6 7 2.25 3.75 4.500 5.63 7.50 11.25 22.50 4 9 4 10 b-1. What is the economic rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) % Answer is complete but not entirely correct Economic rate of return (3.62 % b-2. Now compute the steady-state book rate of return (ROI) for a mature company producing polyzone. Assume no growth and competitive spreads. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Answer is complete and correct. (4.68 % ROI Use the cash flows and competitive spreads shown in the table below. {$ millions) Year 1 Year 2 Years 3-10 Year 0 200 50 1.05 1.05 1.05 Investment Production (millions of pounds per year) Spread ($ per pound) Net revenues Production costs Transport Other conta 1.05 52.50 40.00 40.00 30 30 cash flow -200 -30 -17.50 24.50 NTV (at 08) = 0 Assume the dividend payout ratio each year is 100%. a. Calculate the year-by-year book and economic profitability for investment in polyzone production. Assume straight-line depreciation over 10 years and a cost of capital of 8%. (Negative answers should be indicated by a minus sign. Leave no cells blank - be certain to enter "O" wherever required. Do not round intermediate calculations. Enter your income answers in millions rounded to 2 decimal places and enter the rate of return as a percent rounded to 2 decimal places.) X Answer is complete but not entirely correct. Period Book income is in millions) Book rate of return (%) Economic Income ($ in millions) 0 (25.00) (20.83) 2.25 07 (50.00% (37.50) 4.50 4.50 4.50 4.50 .50 4.50 .50 4.50 (53.50) X (50.00% 11.50 11.50X 11.50 11.50% 11.50 11.50X 11.50% 11.50 X 6 7 2.25 3.75 4.500 5.63 7.50 11.25 22.50 4 9 4 10 b-1. What is the economic rate of return? (Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) % Answer is complete but not entirely correct Economic rate of return (3.62 % b-2. Now compute the steady-state book rate of return (ROI) for a mature company producing polyzone. Assume no growth and competitive spreads. (Negative answers should be indicated by a minus sign. Do not round intermediate calculations. Enter your answer as a percent rounded to 2 decimal places.) Answer is complete and correct. (4.68 % ROI