Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide solution with explanations. I will upvote. Thanks. On 1 January 2021, Hayden, Inc., purchased 80% of the common stock of Rossi Manufacturing Company

Please provide solution with explanations. I will upvote. Thanks.

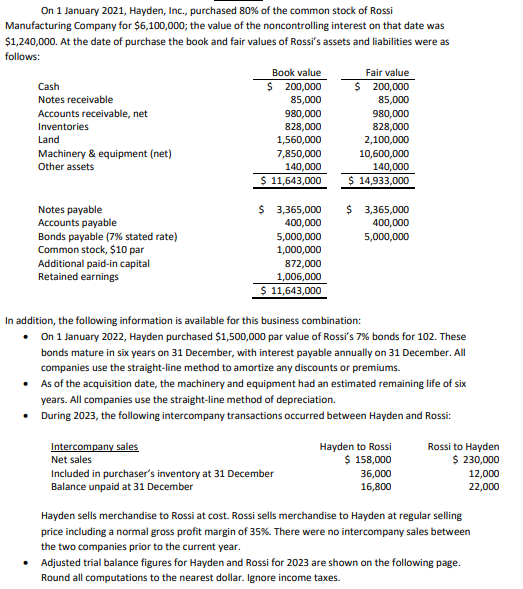

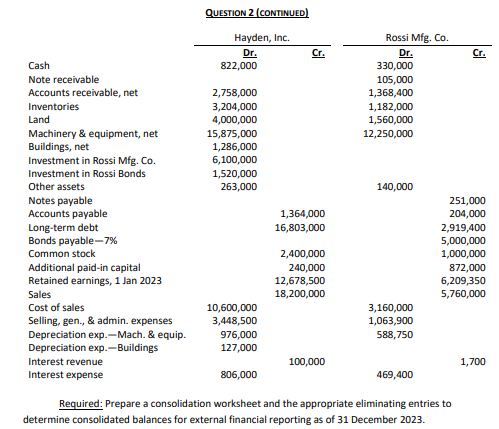

On 1 January 2021, Hayden, Inc., purchased 80% of the common stock of Rossi Manufacturing Company for $6,100,000; the value of the noncontrolling interest on that date was $1,240,000. At the date of purchase the book and fair values of Rossi's assets and liabilities were as follows: Book value Fair value Cash $ 200,000 $ 200,000 Notes receivable 85,000 85,000 Accounts receivable, net 980,000 980,000 Inventories 828,000 828,000 Land 1,560,000 2,100,000 Machinery & equipment (net) 7,850,000 10,600,000 Other assets 140,000 140,000 $ 11,643,000 $ 14,933,000 $ 3,365,000 400,000 5,000,000 Notes payable Accounts payable Bonds payable (7% stated rate) Common stock, $10 par Additional paid-in capital Retained earnings $ 3,365,000 400,000 5,000,000 1,000,000 872,000 1,006,000 $ 11,643,000 In addition, the following information is available for this business combination: On 1 January 2022, Hayden purchased $1,500,000 par value of Rossi's 7% bonds for 102. These bonds mature in six years on 31 December, with interest payable annually on 31 December. All companies use the straight-line method to amortize any discounts or premiums. As of the acquisition date, the machinery and equipment had an estimated remaining life of six years. All companies use the straight-line method of depreciation. During 2023, the following intercompany transactions occurred between Hayden and Rossi: Intercompany sales Net sales Included in purchaser's inventory at 31 December Balance unpaid at 31 December Hayden to Rossi $ 158,000 36,000 16,800 Rossi to Hayden $ 230,000 12,000 22,000 Hayden sells merchandise to Rossi at cost. Rossi sells merchandise to Hayden at regular selling price including a normal gross profit margin of 35%. There were no intercompany sales between the two companies prior to the current year. Adjusted trial balance figures for Hayden and Rossi for 2023 are shown on the following page. Round all computations to the nearest dollar. Ignore income taxes. QUESTION 2 (CONTINUED) Hayden, Inc. Dr. 822,000 Cr. Cr. 2,758,000 3,204,000 4,000,000 15,875,000 1,286,000 6,100,000 1,520,000 263,000 Rossi Mfg.Co. Dr. 330,000 105,000 1,368,400 1,182,000 1,560,000 12,250,000 140,000 Cash Note receivable Accounts receivable, net Inventories Land Machinery & equipment, net Buildings, net Investment in Rossi Mfg.Co. Investment in Rossi Bonds Other assets Notes payable Accounts payable Long-term debt Bonds payable-7% Common stock Additional paid-in capital Retained earnings, 1 Jan 2023 Sales Cost of sales Selling, gen., & admin. expenses Depreciation exp.- Mach. & equip. Depreciation exp.