Answered step by step

Verified Expert Solution

Question

1 Approved Answer

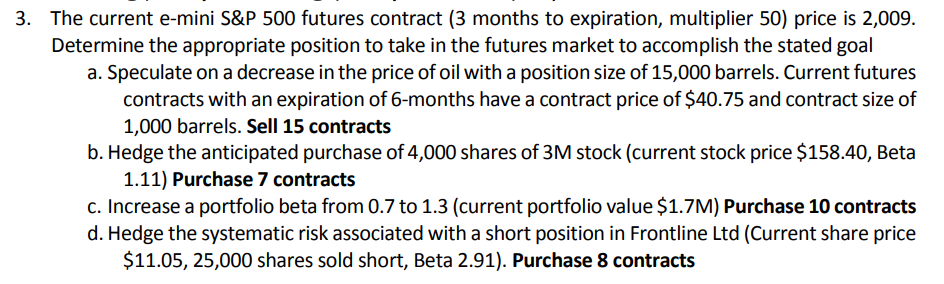

Please provide the calculation and explain why. The current e-mini S&P 500 futures contract (3 months to expiration, multiplier 50) price is 2,009. Determine the

Please provide the calculation and explain why.

The current e-mini S&P 500 futures contract (3 months to expiration, multiplier 50) price is 2,009. Determine the appropriate position to take in the futures market to accomplish the stated goal a. Speculate on a decrease in the price of oil with a position size of 15,000 barrels. Current futures contracts with an expiration of 6-months have a contract price of exist40.75 and contract size of 1,000 barrels. Sell 15 contracts b. Hedge the anticipated purchase of 4,000 shares of 3M stock (current stock price exist158.40, Beta 1.11) Purchase 7 contracts c. Increase a portfolio beta from 0.7 to 1.3 (current portfolio value exist1.7M) Purchase 10 contracts d. Hedge the systematic risk associated with a short position in Frontline Ltd (Current share price exist11.05, 25,000 shares sold short, Beta 2.91). Purchase 8 contractsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started