Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide step to step solutions, questions are on the pictures attached above, thank you. 1. If, in today's respective markets for one month, three

Please provide step to step solutions, questions are on the pictures attached above, thank you.

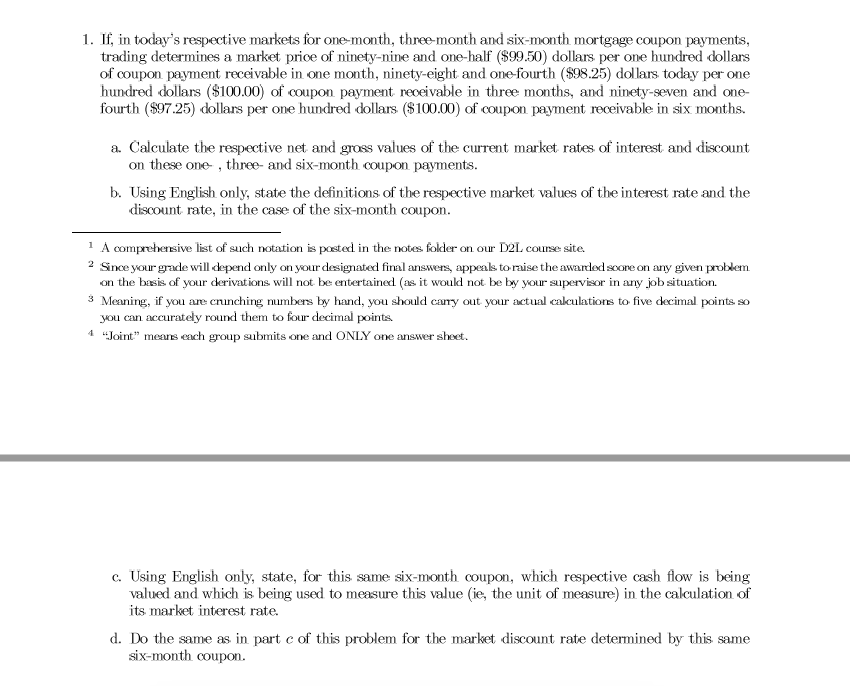

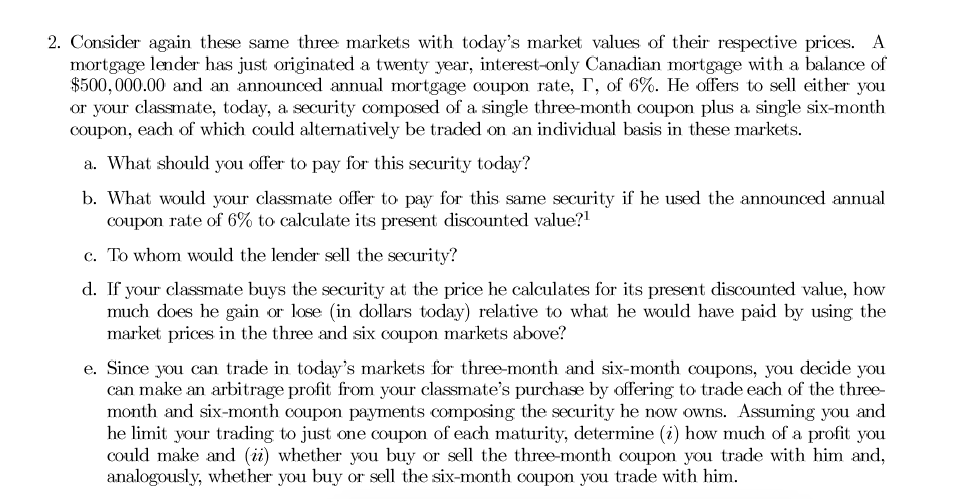

1. If, in today's respective markets for one month, three month and six-month mortgage coupon payments, trading determines a market prioe of ninety-nine and one-half ($99.50 dollars per one hundred dollars of coupon payment receivable in one month, ninety-eight and one fourth ($98.25) dollars today per one hundred dollars ($100.00) of coupon payment receivable in three months, and ninety-seven and one- fourth ($97.25) dollars per one hundred dollars ($100.00) of coupon payment receivable in six months. a. Calculate the respective net and gross values of the current market rates of interest and discount on these one , three- and six-month coupon payments. b. Using English only, state the definitions of the respective market values of the interest rate and the discount rate, in the case of the six-month coupon. 1 A comprehensive list of such notation is posted in the notes folder on our D2L course site. 2 Since your grade will depend only on your designated final answers, appeals to raise the awarded score on any given problem on the basis of your derivations will not be entertained (as it would not be by your supervisor in any job situation. 3 Meaning, if you are crunching numbers by hand, you should carry out your actual calculations to five decimal points so you can accurately round them to four decimal points "Joint" means each group submits one and ONLY one answer sheet. c. Using English only, state, for this same six-month coupon, which respective cash flow is being valued and which is being used to measure this value (ie, the unit of measure) in the calculation of its market interest rate. d. Do the same as in part c of this problem for the market discount rate determined by this same six-month coupon. 2. Consider again these same three markets with today's market values of their respective prices. A mortgage lender has just originated a twenty year, interest-only Canadian mortgage with a balance of $500,000.00 and an announced annual mortgage coupon rate, T, of 6%. He offers to sell either you or your classmate, today, a security composed of a single three-month coupon plus a single six-month coupon, each of which could alternatively be traded on an individual basis in these markets. a. What should you offer to pay for this security today? b. What would your classmate offer to pay for this same security if he used the announced annual coupon rate of 6% to calculate its present discounted value?! c. To whom would the lender sell the security? d. If your classmate buys the security at the price he calculates for its present discounted value, how much does he gain or lose in dollars today) relative to what he would have paid by using the market prices in the three and six coupon markets above? e. Since you can trade in today's markets for three-month and six-month coupons, you decide you can make an arbitrage profit from your classmate's purchase by offering to trade each of the three month and six-month coupon payments composing the security he now owns. Assuming you and he limit your trading to just one coupon of each maturity, determine (i) how much of a profit you could make