Please provide step by step solution all question i will vote your answer thanks in advance!

I have last one expert question thats why i cant send seperately.

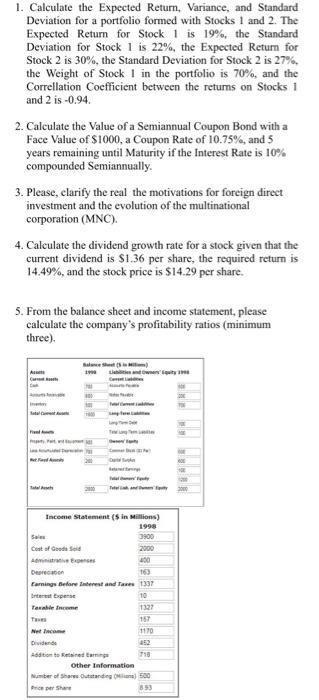

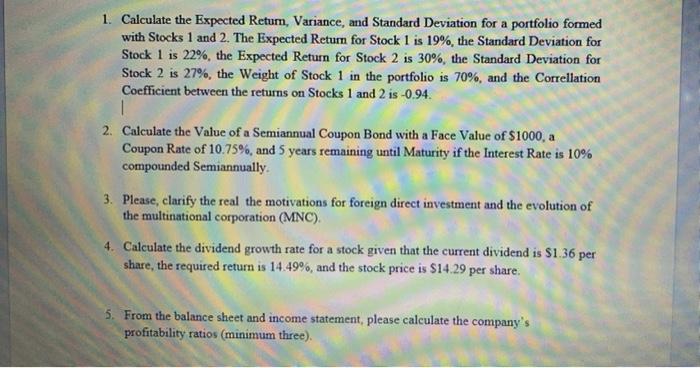

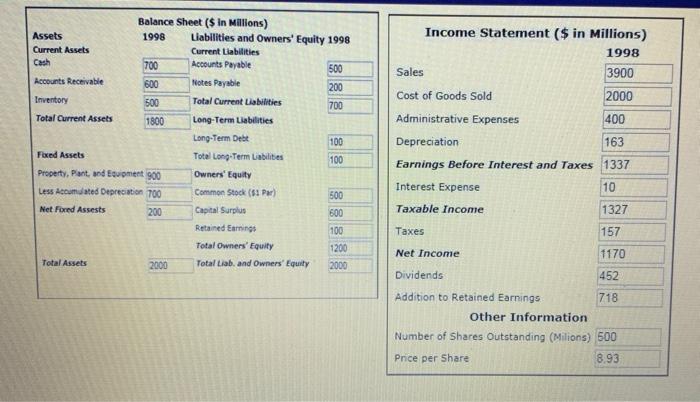

1. Calculate the Expected Return, Variance, and Standard Deviation for a portfolio formed with Stocks 1 and 2. The Expected Return for Stock 1 is 19%, the Standard Deviation for Stock 1 is 22%, the Expected Return for Stock 2 is 30%, the Standard Deviation for Stock 2 is 27% the Weight of Stock I in the portfolio is 70%, and the Correllation Coefficient between the returns on Stocks 1 and 2 is -0.94 2. Calculate the value of a Semiannual Coupon Bond with a Face Value of $1000, a Coupon Rate of 10.75%, and 5 years remaining until Maturity if the Interest Rate is 10% compounded Semiannually. 3. Please, clarify the real the motivations for foreign direct investment and the evolution of the multinational corporation (MNC). 4. Calculate the dividend growth rate for a stock given that the current dividend is $1.36 per share the required return is 14.49%, and the stock price is $14.29 per share. 5. From the balance sheet and income statement, please calculate the company's profitability ratios (minimum three). ht A Income Statement (in Millions) 1998 Sale 3900 Cost of Good Sold 2000 Anime 400 Depreciation 100 Famnings Before Interest and Tame 1337 Internet pense 10 Taxable income 1227 Te 157 1170 Addition to end 798 Other Information Number of Share Outstanding om 500 853 a 1. Calculate the Expected Return, Variance, and Standard Deviation for a portfolio formed with Stocks 1 and 2. The Expected Return for Stock 1 is 19%, the Standard Deviation for Stock 1 is 22%, the Expected Return for Stock 2 is 30%, the Standard Deviation for Stock 2 is 27%, the Weight of Stock 1 in the portfolio is 70%, and the Correllation Coefficient between the returns on Stocks 1 and 2 is -0.94. 1 2. Calculate the value of a Semiannual Coupon Bond with a Face Value of $1000, a Coupon Rate of 10.75%, and 5 years remaining until Maturity if the Interest Rate is 10% compounded Semiannually. 3. Please, clarify the real the motivations for foreign direct investment and the evolution of the multinational corporation (MNC). 4. Calculate the dividend growth rate for a stock given that the current dividend is $1.36 per share, the required return is 14.49%, and the stock price is $14.29 per share. 5. From the balance sheet and income statement, please calculate the company's profitability ratios (minimum three). Income Statement ($ in Millions) 1998 Balance Sheet ($ in Millions) Assets 1998 Liabilities and Owners' Equity 1998 Current Assets Current Liabilities Cash 700 Accounts Payable 500 Accounts Receivable 600 Notes Payable 200 Inventory 500 Total Current Liabilities 700 Total Current Assets 1800 Long-Term Liabilities Long-Term Debt 100 Fixed Assets Total Long Term Liabilities 100 Property, Pant, and Equipment 900 Owners' Equity Less Accurated Depreciation 700 Common Stock (61 Par) 500 Net Fored Assests 200 Capital Surplus 600 Retained Earnings 100 Total Owners' Equity 1200 Total Assets 2000 Total Liab, and Owners' Equity 2000 Sales 3900 Cost of Goods Sold 2000 Administrative Expenses 400 Depreciation 163 Earnings Before Interest and Taxes 1337 Interest Expense 10 Taxable Income 1327 Taxe 157 