Answered step by step

Verified Expert Solution

Question

1 Approved Answer

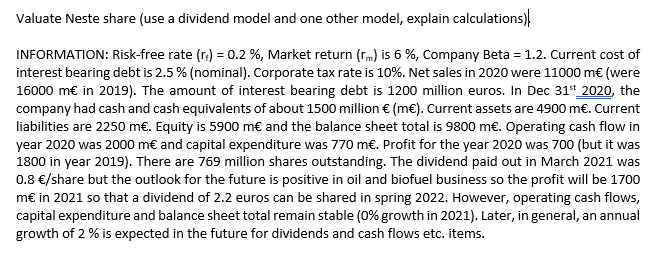

Please provide the answer with a screenshot Valuate Neste share (use a dividend model and one other model, explain calculations) INFORMATION: Risk-free rate (re) =

Please provide the answer with a screenshot

Valuate Neste share (use a dividend model and one other model, explain calculations) INFORMATION: Risk-free rate (re) = 0.2 %, Market return (rm) is 6 %, Company Beta = 1.2. Current cost of interest bearing debt is 2.5% (nominal). Corporate tax rate is 10%. Net sales in 2020 were 11000 m (were 16000 m in 2019). The amount of interest bearing debt is 1200 million euros. In Dec 31st 2020, the company had cash and cash equivalents of about 1500 million (m). Current assets are 4900 m. Current liabilities are 2250 m. Equity is 5900 m and the balance sheet total is 9800 m. Operating cash flow in year 2020 was 2000 m and capital expenditure was 770 m. Profit for the year 2020 was 700 (but it was 1800 in year 2019). There are 769 million shares outstanding. The dividend paid out in March 2021 was 0.8 /share but the outlook for the future is positive in oil and biofuel business so the profit will be 1700 m in 2021 so that a dividend of 2.2 euros can be shared in spring 2022. However, operating cash flows, capital expenditure and balance sheet total remain stable (0% growth in 2021). Later, in general, an annual growth of 2% is expected in the future for dividends and cash flows etc. items. Valuate Neste share (use a dividend model and one other model, explain calculations) INFORMATION: Risk-free rate (re) = 0.2 %, Market return (rm) is 6 %, Company Beta = 1.2. Current cost of interest bearing debt is 2.5% (nominal). Corporate tax rate is 10%. Net sales in 2020 were 11000 m (were 16000 m in 2019). The amount of interest bearing debt is 1200 million euros. In Dec 31st 2020, the company had cash and cash equivalents of about 1500 million (m). Current assets are 4900 m. Current liabilities are 2250 m. Equity is 5900 m and the balance sheet total is 9800 m. Operating cash flow in year 2020 was 2000 m and capital expenditure was 770 m. Profit for the year 2020 was 700 (but it was 1800 in year 2019). There are 769 million shares outstanding. The dividend paid out in March 2021 was 0.8 /share but the outlook for the future is positive in oil and biofuel business so the profit will be 1700 m in 2021 so that a dividend of 2.2 euros can be shared in spring 2022. However, operating cash flows, capital expenditure and balance sheet total remain stable (0% growth in 2021). Later, in general, an annual growth of 2% is expected in the future for dividends and cash flows etc. itemsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started