Please provide legal basis under Philippine Tax Code. Thank you.

Please provide legal basis under Philippine Tax Code. Thank you.

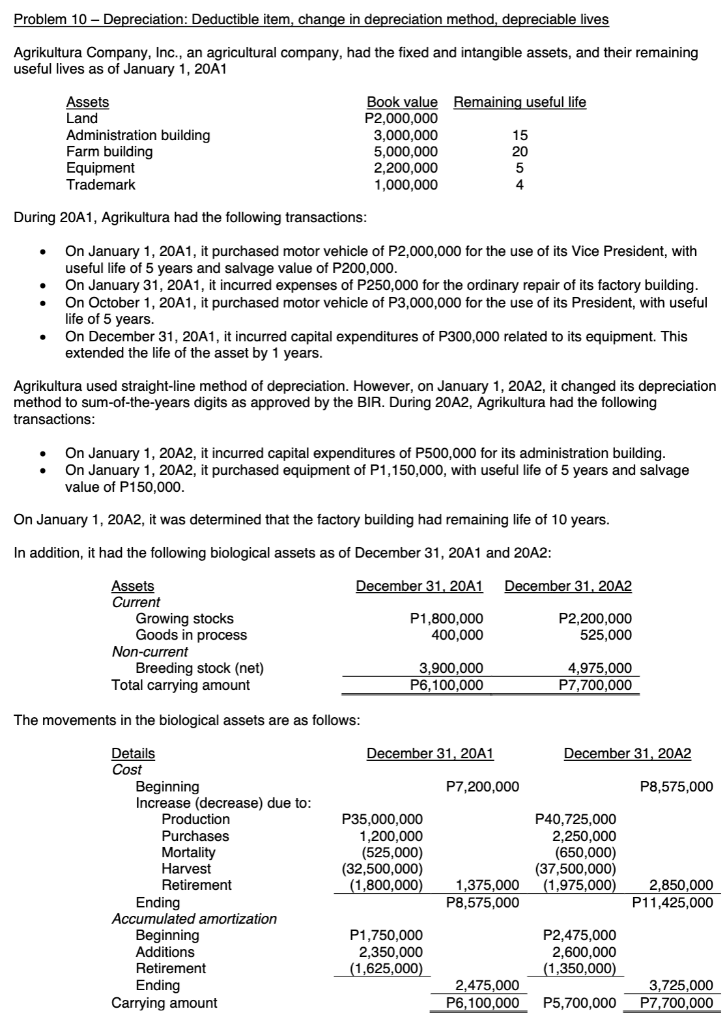

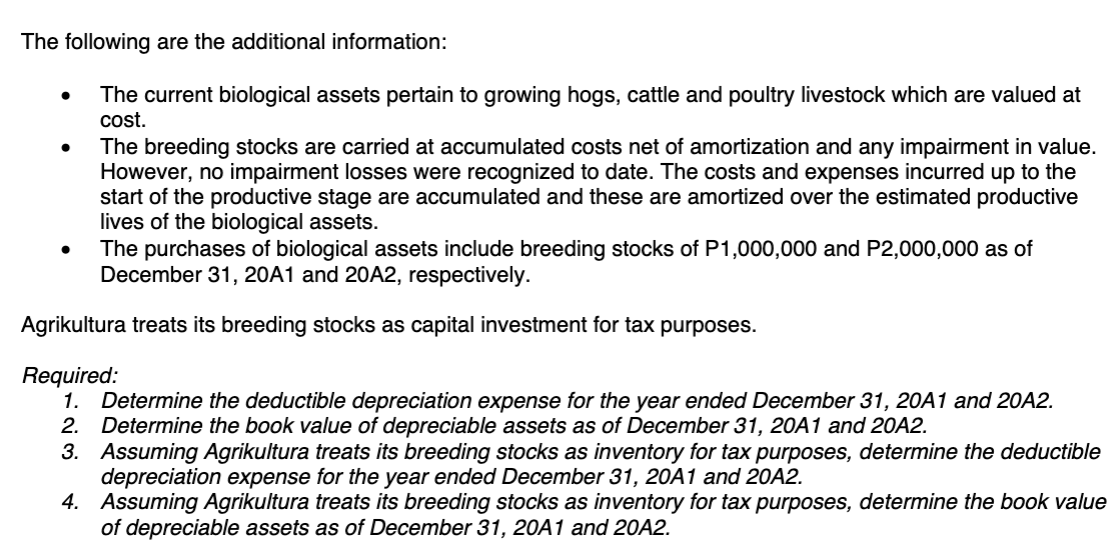

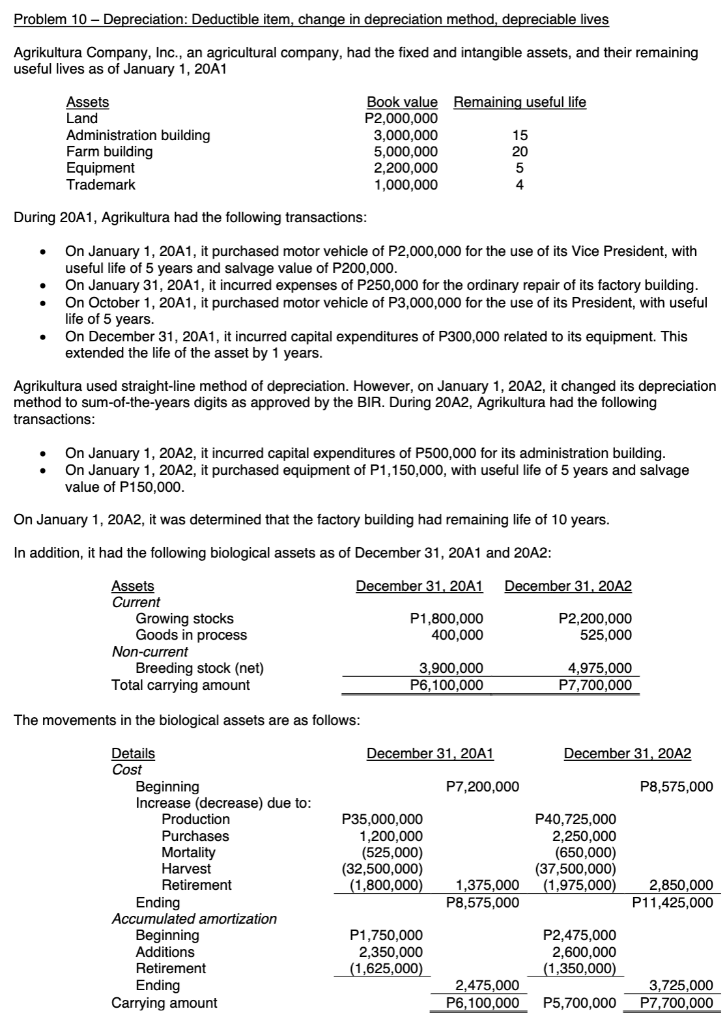

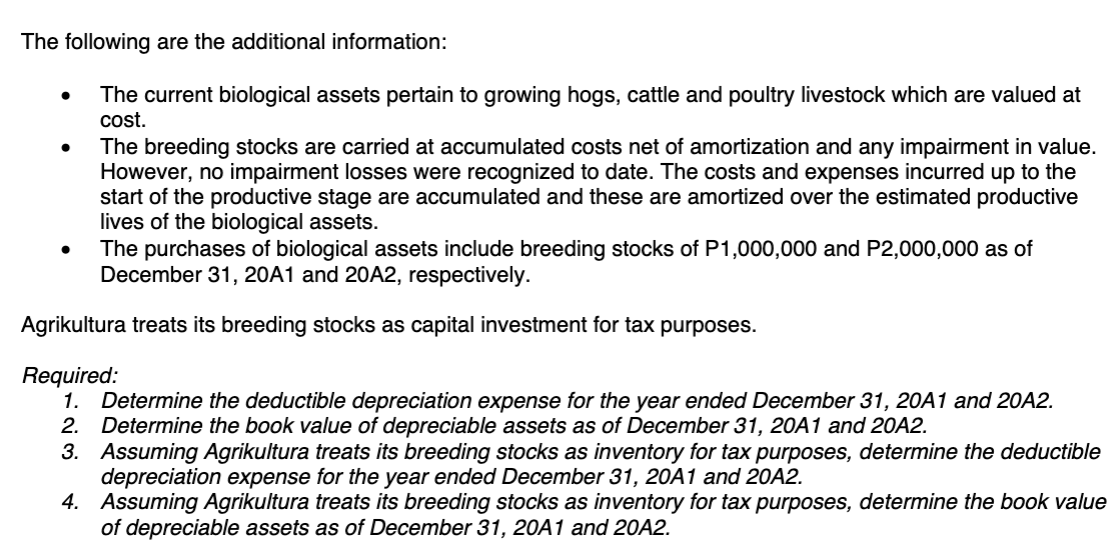

Problem 10 - Depreciation: Deductible item, change in depreciation method, depreciable lives Agrikultura Company, Inc., an agricultural company, had the fixed and intangible assets, and their remaining useful lives as of January 1, 20A1 During 20A1, Agrikultura had the following transactions: - On January 1, 20A1, it purchased motor vehicle of P2,000,000 for the use of its Vice President, with useful life of 5 years and salvage value of P200,000. - On January 31, 20A1, it incurred expenses of P250,000 for the ordinary repair of its factory building. - On October 1, 20A1, it purchased motor vehicle of P3,000,000 for the use of its President, with useful life of 5 years. - On December 31, 20A1, it incurred capital expenditures of P300,000 related to its equipment. This extended the life of the asset by 1 years. Agrikultura used straight-line method of depreciation. However, on January 1, 20A2, it changed its depreciation method to sum-of-the-years digits as approved by the BIR. During 20A2, Agrikultura had the following transactions: - On January 1, 20A2, it incurred capital expenditures of P500,000 for its administration building. - On January 1, 20A2, it purchased equipment of P1,150,000, with useful life of 5 years and salvage value of P150,000. On January 1, 