Answered step by step

Verified Expert Solution

Question

1 Approved Answer

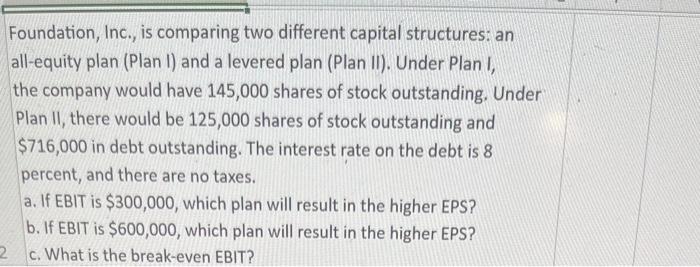

- please provide the excel formula used to find answer- Foundation, Inc., is comparing two different capital structures: an all-equity plan (Plan I) and a

- please provide the excel formula used to find answer-

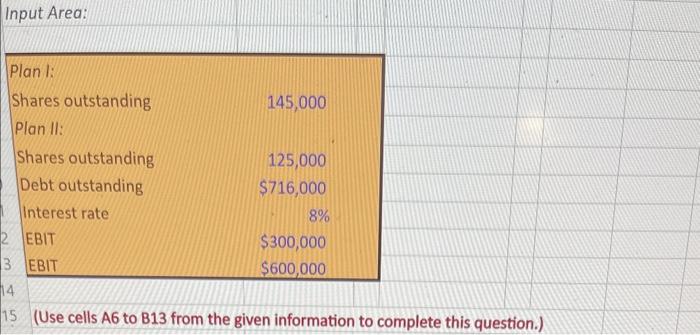

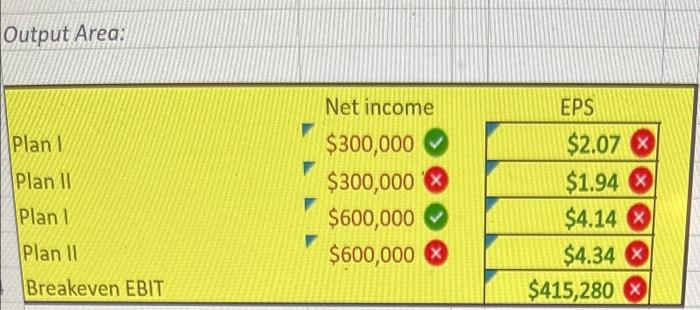

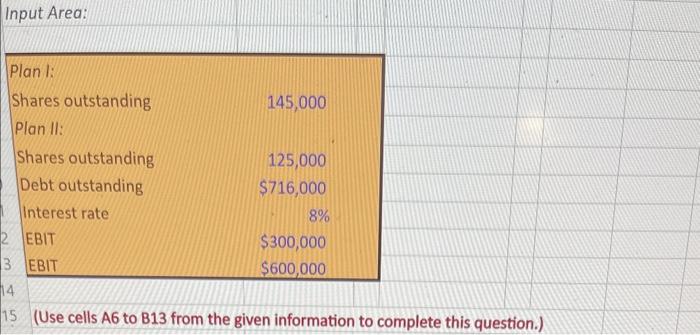

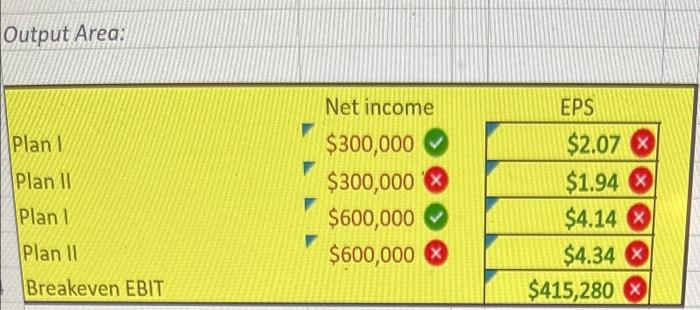

Foundation, Inc., is comparing two different capital structures: an all-equity plan (Plan I) and a levered plan (Plan II). Under Plan I, the company would have 145,000 shares of stock outstanding, Under Plan II, there would be 125,000 shares of stock outstanding and $716,000 in debt outstanding. The interest rate on the debt is 8 percent, and there are no taxes. a. If EBIT is $300,000, which plan will result in the higher EPS? b. If EBIT is $600,000, which plan will result in the higher EPS? c. What is the break-even EBIT? (Use cells A6 to B13 from the given information to complete this question.) Output Area: \begin{tabular}{|lr|r|} \hline & Net income & \multicolumn{1}{|r|}{ EPS } \\ \hline Plan I & $300,000 & $2.07 \\ \hline Plan II & $300,000 & $1.94 \\ \hline Plan I & $600,000 & $4.14 \\ Plan II & $600,000 & $4.34 \\ Breakeven EBIT & & $415,280 \\ \hline \hline \end{tabular}

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started