and (ii) whether you buy or sell the three-month coupon you trade with him and. analogously, whether you buy or sell the six-month coupon you trade with him. 1. If, in today's respective markets for one month, three month and six-month mortgage coupon payments, trading determines a market prioe of ninety-nine and one-half ($99.50 dollars per one hundred dollars of coupon payment receivable in one month, ninety-eight and one fourth ($98.25) dollars today per one hundred dollars ($100.00) of coupon payment receivable in three months, and ninety-seven and one- fourth ($97.25) dollars per one hundred dollars ($100.00) of coupon payment receivable in six months. a. Calculate the respective net and gross values of the current market rates of interest and discount on these one , three- and six-month coupon payments. b. Using English only, state the definitions of the respective market values of the interest rate and the discount rate, in the case of the six-month coupon. 1 A comprehensive list of such notation is posted in the notes folder on our D2L course site. 2 Since your grade will depend only on your designated final answers, appeals to raise the awarded score on any given problem on the basis of your derivations will not be entertained (as it would not be by your supervisor in any job situation. 3 Meaning, if you are crunching numbers by hand, you should carry out your actual calculations to five decimal points so you can accurately round them to four decimal points "Joint" means each group submits one and ONLY one answer sheet. c. Using English only, state, for this same six-month coupon, which respective cash flow is being valued and which is being used to measure this value (ie, the unit of measure) in the calculation of its market interest rate. d. Do the same as in part c of this problem for the market discount rate determined by this same six-month coupon. 2. Consider again these same three markets with today's market values of their respective prices. A mortgage lender has just originated a twenty year, interest-only Canadian mortgage with a balance of $500,000.00 and an announced annual mortgage coupon rate, T, of 6%. He offers to sell either you or your classmate, today, a security composed of a single three-month coupon plus a single six-month coupon, each of which could alternatively be traded on an individual basis in these markets. a. What should you offer to pay for this security today? b. What would your classmate offer to pay for this same security if he used the announced annual coupon rate of 6% to calculate its present discounted value?! c. To whom would the lender sell the security? d. If your classmate buys the security at the price he calculates for its present discounted value, how much does he gain or lose in dollars today) relative to what he would have paid by using the market prices in the three and six coupon markets above? e. Since you can trade in today's markets for three-month and six-month coupons, you decide you can make an arbitrage profit from your classmate's purchase by offering to trade each of the three month and six-month coupon payments composing the security he now owns. Assuming you and he limit your trading to just one coupon of each maturity, determine (i) how much of a profit you could make and (ii) whether you buy or sell the three-month coupon you trade with him and. analogously, whether you buy or sell the six-month coupon you trade with himStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started