Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please provide steps and calculations in detail, thank you Problem 12-1A Corporate balance sheet preparation LO2 CHECK FIGURES: Total assets =$546,400; Total equity =$301,800 Required

Please provide steps and calculations in detail, thank you

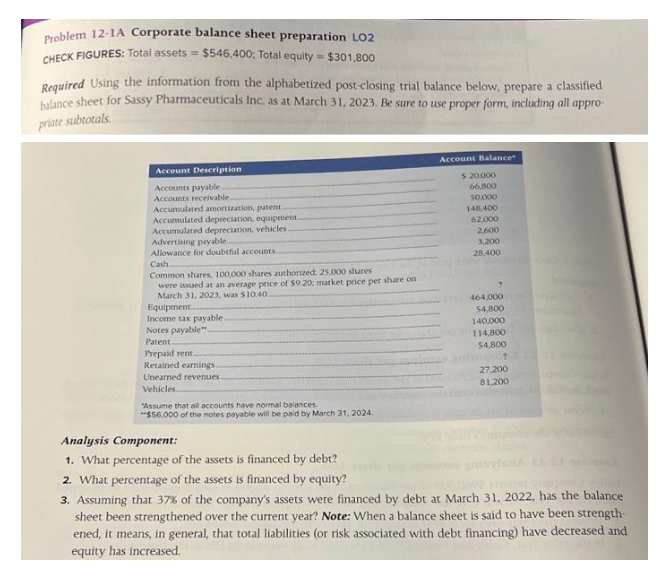

Problem 12-1A Corporate balance sheet preparation LO2 CHECK FIGURES: Total assets =$546,400; Total equity =$301,800 Required Using the information from the alphabetized post-closing trial balance below, prepare a classified balance sheet for Sassy Pharmaceuticals Inc. as at March 31, 2023. Be sure to use proper form, including all appropriate subtotals. $56.000 of the notes payable will be bad by March 31,2024 . Analysis Component: 1. What percentage of the assets is financed by debt? 2. What percentage of the assets is financed by equity? 3. Assuming that 37% of the company's assets were financed by debt at March 31,2022 , has the balance sheet been strengthened over the current year? Note: When a balance sheet is said to have been strengthened, it means, in general, that total liabilities (or risk associated with debt financing) have decreased and equity has increased

Problem 12-1A Corporate balance sheet preparation LO2 CHECK FIGURES: Total assets =$546,400; Total equity =$301,800 Required Using the information from the alphabetized post-closing trial balance below, prepare a classified balance sheet for Sassy Pharmaceuticals Inc. as at March 31, 2023. Be sure to use proper form, including all appropriate subtotals. $56.000 of the notes payable will be bad by March 31,2024 . Analysis Component: 1. What percentage of the assets is financed by debt? 2. What percentage of the assets is financed by equity? 3. Assuming that 37% of the company's assets were financed by debt at March 31,2022 , has the balance sheet been strengthened over the current year? Note: When a balance sheet is said to have been strengthened, it means, in general, that total liabilities (or risk associated with debt financing) have decreased and equity has increased Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started