Answered step by step

Verified Expert Solution

Question

1 Approved Answer

***** Please provide The Common Sized Financial Statement (CC&Rs)****** The financial data of Bob Smith, Inc. Bob is an existing bank customer. When the loan

***** Please provide The Common Sized Financial Statement (CC&Rs)******

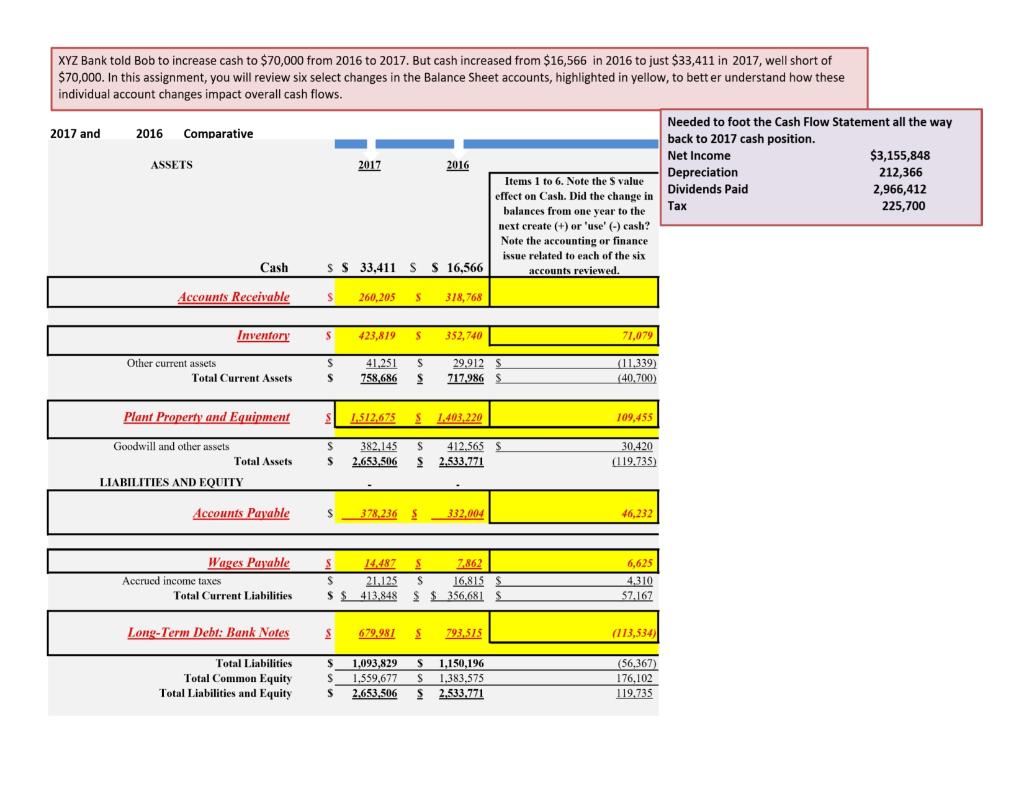

The financial data of Bob Smith, Inc. Bob is an existing bank customer. When the loan to Bob was originally made in 2016, the bank required Bob to increase the YE 2016 cash balance to at least $70,000 to qualify for the interest rate that the bank used for the original loan. This cash balance was required for the bank to make its target yield on the loan created. The Cash Flow Statement and Balance Sheet show an actual YE 2017 cash balance of less than $34,000.

| Year End 2017 | |

| Cash Flows from Operating Activities | |

| Net Income | $ 3,155,848 |

| Depreciation | $ 212,366 |

| Decrease in Accounts Receivable | $ 58,563 |

| Increase in Accounts Payable | $ 46,232 |

| Increase in Wages Payable | $ 6,625 |

| Increase in Accrued Income Tax | $ 4,310 |

| Increase in Inventory | $ (71,079) |

| Increase in Other Current Assets | $ (11,339) |

| Taxes | $ (225,700) |

| Net Cash Provided from Operating Activities | $ 3,175,826 |

| Cash Flows from Investing Activities | |

| Decrease in Goodwill and other assets | $ 30,420 |

| Increase in PP&E | $ (109,455) |

| Dividends Paid | $ (2,966,412) |

| Net Cash Used in Investing Activities | $ (3,045,447) |

| Cash Flows from Financing Activities | |

| Decrease in Long term debt bank notes | $ (113,534) |

| Net Cash Provided from Financing Activities | $ (113,534) |

| Cash Reconciliation | |

| Net increase/decrease in cash | $ 16,845 |

| Cash at beginning of the year | $ 16,566 |

| Cash at end of the year | $ 33,411 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started