Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please provide formula and rough solution 24. Mr.N works in a private company. Have stable income and work Receive a monthly salary of 55,000 baht

please provide formula and rough solution

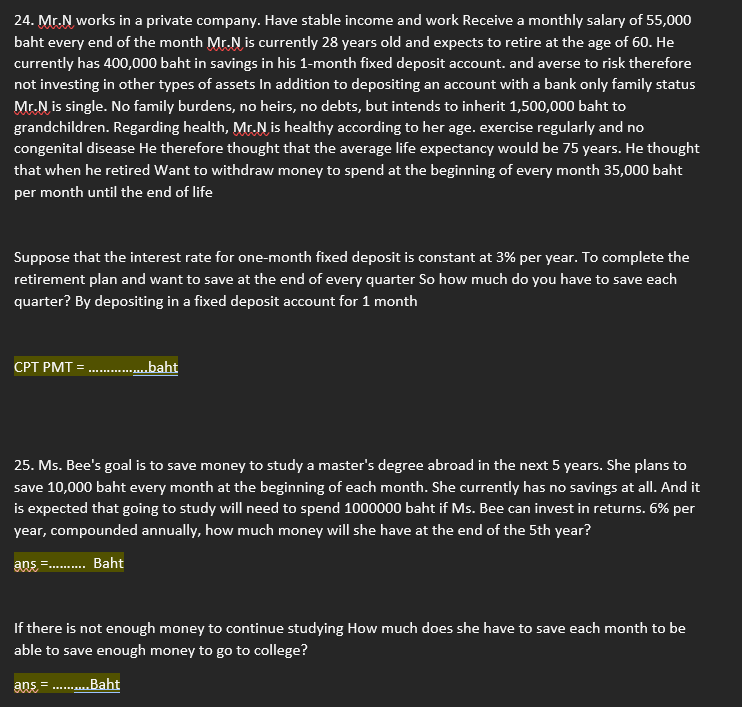

24. Mr.N works in a private company. Have stable income and work Receive a monthly salary of 55,000 baht every end of the month Mr.N is currently 28 years old and expects to retire at the age of 60.He currently has 400,000 baht in savings in his 1-month fixed deposit account. and averse to risk therefore not investing in other types of assets In addition to depositing an account with a bank only family status Mr. N is single. No family burdens, no heirs, no debts, but intends to inherit 1,500,000 baht to grandchildren. Regarding health, Mr. N is healthy according to her age. exercise regularly and no congenital disease He therefore thought that the average life expectancy would be 75 years. He thought that when he retired Want to withdraw money to spend at the beginning of every month 35,000 baht per month until the end of life Suppose that the interest rate for one-month fixed deposit is constant at 3% per year. To complete the retirement plan and want to save at the end of every quarter So how much do you have to save each quarter? By depositing in a fixed deposit account for 1 month CPT PMT = baht 25. Ms. Bee's goal is to save money to study a master's degree abroad in the next 5 years. She plans to save 10,000 baht every month at the beginning of each month. She currently has no savings at all. And it is expected that going to study will need to spend 1000000 baht if Ms. Bee can invest in returns. 6% per year, compounded annually, how much money will she have at the end of the 5 th year? If there is not enough money to continue studying How much does she have to save each month to be able to save enough money to go to college

24. Mr.N works in a private company. Have stable income and work Receive a monthly salary of 55,000 baht every end of the month Mr.N is currently 28 years old and expects to retire at the age of 60.He currently has 400,000 baht in savings in his 1-month fixed deposit account. and averse to risk therefore not investing in other types of assets In addition to depositing an account with a bank only family status Mr. N is single. No family burdens, no heirs, no debts, but intends to inherit 1,500,000 baht to grandchildren. Regarding health, Mr. N is healthy according to her age. exercise regularly and no congenital disease He therefore thought that the average life expectancy would be 75 years. He thought that when he retired Want to withdraw money to spend at the beginning of every month 35,000 baht per month until the end of life Suppose that the interest rate for one-month fixed deposit is constant at 3% per year. To complete the retirement plan and want to save at the end of every quarter So how much do you have to save each quarter? By depositing in a fixed deposit account for 1 month CPT PMT = baht 25. Ms. Bee's goal is to save money to study a master's degree abroad in the next 5 years. She plans to save 10,000 baht every month at the beginning of each month. She currently has no savings at all. And it is expected that going to study will need to spend 1000000 baht if Ms. Bee can invest in returns. 6% per year, compounded annually, how much money will she have at the end of the 5 th year? If there is not enough money to continue studying How much does she have to save each month to be able to save enough money to go to college Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started