Question

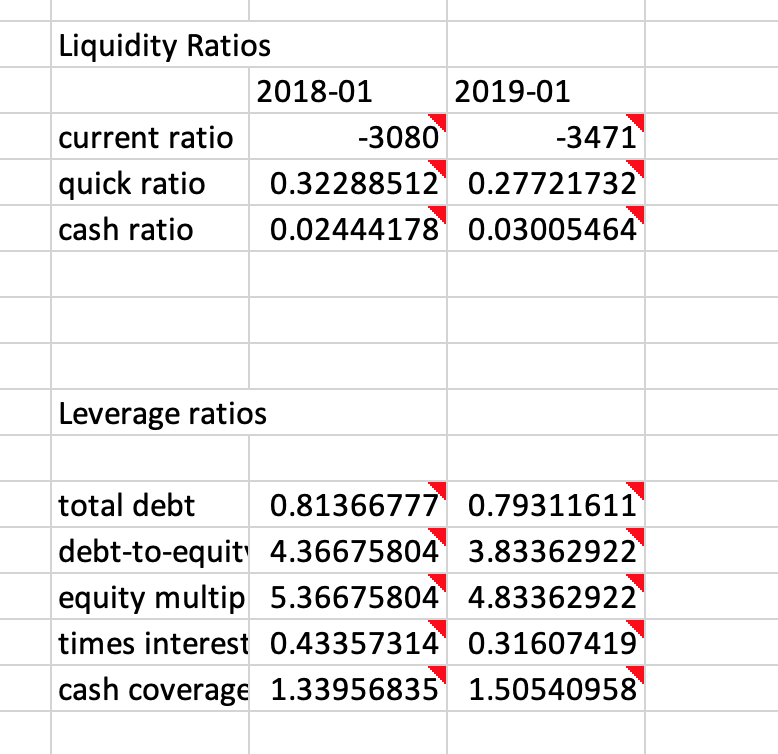

Please provide sufficient interpretations of the ratios and explain their change (or no change) from the year before, in 2-3paragraphsfor all the ratios. If theres

Please provide sufficient interpretations of the ratios and explain their change (or no change) from the year before, in 2-3paragraphsfor all the ratios. If theres anything unusual or notable, please explain. Please be cautious about the signson financial statement figures, especially on the income and cash flow statement. Some companies choose to report expense items as negative numbers because they get subtracted from the revenue to obtain the net income. When calculating the ratios, use your judgement to adjust their signs appropriately.

Kroger ratios 2018-2019

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started