Answered step by step

Verified Expert Solution

Question

1 Approved Answer

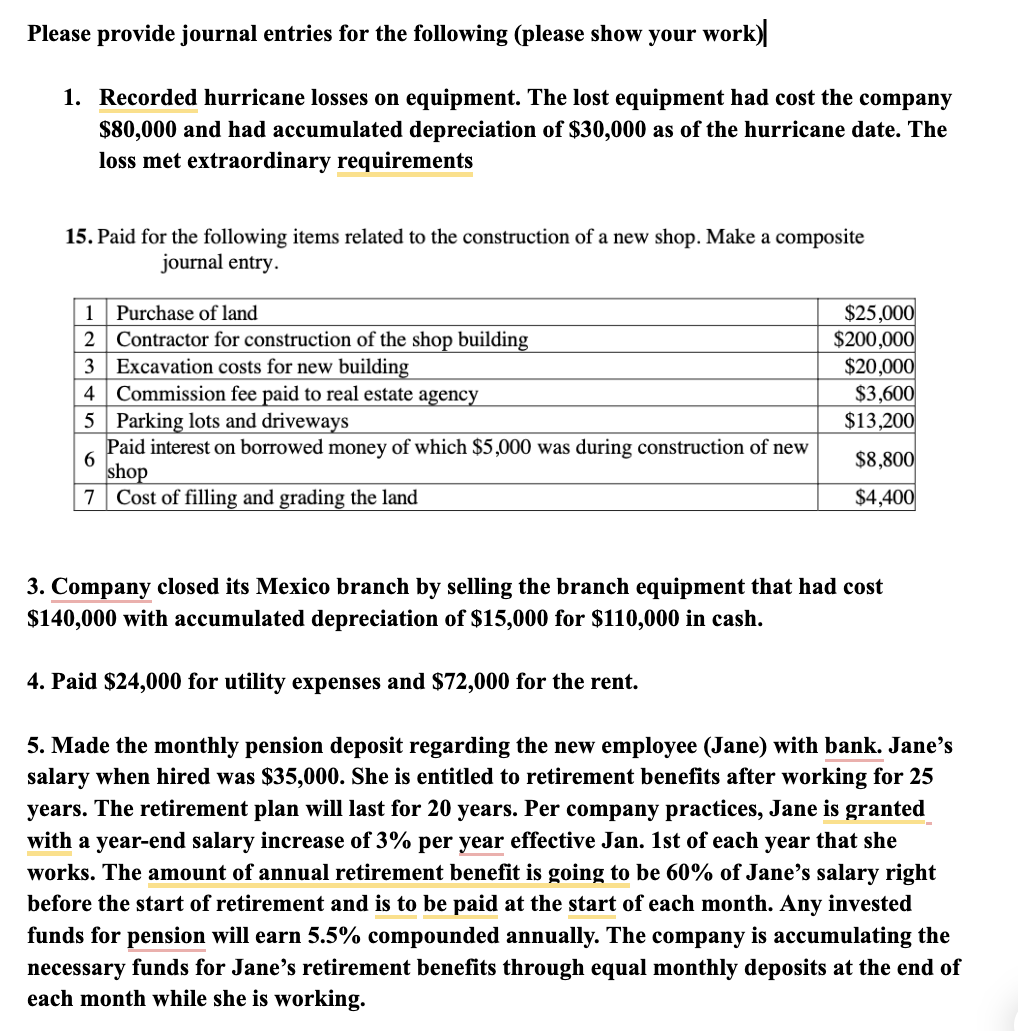

Please provide journal entries for the following ( please show your work ) Recorded hurricane losses on equipment. The lost equipment had cost the company

Please provide journal entries for the following please show your work

Recorded hurricane losses on equipment. The lost equipment had cost the company

$ and had accumulated depreciation of $ as of the hurricane date. The

loss met extraordinary requirements

Paid for the following items related to the construction of a new shop. Make a composite

journal entry.

Company closed its Mexico branch by selling the branch equipment that had cost

$ with accumulated depreciation of $ for $ in cash.

Paid $ for utility expenses and $ for the rent.

Made the monthly pension deposit regarding the new employee Jane with bank. Jane's

salary when hired was $ She is entitled to retirement benefits after working for

years. The retirement plan will last for years. Per company practices, Jane is granted

with a yearend salary increase of per year effective Jan. st of each year that she

works. The amount of annual retirement benefit is going to be of Jane's salary right

before the start of retirement and is to be paid at the start of each month. Any invested

funds for pension will earn compounded annually. The company is accumulating the

necessary funds for Jane's retirement benefits through equal monthly deposits at the end of

each month while she is working.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started