-Buildings Interest revenue Interest expense 1,364,000 16,803,000 2,400,000 240,000 12,678,500 18,200,000 251,000 204,000 2,919,400 5,000,000 1,000,000 872,000 6,209,350 5,760,000 10,600,000 3,448,500 976,000 127,000 3,160,000 1,063,900 588,750 100,000 1,700 806,000 469,400 Required: Prepare a consolidation worksheet and the appropriate eliminating entries to determine consolidated balances for external financial reporting as of 31 December 2023. On 1 January 2021, Hayden, Inc., purchased 80% of the common stock of Rossi Manufacturing Company for $6,100,000; the value of the noncontrolling interest on that date was $1,240,000. At the date of purchase the book and fair values of Rossi's assets and liabilities were as follows: Book value Fair value Cash $ 200,000 $ 200,000 Notes receivable 85,000 85,000 Accounts receivable, net 980,000 980,000 Inventories 828,000 828,000 Land 1,560,000 2,100,000 Machinery & equipment (net) 7,850,000 10,600,000 Other assets 140,000 140,000 $ 11,643,000 $ 14,933,000 $ 3,365,000 400,000 5,000,000 Notes payable Accounts payable Bonds payable (7% stated rate) Common stock, $10 par Additional paid-in capital Retained earnings $ 3,365,000 400,000 5,000,000 1,000,000 872,000 1,006,000 $ 11,643,000 In addition, the following information is available for this business combination: On 1 January 2022, Hayden purchased $1,500,000 par value of Rossi's 7% bonds for 102. These bonds mature in six years on 31 December, with interest payable annually on 31 December. All companies use the straight-line method to amortize any discounts or premiums. As of the acquisition date, the machinery and equipment had an estimated remaining life of six years. All companies use the straight-line method of depreciation. During 2023, the following intercompany transactions occurred between Hayden and Rossi: Intercompany sales Net sales Included in purchaser's inventory at 31 December Balance unpaid at 31 December Hayden to Rossi $ 158,000 36,000 16,800 Rossi to Hayden $ 230,000 12,000 22,000 Hayden sells merchandise to Rossi at cost. Rossi sells merchandise to Hayden at regular selling price including a normal gross profit margin of 35%. There were no intercompany sales between the two companies prior to the current year. Adjusted trial balance figures for Hayden and Rossi for 2023 are shown on the following page. Round all computations to the nearest dollar. Ignore income taxes. QUESTION 2 (CONTINUED) Hayden, Inc. Dr. 822,000 Cr. Cr. 2,758,000 3,204,000 4,000,000 15,875,000 1,286,000 6,100,000 1,520,000 263,000 Rossi Mfg.Co. Dr. 330,000 105,000 1,368,400 1,182,000 1,560,000 12,250,000 140,000 Cash Note receivable Accounts receivable, net Inventories Land Machinery & equipment, net Buildings, net Investment in Rossi Mfg.Co. Investment in Rossi Bonds Other assets Notes payable Accounts payable Long-term debt Bonds payable-7% Common stock Additional paid-in capital Retained earnings, 1 Jan 2023 Sales Cost of sales Selling, gen., & admin. expenses Depreciation exp.- Mach. & equip. Depreciation exp.-Buildings Interest revenue Interest expense 1,364,000 16,803,000 2,400,000 240,000 12,678,500 18,200,000 251,000 204,000 2,919,400 5,000,000 1,000,000 872,000 6,209,350 5,760,000 10,600,000 3,448,500 976,000 127,000 3,160,000 1,063,900 588,750 100,000 1,700 806,000 469,400 Required: Prepare a consolidation worksheet and the appropriate eliminating entries to determine consolidated balances for external financial reporting as of 31 December 2023Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started