Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide step by step explanation and send to my email. JAM World Jamaica Limited, a leading juice manufacturing company has recently hired you as

Please provide step by step explanation and send to my email.

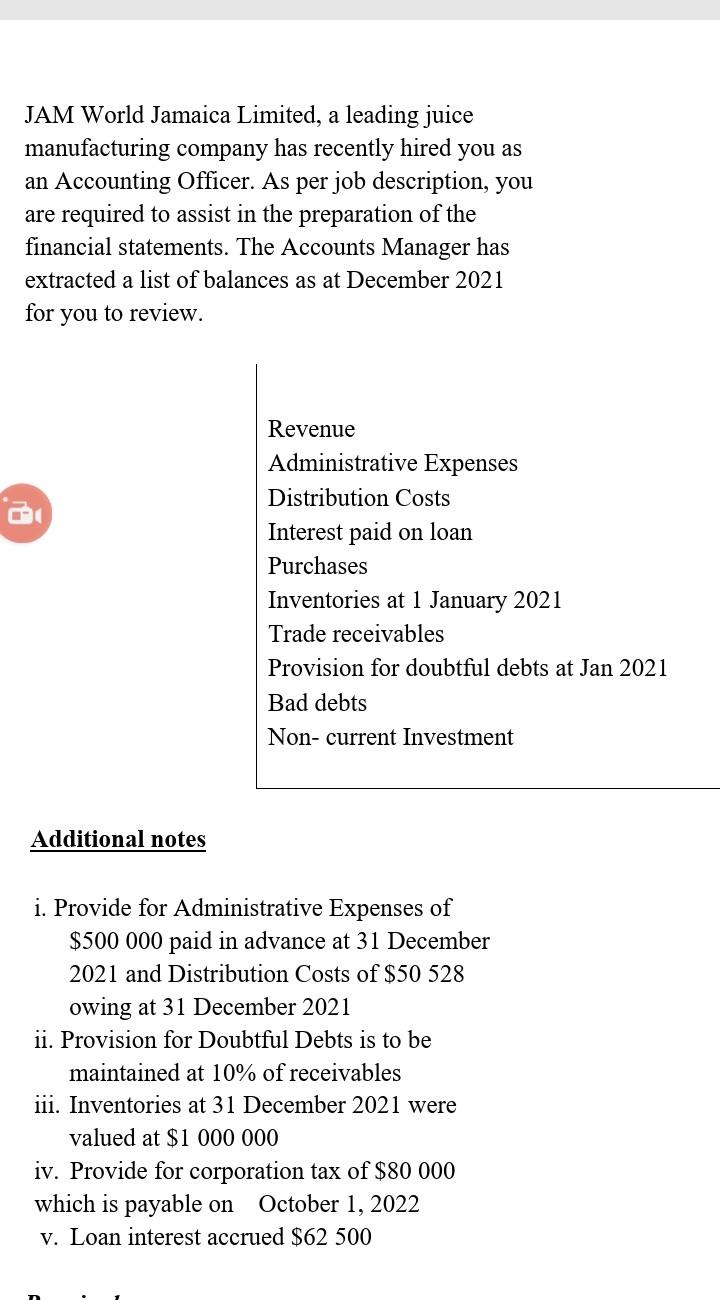

JAM World Jamaica Limited, a leading juice manufacturing company has recently hired you as an Accounting Officer. As per job description, you are required to assist in the preparation of the financial statements. The Accounts Manager has extracted a list of balances as at December 2021 for you to review. Additionalnotes i. Provide for Administrative Expenses of $500000 paid in advance at 31 December 2021 and Distribution Costs of $50528 owing at 31 December 2021 ii. Provision for Doubtful Debts is to be maintained at 10% of receivables iii. Inventories at 31 December 2021 were valued at $1000000 iv. Provide for corporation tax of $80000 which is payable on October 1, 2022 v. Loan interest accrued $62500 i. Provide for Administrative Expenses of $500000 paid in advance at 31 December 2021 and Distribution Costs of $50528 owing at 31 December 2021 ii. Provision for Doubtful Debts is to be maintained at 10% of receivables iii. Inventories at 31 December 2021 were valued at $1000000 iv. Provide for corporation tax of $80000 which is payable on October 1,2022 v. Loan interest accrued $62500 i. Provide for Administrative Expenses of $500000 paid in advance at 31 December 2021 and Distribution Costs of $50528 owing at 31 December 2021 ii. Provision for Doubtful Debts is to be maintained at 10% of receivables iii. Inventories at 31 December 2021 were valued at $1000000 iv. Provide for corporation tax of $80000 which is payable on October 1, 2022 v. Loan interest accrued $62500 Required: A. Prepare for presentation to the shareholders a published Income Statement for the year ended 31 December 2021. (14 marks) B. Notes to the Income Statement. (6 marks) JAM World Jamaica Limited, a leading juice manufacturing company has recently hired you as an Accounting Officer. As per job description, you are required to assist in the preparation of the financial statements. The Accounts Manager has extracted a list of balances as at December 2021 for you to review. Additionalnotes i. Provide for Administrative Expenses of $500000 paid in advance at 31 December 2021 and Distribution Costs of $50528 owing at 31 December 2021 ii. Provision for Doubtful Debts is to be maintained at 10% of receivables iii. Inventories at 31 December 2021 were valued at $1000000 iv. Provide for corporation tax of $80000 which is payable on October 1, 2022 v. Loan interest accrued $62500 i. Provide for Administrative Expenses of $500000 paid in advance at 31 December 2021 and Distribution Costs of $50528 owing at 31 December 2021 ii. Provision for Doubtful Debts is to be maintained at 10% of receivables iii. Inventories at 31 December 2021 were valued at $1000000 iv. Provide for corporation tax of $80000 which is payable on October 1,2022 v. Loan interest accrued $62500 i. Provide for Administrative Expenses of $500000 paid in advance at 31 December 2021 and Distribution Costs of $50528 owing at 31 December 2021 ii. Provision for Doubtful Debts is to be maintained at 10% of receivables iii. Inventories at 31 December 2021 were valued at $1000000 iv. Provide for corporation tax of $80000 which is payable on October 1, 2022 v. Loan interest accrued $62500 Required: A. Prepare for presentation to the shareholders a published Income Statement for the year ended 31 December 2021. (14 marks) B. Notes to the Income Statement. (6 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started