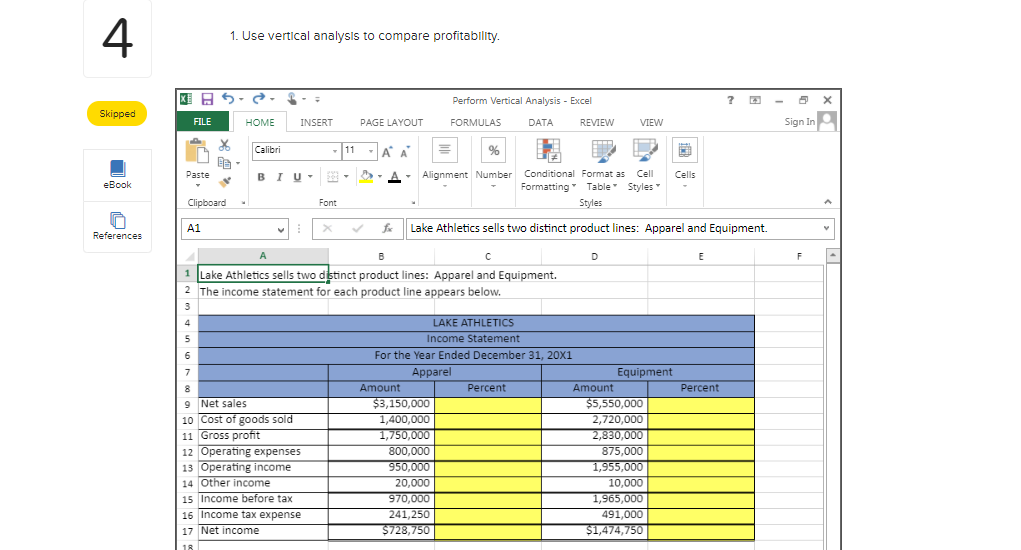

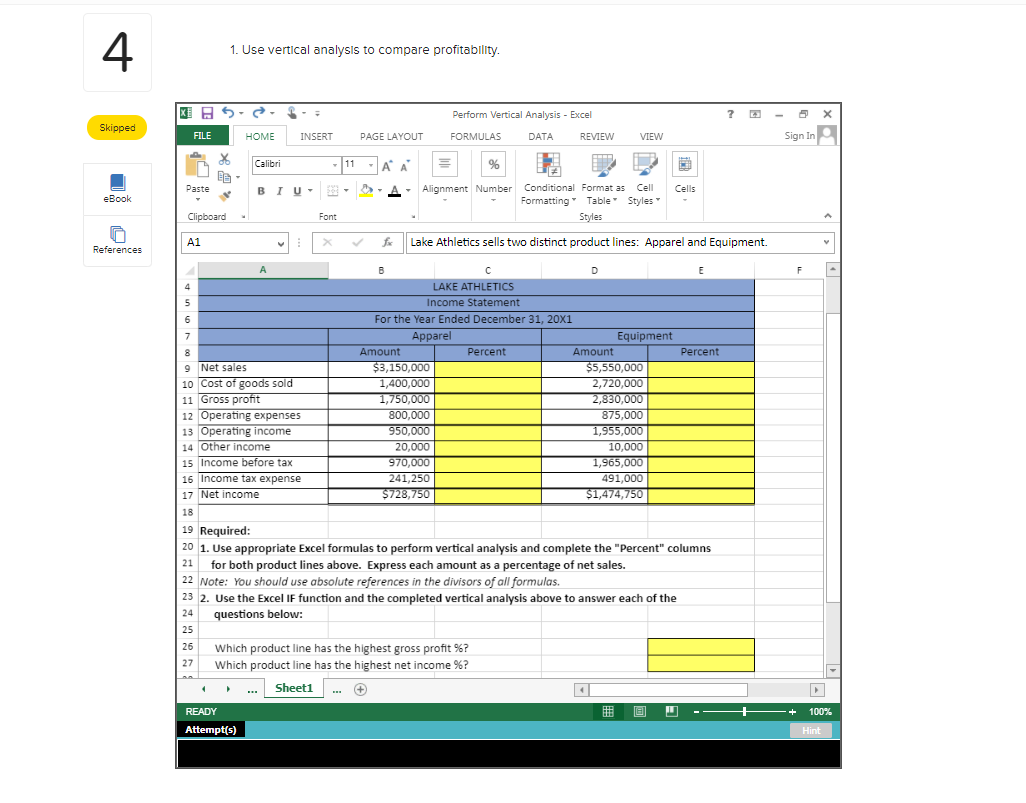

***Please provide formulas with solution. I would greatly appreciate it!

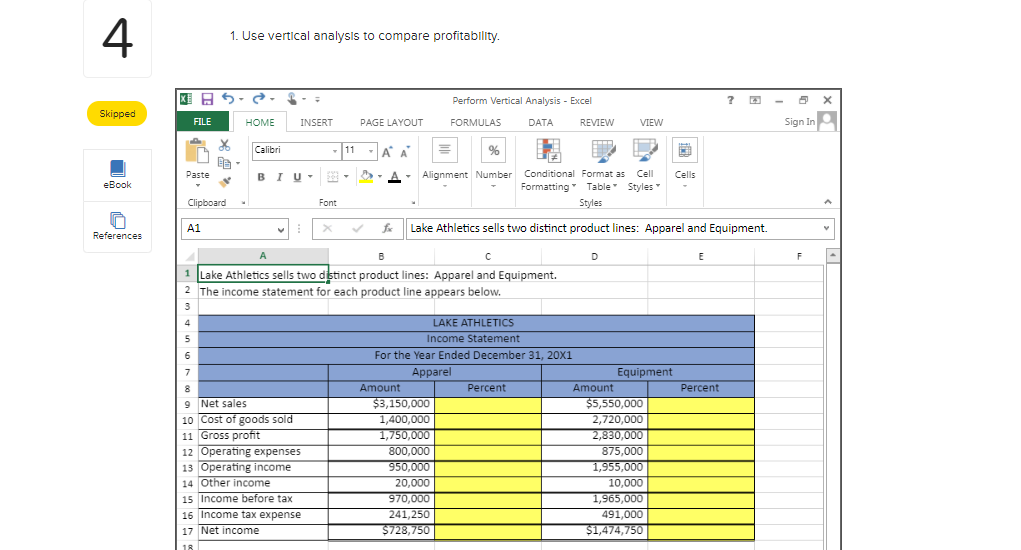

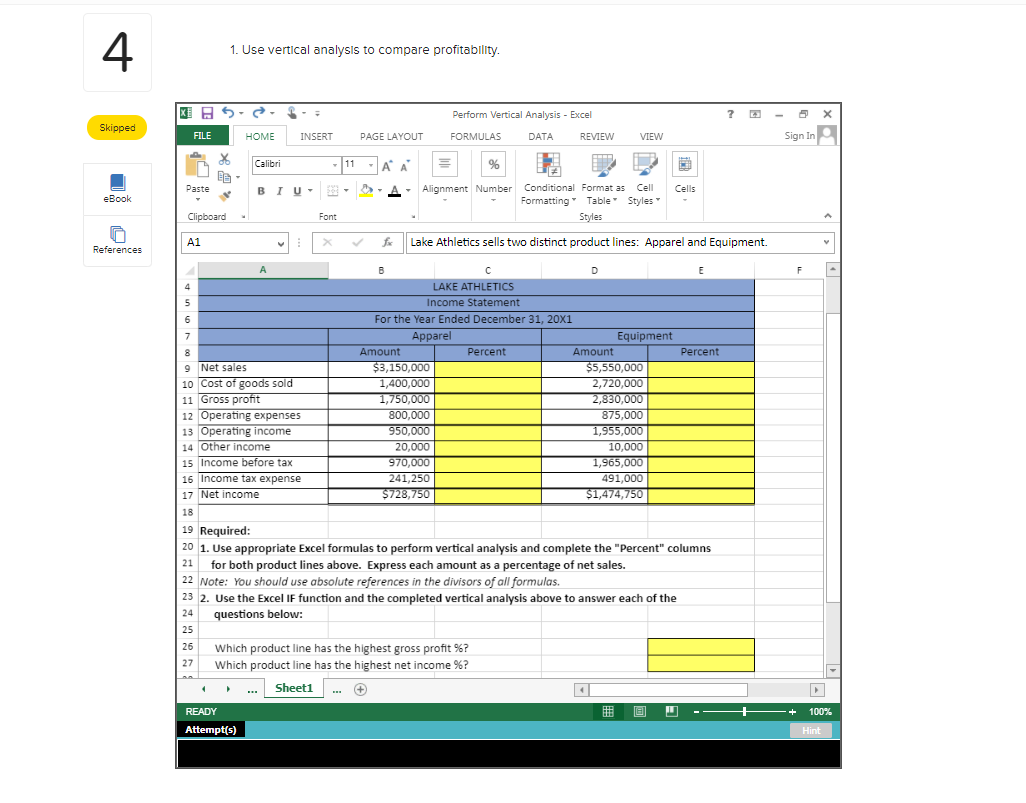

All answers must be entered as a formula. Click OK to begin. OK 4. 1. Use vertical analysis to compare profitability KE 5 Perform Vertical Analysis - Excel ? Skipped FILE HOME INSERT PAGE LAYOUT FORMULAS DATA REVIEW VIEW Sign In Calibri -11 A A % Paste BIU >>> eBook Alignment Number Conditional Format as Cell Formatting Table Styles Styles Clipboard A Font A1 f References Lake Athletics sells two distinct product lines: Apparel and Equipment. E F Percent B D 1 Lake Athletics sells two distinct product lines: Apparel and Equipment. 2 The income statement for each product line appears below. 