Please provide the entire answers, including journals and t-accounts, on Excel's Spreadsheets. (No handwritten answer and/or answers on word documents)

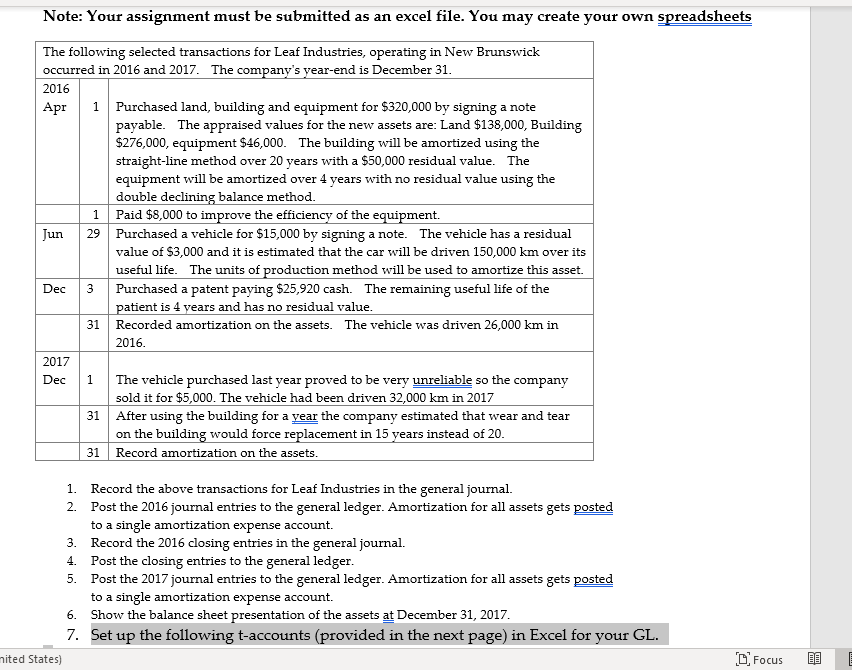

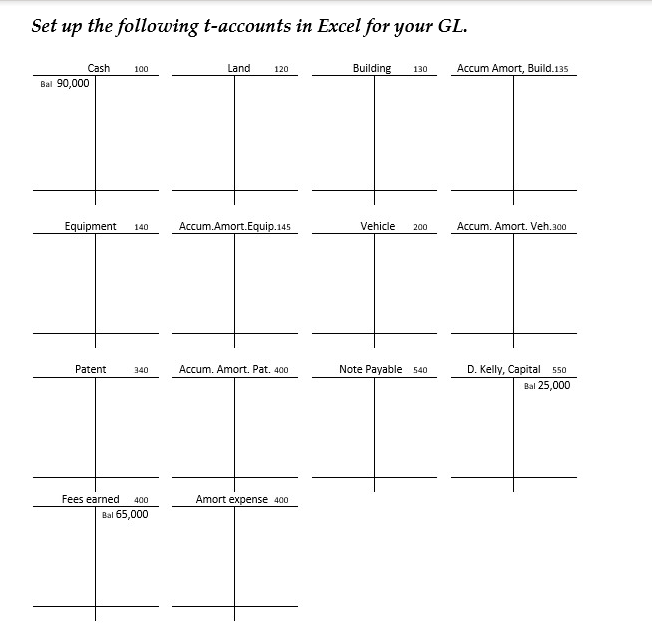

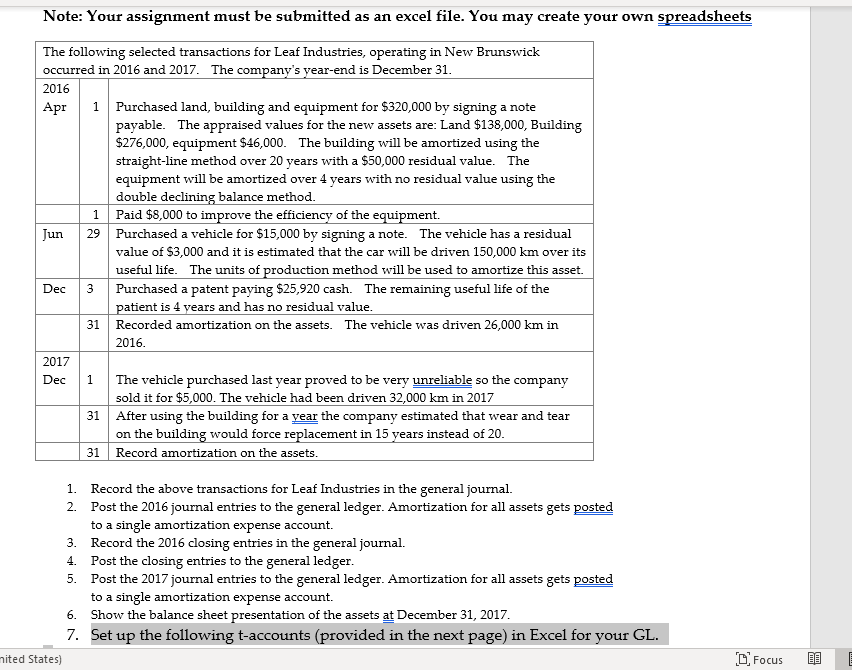

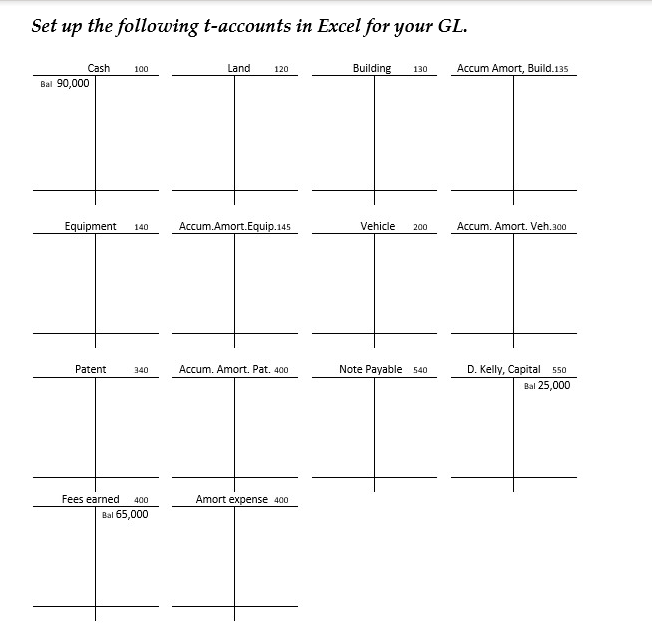

Note: Your assignment must be submitted as an excel file. You may create your own spreadsheets 1 The following selected transactions for Leaf Industries, operating in New Brunswick occurred in 2016 and 2017. The company's year-end is December 31. 2016 Apr 1 Purchased land, building and equipment for $320,000 by signing a note payable. The appraised values for the new assets are: Land $138,000, Building $276,000, equipment $46,000. The building will be amortized using the straight-line method over 20 years with a $50,000 residual value. The equipment will be amortized over 4 years with no residual value using the double declining balance method. Paid $8,000 to improve the efficiency of the equipment. Jun 29 Purchased a vehicle for $15,000 by signing a note. The vehicle has a residual value of $3,000 and it is estimated that the car will be driven 150,000 km over its useful life. The units of production method will be used to amortize this asset. 3 Purchased a patent paying $25,920 cash. The remaining useful life of the patient is 4 years and has no residual value. Recorded amortization on the assets. The vehicle was driven 26,000 km in 2016. 2017 Dec The vehicle purchased last year proved to be very unreliable so the company sold it for $5,000. The vehicle had been driven 32,000 km in 2017 31 After using the building for a year the company estimated that wear and tear on the building would force replacement in 15 years instead of 20. 31 Record amortization on the assets. Dec 31 1 1. Record the above transactions for Leaf Industries in the general journal. 2. Post the 2016 journal entries to the general ledger. Amortization for all assets gets posted to a single amortization expense account. 3. Record the 2016 closing entries in the general journal. 4. Post the closing entries to the general ledger. 5. Post the 2017 journal entries to the general ledger. Amortization for all assets gets posted to a single amortization expense account. 6. Show the balance sheet presentation of the assets at December 31, 2017. 7. Set up the following t-accounts (provided in the next page) in Excel for your GL. nited States) C Focus Set up the following t-accounts in Excel for your GL. 100 Land 120 Building 130 Cash Bal 90,000 Accum Amort, Build.135 Equipment 140 Accum.Amort.Equip.145 Vehicle 200 Accum. Amort. Veh.300 Patent 340 Accum. Amort. Pat. 400 Note Payable 540 D. Kelly, Capital 550 Bal 25,000 Amort expense 400 Fees earned 400 Bal 65,000