Net Income 1170 Dividends 452 Addition to Retained Earnings 718 Other Information Number of Shares Outstanding (Milions) 500 Price per Share 8.93 1. Calculate the Expected Return, Variance, and Standard Deviation for a portfolio formed with Stocks 1 and 2. The Expected Return for Stock 1 is 19%, the Standard Deviation for Stock 1 is 22%, the Expected Return for Stock 2 is 30%, the Standard Deviation for Stock 2 is 27% the Weight of Stock I in the portfolio is 70%, and the Correllation Coefficient between the returns on Stocks 1 and 2 is -0.94 2. Calculate the value of a Semiannual Coupon Bond with a Face Value of $1000, a Coupon Rate of 10.75%, and 5 years remaining until Maturity if the Interest Rate is 10% compounded Semiannually. 3. Please, clarify the real the motivations for foreign direct investment and the evolution of the multinational corporation (MNC). 4. Calculate the dividend growth rate for a stock given that the current dividend is $1.36 per share the required return is 14.49%, and the stock price is $14.29 per share. 5. From the balance sheet and income statement, please calculate the company's profitability ratios (minimum three). ht A Income Statement (in Millions) 1998 Sale 3900 Cost of Good Sold 2000 Anime 400 Depreciation 100 Famnings Before Interest and Tame 1337 Internet pense 10 Taxable income 1227 Te 157 1170 Addition to end 798 Other Information Number of Share Outstanding om 500 853 a 1. Calculate the Expected Return, Variance, and Standard Deviation for a portfolio formed with Stocks 1 and 2. The Expected Return for Stock 1 is 19%, the Standard Deviation for Stock 1 is 22%, the Expected Return for Stock 2 is 30%, the Standard Deviation for Stock 2 is 27%, the Weight of Stock 1 in the portfolio is 70%, and the Correllation Coefficient between the returns on Stocks 1 and 2 is -0.94. 1 2. Calculate the value of a Semiannual Coupon Bond with a Face Value of $1000, a Coupon Rate of 10.75%, and 5 years remaining until Maturity if the Interest Rate is 10% compounded Semiannually. 3. Please, clarify the real the motivations for foreign direct investment and the evolution of the multinational corporation (MNC). 4. Calculate the dividend growth rate for a stock given that the current dividend is $1.36 per share, the required return is 14.49%, and the stock price is $14.29 per share. 5. From the balance sheet and income statement, please calculate the company's profitability ratios (minimum three). Income Statement ($ in Millions) 1998 Balance Sheet ($ in Millions) Assets 1998 Liabilities and Owners' Equity 1998 Current Assets Current Liabilities Cash 700 Accounts Payable 500 Accounts Receivable 600 Notes Payable 200 Inventory 500 Total Current Liabilities 700 Total Current Assets 1800 Long-Term Liabilities Long-Term Debt 100 Fixed Assets Total Long Term Liabilities 100 Property, Pant, and Equipment 900 Owners' Equity Less Accurated Depreciation 700 Common Stock (61 Par) 500 Net Fored Assests 200 Capital Surplus 600 Retained Earnings 100 Total Owners' Equity 1200 Total Assets 2000 Total Liab, and Owners' Equity 2000 Sales 3900 Cost of Goods Sold 2000 Administrative Expenses 400 Depreciation 163 Earnings Before Interest and Taxes 1337 Interest Expense 10 Taxable Income 1327 Taxe 157 Net Income 1170 Dividends 452 Addition to Retained Earnings 718 Other Information Number of Shares Outstanding (Milions) 500 Price per Share 8.93