3 4 LAKE ATHLETICS 5 Income Statement 6 For the Year Ended December 31, 20X1 7 Apparel Equipment 8 Amount Percent Amount 9 Net sales $3,150,000 $5,550,000 10 Cost of goods sold 1,400,000 2,720,000 11 Gross profit 1,750,000 2,830,000 12 Operating expenses 800,000 875,000 13 Operating income 950,000 1,955,000 14 Other income * 20,000 10,000 15 income 15 Income before tax 970,000 1,965,000 16 Income tax expense 241,250 491,000 17 Net income $728,750 $1,474,750 18 4 1. Use vertical analysis to compare profitability. 2 5 X Skipped Perform Vertical Analysis - Excel FORMULAS DATA REVIEW FILE HOME INSERT PAGE LAYOUT VIEW Sign In X E- Calibri 11 -A A % Paste BIU Cells eBook Alignment Number Conditional Format as Cell Formatting" Table Styles Styles Clipboard Font O References A1 fe Lake Athletics sells two distinct product lines: Apparel and Equipment. F B D E 4 LAKE ATHLETICS 5 Income Statement 6 For the Year Ended December 31, 20X1 7 Apparel Equipment 8 Amount Percent Amount Percent 9 Net sales $3,150,000 $5,550,000 10 Cost of goods sold 1,400,000 2,720,000 11 Gross profit 1,750,000 2,830,000 12 Operating expenses 800,000 0.000 875,000 13 Operating income 950,000 . 1,955,000 14 Other income 20,000 10.000 10,000 15 Income before tax 970,000 1,965,000 16 Income tax expense 241,250 491,000 17 Net income $728,750 $1,474,750 18 19 Required: 20 1. Use appropriate Excel formulas to perform vertical analysis and complete the "Percent" columns 21 for both product lines above. Express each amount as a percentage of net sales. 22 Note: You should use absolute references in the divisors of all formulas. 23 2. Use the Excel IF function and the completed vertical analysis above to answer each of the 24 questions below: 25 26 Which product line has the highest gross profit %? 27 Which product line has the highest net income %? Sheet1 4 U 100% READY Attempt(s) Hint