20A2, it was determined that the factory building had remaining life of 10 years. In addition, it had the following biological assets as of December 31, 20A1 and 20A2: The movements in the biological assets are as follows: The following are the additional information: - The current biological assets pertain to growing hogs, cattle and poultry livestock which are valued at cost. - The breeding stocks are carried at accumulated costs net of amortization and any impairment in value. However, no impairment losses were recognized to date. The costs and expenses incurred up to the start of the productive stage are accumulated and these are amortized over the estimated productive lives of the biological assets. - The purchases of biological assets include breeding stocks of P1,000,000 and P2,000,000 as of December 31, 20A1 and 20A2, respectively. Agrikultura treats its breeding stocks as capital investment for tax purposes. Required: 1. Determine the deductible depreciation expense for the year ended December 31, 20A1 and 20A2. 2. Determine the book value of depreciable assets as of December 31, 20A1 and 20A2. 3. Assuming Agrikultura treats its breeding stocks as inventory for tax purposes, determine the deductible depreciation expense for the year ended December 31, 20A1 and 20A2. 4. Assuming Agrikultura treats its breeding stocks as inventory for tax purposes, determine the book value of depreciable assets as of December 31, 20A1 and 20A2

Please provide legal basis under Philippine Tax Code. Thank you.

Please provide legal basis under Philippine Tax Code. Thank you.